The next pair in the row to try is the ADX (Average Directional Index) indicator accompanied by the Moving Average. Can this pair of indicators show good results? What are the best settings for ADX to perform with?

Intrigued? Read the results below.

What can the ADX indicator reveal?

The main aim of the ADX indicator is to measure trendiness. So if you are looking for an indicator to check whether the trend is going up or worn, it is not the proper one – it shows only whether the trend is strong or the market is consolidating.

The trend is strong and is not going to fade if the indicator reaches above the 25 line. On the contrary, if the indicator reaches below the 25 line, then the trend is weak or the market is not trending, so it is better not to enter trades during such a period.

The ADX signals over 30 demonstrate the strong trend to happen – it is definitely the best time to get into the trade.

Important tip: when the ADX is over 35 and it is above either +DI or -Di, then the trader should look carefully for the signals from another indicator because the possibility of the reversal is very high.

What is the purpose of MA here?

Within this strategy, we use additionally the Moving Average. As said above, the ADX cannot spot the trend, but only its strength, so we use MA to check whether the trend is up or down and take the candlestick crossover as the entry signal.

Initial conditions of the ADX + Moving Average Indicators test

Timeframe: 15 mins and above (we backtest within the 30 mins timeframe).

Currency pair: Any.

Indicators: ADX (with default settings); 14 EMA.

Step-by-Step ADX + EMA Trading Rules

Buy Rules:

- ADX line should cross the 25 line to indicate the strong trend

- The Bullish candlestick should close above the 14 EMA

- Place a pending buy stop order 1-2 pips above the high of that candlestick

- Stop Loss should be placed 2-5 pips below the low of that candlestick

- Take profit should be 3 times more than Stop Loss or place it on the closest swing high

Sell Rules:

- ADX line should cross the 25 line to indicate the strong trend

- The Bearish candlestick should close below the 14 EMA

- Place a pending sell stop order 1-2 pips below the low of that candlestick

- Place your stop loss 2-5 pips above the high of that candlestick

- Take profit should be 3 times bigger than the Stop Loss or place it below the closest swing low

Important: we do not trade when the ADX is below the 25 line.

Ready to test ADX + MA trading strategy?

To check this (or any other) strategy’s performance you can try Forex Tester Online (FTO).

Check how to use FTO simulator in our step-by-step guide or watch this video:

Customizing the Strategy: ADX Settings & Indicator Pairings

There are several ways to read the ADX indicator, the author of the method indicates that if the ADX crosses the 20 level – then the trend is getting stronger if the ADX is over 30 – the trend has gained even more power.

However, still different traders emerge various readings of this indicator:

- Some propose to get into the trade when the ADX is below the 20 line, so it gives the possibility to catch the growing trend and not to miss the beginning of it. The basic idea is that the more mature trend is the more possible is the reversal;

- Other traders make the use of all three lines of the indicator: ADX itself, +Di and –Di lines – they perceive the cross of these lines as the additional signal of the (), while there are some traders who propose to ignore those lines and trade ADX directly (as we did in the described strategy);

- In addition, we should mention several opinions that not the cross of the 20 line is that important as the slopes of the indicator and its direction.

We cannot claim any of these being false or true, as obviously every trader finds its own way to read popular indicators and adjust them according to their trading needs. Again, the best way to find out – to backtest any of these settings and pick the one that will work the best for you.

Tips for Take Profit/Stop Loss and Timeframe parameters

- The meaning of the Take Profit and Stop Loss – traditionally we mention this in every article, but it doesn’t lose the common sense – try to set the same meanings, 1:2 or 1:3 ratio, put it manually above/beyond the nearest swing – any of your SL/TP management can possibly influence the result of the trade;

- Timeframe – usually we list all the possible timeframes you can trade the strategy within, and we backtest one of them – it is up to you to try various timeframes;

- The ADX and EMA combo might not bring the expected results – you can try to combine ADX with the MACD or the Bollinger Bands in order to get more precise signals for the trade entries.

Backtesting Results: ADX + Moving Average trading strategy

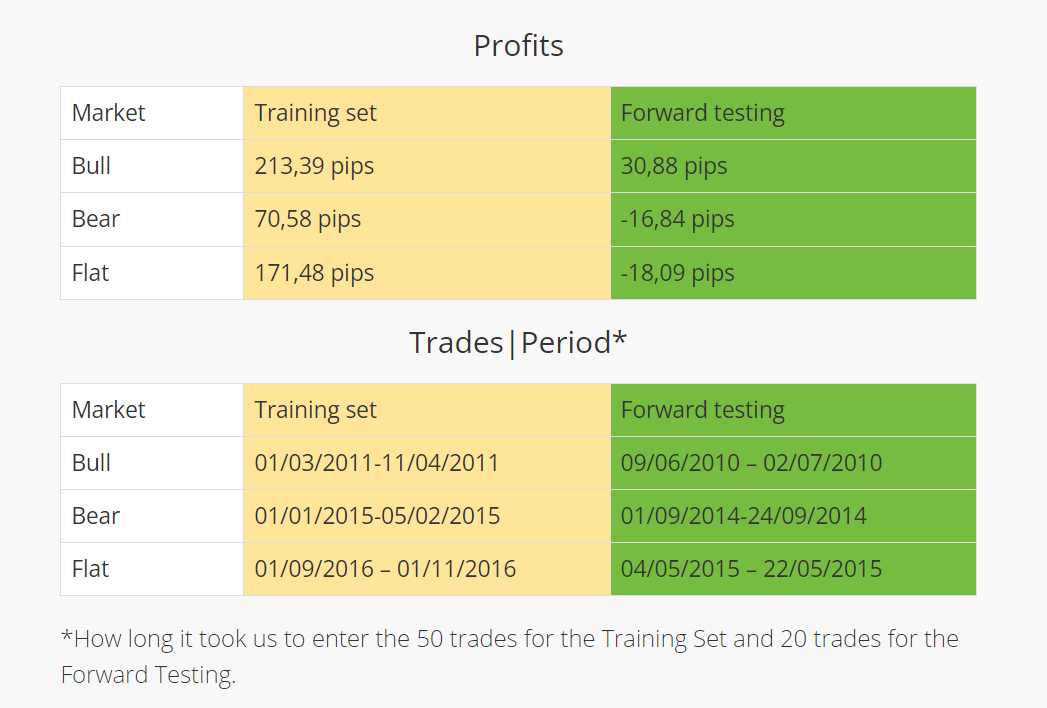

A Reminder: in order to save your valuable time and efforts, we have introduced the system of backtesting when you perform only 50 trades through 3 different types of market (Bullish, Bearish and Flat markets) and then again 20 trades through the given types of market, but during other periods. Then with simple math calculations, we can make conclusions about effectiveness or irrelevance of the chosen strategy.

The full version of the theory of our backtesting experiments and how did we come up with the idea of such backtesting you can read here.

Conclusion

As believed the best results this combo of indicators revealed during the Bull markets.

Backtesting during the Flat market showed optimistic results, so we thought: “Finally, we have found a strategy and the indicator that shows pleasant results when the market is Flat”, but no, the forward testing proved again that trading in trending markets shows more results as always.

Besides, as the market is not trending, the ADX was quite often under 25, so it was hard to find the trades setups.

As for the period, it took us to perform the trades, we have achieved the aimed quantity of trades in a month or less. Not bad, right?

Based on that we can assume that this strategy can work out potentially with the different settings backtested.

As you can see, the main idea of our backtesting experiment was to show that:

- First of all, you shouldn’t trust anything/anyone on the internet if you risk your money/time/efforts.

- Any idea/strategy/trading plan should be backtested first.

- Even the slight changes in the trading plan can cause different and sometimes surprising outcomes.

As you can see, backtesting is quite a simple activity in case you have the right backtesting tools.

The testing of this strategy was arranged on FTO with the historical data that comes along with the program.

FAQ

What is the MA indicator in ADX?

The Moving Average (MA) is not directly part of the ADX indicator itself but is often used alongside ADX to provide trend direction. ADX measures trend strength using the smoothed moving average of directional indicators (+DI and -DI) divided by the average true range (ATR). However, a separate MA can be used to complement ADX by indicating the direction of the trend, helping traders decide whether to enter long or short positions based on both strength and direction.

How the Moving Average helps the ADX Indicator?

The Moving Average (MA) adds trend direction to the ADX, which only measures trend strength. A 14-period EMA filters direction: prices above EMA signal uptrends, below indicate downtrends. When ADX >25 (strong momentum), EMA crossovers (price crossing EMA) confirm entries/exits, reducing false signals. Smoothing the ADX line with an MA highlights trend sustainability. Together, they combine directional clarity (MA) and strength (ADX) for higher-probability trades.

Develop ADX Trading Strategy

Develop ADX Trading Strategy

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska