Finding the best Forex signals provider is a challenge for many traders. Forex markets move fast, and making the right trading decision at the right time is critical. A reliable Forex signal service can provide trade ideas based on expert analysis, helping traders increase their profit. However, not all signals are accurate or worth following. Sometimes it’s even better to make your own decisions rather than following somebody’s signals. But how do you know which one to trust?

In this article, we will show how to find best Forex signals providers in 2026, both free and paid options, to help you make an informed choice. We will also share some life hacks on how to check if a provider is reliable or not.

What Are Trading Signals in Forex and Why Do You Need Them?

Forex trading signals are trade recommendations based on technical or fundamental analysis. They tell traders when to buy or sell a currency pair (or stock/crypto/commodity/futures etc), often including details like entry price, stop-loss, and take-profit levels.

Traders use Forex signals for several reasons:

- To save time on market analysis

- To follow expert strategies

- To improve trading decisions with accurate trade ideas

- To automate part of their trading process

Using a good Forex signals provider can help traders avoid emotional trading and follow a structured strategy. However, signals are not always 100% correct, so testing them before real trading is important. The best way to do this is with historical data on a backtesting platform, which we will discuss later.

Where to Get Forex Signals?

Forex signals come from different sources, and choosing the right one depends on your trading style and goals. The main types of Forex signals providers are:

- Professional Analysts & Trading Firms. These providers generate signals based on expert technical and fundamental analysis. They usually offer paid subscriptions. Let’s be honest. These are 1% of all signal providers.

- Automated Trading Systems (EAs & Bots). These are algorithm-based systems that scan the market and generate Forex signals without human intervention. Some are free, while others require a purchase or subscription. These are much more popular.

- Social Trading & Copy Trading Platforms. Platforms like ZuluTrade or Myfxbook let traders follow and copy Forex signals from experienced traders.

- Telegram & Twitter Signal Groups. Many traders share their trade ideas in Telegram groups or on Twitter. Some are free, while others require a membership. This is the largest market. You can find tons of signals on Telegram and X. But are they worthy?

As said before, not all Forex signals providers are reliable. Some services may send inaccurate or delayed signals, leading to losses. Before using any provider, it’s smart to test their signals on historical data to see how well they performed in past market conditions.

Watch Out for Forex Signal Scams

While there are many genuine Forex signal providers, the industry is unfortunately full of scams as well. Some providers fabricate their performance statistics, showing unrealistically high success rates that cannot be independently verified. Others use their signals as a way to manipulate the market — recommending certain trades not because they are good opportunities, but to benefit their own positions through pump-and-dump schemes.

Another common scam is recommending low-quality or highly speculative assets just to earn commissions or create artificial price movements. Traders who follow these signals blindly can quickly find themselves on the wrong side of the market.

Here’s how you can protect yourself:

-

Don’t trust results without proof. Always look for verified performance records.

-

Use backtesting. Test the provider’s past signals on historical data to see if they actually work under real market conditions.

-

Think independently. Signals can be a helpful tool, but smart trading decisions require your own analysis, risk management, and judgment.

-

Be cautious with free groups. Many Telegram and Twitter groups focus more on hype than real trading value.

Ultimately, Forex signals should complement your trading strategy — not replace it. A good trader stays critical, informed, and always in control of their own decisions.

Also check:

- 18 Best Forex Traders to follow on Twitter

- 45 TOP Forex Traders on Instagram

- TOP 15 Forex Traders on YouTube

How to Test Trading Signal Providers via FTO

Before relying on any Telegram signal group, it’s a good idea to test their signals on historical data. This helps determine how accurate and reliable they are before risking real money. Forex Tester Online allows traders to do this efficiently. You can try it now.

✅ Fast market replay on 20+ years of historical tick data

✅ Bar-by-bar control to study reactions at Point of Control (POC), Value Area (VA), VAH, and VAL

✅ 50+ pre-built indicators plus custom indicators

✅ Realistic costs (spread, slippage, commissions) so the idea is tested under real conditions

✅ Trade log + analytics (win rate, drawdown, R-multiple, expectancy) to validate a trading strategy, not just “a nice chart”

✅ “Jump to” to quickly teleport to specific moment on a chart (for example, indicator touch).

✅ Blind Testing mode to remove bias.

✅ Pre-designed scenarios to stress-test your strategies.

✅ Prop Firm Challenge mode

✅ Advanced analytics with personalized advice on trading psychology

✅ Exit Optimizer that helps you to get more profit from each individual trade

✅ Automations and scripts

✅ AI trading analysis

✅ And much more advanced backtesting features…

Here is a short quick-start guide:

1) Register on the FTO website to get started.

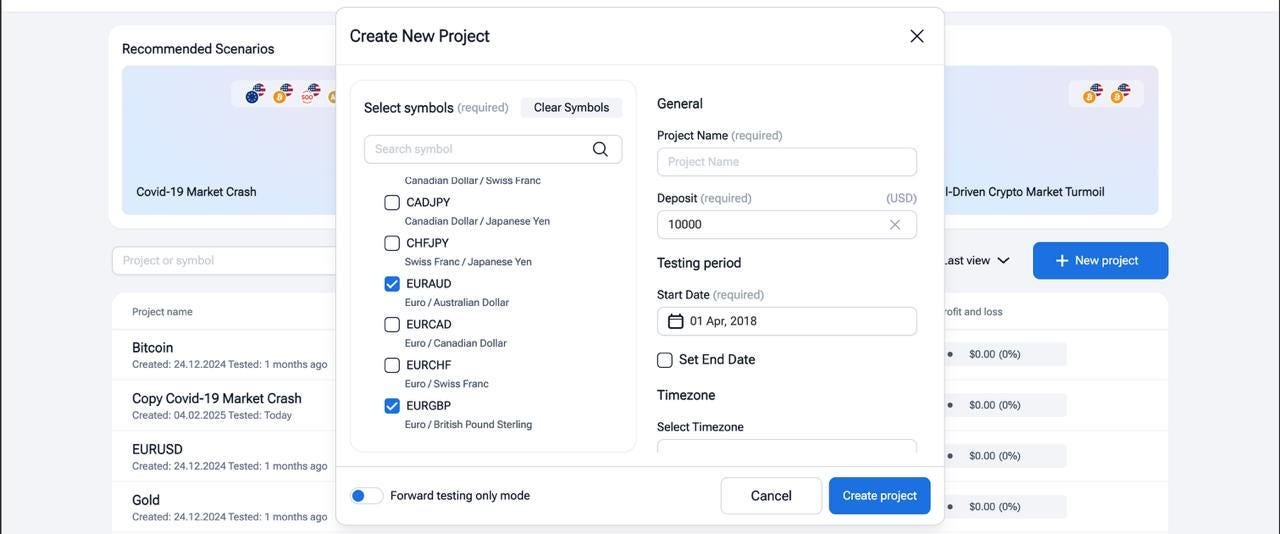

2) Then, create and launch a project. Choose a recent time frame (for example, previous month), and set in in the “Start Date” field.

3) Then, go to the signal provider and check their signals for this time frame.

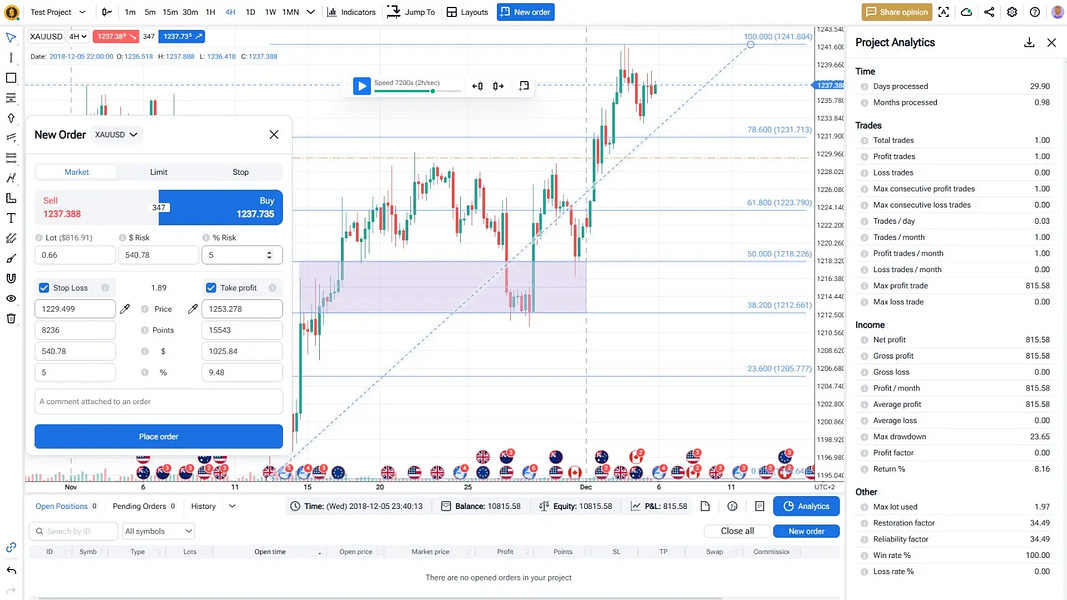

4) Launch a demo project on Forex Tester Online and follow their signals. Buy and sell whenever they tell you to do so. You don’t risk anything, because FTO is a trading simulator – you only use virtual money

5) Review analytics to see how much you could earn (or lose) if this was a real project. Save this data for further analysis.

6) Run a new project to test the next signal provider. Repeat as many times as you want.

With the right trading platforms and disciplined backtesting, trend traders can follow trends with confidence and clear trading rules.

Conclusion

Choosing the best Forex signals provider is important for improving trading decisions. Reliable signals can help traders identify profitable opportunities, but not all services offer accurate trade ideas. Some providers perform well, while others may send delayed or misleading data. That’s why testing signals before trading with real money is so important.

With Forex Tester Online, traders can backtest signals using historical data to see how well they performed in past market conditions. This allows for a risk-free way to evaluate a Forex signals provider before committing funds.

FAQ

Which Forex signal is best?

The best Forex signal providers are those that offer accurate trade signals, clear entry and exit points, and, most importantly, a proven track record.

How do you predict Forex signals?

A Forex signals provider generates trade ideas using technical indicators, fundamental analysis, or automated algorithms. Professional traders look at price action, trend patterns, and economic news to predict market movements. Some services rely on AI-based models, while others use manual analysis.

How much do Forex signals cost?

The price of Forex signals depends on the provider. Some services offer free Forex signals, while others charge a monthly or yearly subscription. Prices range from a few dollars per month to several hundred, depending on the provider and subscription package. In general, there is no need to pay for “exclusive” signals, since they are generally the same.

Can I get free Forex signals?

Yes, many Forex signals providers offer free options. These can be found in Telegram groups, Twitter accounts, or broker-sponsored services. However, free signals may have lower accuracy or fewer trade opportunities than paid ones.

Should I trust Forex signals?

Not all Forex signals are reliable. So, we recommend you either make your own decisions or at least check the reliability of the provider by testing its signals on historical data in a trading simulator. Using Forex Tester Online, traders can check how well signals performed under real market conditions.

Forex Tester Online

Verify trading signals via FTO

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska