Trading live can be exciting, but it’s also risky. That’s why many of us use paper trading simulators. These tools let us practice trading with real market conditions without risking our money. We can test strategies, learn from mistakes, and build confidence. In 2026, there are several simulators worth trying.

We’ve looked into them to help you find the best paper trading simulator for your needs. Here is an honest comprehensive comparison and review.

But first, let’s start from the beginning.

Why is paper trading important?

When you want to master your trading skills and/or sharpen your market wisdom without damaging your account, probably the easiest and safest method is paper trading. This word combination assumes opening and closing deals abstractly (a.k.a. on paper), following the real price movements, and getting a hint on how much money you would win or lose would you trade for real.

In its classical way, paper trading requires the simple ingredients which you most certainly already possess:

- pen

- paper

- your brain calibrated for calculating

- access to the market chart

Ironically, it is pen and paper from this list that are replaceable. For example, you can (and you should) use spreadsheets to sort your notes for more detailed paper trading. Even paper trading programs are at your disposal, which we will touch on a bit later in this message.

Surprisingly, such an accessible way to manage your trading skills has numerous advantages, as well as baddies, so let’s cover all these fellas and see if this way of practicing suits you best.

Modern “paper trading simulators” that we will look into in this article, don’t use old-school methods. Instead, they create a virtual trading environment, similar to a real trading platform. There you can test your strategies and practice skills.

How Do Paper Trading Simulators Work

As we already said, paper trading simulators let us trade in a virtual environment that mirrors the live markets. They provide up-to-the-minute market data, so the prices and movements we see are happening right now. When we place a trade in the simulator, it reacts just like a real trading platform would.

These simulators connect to live market feeds, showing actual prices of stocks, currencies, or other assets. We use virtual money to buy and sell, but the experience feels genuine. This helps us practice our strategies under real market conditions without risking our funds.

For example, if we want to test how our strategy performs during a volatile market, a paper trading simulator shows us the immediate impact of our trades. We can see how quickly prices change and how our decisions affect our portfolio. This hands-on experience is invaluable for learning and refining our trading approaches.

Also read: Best Stock Backtesting Tools in 2026

How we choose the best paper trading simulators

For this article, we tried and analyzed more than 10 different paper trading programs. Of these, we selected the 6 best ones, and are ready to share them.

We selected these simulators based on:

- Realistic experience: They closely mimic real market conditions. This is the most important thing in paper trading, because we want a simulator to be as realistic as possible to backtest and train in almost real conditions.

- User-friendly design: Easy to navigate, even for beginners.

- Advanced tools: Offer technical indicators and charting features.

- Accessibility. Available on various devices and operating systems. We think it’s important.

- Affordability: Free or reasonably priced to suit all budgets. This is not the main criteria when it comes to best solutions, but this is still a factor.

By focusing on these criteria, we ensure you get the best tools to practice and improve your trading skills.

So, these are our 6 recommendations.

Best Paper Trading Simulators

Experienced traders managed to turn their knowledge into a comfortable way for beginners to boost the experience. We talked about paper trading saving your money and nerves but now let’s talk about saving tons of time as well. You can’t stick to trading with metaphorical money forever, right? Unless you’re alright with metaphorical food. So you need to get skills as quickly as possible.

1. Forex Tester Online (FTO)

The first simulator we recommend to try is Forex Tester Online as the best paper trading simulator. It replicates the market environment and uses the real historical data of the market behavior.

Among the best simulators, Forex Tester Online shines brightest. It’s a web-based platform that lets you backtest and refine your Forex strategies efficiently.

Benefits:

- Accessible everywhere. Use FTO on Windows, MacOS, Linux, Android, or iOS — any device with a web browser.

- Free historical data. Access updated historical Forex data at no extra cost.

- Advanced tools. Enjoy professional-level trade and order management features.

- Fast performance. No server delays mean quicker simulations and faster learning.

Downsides:

- Some features are under development, but improvements are on the way. The tool gets new updates almost every month.

You can get access now – and get all future regular updates for free.

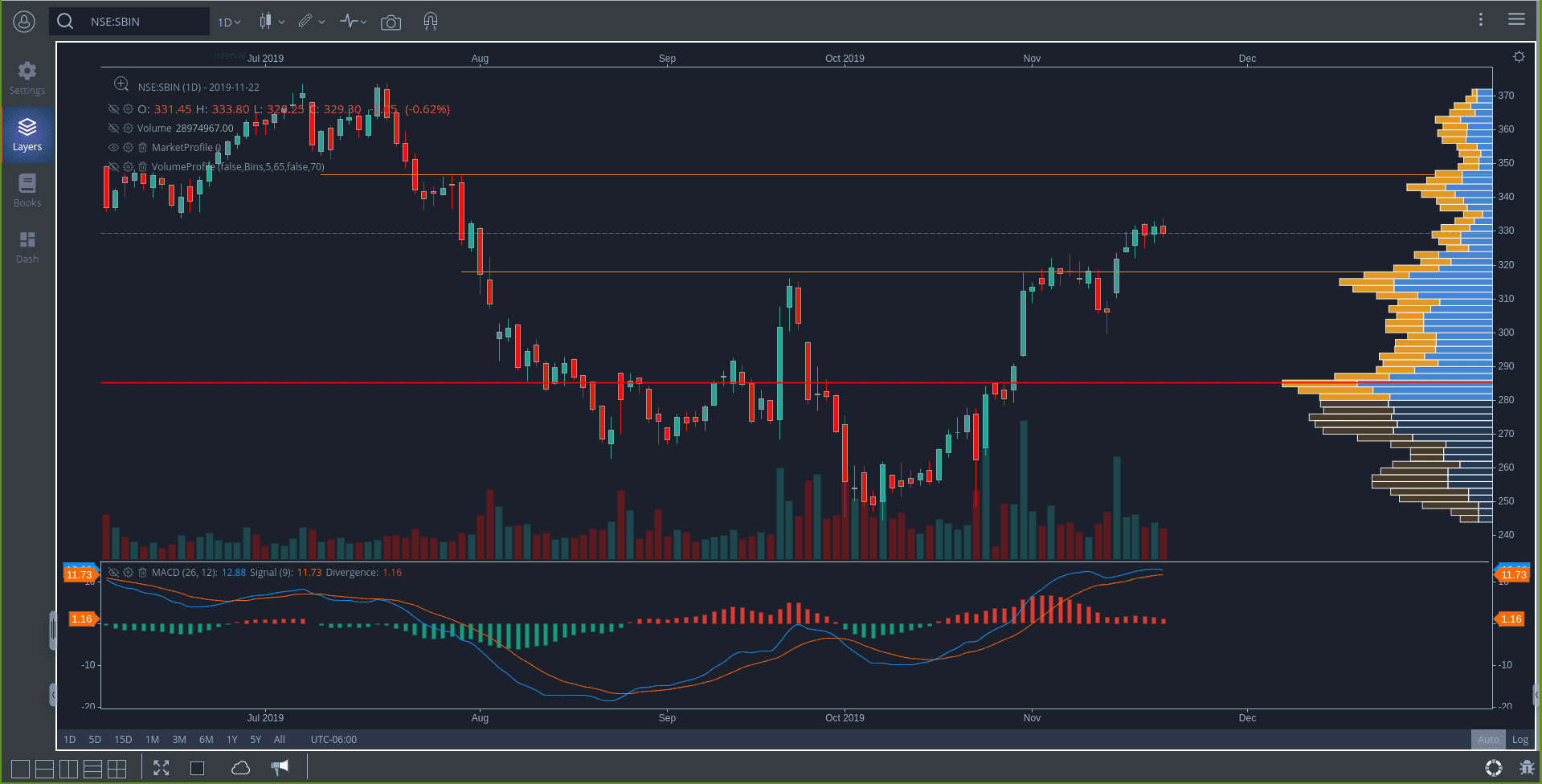

2. GoCharting

Another noteworthy simulator is GoCharting, an advanced charting and trading platform that caters to multiple asset classes like stocks, futures, options, commodities, Forex, and cryptocurrencies.

Benefits:

- Advanced Charting. Offers a variety of chart types, including FootPrint, MarketFlow, and VolumeFlow.

- Rich Features. Supports over 14 advanced chart types (like Renko and Point & Figure), more than 100 technical indicators, and a plethora of drawing tools.

- Multi-Asset Support. Allows you to analyze and trade across different markets all in one place.

Downsides:

- Limited Customization. Some users feel the interface isn’t as customizable as they’d prefer.

- Integration Issues. Might not seamlessly integrate with all brokerage platforms or other software.

- Backtesting Limitations. While excellent for charting and technical analysis, it doesn’t offer robust backtesting capabilities.

GoCharting is ideal for traders who rely heavily on technical analysis across various markets. Its extensive charting tools can provide deep insights into market trends and price movements.

3. Webull

Another platform worth your attention is Webull, a mobile-focused brokerage app that provides a robust paper trading feature.

Benefits:

- Risk-Free Practice. Webull offers a paper trading account with unlimited virtual cash, allowing you to practice without any financial risk.

- Real-Time Data. Access live market quotes and integrated charts to simulate actual trading conditions.

- Advanced Tools. Utilize over 60 technical indicators and 17 charting tools to analyze market trends.

- Multi-Asset Trading. Practice trading stocks, ETFs, options, and cryptocurrencies — all within the same platform.

- User-Friendly Interface. Designed with simplicity in mind, making it ideal for beginners who want to jump right into trading.

- Community Engagement. Connect with an active community of traders to share insights and strategies.

Downsides:

- Limited Asset Classes. Does not support trading of mutual funds, bonds, futures, or forex.

- Educational Resources. Offers fewer educational materials compared to other platforms, which might require you to seek learning materials elsewhere.

- Customer Support. Some users report that customer service can be slow or less responsive, lacking live chat support.

Webull’s paper trading feature is perfect for those who want to hone their trading skills in a real-time market simulation without any financial risk. The platform’s intuitive mobile app allows you to practice anytime, anywhere, and its community aspect adds a social dimension to your learning experience.

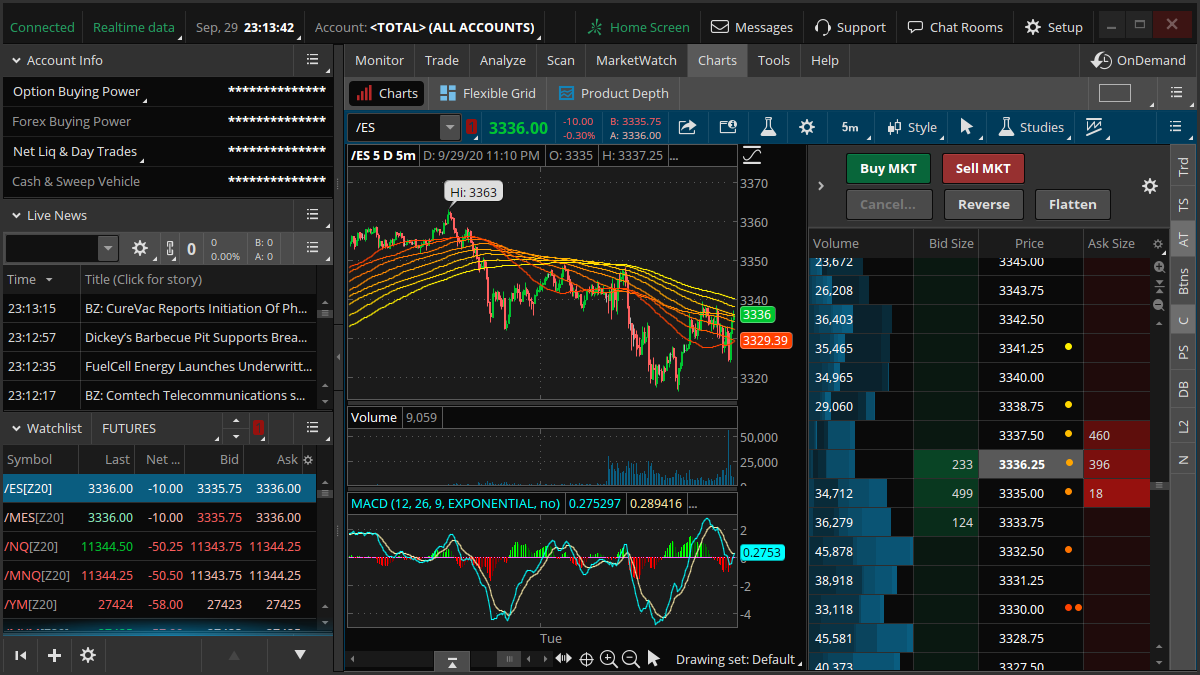

4. Thinkorswim

Another powerful platform to enhance your trading skills is Thinkorswim, offered by TD Ameritrade. It’s a professional-grade trading platform that caters to both beginners and seasoned traders.

Benefits:

- PaperMoney Feature. Allows you to practice trading with virtual funds in real market conditions.

- Advanced Charting Tools. Offers a vast array of technical indicators, drawing tools, and customizable chart types.

- Multi-Asset Support. Trade stocks, options, futures, Forex, and more — all in one place.

- Educational Resources. Access to tutorials, webinars, and in-platform guidance to boost your trading knowledge.

Downsides:

- Complex Interface. The platform can be overwhelming for newcomers due to its extensive features.

- Account Requirement. Requires opening a TD Ameritrade account, which may not be convenient for everyone.

- Limited Availability. Some features might be restricted to users in certain regions. Meanwhile, FTO is available worldwide.

Thinkorswim’s PaperMoney is ideal for practicing strategies without risking real money. Its comprehensive tools and real-time data help you get a realistic trading experience.

5. eToro

Another platform worth considering is eToro, a popular social trading platform that provides paper trading through its virtual portfolio feature.

Benefits:

- Virtual Portfolio. eToro offers a $100,000 virtual portfolio, allowing you to practice trading without risking real money.

- User-Friendly Interface. The platform is designed with simplicity in mind, making it ideal for beginners.

- Social Trading. You can follow and learn from experienced traders by viewing their portfolios and trade histories.

- Multi-Asset Access. Trade stocks, Forex, cryptocurrencies, commodities, and more — all from one platform.

Downsides:

- Limited Advanced Tools. May lack some of the advanced charting and backtesting features found in specialized platforms.

- Higher Spreads. Trading costs can be higher compared to other platforms due to wider spreads.

eToro’s virtual trading environment is perfect for those who want to get comfortable with the markets in a social and interactive setting. The ability to mimic successful traders adds a unique learning dimension that can accelerate your understanding of trading strategies.

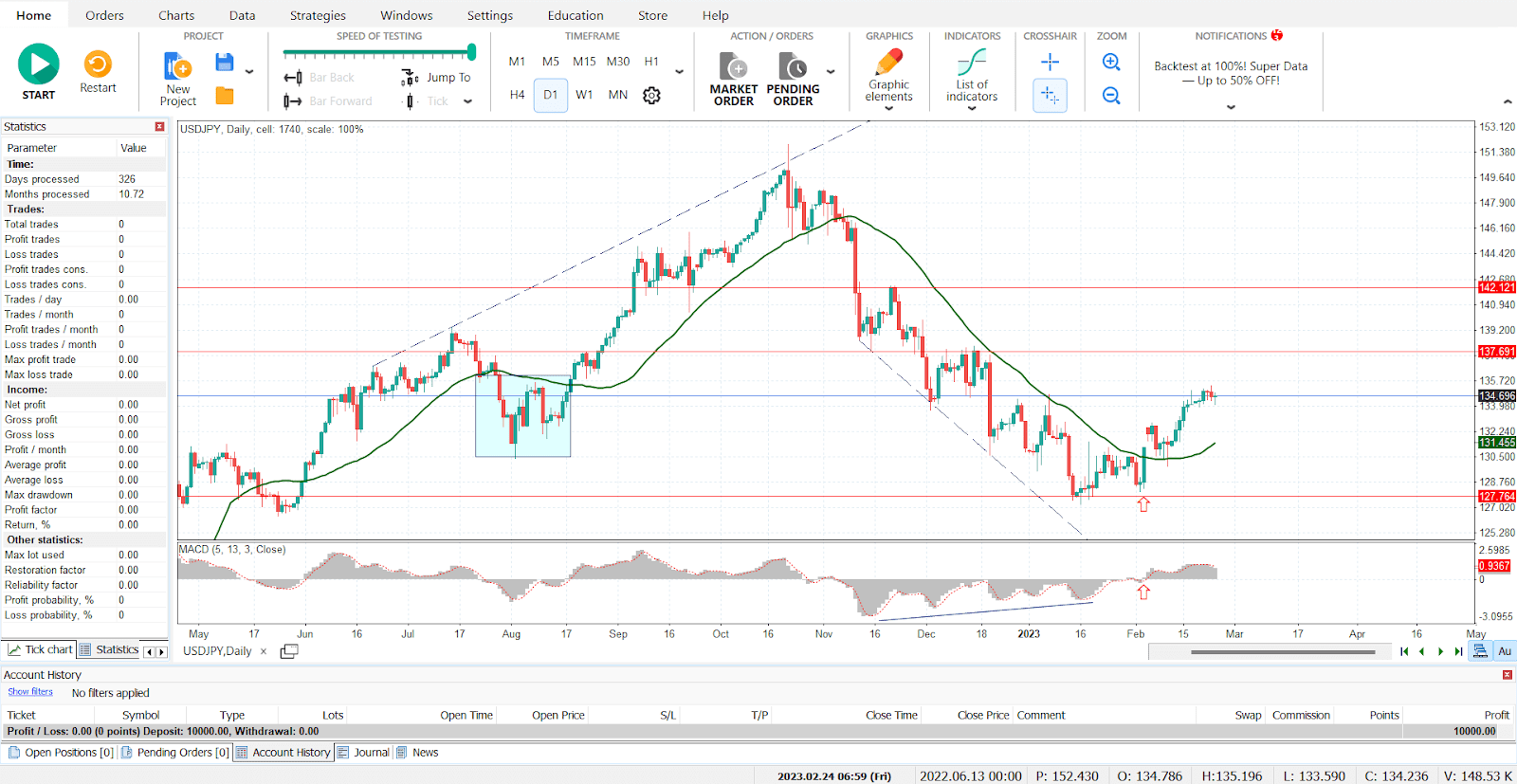

6. Forex Tester

Here you can easily open and close deals on multiple charts simultaneously and control the time. Fast-forward the market and get right to the result. If you feel it can be better, go back in time, adjust your strategy and try again. And the beautiful thing is that you can do it as much as you need!

Pros of Paper Trading

Here’s why paper trading is definitely a must-do thing for your development as a trader:

- No real losses. Let’s take the elephant from the room and start with the most obvious benefit which makes paper trading accessible to almost everyone.

- Gaining experience. Whether you’re only starting trading or just want to test your newly crafted strategy, it’s awesome to know that paper trading helps you to acquire the necessary experience. Combine this with the previous point, and you’ve got a powerful combination to tilt the scales for the benefit of paper trading.

- Tranquility. Develop your trading confidence using a paper trading simulator without any pressure. You won’t make a hasty decision since you receive no stress simulating trading with abstract money. Making weighted choices can certainly set up your confidence before the real market.

Cons of Paper Trading

To brace yourself and get the most from a paper trading app, it is essential for you to be aware of all the pitfalls that this way of practicing has in store:

- Overvalued optimism. The benefit of not losing money may be too heavy for an unprepared mind. It is easy to get into the loop of opening deals of unbearable risk ‘left and right’. So you got to remind yourself that all this is not a game but a preparation for the main stage and you can risk only with those amounts that you can actually afford.

- Unexpected price shifts. What goes well on paper does not always go as smoothly in reality. During paper trading, you may miss the slippage which sometimes takes place in the market. It may be caused by a sudden change of the spread and result in you spending more money than expected.

- Scratching only the tip of the iceberg. There are so many processes happening in the market affecting the market behavior that paper trading can’t address. It gives a false sense of simplicity.

Today there are more ways for paper trading than just involving actual paper. Various brokers offer a demo account that works in a similar way, as well as has quite the same pros and cons. Besides, either of these methods saves your time which is an extremely overlooked resource.

You open and close deals with the same tempo as you will eventually do in real trading which is far slower than you need to. If only there was a way to speed up the practicing… Oh wait, there is one.

With all the pros and cons, it is definitely worth trying for anyone who is serious about trading.

Conclusion

After reviewing these 6 paper trading simulators, we can conclude that Forex Tester Online stands out due to its comprehensive features, real-time data, and user-friendly interface, making it suitable for traders at all levels. This is our top pick that we can recommend.

As for other platforms, we also find them useful and convenient. Each of these platforms has its strengths and weaknesses, so the best paper trading simulator for us depends on our specific trading goals and preferences.

FAQ

What features does a paper trading simulator offer for simulating real-time trading conditions?

A paper trading simulator provides live market data, simulated order execution, interactive charts, and risk management tools. These features let you practice trading as if you were on a real-time day trading platform, experiencing actual market conditions without risking real money.

How does the simulator ensure real-time market data accuracy?

Simulators connect to live data feeds from financial markets. By receiving real-time quotes directly from exchanges or reliable providers, they ensure that the prices and conditions you see reflect the actual markets, giving you a genuine real-time trading experience.

How do I use a paper trading platform?

Start by choosing a paper trading platform that fits your needs. After signing up, set up a virtual account with a starting balance. You can then practice trading in real time, placing orders, and analyzing the markets just like on a live platform.

Should I use a paper trading app?

Yes, using a paper trading app is beneficial. It allows you to practice trading without risking money, experience live market conditions, and improve your decision-making skills. It’s a valuable tool for building confidence and testing strategies.

Are paper trade simulators suitable for all trader levels?

Absolutely. They are useful for beginners learning the basics, intermediate traders refining strategies, and advanced traders testing complex approaches. Paper trade simulators provide a realistic environment for traders at all levels to enhance their skills.

Can I access a paper trading simulator on mobile devices?

Yes, many paper trading apps (including Forex Tester Online) are available for smartphones and tablets. This allows you to practice trading on the go, making it convenient to stay connected with the markets anytime, anywhere.

Does using a paper trading simulator cost money?

Most paper trading platforms offer their simulators for free, especially as part of their educational tools. This means you can practice trading and test your strategies without any financial commitment.

Forex Tester Online

Advanced paper trading simulator

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska