We’ve reached a point where AI isn’t good enough to make money for us automatically, but it’s already an essential part of any advanced trader’s toolbox. Today we have scanners, bots, an AI assistant in every tab, and tools that run automated trading, technical analysis, and backtesting in minutes. So, the goal of this guide is simple: show the best tools for real work – market analysis, portfolio management, journaling, and risk control. We review picks for day traders and investors, plus how backtesting ties it all together with Forex Tester Online and a free trading audit.

Read on to find what fits your desk in 2026.

AI Trading Tools

As we said before, today’s AI trading platform options cover scanners, signal engines, and automated trading with smart bots. The best picks stream real-time trade signal ideas and handle algorithmic trading orders with AI-driven filters. Below we start with a crypto tool many readers ask about.

WunderTrading

WunderTrading is an AI-powered platform for crypto that lets you run automated trading 24/7 across top exchanges from one dashboard. You connect APIs, pick or build bots (Grid, DCA, Signal), set rules, and the system handles entries, exits, and sizing. It supports copy trading, paper trading, spreads/arbitrage tools, and multi-account control, so you can scale the same logic across many wallets. We like that you can test in demo first, then go live when ready. Tip: pair it with separate backtesting software to vet any trade signal logic before real risk.

Key features

- Grid, DCA, and Signal bots with rule presets and custom logic

- One terminal for many exchanges; automated trading on multiple APIs

- Copy trading and signal marketplace (follow or publish)

- Smart orders: TP/SL, trailing, partials

- Paper trading and portfolio tracker

- Spreads/arbitrage and pump screener tools

How can it be useful?

If you trade crypto and want hands-off execution, WunderTrading cuts clicks and misses. You can mirror a strategy across accounts, react faster than manual trading, and keep discipline when volatility spikes.

Other Tools

Here are a few solid AI trading tools to check out (besides WunderTrading):

- Trade Ideas (aka Holly AI) – AI-generated day-trade signals, realtime scanners, and bot execution.

- QuantConnect – cloud research and backtesting with C#, Python, and machine learning libraries.

- Capitalise.ai – natural-language rules that automate trades without code; broker integrations.

AI Tools for Market Research and Analysis

Good research saves time and money. AI-driven scanners and pattern tools speed up market analysis, cut noise, and surface clean setups for technical analysis and strategy ideas.

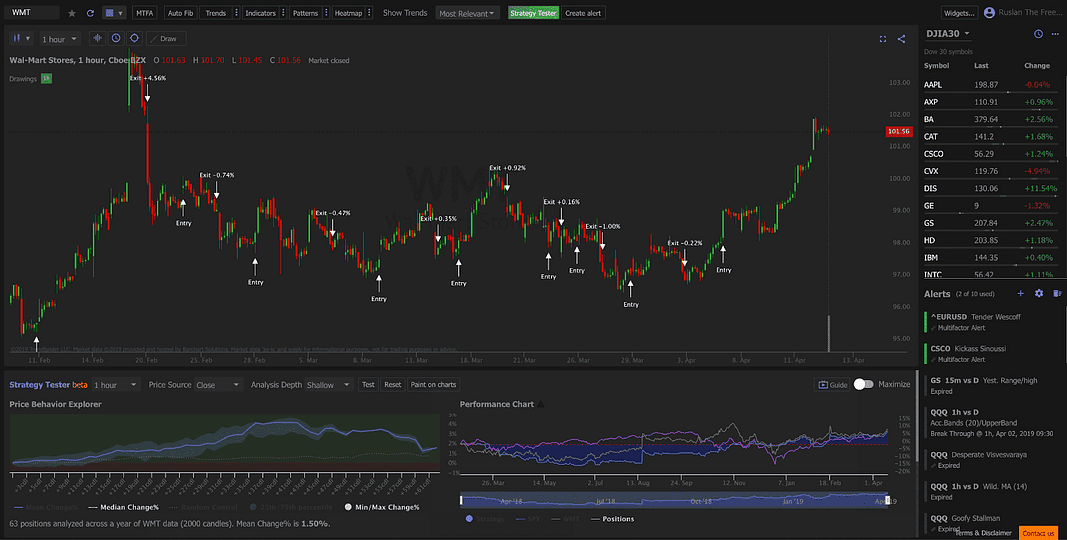

TrendSpider

TrendSpider is a charting and research suite that automates technical analysis and scanning. It auto-draws trendlines, maps supply/demand zones, and detects candlestick and chart patterns in seconds. You can run backtesting on those rules without code, then turn them into alerts.

Multi-timeframe views let you stack daily, 4-hour, and hourly signals on one chart. For workflow, the Raindrop charts and strategy tester make it easy to study price/volume behavior before you commit risk. TrendSpider also connects alerts to webhooks, so your bots or broker rules can react right away.

Key features

- Automated trendlines, patterns, and heat-mapped support/resistance

- Multi-timeframe overlay on a single chart

- Strategy alerts to webhooks; optional automated trading via integrations

- Raindrop charts for price + volume at time (great for volume confirmation)

- Global market scanner for trade signal ideas

How can it be useful?

It removes manual line drawing, so technical analysis is faster and more consistent. You can turn a chart idea into a tested rule with quick backtesting, then judge if it holds up. The volume-aware visuals help you filter fake moves. Alerts can feed your bots or scripts, making automation simple. Overall, it’s a clean way to validate edges before a full algorithmic trading rollout.

Other Market Research Tools

Here are solid AI tools for market research in case you don’t like TrendSpider:

- AlphaSense – NLP search over filings, earnings calls, and research; quick sentiment and theme pulls.

- RavenPack – AI news/sentiment scores and event tagging for faster market analysis.

Also read: TrendSpider Alternatives for backtesting

AI Tools for Portfolio Management and Optimization

Modern portfolio management needs clear risk views, fast rebalancing, and data you can trust. AI helps with asset allocation, factor exposure, and long-term forecast models. The goal is simple: size risk, cut noise, and keep your book aligned with rules you can defend. Pair these tools with backtesting so ideas are proven before money is on the line.

BlackRock Aladdin

Aladdin is BlackRock’s enterprise system used by large asset managers, pensions, and insurers to run portfolios end-to-end. It brings positions, pricing, and risk into one screen and layers in advanced analytics to spot factor drift, concentration, and cross-asset exposure. Teams use it for daily portfolio management, compliance checks, and “what-if” shocks across rates, credit, equities, and of course FX.

Aladdin’s modeling stack covers factor risk, scenario analysis, and stress tests that map P&L to real drivers. For systematic desks, it supports data pipelines and rules that align model output with trading constraints. This is kind of a control room: positions in, analytics out, decisions logged.

Key features

- Consolidated holdings, risk, and compliance in one system

- Factor models and scenario/stress testing across asset classes

- Rebalancing tools with trade lists and pre-trade checks

- Attribution to see what actually moved P&L

- Workflow for teams: approvals, limits, and audit trail

How can it be useful?

When books grow, spreadsheets break. Aladdin helps managers see true exposure, test shocks before they hit, and keep trades inside mandate. It reduces blind spots and turns scattered data into a single, tradable plan – especially useful when your quantitative trading or model signals must pass real-world limits.

Similar tools worth a look

- SigFig – retail/advisor portfolios with automated rebalancing and tax-loss harvesting.

- Omega Point – factor risk analytics and model alignment for equity portfolios.

- Portfolio Visualizer – efficient frontier, Monte Carlo, and backtesting for asset mixes.

AI Tools for Trade Journaling and Performance Review

Good journaling turns raw trades into clear lessons. AI can tag patterns, link context to outcome, and point to fixes you can test with backtesting before changing live rules. The result is steady, data-driven improvement that fits both discretionary and algorithmic trading styles.

Edgewonk

Edgewonk is not a well-known, but a solid modern trading journal that ingests your full trade history and turns it into plain, useful insights. Import from hundreds of brokers in seconds, add a few custom tags. The dashboard shows which setups pay, and how exits and stop losses rules affect results. Privacy is built in; your data stays your own.

The AI modules surface hidden leaks (late entries, early exits, rule breaks) and map them to concrete fixes you can test via backtesting. It works for scalping, swing, or AI assistant trading systems, across forex, stocks, crypto, and futures. If you use bots, you can journal bot trades too and compare them to manual ones to see which rules actually deliver. Pair these findings with a quick test loop to confirm changes before you deploy the next trade signal.

Key features

- One-click imports from 200+ brokers and platforms

- AI insights on win rate drivers, timing, and rule adherence

- Custom tags for setups, sessions, market state, and risk

- P&L attribution, MAE/MFE, drawdown and equity analytics

- Cloud access, all markets/currencies, secure by design

How can it be useful?

Most traders don’t need a new system – they actually need proof of what already works. Edgewonk shows which entries, exits, and management rules create edge and which habits hurt. You get a simple action list, then verify tweaks with backtesting before touching live capital. It’s a clean path from diary to measurable improvement – whether you click entries yourself or run bots inside an AI trading platform.

Other tools worth a look

- Tradervue – fast imports, sharing/mentoring options, clean stats.

- TraderSync – strong tagging, mistake tracking, and heatmaps.

- Chartlog – session notes plus metrics tied to setups and risk.

AI Tools for Risk Management

Good risk management keeps you in the game. AI can flag exposure, size positions, and spot drift from your rules. But the safest place to test risk is before you trade. That means strict backtesting, stress tests, and clear rules you can repeat in live markets.

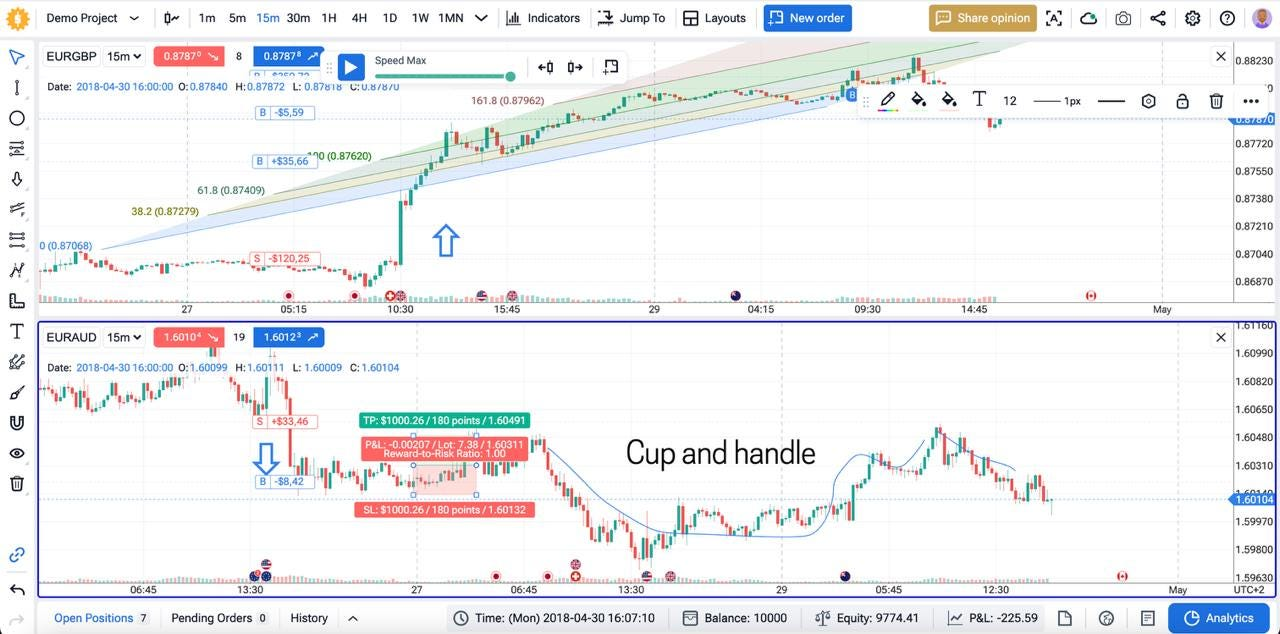

Forex Tester Online

Forex Tester Online is our go-to backtesting software for risk work. It is a web-based backtesting platform that replays real markets tick-by-tick across forex, crypto, indices, stocks, ETFs, and commodities. You can mirror live trading with floating spreads, commissions, slippage, margin, and multi-chart layouts. Run both manual and automated tests, or script rules for algorithmic trading. Then read clean analytics to see what truly cuts risk.

What you get with FTO:

✅ 20+ years of tick data

✅ Integrated news feed

✅ AI trading analysis

✅ Mystery Mode to hide future bars

✅ Custom technical indicators

✅ “Jump to” specific time frame meeting required conditions

✅ Prebuilt market scenarios

✅ Detailed analytics and latency logs

✅ Technical analysis filters

✅ Prop Firm challenges

✅ Exit Optimizer analytics to find perfect exits in future trades

✅ Automated tests using AI assistants

✅ And more

FTO also offers AI Analytics & Automations on Pro plans, custom indicators, mixed portfolio testing, and jump-to-signal navigation.

A smart workflow pairs FTO with our free AI Chart Analyzer. Upload your trade history, get data-driven fixes for sizing, timing, and costs, then take those ideas back into FTO for strict backtesting. You move from “guessing” to rules that hold up.

If you want tighter risk, start a small project in Forex Tester Online today. Run 100 trades of your breakout or mean-reversion rules. Lock in the stop distance and position size that keep drawdown within your limit. Only then push changes to your live platform.

How to Choose AI Tools Based on Your Trading Needs

Start with style and goal. Day traders who live on speed and momentum trading strategies do well with AI trading tools for real-time trade signals, automated trading via bots, and lightweight news/volatility filters. Swing traders can lean on market-scan and technical analysis platforms (such as TrendSpider) to define support and resistance, then route orders through simple automation. Longer-horizon investors and allocators benefit more from portfolio-level analytics (such asAladdin-style risk and factor views) and disciplined journaling to track edge over months, not minutes.

Most of us end up with a small stack: research + signals, execution bots for algorithmic trading or rules-based automated trading, a journal/analytics tool, and a dedicated backtesting engine.

Getting Started: Practical Tips for Implementing AI and Risk Tools

Stand up a simple pipeline, prove it in backtesting, then scale.

- Pick one market and one timeframe; write clear entry/exit and stop loss rules.

- Choose a research/scanner (e.g., TrendSpider) plus one execution path: automated trading via a bot or semi-auto with alerts.

- Build the rule in FTO and run 100+ trades of backtesting; record win rate, drawdown, slippage.

- Use the FREE AI Chart Analyzer to audit live or demo history; apply the suggested sizing/timing fixes, then re-test.

- Start with read-only API keys and small size; monitor trade signals vs fills and latency.

- Journal every trade (Edgewonk) and review weekly; retire rules that fail out-of-sample.

- Add safeguards: daily loss limits, max positions, correlation caps; automate them where possible.

- Expand tools only when the current stack is stable and proven by backtesting.

Disclaimer

Trading involves risk. The indicators in this article are for educational purposes only and are not financial advice. Past performance does not guarantee future results. Always test strategies before using real money.

Conclusion

Breakout moves come and go, but a solid process lasts. Pick a small stack: research, trade signals, bots for automated trading, a journal, and rigorous backtesting. Prove every rule in FTO, and only then run another backtesting pass for true strategy validation. Start small, keep risk tight, and let verified edges do the work. Good luck!

Forex Tester Online

Discover reliable AI backtesting assistant

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska