Summarize at:

Want to improve your trading skills without risking real money? Practice trading online is the solution. Using a practice trading simulator lets you test strategies, learn market dynamics, and build confidence.

In this article, we’ll discuss the best simulators in 2026 that help you practice Forex trading and stock trading.

What Are Practice Trading Simulators Used For

Practice trading simulators are tools that replicate real market conditions. They provide a practice trading platform where you can trade currencies, stocks, or other assets without using actual money. Here’s what they are used for:

- Learning the Basics. If you’re new to trading, simulators help you understand how markets work. You can get familiar with trading terms and platforms.

- Testing Strategies. Experienced traders use simulators to test new strategies in a risk-free setting. This way, they can see what works before applying it in the real world.

- Building Confidence. By using a trading practice app or website, you can build confidence. Making trades without fear of losing money helps you make better decisions.

- Understanding Market Dynamics. Simulators show real-time market movements. This helps you learn how prices change and how different factors affect the market.

- Practicing Discipline. Trading requires discipline and patience. Simulators let you practice these skills without financial pressure.

Using a practice trading simulator is like a flight simulator for pilots. It prepares you for real trading by providing a safe environment to learn and make mistakes.

Who Needs Practice Trading Simulators

Trading simulators are for anyone interested in the markets. If you’re just starting out, they let you practice trading online without risking real money. You can learn how trading works, get comfortable with the process, and build confidence.

For experienced traders, simulators are a way to test new strategies. Before putting real money on the line, you can see how your ideas perform on a practice trading platform. It’s a chance to fine-tune your approach in a risk-free environment.

Beginner traders learning Forex, stocks, or crypto, can use a trading practice website to bring their lessons to life. It helps turn theory into practical understanding.

Even if you’re simply curious about trading, an online trading practice app lets you explore without any pressure. You can find out if trading is something you’d enjoy, all without any financial commitment.

By the way, we have another article in our blog where we tell why traders need simulated trading.

How We Chose the Best Practice Trading Simulators

We wanted to find simulators that truly help you practice trading effectively.

First, they needed to feel real. The best simulators mirror actual market conditions closely. When you practice forex trading online or dive into stocks, it should feel authentic. Ease of use was important. A practice trading website should be straightforward and user-friendly. You shouldn’t have to struggle with complicated menus or controls.

We looked for a variety of assets. Whether you’re interested in forex practice, practice stock trading, or commodities, having options is key.

Getting feedback on your trades helps you learn. So we chose platforms that provide detailed insights into your performance.

By focusing on these things, we aimed to find simulators that are both helpful and easy to use, so you can make the most of your trading practice.

Best Practice Trading Simulators in 2026

As we look at the top tools to practice trading online in 2026, several platforms stand out for their realism and user-friendly interfaces. These simulators help you learn without risking real money, making them ideal for both beginners and seasoned traders wanting to refine their strategies.

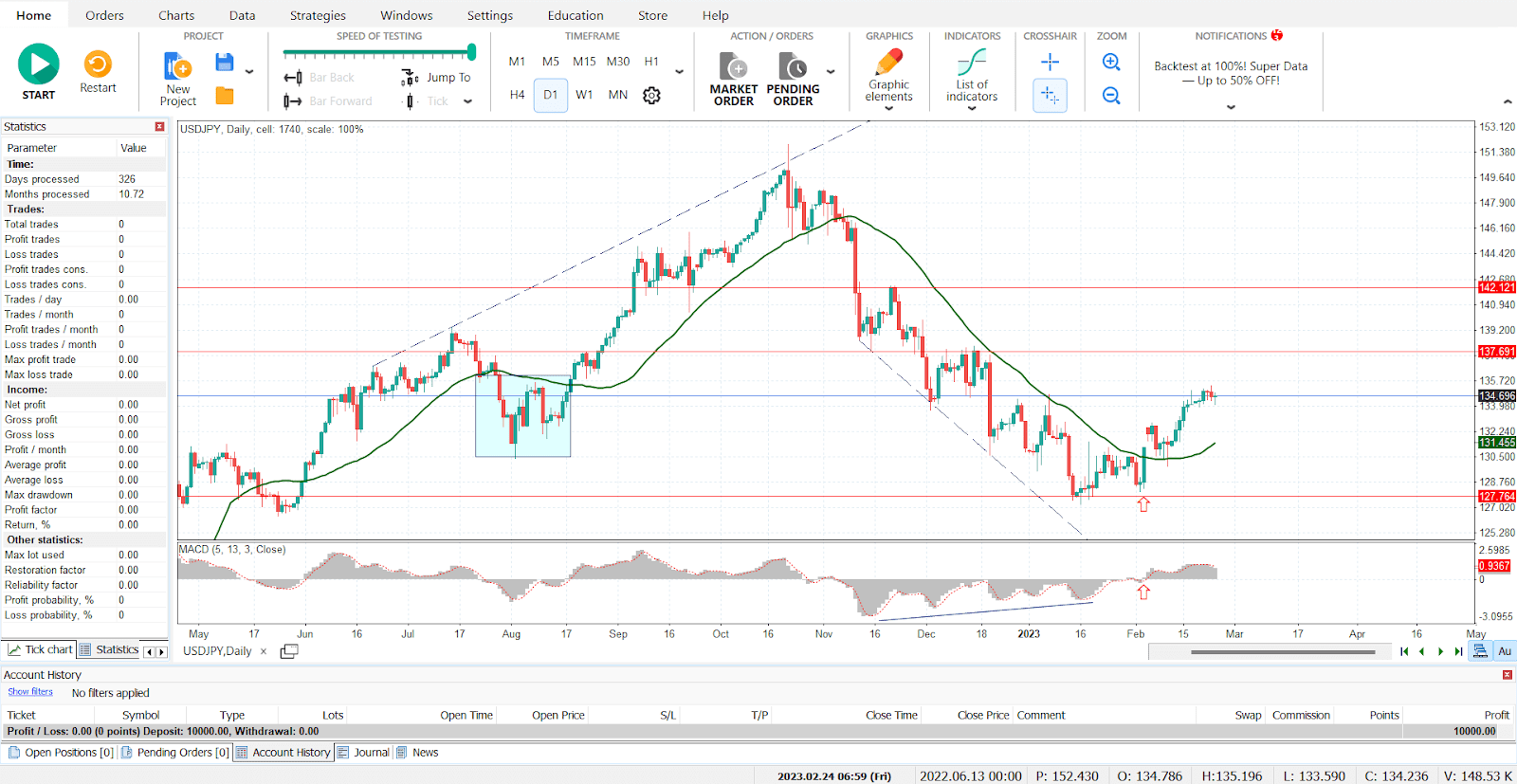

1. Forex Tester Online

Forex Tester Online is a standout practice trading simulator that offers a realistic trading environment. It’s a web-based platform, so there’s no need to download any software — you can access it from any device with an internet connection.

With Forex Tester Online, you can practice forex trading using historical data that mirrors real market conditions. This allows you to test your strategies over different time periods and market scenarios. The platform is designed to be intuitive, making it easy to navigate even if you’re new to trading.

Key Features:

- Extensive historical data. Access years of market data to see how your strategies would have performed in the past.

- Realistic simulation. The platform mimics real trading conditions, providing a genuine forex trading practice experience.

- Customizable indicators. Use various technical indicators to analyze the market and refine your strategies.

- Multiple timeframes. Practice on different time frames to suit your trading style, whether it’s practice day trading or long-term investing.

- User-friendly interface. Simple design makes it easy to focus on trading without getting overwhelmed by complex menus.

- Advanced backtesting features, including news integration, custom scenarios, custom EAs & indicators, etc.

If you’re looking for a platform to practice trading online effectively, Forex Tester Online offers a comprehensive set of tools. It’s suitable for those who want to engage in forex practice or practice stock trading (if supported). The realistic environment helps you build confidence and develop skills that are transferable to real trading.

Accessibility:

- Web-Based platform. No downloads required; access it through any web browser.

- Flexible use. Practice anytime, anywhere, making it a convenient online trading practice app alternative.

2. Trade Nation

Trade Nation provides a trading simulator that lets you practice trading without any risk or commitment. You don’t need to sign up or provide any personal information to use it. This makes it easy for beginners to explore trading and learn the basics in a stress-free environment.

Their simulator is designed to help you understand each stage of trading and get familiar with terms and concepts. It’s a straightforward way to gain confidence before moving on to real trading with actual money.

Key Features:

- No registration needed. Access the simulator directly without creating an account.

- Beginner-friendly. Learn the essentials of trading in an easy-to-understand format.

- Accessible. Open to everyone, not just Trade Nation customers.

User Feedback

Many users appreciate Trade Nation’s responsive customer support. They find the team helpful and quick to assist with any questions. Some users have mentioned that while the simulator is great for learning, the process of signing up for a live account can be a bit detailed, requiring a lot of personal information.

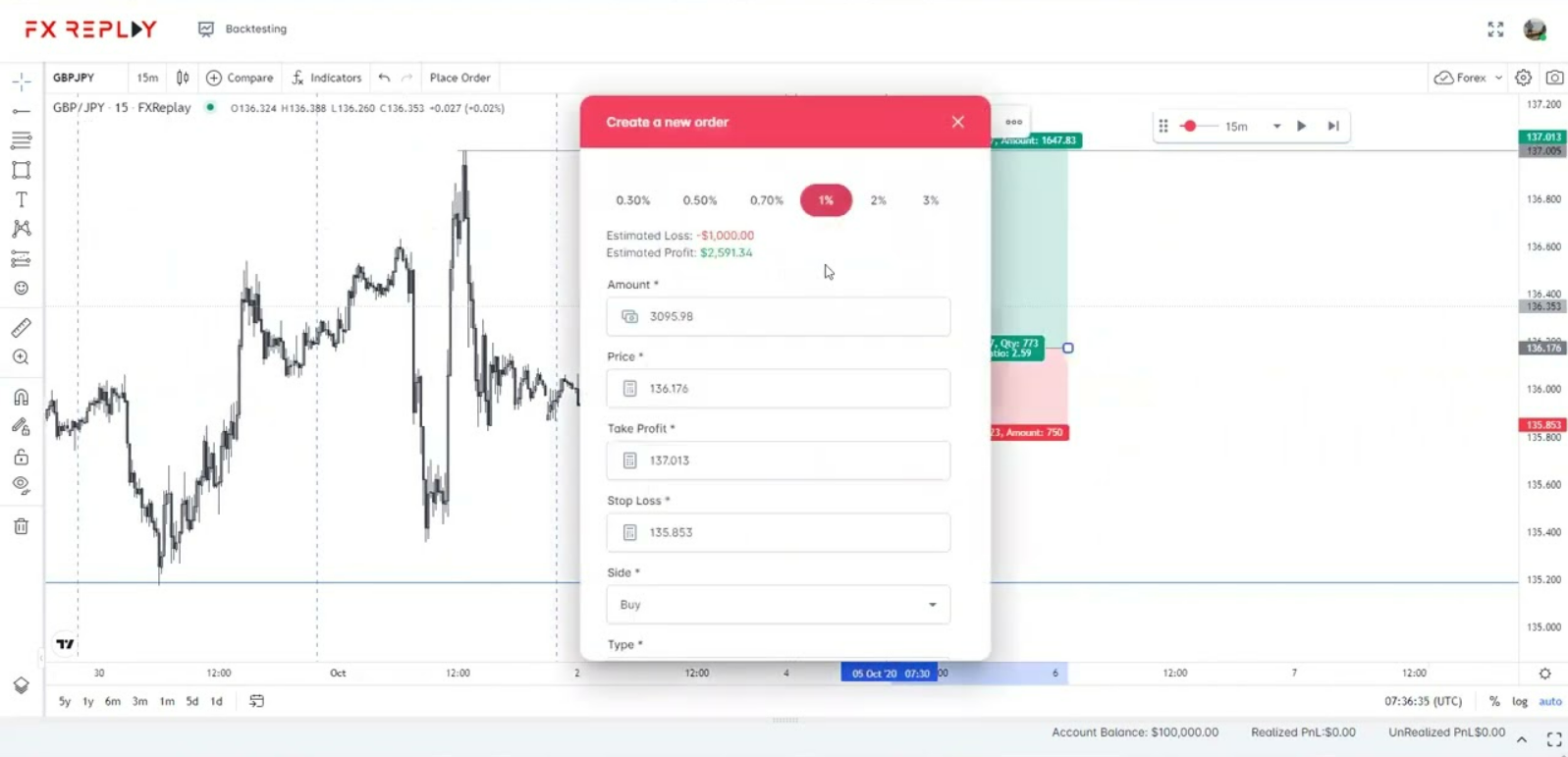

3. FX Replay

FX Replay is a backtesting tool designed to help you practice trading using historical market data. It offers an interface similar to TradingView, which many traders find familiar and easy to navigate. One of its main advantages is the ability to go back further in time compared to TradingView’s replay mode, allowing for more extensive trading practice online.

However, some users have reported issues with FX Replay. They mention that the platform can lag and feel slow at times, which can be frustrating during forex trading practice. Placing limit orders may require manually entering prices each time, instead of auto-filling based on the current price. This can make the process less efficient.

There have also been reports of bugs affecting stop loss and take profit settings. For example, setting a specific risk amount doesn’t always result in accurate profit calculations. Some users feel that the platform could improve its user experience to make practice trading smoother and more reliable.

On the positive side, others have found FX Replay to be a valuable tool for backtesting strategies. They appreciate the TradingView-like features and the ability to customize and use familiar drawing tools. Customer support has been noted as responsive and helpful in resolving issues.

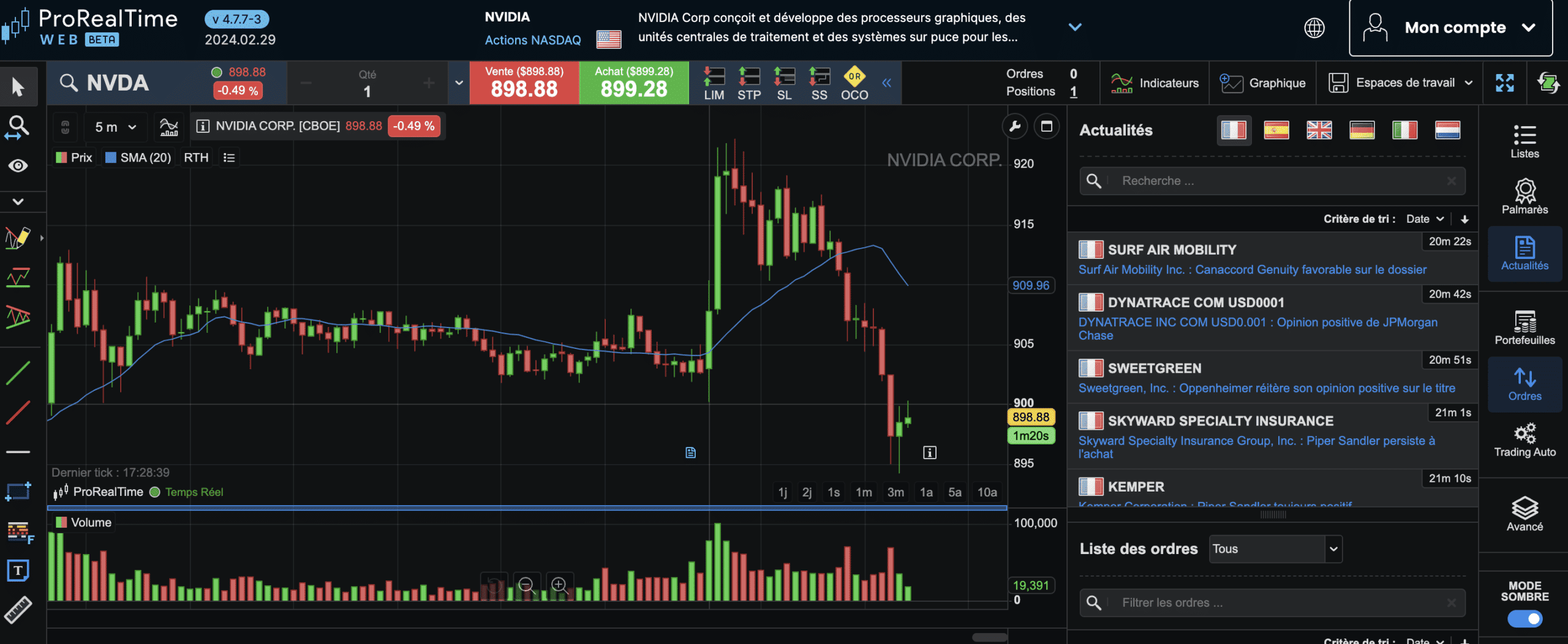

4. ProRealTime

ProRealTime is a trading platform known for its high-quality charts and advanced technical analysis tools. It’s designed to help traders of all levels practice and improve their trading skills. The platform offers over 100 technical indicators and charting tools, allowing you to analyze markets in depth. You can view data in various time frames, from seconds to days, which helps tailor your analysis to your trading style.

One of the standout features is its automatic trend lines. ProRealTime can automatically draw trend lines, support, and resistance levels on your charts. This makes it easier to identify market trends and potential trading opportunities. Additionally, the ProScreener tool lets you scan thousands of securities quickly based on your criteria, such as price movements, indicators, and timeframes. This helps you find assets that match your trading strategy.

ProRealTime is accessible on multiple devices. You can use it directly in your web browser without any installation, on your desktop computer, or on your smartphone. This flexibility allows you to practice trading wherever you are.

Pros:

- Comprehensive tools. Suitable for various trading styles, offering extensive technical analysis features.

- Free access. The web version is free and doesn’t require installation.

- User-Friendly interface. Easy to navigate, even for beginners.

- Dedicated support. Offers assistance via email, phone, and screen sharing.

Cons:

- Technical issues: Some users have reported software crashes and bugs.

- Customer support delays: Instances of slow response times from the support team.

- Limited brokerage options: Trading through the platform might involve higher spreads or limited broker choices.

ProRealTime is a platform for those who want to dive deep into technical analysis and practice trading online. Its wide range of tools makes it suitable for both beginners and experienced traders.

However, if you plan to trade directly through the platform, be aware of potential issues with execution and customer support.

5. StockCharts

StockCharts is an online charting tool that helps you analyze the stock market without the need to download any software. It’s ideal for those who want to practice stock trading and enhance their technical analysis skills. The platform provides interactive charts that you can customize with various indicators and overlays, helping you study market trends and patterns effectively.

With extensive data coverage on stocks, ETFs, and mutual funds, StockCharts gives you a broad view of the market. It also offers educational resources, including tutorials and articles, to help you learn more about trading and technical analysis. The user interface is straightforward and easy to navigate, making it suitable for beginners who are new to trading practice websites.

Pros:

- Educational resources. Provides tutorials and articles for learning.

- Community interaction. Engage with other traders to share ideas and strategies.

- Free version available. Try out basic features without any cost.

Cons:

- Limited asset classes. Focused mainly on stocks and ETFs; not ideal for practicing forex trading.

- No trading simulator. Does not offer a simulated trading account to practice executing trades.

If you’re interested in practicing stock trading and improving your chart analysis, StockCharts is a valuable resource. It helps you understand market movements and develop your technical analysis skills. However, it doesn’t provide a full-fledged practice trading simulator with real-time trading practice. For those looking to execute simulated trades or practice forex trading, you might need to consider other platforms that offer these features.

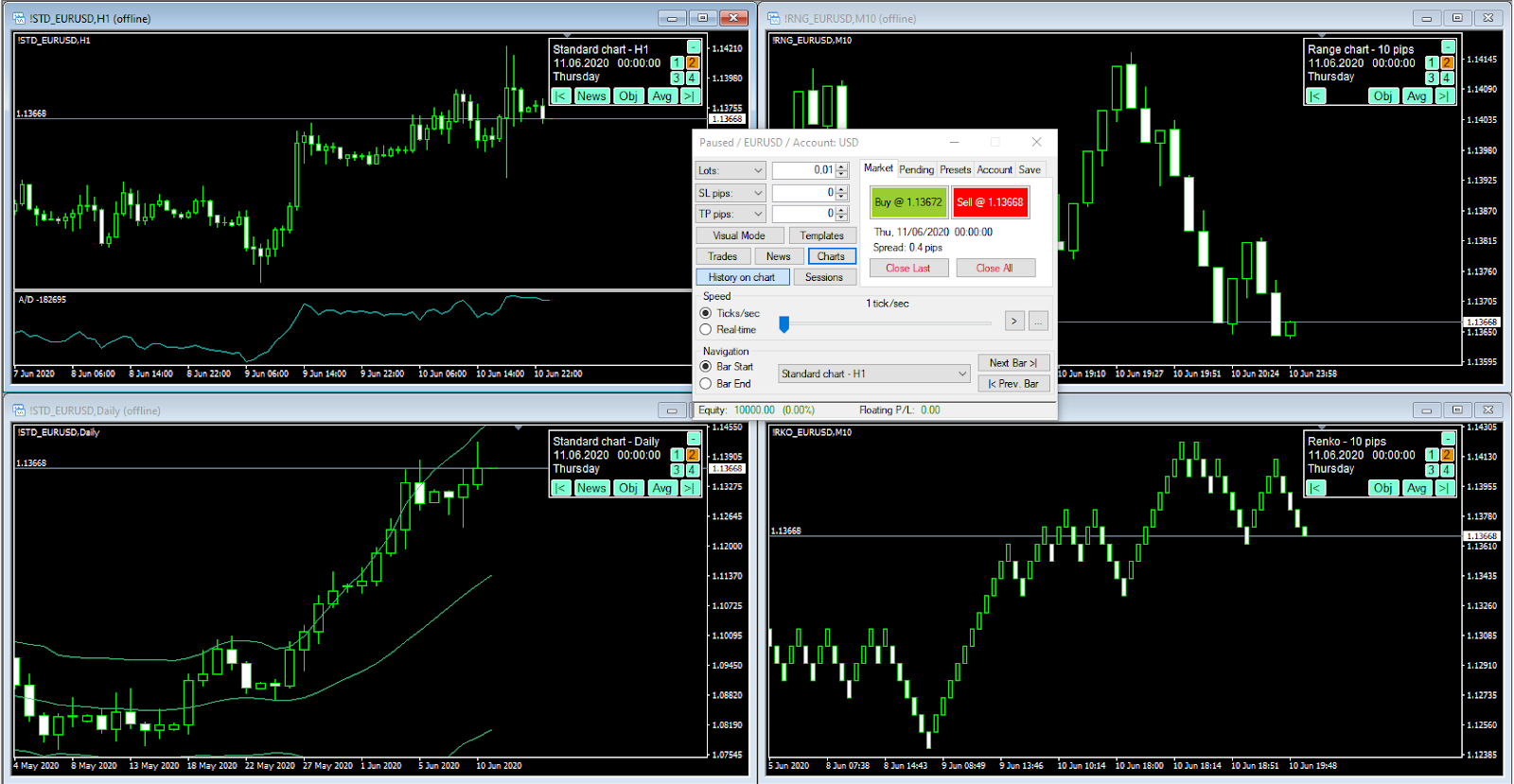

6. Soft4FX

Soft4FX is a Forex trading simulator that functions as an add-on for MetaTrader 4 (MT4). It allows us to practice trading using historical data within the familiar MT4 platform.

Pros:

- Easy Integration. Since it operates within MT4, if you’re already using this platform, adding Soft4FX is straightforward. You don’t need to learn new software.

- Affordable One-Time Purchase. Soft4FX offers lifetime access for around $100, making it a cost-effective option compared to subscription-based simulators.

- Versatile Trading Practice. You can simulate both day trading and longer-term strategies, catering to different trading styles.

Cons:

- Dependent on MT4. The simulator only works with MT4. If we use other platforms like MetaTrader 5 or prefer web-based platforms, Soft4FX isn’t compatible unless we switch to or also run MT4.

- Limited to Forex Trading. It focuses solely on Forex. If you’re interested in practicing with stocks, commodities, or cryptocurrencies, this simulator doesn’t support those assets.

- No Real-Time Simulation. Soft4FX uses historical data for backtesting but doesn’t provide real-time market simulation.

- Outdated Interface. The software’s design feels dated, which might affect user experience.

User experience (based on reviews):

Using Soft4FX, users appreciated the ability to test our Forex strategies within MT4, a platform they were already comfortable with. Setting up the simulator was simple, and you could start practicing quickly. The ability to control the speed of the simulation helped us focus on specific market conditions.

However, users noticed that the interface isn’t as modern or intuitive as other simulators. The reliance on MT4 means we’re limited if you prefer other trading platforms. Also, since it’s confined to Forex and doesn’t offer real-time data, our practice was limited to historical scenarios without exposure to live market dynamics.

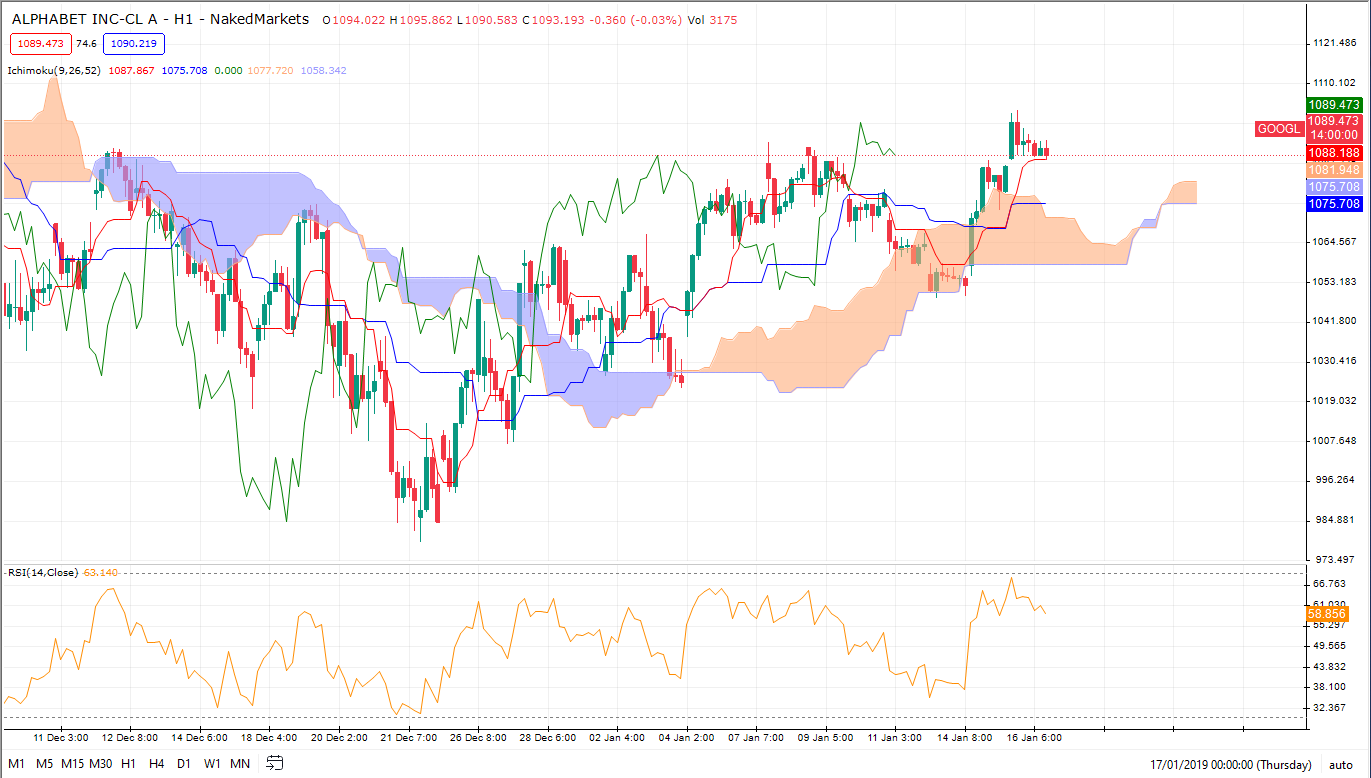

7. NakedMarkets

NakedMarkets is a Forex trading simulator designed to offer a realistic environment for testing trading strategies using historical data. It caters to both novice and experienced traders, aiming to replicate real market conditions closely.

Pros:

- Realistic Simulation. Provides high-quality, tick-by-tick data, allowing us to see how our strategies would have performed in precise historical conditions.

- Customization Options. You can tailor various aspects of our trading strategies, including entry and exit points and money management rules.

- User-Friendly Interface. The platform is designed to be intuitive, making it accessible for beginners while offering depth for advanced traders.

- Fast Backtesting. NakedMarkets is known for its quick backtesting capabilities, enabling us to run multiple tests efficiently.

- Risk Management Tools. Includes features that help us understand potential losses and adjust our strategies to mitigate risks effectively.

Cons:

- Cost. NakedMarkets requires a purchase, which might be a barrier if we’re just starting out or want to experiment without financial commitment. The software itself can cost between $100 and $500, and access to professional-quality historical data might add $30 or more per month.

- Learning Curve for Beginners. Despite being user-friendly, the range of features could overwhelm those new to Forex trading.

- Limited Asset Classes. Focuses primarily on Forex trading, so if we’re interested in other markets like stocks or commodities, the options may be limited.

User experience (based on reviews):

When users tried NakedMarkets, they were impressed by the realistic trading environment it provided. The tick-by-tick data allowed us to test our strategies with high precision. Customizing our trading parameters helped us refine our approaches and understand the nuances of our methods.

The platform’s speed in backtesting was a significant advantage. Users could run multiple scenarios without long waiting times, which made our practice sessions more productive.

However, the cost was a consideration. For traders on a tight budget or those who are just testing the waters, the initial investment might be steep. Additionally, while the interface is designed to be user-friendly, the sheer number of features and options could be daunting for complete beginners.

More Options to Consider

In addition to the platforms we’ve discussed, there are other practice trading simulators that can help you improve your trading skills:

-

MetaTrader 4 / 5 Demo Account

MT4 or MT5 is a popular trading platform that offers a free demo account. You can practice forex trading online with real-time market data. It provides various technical indicators and charting tools to help you analyze the markets. This practice trading platform is suitable for both beginners and experienced traders.

-

TradingView Paper Trading

TradingView offers a paper trading feature where you can practice trading without risking real money. It’s a web-based platform with interactive charts and a large community of traders. You can use it as a trading practice website to test your strategies across different markets, including stocks and forex.

-

Thinkorswim by TD Ameritrade

Thinkorswim is a comprehensive trading platform that provides a paperMoney account for practice trading. You can trade stocks, options, futures, and forex. The platform includes advanced charting and analysis tools, making it ideal for day trading practice.

-

eToro Virtual Portfolio

eToro offers a virtual portfolio where you can practice stock trading and explore other assets like cryptocurrencies. With $100,000 in virtual money, you can practice trading online and learn from other traders through eToro’s social trading features.

-

NinjaTrader Simulation Account

NinjaTrader provides a free simulation account that lets you practice trading futures and forex markets. It offers advanced charting, market analysis, and a variety of tools to help you develop your strategies on this practice trading simulator.

-

Interactive Brokers Paper Trading

Interactive Brokers allows you to open a paper trading account to practice trading in a simulated environment. You can access a wide range of markets and use their professional trading platform to enhance your trading practice online.

-

Investopedia Stock Simulator

Investopedia offers a stock simulator that lets you practice stock trading with virtual money. It’s a great way to learn the basics of trading and test your strategies in a risk-free setting on this trading practice website.

-

Forex.com Demo Account

Forex.com provides a demo account for those interested in forex practice. You can trade currencies with real-time charts and technical analysis tools, making it a suitable practice trading platform for forex traders.

-

Plus500 Demo Account

Plus500 offers a free demo account where you can practice trading CFDs on stocks, forex, commodities, and more. The platform is user-friendly and helps you get comfortable with trading before moving to a live account.

-

Robinhood Paper Trading

While Robinhood doesn’t offer a traditional paper trading account, some third-party tools simulate the Robinhood experience for practice trading. These can help you get familiar with the platform and practice stock trading without risking real money.

These platforms provide various ways to engage in trading practice online. Whether you’re interested in forex trading practice, practice stock trading, or day trading practice, there’s an option that fits your needs. Exploring these simulators can help you build confidence and develop your trading skills in a safe environment.

Practice Trading with Forex Tester

- Let’s face it: trading Forex is no cakewalk. It requires an in-depth understanding of the market, sharp trading skills, and the ability to make split-second decisions. As the practice shows, conventional demo accounts do not solve the issue. But fear not, fellow traders! Forex Tester is here to save the day.

- Realistic Simulation: Imagine being able to practice your Forex trading strategies without losing your hard-earned money. That’s precisely what Forex Tester offers. It provides a realistic simulation of the Forex market, allowing you to test your trading ideas, strategies, and theories using historical data. In contrast to simulated trading, a demo trading account cannot hide the price action after some point. You might only scroll through historical charts in the trading platform, see where the price went, and add notes to a spreadsheet. With Forex Tester, you can rewind, fast-forward, and pause the market whenever you want, giving you the power to analyze and learn from every single trade.

- Learn from Mistakes: One of the most valuable lessons in trading comes from analyzing your mistakes. With Forex Tester, you can review your trades, identify where you went wrong, and understand how to avoid making the same errors in the future. It’s like having a personal trading coach who guides you through the ups and downs of the market. Again, it’s hard to achieve that with a demo account, whatever trading platform you might choose.

- Backtesting and Optimization: The key to successful trading lies in rigorous testing and optimization of your strategies. Forex Tester allows you to backtest your trading systems using years of historical data. You can tweak the conditions of various Forex brokers, test different indicators, and analyze the results to fine-tune your approach. This process enables you to eliminate guesswork and make data-driven decisions, increasing your chances of success in a live trading account.

- Time Travel: Okay, not literally, but Forex Tester lets you travel back in time and trade as if you were in the past. You can backtest trading strategies in a simulated live trading environment and see how they would have performed during different market conditions. Can a demo account on any trading platform provide you with the same feeling? This feature is like having a crystal ball that allows you to peek into the past and gain insights into potential future market movements. It will help you start trading confidently in a live account when you get to that point.

- Real-Time Trading Experience: Once you’ve honed your skills in the simulated environment, Forex Tester lets you take your knowledge to the next level. You can connect the software to your broker’s trading platform and execute trades in real-time but with virtual money. This feature bridges the gap between practice trading and live accounts, helping you gain confidence and experience without risking your capital.

Conclusion: Best Practice Trading Simulator

Practicing trading without risking real money is a smart way to build your skills and confidence. Among the simulators we’ve explored, we recommend Forex Tester Online as the best practice trading platform. It offers a realistic trading environment with extensive historical data and user-friendly tools.

FAQ

How can I practice forex trading?

You can practice forex trading by using a practice trading simulator like Forex Tester Online or MetaTrader 4 Demo Account. These platforms let you trade virtual money in real market conditions, helping you learn without financial risk.

How long should I practice forex trading?

The amount of time varies for each person. It’s recommended to practice until you consistently make positive results and feel confident in your trading strategies. This could take several months or more, depending on your dedication and learning pace.

Do practice trading simulators use real market data?

Yes, most reputable practice trading platforms use real-time or historical market data. This ensures that the trading experience is as close to real market conditions as possible.

Can I practice day trading online?

Yes, you can practice day trading using simulators like Forex Tester Online, Thinkorswim’s paperMoney, or NinjaTrader’s simulation account. These platforms allow you to execute trades in short time frames, mimicking real day trading activities.

Where can I practice before I start trading on a real account?

You can practice on demo accounts provided by many Forex trading platforms. These accounts use virtual money, allowing you to test strategies without financial risk. But often these accounts do not provide enough tools for good practice.

To hone your skills even more without risking your money, we recommend using professional backtesting software like Forex Tester.

Forex Tester Online

Advanced practice trading simulator

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska

![Top 6 MetaStock Alternatives to Backtest Strategies [2026]](https://cdn-wp.forextester.com//app/themes/ft-blog/resources/gradients/A&B/Tools.webp)