Price action trading focuses on interpreting raw price movements in financial markets, representing a fundamental approach to technical analysis that eschews indicators and complex analytical tools. The underlying principle is straightforward yet powerful: while indicators lag by nature, price itself represents the immediate interaction between buyers and sellers, offering direct insights into market behavior patterns and potential future movements.

In an era where trading technology advances rapidly and markets grow increasingly complex, many retail traders wonder if they can compete with sophisticated algorithms and high-frequency trading systems. However, the answer lies not in choosing between human judgment and technology, but in combining their strengths. While automated systems excel at rapid calculations and execution, the human mind possesses unique capabilities in pattern recognition and contextual analysis that define successful price action trading.

The key to mastering price action trading lies in bridging the gap between human analytical capabilities and technological tools. Modern backtesting platforms like Forex Tester Online enable traders to study and validate their price action observations across 20+ years of historical data for Forex, stocks, indices, commodities, and crypto. FTO combines human pattern recognition skills with technological efficiency.

This synergy between human insight and technological capability offers traders a path to developing robust price action trading skills in today’s complex markets.

What is Price Action Trading?

Price action trading centers on understanding the language of the markets through direct price movements. While modern trading platforms offer an array of sophisticated indicators and automated systems, price action practitioners focus on the most fundamental market data: the actual prices at which market participants conduct their transactions.

The appeal of price action analysis lies in its direct connection to market psychology. Each price movement reflects the collective decisions of market participants, from major institutions to individual traders. These movements often create recognizable patterns – not because of any mysterious market forces, but because human behavior and institutional trading practices tend to follow recurring patterns.

In the forex market, this behavioral aspect becomes particularly evident as prices interact with support and resistance levels. These levels can be identified through various methods – from simple horizontal price levels where market previously reversed, to complex mathematical calculations, trend lines, moving averages, or Fibonacci retracements.

While different traders may identify these levels using different approaches, price reactions often occur when enough market participants recognize and act upon these zones, regardless of their individual methods of analysis. This diversity in analytical approaches, combined with collective market behavior, creates opportunities for price action traders who carefully study how price behaves around these significant levels.

How to Read Price Action in Forex?

Reading price action requires developing sensitivity to market rhythm and structure. Every price movement tells a story about the ongoing dialogue between buyers and sellers, though interpreting this dialogue accurately requires both experience and systematic analysis.

Market structure provides the context for all price action analysis. Trends emerge as prices create sequences of higher highs and lows (in uptrends) or lower highs and lows (in downtrends). However, these patterns rarely develop in straight lines – understanding how prices move within these larger structures helps traders identify potential trading opportunities.

The analysis of individual candlesticks and their combinations adds depth to market structure analysis. While single candlesticks provide information about short-term price behavior, their relationship to surrounding price action and key market levels often proves more significant than isolated patterns.

Support and resistance levels emerge naturally through price action analysis, representing areas where supply and demand have previously shown significant imbalances. These levels gain importance not through any inherent market mechanism, but through the collective memory and action of market participants.

5 Best Price Action Trading Strategies in 2026

The most effective price action strategies combine straightforward pattern recognition with deeper understanding of market dynamics. While no strategy works perfectly in all conditions, certain approaches have demonstrated consistent utility across different market environments.

1. Pin Bar Pattern Strategy

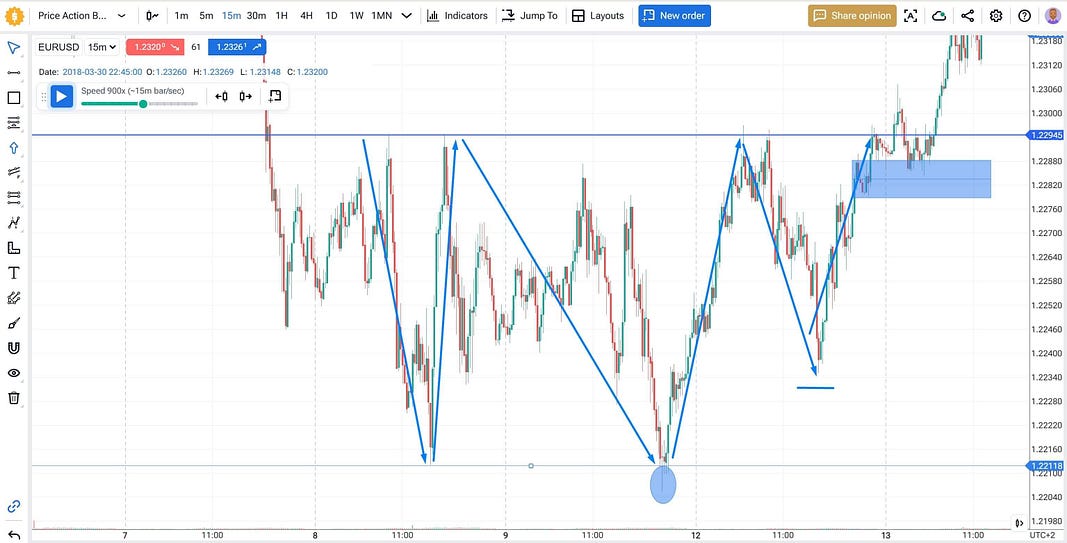

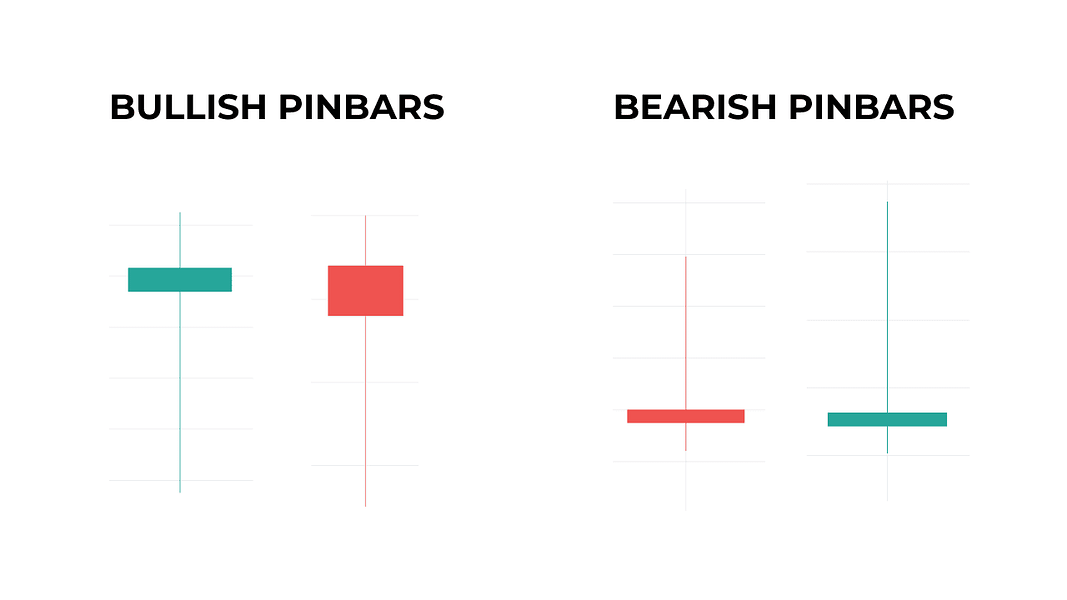

A pin bar forms when you see a candlestick with a long wick (or shadow) and a small body, resembling a pin or hammer shape. Traders look for the long wick to be at least 2-3 times the size of the body, with the body positioned at the opposite end of the wick.

Pin bars represent moments of price rejection – where the market tests a level but fails to maintain prices at that extreme. The power of pin bars lies not in the pattern itself, but in what it reveals about market psychology at key price levels. When these patterns form at significant support or resistance levels, they often indicate potential turning points in market direction.

2. Inside Bar Pattern Strategy

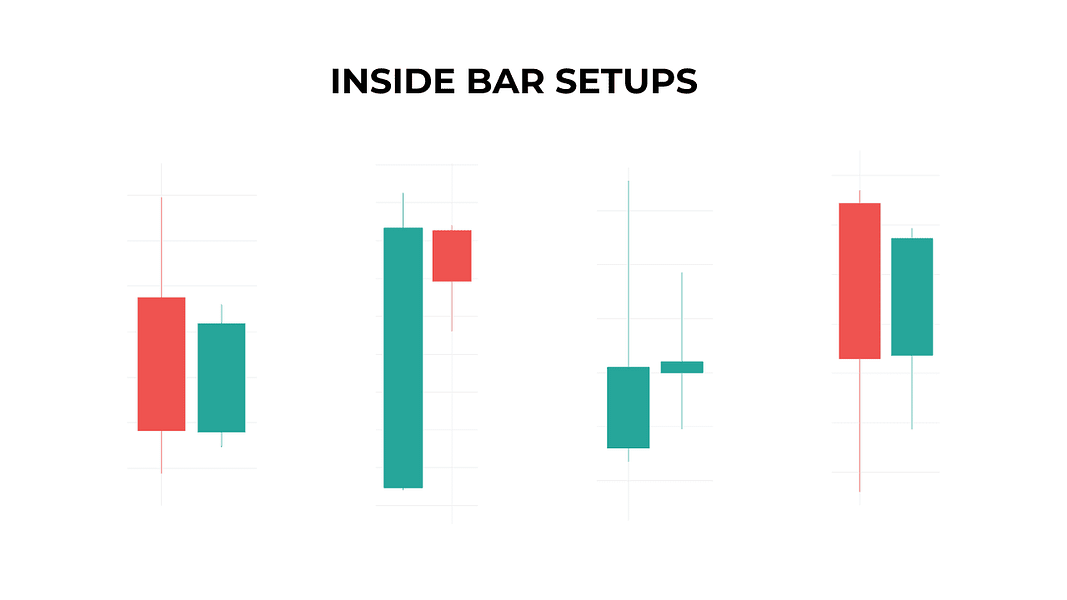

An inside bar setup occurs when a candlestick’s entire price range (high to low) fits within the previous candle’s range. The previous candle, called the mother bar, should typically be larger than average to make the pattern more significant.

Inside bars reflect periods of market consolidation, where price range contracts within the boundaries of a previous bar. While this pattern might appear simple, it often signals potential energy building in the market. Traders who understand market dynamics recognize these patterns as possible precursors to significant price movements.

3. Breakout Entry Strategy

A breakout pattern forms when price moves decisively through a well-defined support or resistance level, with the candle closing beyond the level and often showing strong momentum (indicated by a large body with small wicks).

Breakout trading capitalizes on market dynamics during transitions from consolidation to directional movement. This strategy requires understanding both technical price levels and market psychology, as true breakouts often occur when market sentiment shifts decisively.

4. Fakey Pattern Strategy

The fakey pattern appears as a false breakout – you’ll see price breaking above or below a key level, followed by a quick reversal that traps traders on the wrong side of the market. Look for an initial breakout candle followed by a strong reversal candle in the opposite direction.

Trading these patterns successfully requires both technical skill and psychological preparation, as they often involve trading against the apparent market direction. The pattern’s effectiveness stems from understanding how other market participants might react when their breakout trades prove unsuccessful.

5. Price Action Trend Trading Strategy

Trend trading through price action combines multiple aspects of market analysis into a comprehensive trading approach. This strategy recognizes that while trends provide the overall market direction, the art lies in identifying optimal entry points within these larger movements.

Success in trend trading requires patience and discipline to wait for high-probability setups. Rather than attempting to catch every market move, effective price action traders focus on identifying clear trend structures and waiting for signals that align with the broader market direction.

How to Backtest Price Action Strategy

Backtesting represents the crucial bridge between understanding price action concepts and implementing them successfully in live markets. While price action patterns might appear straightforward, developing the skill to interpret them correctly traditionally required years of market observation. However, modern backtesting solutions like Forex Tester Online (FTO) have revolutionized this learning process, particularly for discretionary approaches that price action traders utilize.

Building the Foundation

Before starting the backtesting process, establish clear definitions for your trading approach:

- Valid market conditions and environments

- Specific pattern identification criteria

- Risk management rules

- Entry and exit parameters

Progressive Strategy Development

The process of building a strategy based on price action should follow a gradual progression. Traders typically start with a single pattern or concept, testing it thoroughly before adding complexity. FTO’s project management capabilities support this approach by allowing traders to save different strategy versions. This feature proves invaluable when traders want to explore alternative approaches or return to previous versions that showed promise.

Understanding Market Context

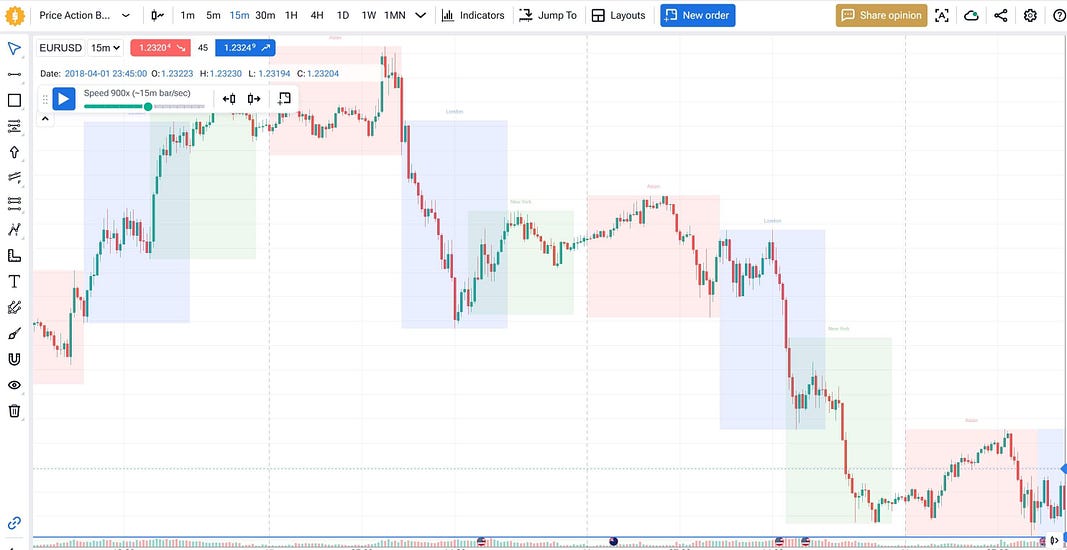

Market context determines the effectiveness of price action patterns. Forex Tester Online (FTO) provides essential tools for understanding market conditions during backtesting. In example, the platform’s session indicator marks the opening, closing, and overlap times of major market sessions (Asian, European, and American), helping traders identify periods of varying market activity.

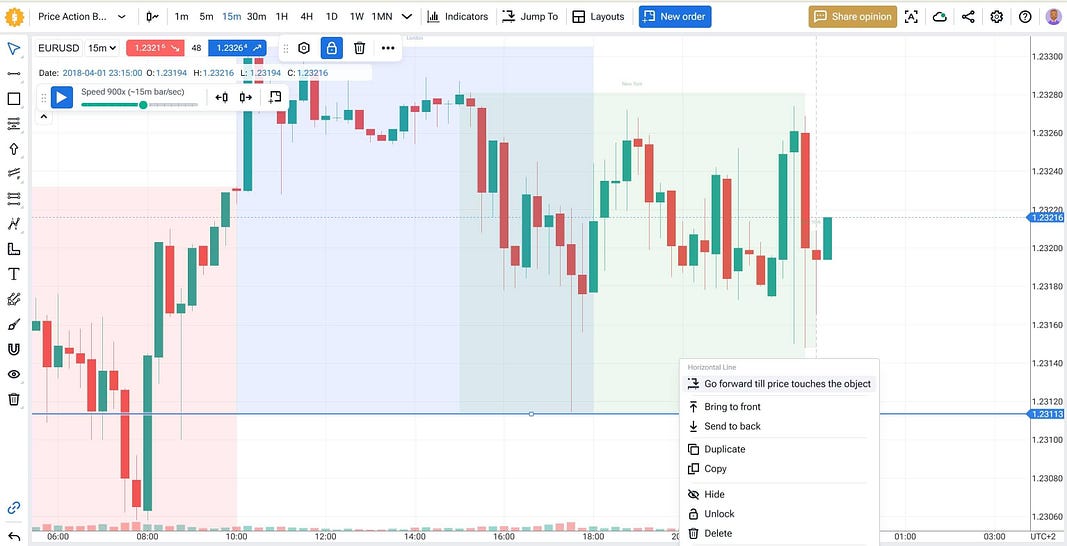

Additionally, FTO marks historical events and news releases directly on charts, allowing traders to study how significant market events affect price action patterns. The “Go Forward Till Price Touches Object” feature helps validate support and resistance levels efficiently, making it easier to understand how price behaves around key levels during different market conditions.

When backtesting a price action strategy, traders should consider:

- Overall market structure (trending vs ranging)

- Session-specific behavior of patterns

- Impact of news events on pattern reliability

- Support and resistance level interactions

Through systematic observation of these factors using FTO’s features, traders can develop strategies that account for varying market conditions, ultimately improving their pattern recognition and trading decisions.

Systematic Testing Framework

- Initial Phase:

- Test basic patterns in clear market conditions

- Document all observations

- Focus on pattern recognition skills

- Refinement:

- Analyze pattern performance across different market environments

- Adjust rules based on results

- Test modifications systematically

- Implementation:

- Practice with real-time simulation

- Build psychological resilience

- Develop consistent execution skills

Through this structured approach to backtesting, traders can develop robust price action analysis skills efficiently. The key lies in combining systematic testing methods with FTO’s specialized features, accelerating the learning process while building confidence in strategy execution.

Other considerations

Trading psychology plays a significant role in price action trading, as this approach often requires quick decision-making based on pattern recognition. The ability to practice extensively in a simulated environment helps traders develop both their analytical skills and their psychological resilience. Forex Tester Online realistic simulation environment, advanced backtesting tools, complete with accelerated replay capabilities, allows traders to experience numerous market scenarios while building confidence in their analysis and decision-making abilities.

Pros and Cons of Price Action Trading

Advantages

Price action trading offers unique benefits that attract traders seeking a cleaner approach to market analysis. Without the clutter of multiple indicators, traders can focus directly on price movements and market structure. This clarity often leads to better understanding of market dynamics and faster decision-making.

The versatility of price action analysis stands out as another significant advantage. These techniques work across all timeframes and markets, making them adaptable to various trading styles and preferences. Additionally, price action strategies can be effectively backtested using modern platforms, allowing traders to validate their approaches before risking real capital.

A particularly valuable aspect of price action trading is its emphasis on reading market sentiment through raw price movements. While automated systems excel at rapid calculations, the human mind’s pattern recognition capabilities often prove superior at interpreting subtle market nuances and contextual factors that influence trading decisions.

Challenges

Despite its advantages, the price action approach presents several challenges that traders must address. The subjective nature of pattern interpretation can lead to inconsistent analysis, especially when emotions influence trading decisions. What one trader sees as a perfect setup might appear irrelevant to another, highlighting the importance of developing and testing a personal approach.

The learning curve for price action trading can be steep. Developing reliable pattern recognition skills requires significant practice and exposure to various market conditions. While modern backtesting platforms can accelerate this process, traders must still invest considerable time in studying and understanding market behavior.

Another challenge lies in maintaining discipline with a discretionary trading approach. Without the rigid rules of automated systems, traders must develop strong psychological resilience and strict risk management practices. The freedom to interpret patterns comes with the responsibility to maintain consistent trading practices.

Balancing the Trade-offs

The key to successful price action trading lies in understanding these trade-offs and developing strategies to address them. By combining human analytical capabilities with technological tools for backtesting and validation, traders can work to minimize the challenges while maximizing the benefits of this approach.

Modern backtesting platforms help bridge the gap between price action trading’s advantages and challenges. They provide environments where traders can develop their skills systematically, test their interpretations objectively, and build confidence in their analysis without risking real capital.

Conclusion

Price action trading offers a powerful approach to understanding and participating in financial markets. Its effectiveness stems not from any mysterious properties of chart patterns, but from its direct connection to market psychology and behavior. However, developing proficiency in price action trading requires more than just theoretical understanding.

The path to success in price action trading lies in combining human pattern recognition capabilities with technological tools for practice and validation. Platforms like Forex Tester Online provide the ideal environment for this development, allowing traders to accelerate their learning curve through systematic practice and analysis.

As markets continue to evolve with technological advancement, the ability to combine human insight with technological tools becomes increasingly valuable. Price action trading, supported by proper backtesting and practice, offers traders a robust framework for developing these complementary skills.

FAQ

Why is price action popular among forex traders?

Price action trading maintains its popularity because it offers direct insight into market behavior without the complexity of multiple indicators. This approach allows traders to develop a deeper understanding of market dynamics while maintaining analytical clarity.

How to combine price action with MACD in trading?

While price action can provide primary trading signals, technical indicators like MACD can offer complementary information about trend strength and momentum. The key lies in using indicators to support, rather than replace, price action analysis.

Which is a better price action chart pattern?

Different patterns suit different trading styles and market conditions. Pin bars and inside bars often provide clear entry and exit levels, though their effectiveness depends heavily on market context and proper execution.

What is price action in day trading?

Day trading with price action involves applying the same analytical principles to shorter timeframes. While the basic patterns remain similar, their interpretation and trading approach may need adjustment for the increased market noise in lower timeframes.

What is the most accurate price action pattern?

Pattern accuracy depends more on context and execution than the pattern itself. Pin bars at key levels during strong trends often provide reliable setups, though success rates vary based on market conditions and trader expertise.

Forex Tester Online

Backtest your price action strategy using our practice trading simulator

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska