Summarize at:

Trading in the stock market requires precision, strategy, and practice. For new and seasoned traders alike, mistakes can be costly. This is where stock backtesting simulators come in. These tools allow traders to practice strategies and refine skills in a risk-free environment using virtual money.

With the best stock trading simulator, you can simulate market conditions, test strategies, and gain confidence without putting real money on the line. Many platforms also offer stock backtesting apps that let you analyze historical data to see how your strategies would perform in real-world conditions.

In this article, we’ll explore the best stock backtesting software options available. Whether you’re a day trader, swing trader, or long-term investor, these tools will help you trade smarter and reduce risks.

Let’s dive into the top picks for stock trading and backtesting.

What is a Stock Trading Simulator?

A stock backtesting simulator is a tool that mimics real market conditions using historical or live data. It allows traders to practice executing trades and testing strategies without risking real money. These platforms are essential for beginners learning the basics and experienced traders refining their techniques.

Simulators often include advanced features like stock backtesting apps to analyze past price movements, helping users understand how their strategies would perform in different market conditions. Unlike actual trading, there’s no financial risk involved, making it a safe environment for experimentation.

The best stock trading simulators go beyond simple practice. They provide features like technical indicators, live charts, and data analytics. For example, tools like best stock backtesting software let traders replay historical data to fine-tune their entry and exit points.

In short, a stock backtesting platform is like a flight simulator for traders. It prepares you for the unpredictable nature of the stock market, ensuring you’re ready to trade smarter when real money is on the line.

Best Stock Backtesting Simulators

1. Forex Tester Online

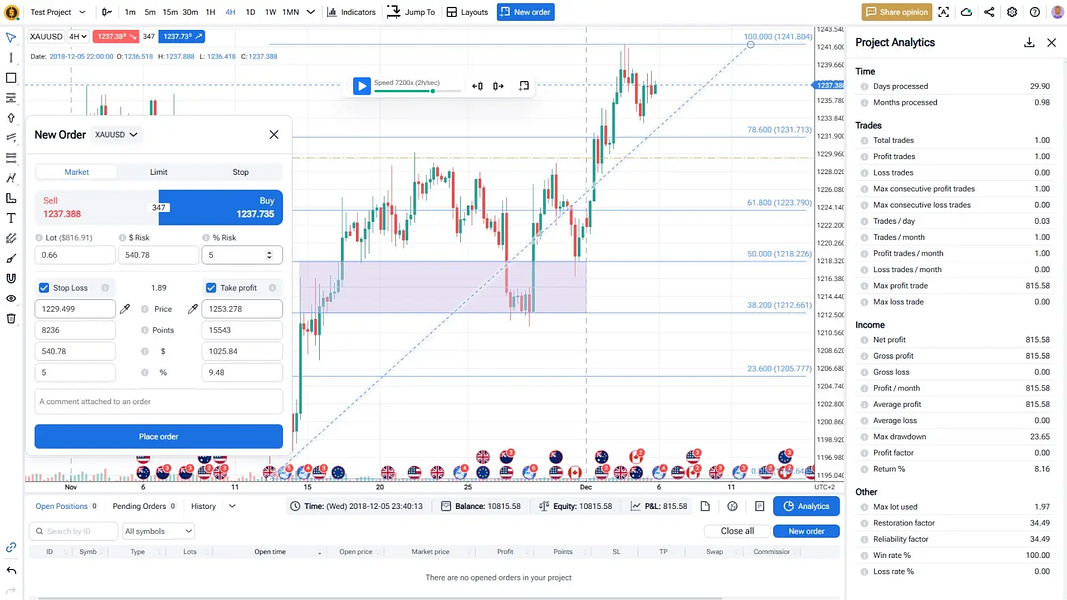

Forex Tester Online stands out as a leading stock backtesting platform and best stock trading simulator, offering unmatched precision and control for traders looking to refine their strategies. Designed exclusively for backtesting, it supports 22 stocks and provides a realistic trading environment that mirrors real-world market conditions.

Key Features

- Lifelike Market Simulations. With Forex Tester Online, you can test months of trading performance in just minutes. The platform uses tick-by-tick data spanning over 20 years for 75+ symbols, including stocks, forex, indices, futures and cryptocurrencies. This level of detail creates an authentic simulation experience.

- Unparalleled Backtesting Control. Navigate through historical data at speeds of up to one day per second. Sync up to eight charts across various timeframes and symbols to fine-tune your strategies with precision.

- Advanced Risk Management Tools. Manage positions directly on the chart with features like automatic Stop Loss calculation and breakeven adjustments. This helps traders implement effective risk management practices seamlessly.

- Comprehensive Analytics. Forex Tester Online offers deep insights into strategy performance, with detailed analytics that highlight strengths and weaknesses. Users report that this level of analysis helps make smarter, data-driven decisions. News integration will help you to perform fundamental analysis right on the chart.

- Wide Asset Coverage. The platform supports stocks, Forex currency pairs, indices, commodities, and even cryptocurrencies. This broad range allows traders to diversify their strategies across multiple asset classes.

- Customizable User Experience. From synced charts to unlimited testing time, Forex Tester Online is built for flexibility. Users can customize timeframes, templates, and trading tools to suit their preferences. And even create custom scenarios, EAs, and indicators.

Forex Tester Online is the ultimate choice for traders seeking the best backtesting software for stocks. Its combination of precision, depth, and usability makes it an indispensable tool for anyone serious about improving their trading strategies.

Available Stocks for Backtesting on Forex Tester Online

2. eToro

eToro offers a user-friendly stock backtesting simulator with a social trading component. Its Virtual Portfolio provides $100,000 in virtual funds, allowing users to practice trading across various assets, including stocks, ETFs, and cryptocurrencies.

Pros:

- Social Trading. eToro’s platform enables users to observe and replicate the trades of experienced investors, fostering a collaborative learning environment.

- User-Friendly Interface. The platform is designed for ease of use, making it accessible to beginners.

Cons:

- Limited Asset Classes. eToro primarily focuses on stocks, ETFs, and cryptocurrencies, which may not cater to traders interested in a broader range of assets.

- Lack of Backtesting Tools. eToro is, first of all, a trading platform, not a backtesting tool. This is why it lacks lots of features, compared to Forex Tester Online and other designated platforms.

3. TradeStation

TradeStation provides a comprehensive stock backtesting platform tailored for active traders. Its Simulated Trading feature allows users to practice strategies with real-time data across various assets, including stocks, options, and futures.

Pros:

- Advanced Tools. TradeStation offers sophisticated charting and analysis tools suitable for experienced traders.

- Customizable Platform. Users can tailor the platform to their preferences.

Cons:

- Complexity for Beginners. The platform’s advanced features may be overwhelming for novice traders.

- Not a Backtesting Tool. Just like eToro, TradeStation doesn’t focus on backtesting. You can still use it for this, but it is not the primary use case.

To sum up, eToro is ideal for beginners seeking a social trading environment, while TradeStation suits experienced traders requiring advanced tools. However, none of them are trading simulators (as their primary use case).

Why are we even considering them? Because there are not so many backtesting tools that support stocks. In the end you need to choose one of two: advanced backtesting features or wide range of supported stocks. The only exception is Forex Tester Online.

So, now let’s move on to the actual trading simulators.

4. TradingView

TradingView is a comprehensive charting platform favored by traders for its extensive features and user-friendly interface.

Pros:

- Advanced Charting Tools. Offers a wide array of chart types and technical indicators, enabling detailed market analysis.

- Customizable Alerts. Allows users to set personalized alerts for specific market conditions, aiding timely decision-making.

- Social Community Integration. Facilitates idea sharing and collaboration among traders through a built-in social network.

Cons:

- Lack of Important Features. Many users on TrustPilot and Reddit complain that TradingView lacks some important basic features. This is especially noticeable when compared to other tools. Even with its huge popularity and extensive functionality, TradingView still fails to implement some essential backtesting tools.

- Subscription Costs. Advanced functionalities necessitate a paid subscription, which might not suit all budgets, and annoy sometimes, even if money is not the problem.

5. MooMoo

MooMoo is an investment and a options trading platform designed to cater to both novice and experienced traders, offering a range of tools and resources.

Anchor text: option trading platform.

Pros:

- Advanced Charting Features. Equipped with over 100 technical indicators and various charting tools for in-depth analysis.

Promotions and Rewards. New users often benefit from promotions like free stock bonuses, points for daily logins, and interest rates on uninvested cash, which provide added incentives to engage with the platform.

Cons:

- Customer Service Complaints. While many users report positive support experiences, others highlight issues such as delayed responses or unhelpful guidance, particularly during fund transfers or withdrawals.

- Trust Concerns. A number of users allege problems with deposit handling, account transfers, and difficulty withdrawing funds. These issues have raised questions about reliability for larger financial transactions.

- Technical Issues. Some users have reported app crashes, network errors, or difficulties with account setup, making the platform less reliable in high-stakes trading situations.

Both TradingView and MooMoo suit different trading needs. Evaluating their features against your specific requirements will help determine the most suitable platform for your trading activities.

Worth Mentioning

Here are three notable stock backtesting platforms:

- Forex Tester

Forex Tester is a dedicated backtesting software designed for forex traders. It was created by the same team as Forex Tester Online, but these are two completely different tools.

Some users continue to use Forex Tester as they are used to. The platform supports multiple timeframes and offers a variety of technical indicators. Users appreciate its user-friendly interface and the ability to practice without risking real money.

However, Forex Tester Online is now more advanced, modern, and available online on all devices and browsers. So we recommend it as our primary stock simulator.

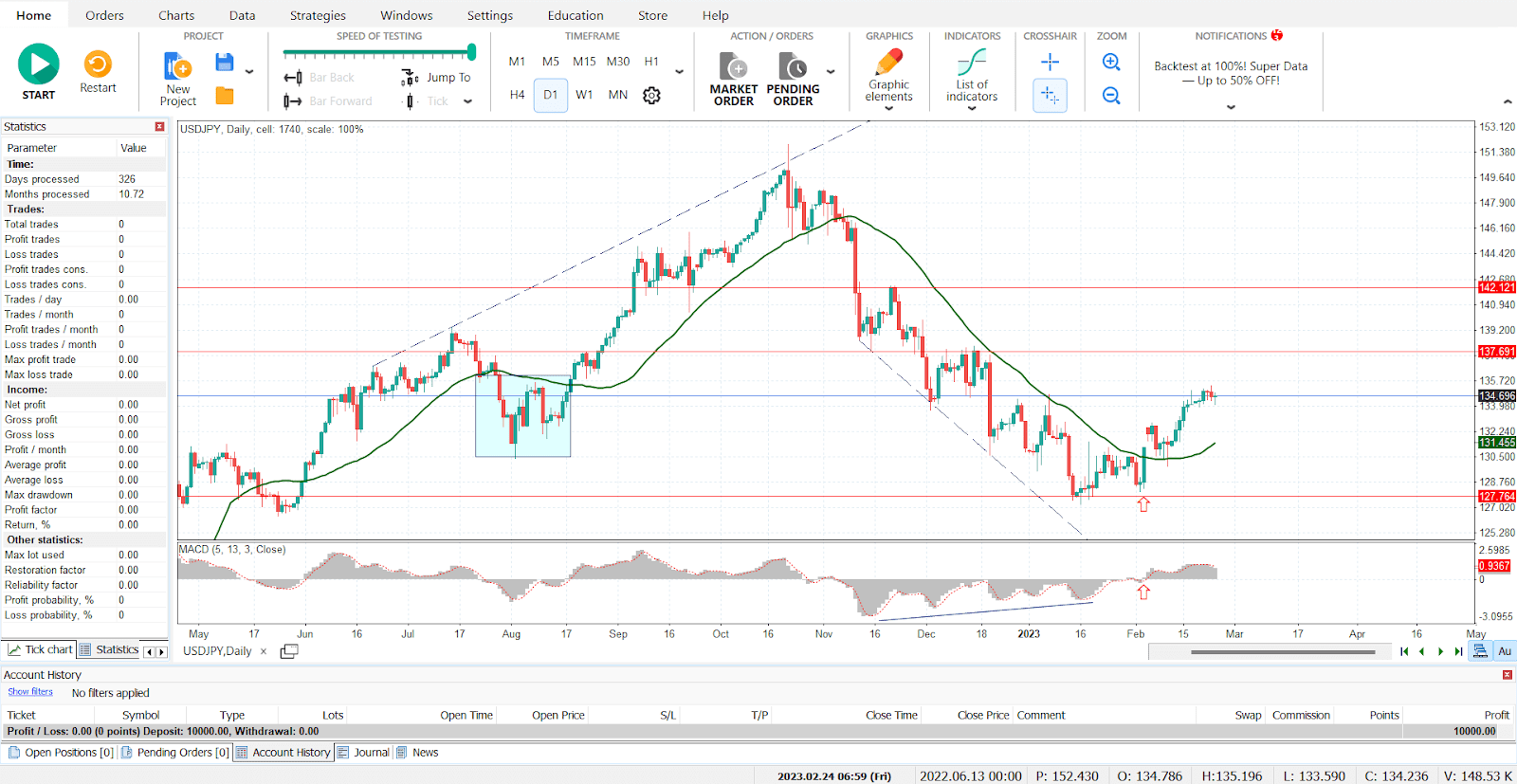

- MetaTrader 5 (MT5)

MetaTrader 5 is a multi-asset trading platform that supports forex, stocks, and futures trading.

It offers advanced charting tools, technical analysis capabilities, and supports automated trading through Expert Advisors.

Users value its popularity and flexibility. However, MT5 is not as advanced as other tools mentioned here.

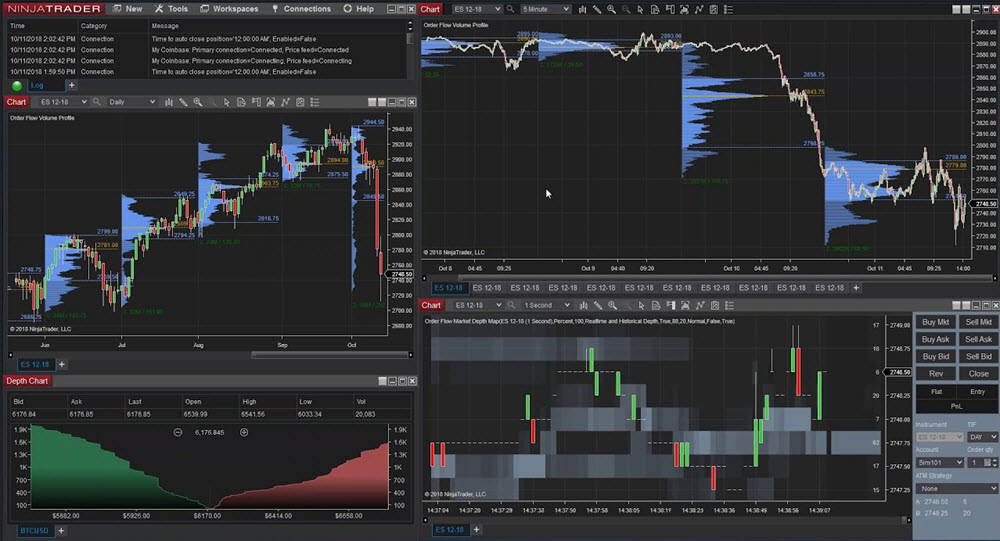

- NinjaTrader

NinjaTrader is a platform tailored for active traders, focusing on futures and forex markets.

It provides advanced charting, market analysis tools, and supports automated strategy development. Users appreciate its extensive customization options and the ability to simulate trades. However, it has a steeper learning curve and may require purchasing additional data feeds.

Each of these platforms offers unique features catering to different trading needs. It’s essential to assess them based on your specific requirements and trading style.

What Should You Look for in Stock Backtesting Software?

When selecting a stock backtesting tool, here are the key factors to consider:

- Historical Data: Ensure the software provides at least 5–10 years of historical data, preferably more. Access to extensive data allows you to evaluate your strategy’s performance across different market conditions and gain more confidence in its effectiveness.

- Data Visualizations: Look for platforms that offer diverse visualization options, such as charts for entry and exit points, scatterplots and barplots of trade returns, and line charts showing account balance and drawdowns. Detailed tables summarizing all executed trades during the backtest are also valuable.

- Support for Custom Strategies: Check whether the tool supports coding for custom strategies or provides no-code options with enough flexibility to design, test, and refine your trading approaches.

- Price: Consider the overall cost, value for money, average cost per month, and whether there are any hidden fees.

- Strategy Optimization Tools: These tools can help fine-tune your strategy for maximum profitability, reduce losses, and limit trading risks by minimizing drawdowns.

- Usability: What the interface looks like, ease of use and navigation, incorporation of modern design elements and features, as well as accessibility.

Advantages of backtesting your trading systems for stock trading

Why you must test trading and investing approaches on history? Stock backtesting has a number of benefits:

-

Saving money

Stock backtesting software helps you to save huge money.Beginner traders very often lay their hopes for their own systems and start trading under them with no testing. Historical backtesting will save you thousands of dollars and you will simply not trade on a loss-making system.

-

Saving time

Trading on an untested trading system, you can lose months or even years trying to refine it. But if backtest the stock strategy immediately, you can see if it is not promising in a few hours and save yourself years’ worth of time and avoid that disappointment.

-

Saving nerves and health

Being in a drawdown for 14 years straight for an investor or 1 year for a trader is not a good perspective to have a steady mental state. Trading in a loss, a trader may stress out too much, fall into depression, and thus destroying their own health.

Thanks to stock market backtesting, a trader has the opportunity to make their losses solely virtual, not affecting their real accounts, in a stock trading simulator, which is not painful at all. On the contrary, it gives the possibility to train your own nerve on virtual money.

Summary

For traders seeking the best stock trading simulator, Forex Tester Online stands out as the top choice. Its focus on precision backtesting, extensive features, and ease of use make it a clear winner.

eToro and TradeStation are solid platforms but are better suited for trading rather than detailed backtesting. They provide good tools for active traders but lack the depth needed for testing strategies effectively.

TradingView and MooMoo are decent alternatives. TradingView offers advanced charting, while MooMoo appeals to beginners with its user-friendly interface. However, both have limitations—TradingView’s complexity and MooMoo’s user complaints about reliability.

If you’re looking for something different, Forex Tester, MetaTrader 5, and NinjaTrader are worth considering. While they aren’t the best for stock backtesting, they can be valuable options depending on your preferences and needs.

FAQ

Should You Use a Simulator to Practice Trading Stocks?

Absolutely. Whether you’re a long-term investor or a day trader, a paper trading simulator is an invaluable tool.

For long-term investors, virtual trading provides hands-on experience with placing orders and observing how stock prices fluctuate. It also helps you get comfortable with the reality that your portfolio won’t always be in the green, teaching you not to panic when you see losses.

That said, trading simulators are primarily designed for active traders. If you’re an aspiring trader or even an experienced one looking for extra practice or a way to test new strategies, a reliable trading simulator can be an essential resource.

What are some common myths about stock trading?

Let’s look at some stock trading myths in a detail:

- Having a mobile app on your phone is enough to trade stocks at a profit. This is more a myth than the truth, as you shall need professional software and the knowledge using it to profitably trade or investing in stocks.

- Investing in stocks is easy — you need just to buy. Investing is easy only on paper. In reality, looking at historical data you can see that having bought stocks in the year 2000, your stock portfolio would gain a profit only in 2014. What beginner investors are willing to be facing losses for 14 years straight?

- Trading stocks is easy and you can begin right with the real account. Easily and quickly you can only lose, not earn. Trading stocks in a profit requires learning.

How to check the effectiveness of your own trading system for stock trading?

Don’t trust ads, but figure out how to trade stocks yourself. But to check, you need to create your own trading approach which should include:

1. Trading System

It is a set of rules, an algorithm of actions on which your trading will be based. It is preferable that the trading system is clearly formalized, written on paper, or on a computer.

Such a system should give a clue on:

- Where to enter the market?

- Where to exit the market?

- With what instruments do you plan to trade?

- What time period — hour, day, week, month — will you analyze?

2. Money management

Money management is an algorithm of volume selection for trading. If trading with too big volume in one deal regarding the deposit, then the trading account will face big risk. If trading with too small volume, then most of the capital will be not used, and the profit percentage will be low.

Money management helps to choose the optimal volume for each deal under the current trading system.

3. Risk management

As the name suggests, this section stands for risks during trading. Long-term success in trading or investing is impossible without strict risk control. Before pressing the buttons on the trading terminal, a trader or an investor must decide what risk they allow for themselves.

What’s the best option for stock and options traders?

ThinkorSwim Paper Trading is a great choice for stock and options traders who want live market data, advanced charting, and real-time practice without risking real money.

Is there an alternative better suited for stock traders?

Yes, MetaStock is a strong option for traders focused on stocks and futures. It offers advanced technical analysis and market scanning tools, though it is more expensive than some other alternatives.

Can I backtest stocks on a Mac?

Forex Tester Online is an online browser tool. So it’s compatible with MacOS, Windows, and Linux, as well as Android and iOS. Any browser, any operating system: both mobile and desktop.

Forex Tester Online

Stock trading simulator for backtesting strategies using historical data

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska