In the financial market, we are all speculators (large and small, nervous and calm). Unlike the traditional surfing, to «catch a wave» in the financial market is not only a pleasure, but also a profit.

A popular Forex coach Alexander Gerchik has compared the market volatility to the car fuel: consumption depends on the brand of your transport (a trade asset), travel time (timeframe) and your driving style (strategy type).

Even if we take into account that the statistics do not lie, and the market is under the flat condition most of the trading time, the range of price fluctuations can be sufficient for each confident trader to earn.

We offer one more useful tool from the well-known book «New Concepts in Technical Trading Systems» by J. Welles Wilder – the Average True Range indicator. It is the ability to use volatility tools that will make you a professional trader.

Average True Range Indicator: Logic and purpose

Let’s start with the main thing: Average True Range was not actually developed in order to make forecasts and generate trading signals. It does not show the key price levels, it cannot even be applied as an indicator of the overbought/oversold zones.

Its only task is to measure and evaluate the volatility dynamically, but the practical value of the indicator does not decrease because of it.

This auxiliary tool was developed for the futures and stocks markets, and it is still most in demand there – the ATR data is included in all regular stock market reports.

ATR indicator: schemes of the market assessment

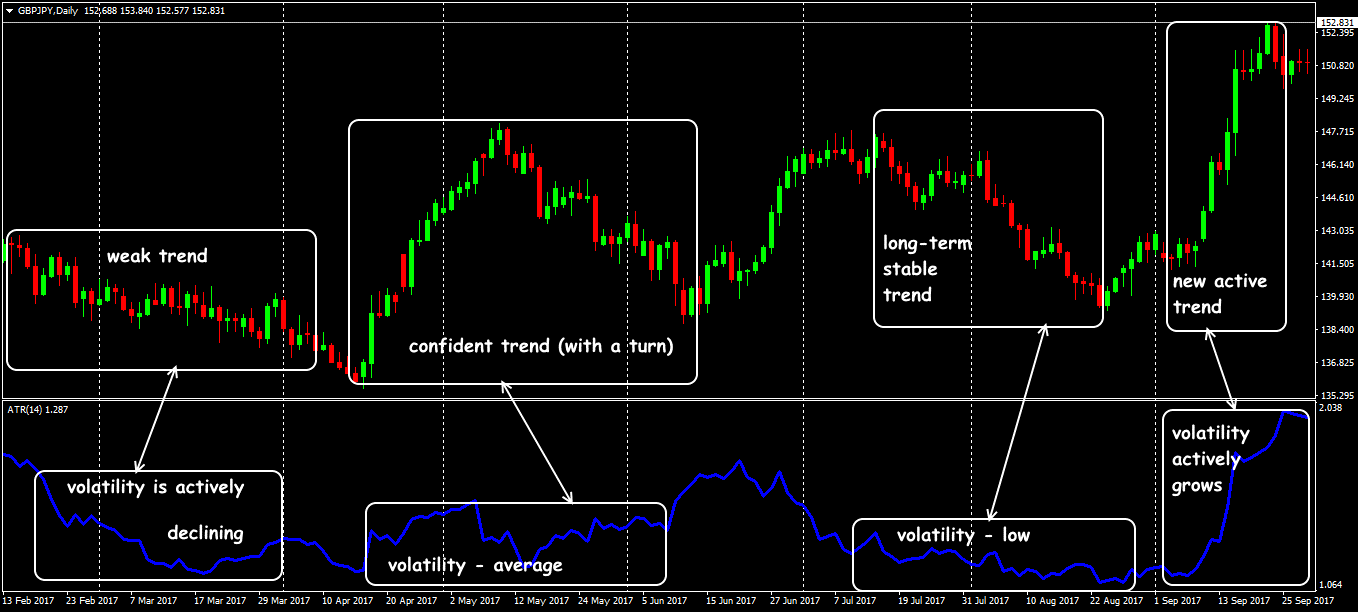

The main idea is evaluation of the trading activity for a specific trading asset:

- if ATR grows, then the asset is highly traded and the current trend is likely to continue;

- if the line declines, then the market’s attention to this asset decreases (weak volatility), the current trend gradually weakens − the probability of the flat or reversal is high;

- high values of the indicator – there is an active movement in a wide range in the market;

- if the indicator moves with a low amplitude, then there is consolidation in the market and we should wait for a sharp breakout.

But here’s the problem:

The ATR indicator doesn’t report information about a direction of the trend (or breakdown). Then what is its advantage? Read further.

Average True Range Indicator: Calculation procedure

The concept of a «true range» (or TR) has been used for a long time in statistics, and in the market analysis, it is used in many technical indicators.

In terms of statistics, the «true range» is the max of the following three values:

- PriceHigh − PriceLow (difference between the current price max/min), or …

- PriceClose (i-1) − PriceHigh (difference between the previous Close price and the current max), or …

- PriceClose (i-1) − PriceLow (difference between the previous Close price and the current min).

After selecting this value, you can calculate the ATR indicator − it is a moving average of the «true range» for a period:

Average True Range = SMA (TR, n).

The most common method is to calculate the simple MA.

Fans of mathematics may be interested in the question of recursion: how to calculate ATR(i-1), or the indicator’s value for the previous period?

The bottom line is that you need to wait until N periods pass and you have enough data to calculate. The first TR is calculated as the usual difference between max and min for the first period. As a result of calculation, we obtain a traditional moving average line.

Average True Range Indicator: Parameters and control

The standard version of the indicator uses only one parameter – the number of bars to calculate; additional smoothing options are not applied.

By default, n = 14 is proposed – the price volatility based on the last 14 periods. This value is considered optimal for the medium-volatility assets (see Indicator ATR).

The indicator line is located in an additional window below the price chart, a scale of values is «floating» and adaptive, the balance lines and critical zones, as a rule, are not used.

Standard version of the ATR indicator

Changing the ATR settings affects its sensitivity. Using of the lower values means a smaller number of the calculation data which makes the indicator much more sensitive to the recent price maneuvers.

The longer the analysis period, the smaller parameter value has to be, for example, for D1, n=7 is recommended.

A long and short period in ATR

With an increase of the parameter, the moving average line becomes smoothed, but the main drawback of the calculation − a strong lag – is amplified, that is the ATR values will reflect the volatility that is not absolutely current.

How to use ATR to make a trade decision?

Let’s look at it in detail.

Trade signals of the ATR indicator

ATR does not show the explicit entry points, all recommendations are based on a visual assessment of the situation, therefore they are very subjective. The indicator shows how much the price of an asset has changed over a period of time, and estimates the approximate price changes in the near future − of course, if the current trend is maintained.

ATR: calculation of the day price range

In this example: in an indicator window (on a scale on the left), you see the current value – 0.01365. It is an average range. The period of the price chart is D1, that is the average volatility of the asset is 1365 pips for the last 14 days.

It means that after this point, the price (with high probability) will change for 1365 pips in a day. And it is right: the following day bar has made 1344 pips which is an excellent result if we consider smoothing in the ATR calculation formula.

When the indicator’s line is actively rising, it means that the new participants join the current movement (create volatility). This fact increases probability of an active continuation of the current trend.

On the price chart, there are either candles with a big shadow (there is a struggle in the market!), or the large bars almost without «tails» (a strong priority of one type of players − bulls or bears).

If the indicator’s line falls or is situated in a zone of the low values, this does not always mean a flat or a weak activity in the market.

The current trend may continue, but at a steady rate − a sequence of the small bars with short «tails» and of the same direction appear on the price chart. That is, there are few speculators and a large margin of stability in the market.

The ATR indicator shows all the strong divergences/convergences perfectly, but you can only use this fact with an additional confirmation from other tools (check Using Graphic Tools).

The ATR indicator together with Alligator

Application in the trade ATR strategies

Average True Range is recommended to be used for the trading assets that are volatile enough, and only as an auxiliary tool of the technical analysis. We will offer only the most popular options.

ATR for Take Profit/Stop Loss

Average True Range allows you to estimate how far from the current point of the market you can place the key levels. For example, if the indicator shows a value of 100 points, and the price of these 100 points has already passed for a trend, then the current trend is more likely coming to an end and it is already dangerous to enter the market.

Why is this so?

Reminder: the ATR value is an average range of volatility for a period.

So, with the help of the additional indicators, you need to make sure that there are serious reasons (technical and fundamental) to exceed this average, and the «action points» for the current trend will allow you to make a transaction correctly.

We argue similarly when installing Stop Loss: calculating the daily price range filters the «market noise» well and allows you to place the order as safely as possible.

If, nevertheless, the price has reached such a Stop Loss level, then the probability of a real trend reversal increases significantly. The ATR values are also recommended for setting the trailing stop levels.

Using ATR as a trend filter

You can apply a signal interpretation that is standard for all volatility indicators. ATR cannot have negative values, and there is no real middle line either .

You can place a certain balance line on the ATR chart, which is approximately determined for each asset separately.

For example, on the ATR data, you can additionally create a moving average with a long period − this will be the «dynamic» mean.

ATR+MA: moving average as a basic trend

While the ATR line is moving below its MA, the volatility is negligible, and the market is calm. If the ATR line breaks the middle one from the bottom upwards – we should wait for a strong trend.

The accuracy of such signals increases when using this method on several timeframes, but the MA parameters for each period will have to be selected separately.

On the ATR data it is possible to use the channel indicators, for example, Bollinger Bands: then the signal of growth/decrease of volatility will be the breakdown of the channel boundaries.

An example of using ATR together with Bollinger Bands

With the help of ATR, traders receive information about the expected size of the price maneuver, so it would be logical to assume that this indicator is effective incombination with the standard oscillators such as RSI or ADX.

An example of using ATR together with RSI

We remind you that during the news release (or other force majeure), market volatility is unstable and the ATR values will be inaccurate.

Several practical remarks

It is Average True Range data that is used by major traders to manage the risks: more «broad» Stop Loss during high volatility, and more «narrow» when the ATR values are low.

Correct evaluation of the price fluctuations range will allow you not to be late with the entrance (do not open a deal when the market is «falling asleep» or making a turn), not to keep a useless deal during a flat period, and place Take Profit/Stop Loss values optimally.

Without using the Average True Range calculation, it is almost impossible to create a serious trading robot, especially when you need to adapt a trading model to the current market volatility.

Yes, this indicator does not provide information about the price direction, entry points, presence of the trend, but at the same time, there is no such thing as «bad» market conditions for it. This technical analysis tool always works.

Develop ATR Trading Strategy

Develop ATR Trading Strategy

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska