Summarize at:

The Canadian dollar is the main commodity currency of the American region, it is one of the world’s top ten assets. Coupled with the US dollar (according to BIS), the CAD holds about 8% of the total turnover of the Forex market, and along with crosses − about 10%.

Political stability and transparency of the monetary policy make the Canadian dollar attractive to traders who, apart from technical trading, have strong fundamental analysis skills. A large amount of information and current statistics on CAD provide the basis for a multifactor analysis and allow us to make a full-fledged forecast.

We will not dwell on general information that can be found on the reference resources, for example, Wikipedia: Canada, especially since at the end of the article there are links to several useful resources on which the trader will find all the information necessary for himself, and always relevant. We have a different goal.

We consider the Canadian dollar as a market trading asset and we are interested only in those factors that directly affect its dynamics, so let’s begin.

Features of the fundamental analysis

The asset is affected by the complex influence of raw materials other than oil, such as coal, ferrous and non-ferrous metals, and also has a strong dependence on the US dollar and on large trading partners (Australia, Japan, China), therefore, economy.

At one time, the two major colonial powers played a significant role in the founding of Canada. And today, exclusively active cooperation in various fields of the economy with these and other countries, formerly part of the British and French empires, is the basis of the Canadian foreign policy. Any decline of bilateral relations with Great Britain or France immediately affects the stability of the Canadian dollar.

During economic uncertainty, external capital inflows have a strong effect on CAD. In periods of high prices for basic goods, investors are always actively investing in the Canadian dollar, so that any political instability in the region has a favorable effect on its rate.

Let’s look at the two main factors that must be taken into account when working with the Canadian dollar in detail.

A Rich neighbor – USA

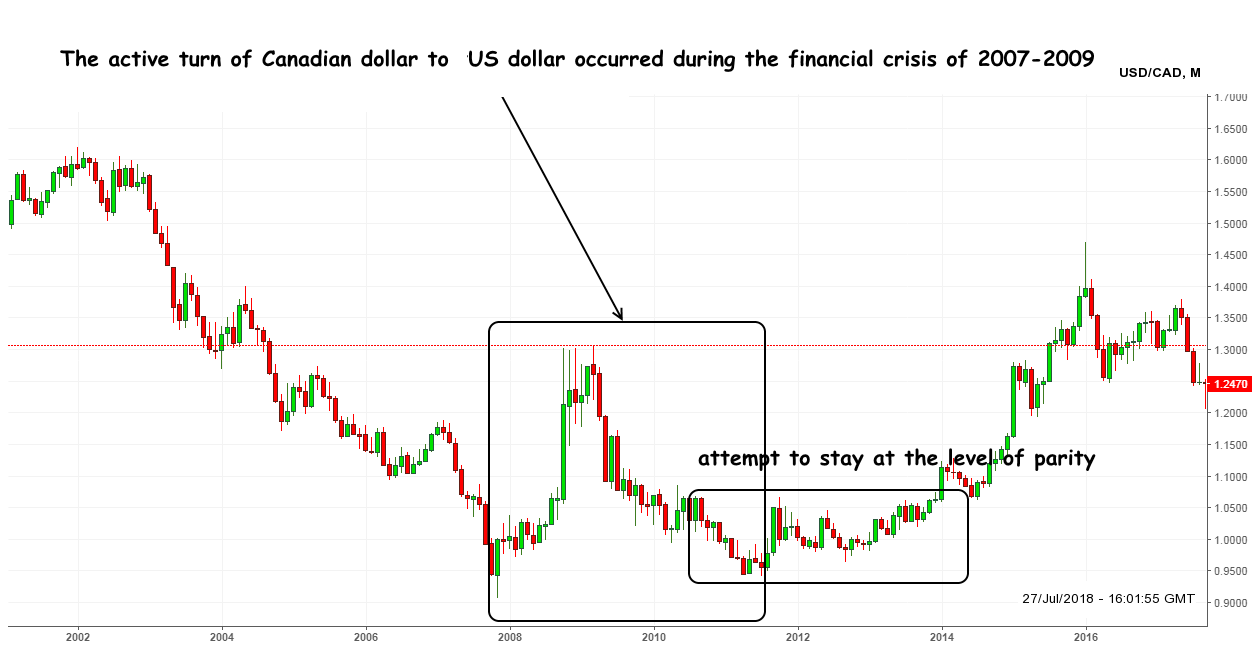

It is usual way to be begin the fundamental analysis of assets involving CAD with the dynamics of the US economy, as the Canadian currency has been synchronized with the US dollar for quite some time (reverse correlation). Only after the financial crisis of 2007-2009, CAD became independent in relation to USD and began to show its own, independent dynamics.

The longest unprotected border in the world, various trade agreements, such as the car deal (1965-2001), the free trade agreement FTA (1989) and NAFTA (1994) make the United States the most important trading partner of Canada and the main consumer of Canadian raw materials and goods.

In addition to the fundamental data, the dynamics of the pair depends on the difference in interest rates between the Fed and Bank of Canada, as well as foreign exchange interventions of the US dollar. USD/CAD actively reacts to economic statistics and political situation, as well as any force majeure in the US. The US economic situation is strongly «crushing» the volume of imported raw materials to the country, so it is important to monitor the US GDP dynamics, sales volumes of residential houses and the index of business activity.

Oil and oil products

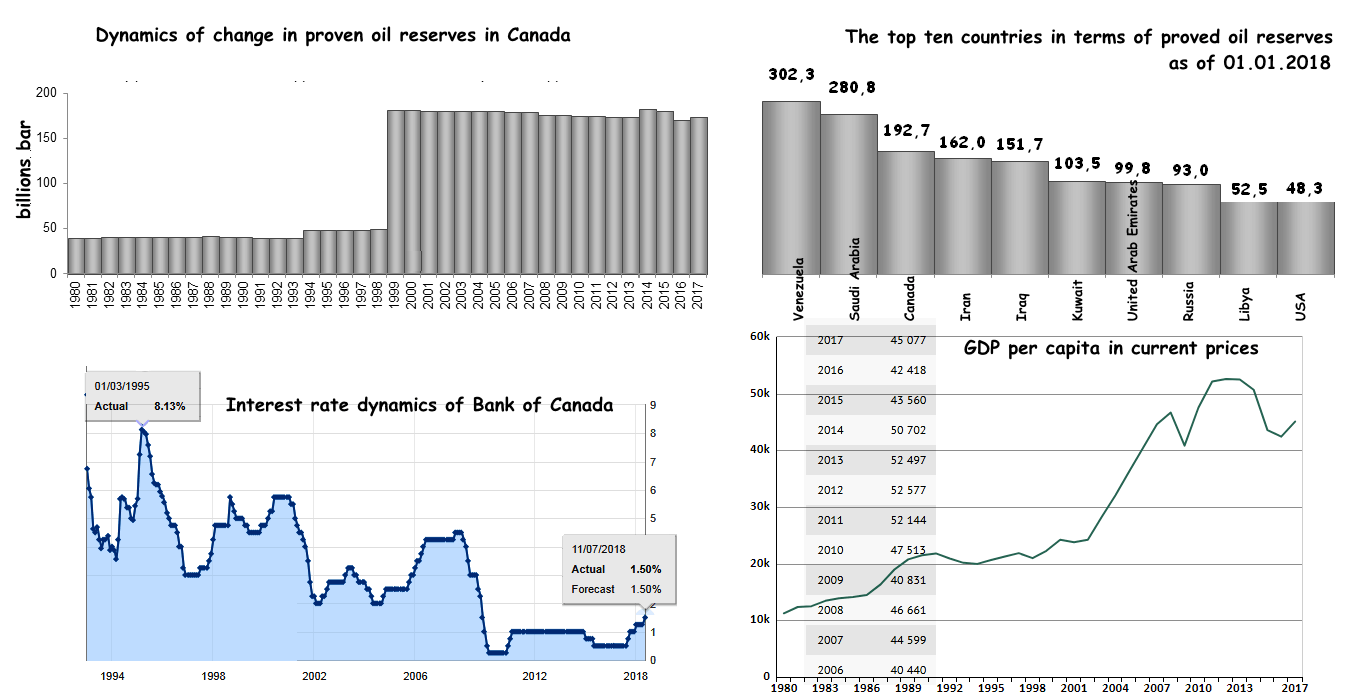

Canada has large reserves of the traditional and huge deposits of the heavy oil (bitumen), so the production of the petroleum products from such complex raw materials requires high technologies, huge labor and energy resources.

The largest deposit of Athabasca was discovered back in 1778, but active development began only in the middle of the twentieth century. As a result of the introduction of innovative technologies (methods SAGD, VAPEX, CHOPS, N-Solv), Canada managed to create a unique industry for the extraction of oil from natural bitumen.

Currently, about the 40% of the reserves of conventional Canadian oil have already been produced (and in the provinces of Alberta and Saskatchewan − respectively 70% and 45%), but the proven reserves of bitumen (up to 2500 billion barrels) guarantee the stability of the oil industry.

The level at which the production of Canadian «sandy» oil will be minimally profitable, experts estimate at $25 per barrel, but the market price of basic benchmarks below $40-45 is already considered critical for Canadian raw materials.

Before the American shale revolution, about 70% of Canadian oil was exported to the United States. At the moment (Fall 2018), the volume of «domestic» exports have fallen sharply, and Canadian oil is mainly consumed by US chemical industry enterprises, especially sensitive to raw materials quality.

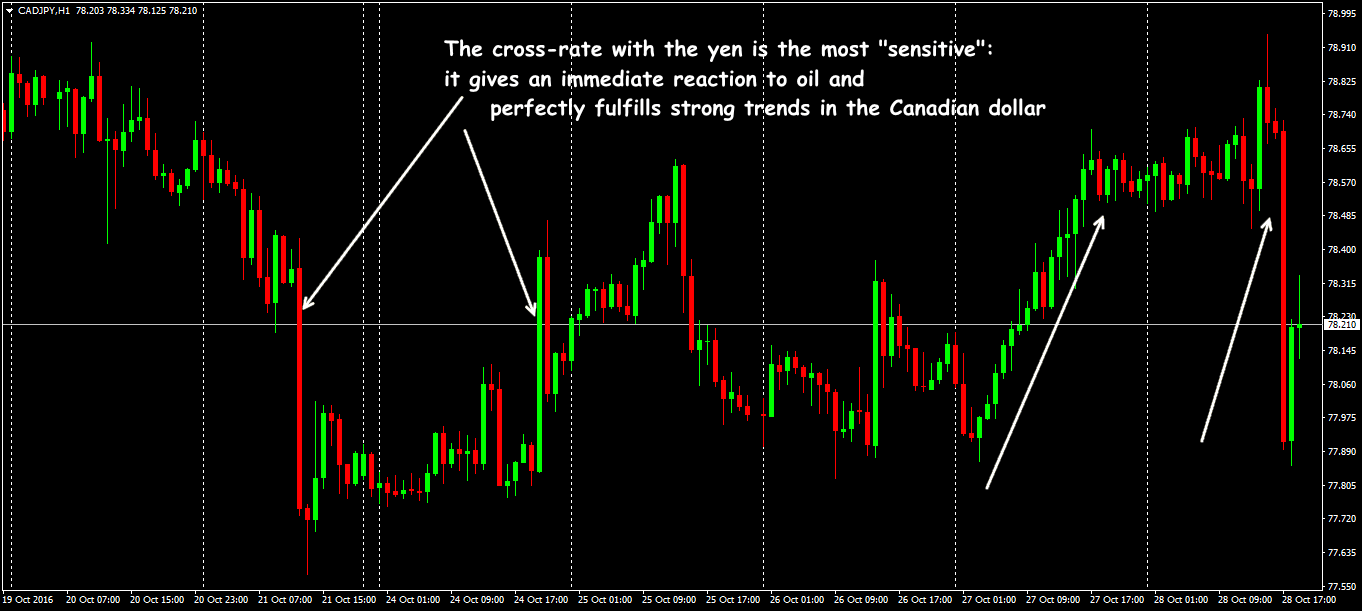

But there is a trading asset that stably depends on the dynamics of Canadian oil: cross-pair CAD/JPY − Japan remains a major importer of this raw material and there is no reason to change the trend yet.

More details on trading on correlations with the Canadian dollar − see below.

Features of technical analysis

USD/CAD is considered a very technical pair and trades well on the trend.

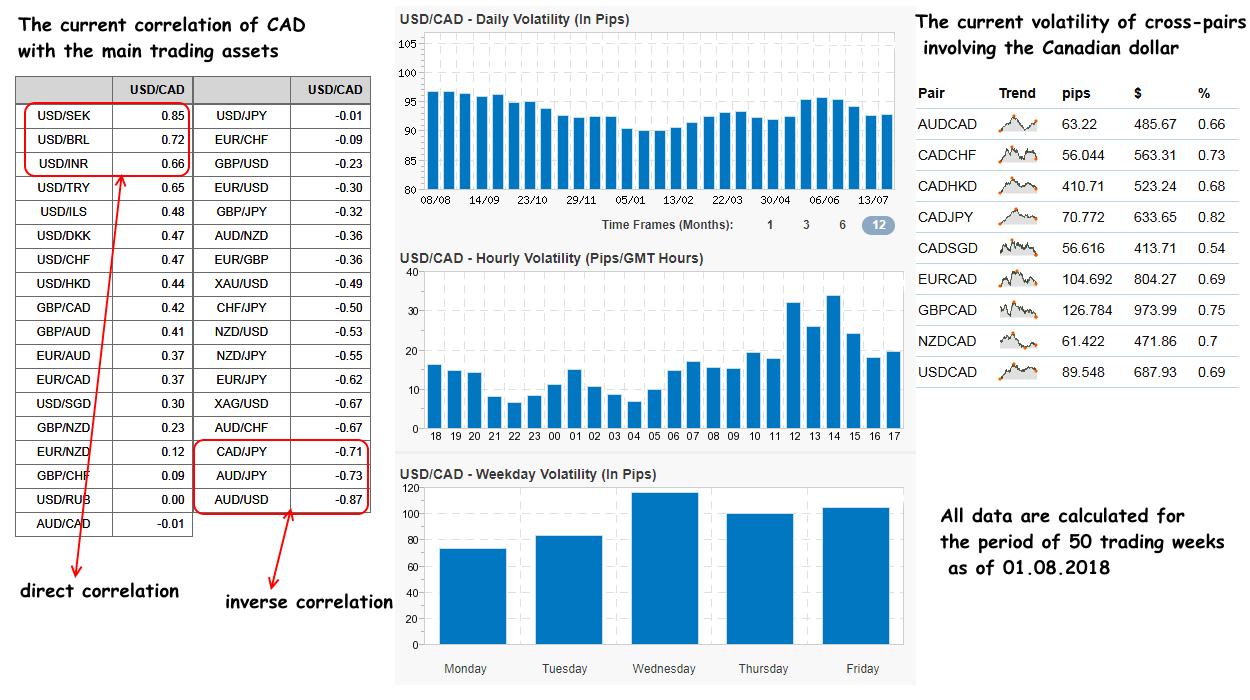

The period of the greatest activity and the maximum volumes in USD/CAD falls to the US session, and on the most popular cross-country CAD/JPY − to the middle of the Asian (after the opening of the Japanese exchanges) and the beginning of the European trading session.

It is always possible to perform here the calculation of actual volatility, and the current correlation could be calculated here.

On assets with CAD, medium-term and long-term trend strategies are effective, as well as non-speculative techniques for breaking the channel’s boundaries. The main pair USD/CAD, and especially crosses CAD/JPY, GBP/CAD and more recently EUR/CAD actively use scalpers, but the traditional speculative strategies remain correlations, cross-rates, and news.

Before you use the Canadian dollar, we recommend testing your strategy with Forex Tester Online − on real quotations of any asset and in different trade conditions.

Trade on correlations

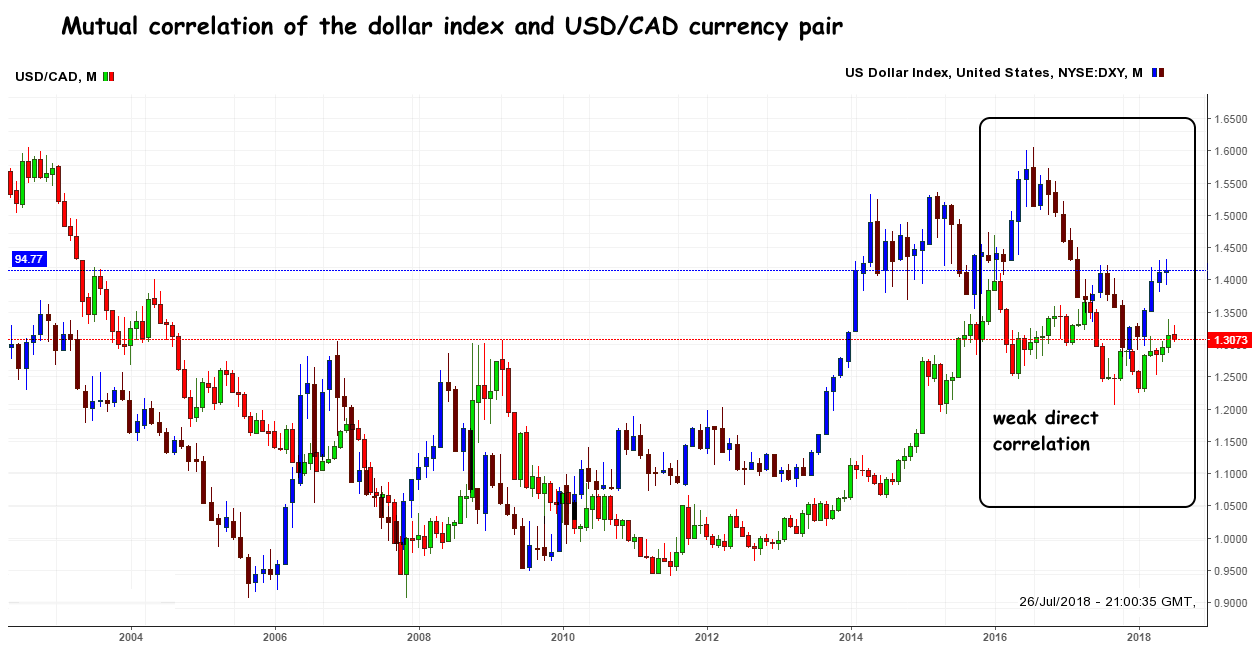

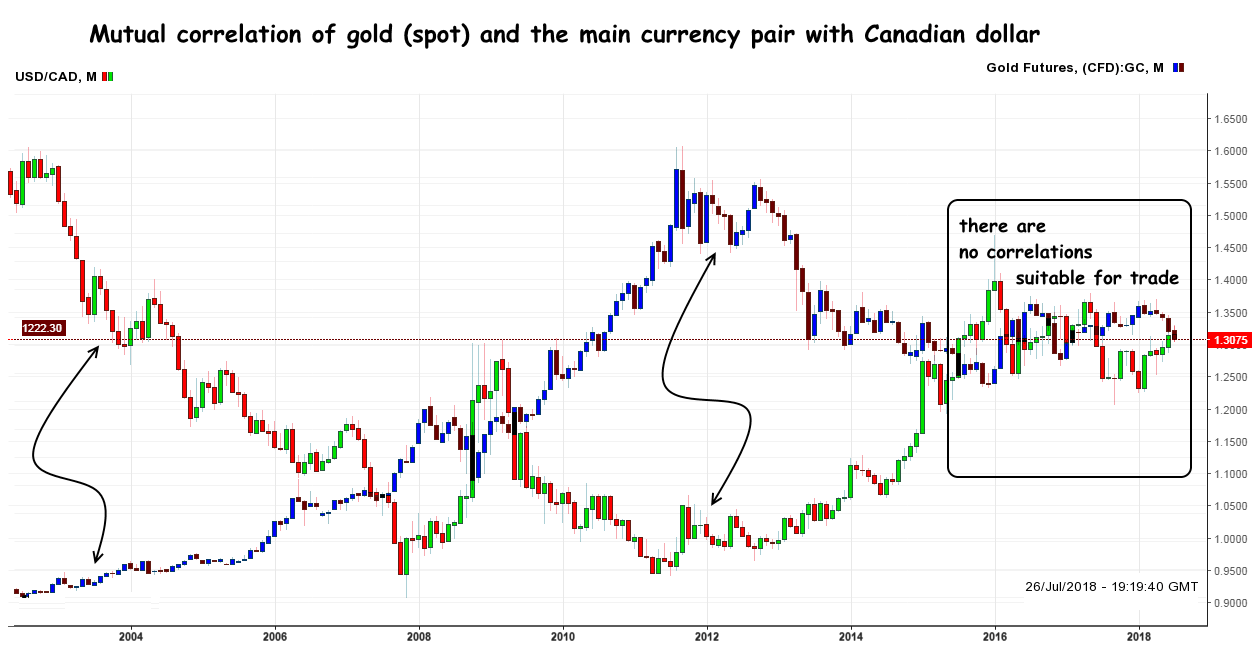

The Canadian dollar demonstrates perfectly the fact that any correlation is very relative, and, most importantly, a temporary phenomenon. The world economy is changing, old relationships no longer work, but new ones are constantly emerging.

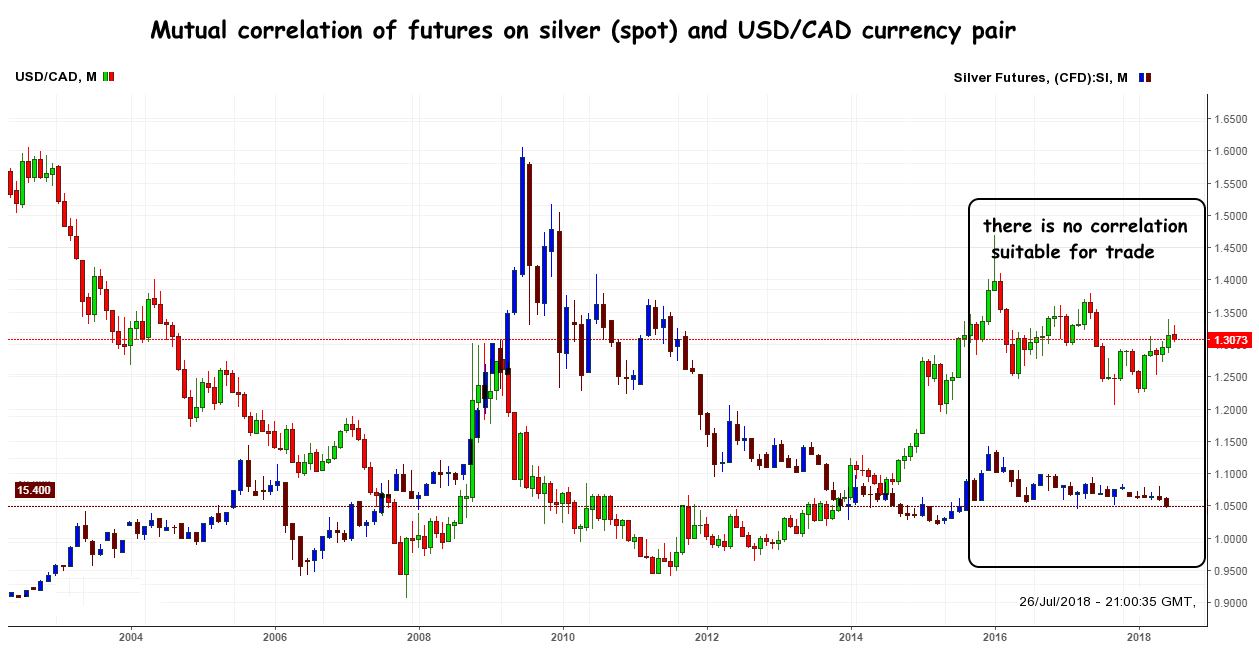

Canada holds the world’s top ten leaders in the extraction of industrial silver, gold, the group of non-ferrous metals (Al, Cu, Fe, Ni, U, Zn), but correlations of the CAD with market assets on this raw material are unstable. Trading interest is represented only by spot-assets for gold and silver.

Concerning silver, the situation is more stable, but the short-term correlation is very dependent on the demand of the Asian market for this raw material. It is necessary to track the results of trading on the stock and commodity exchanges of the Asian region.

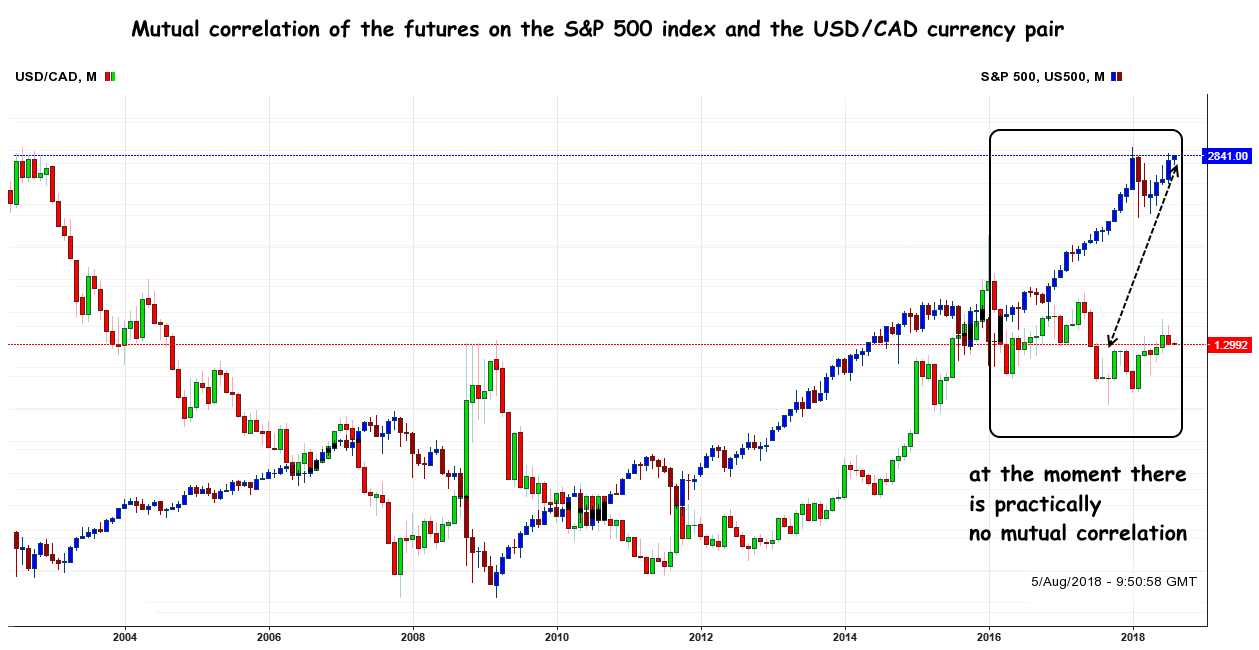

Canada’s interest in the state of the American economy reflects the relationship between the USD/CAD and the US stock indices, but for trade, this correlation is currently not suitable.

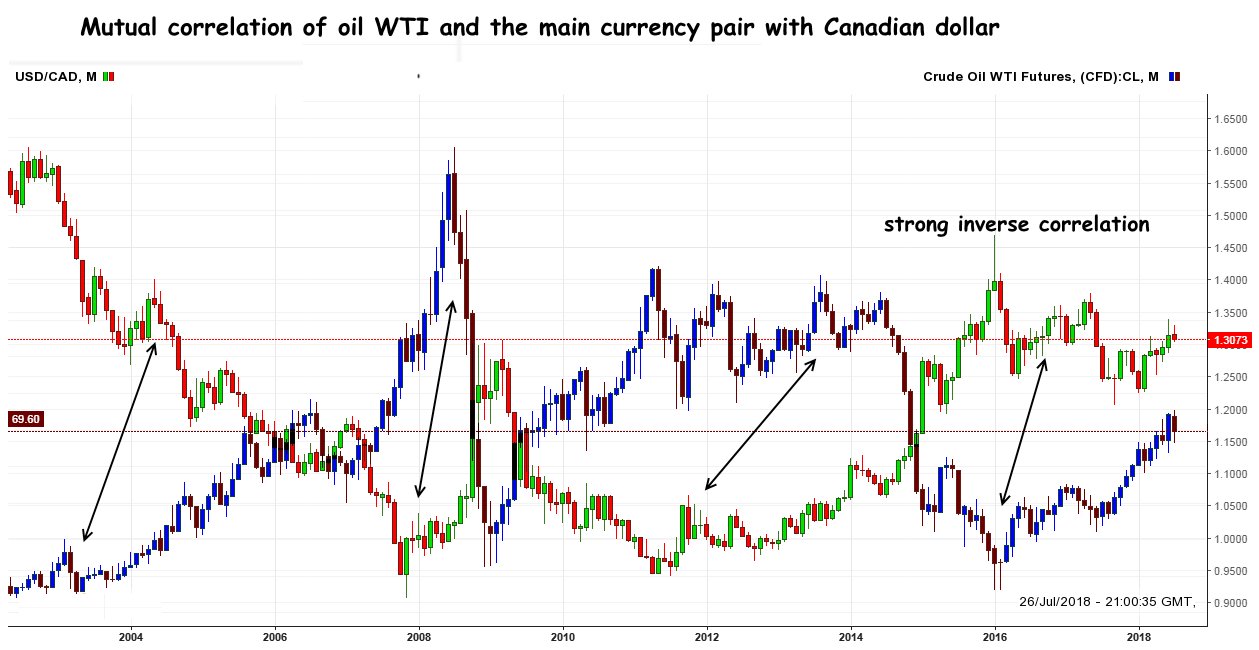

The strongest remains the correlation of the base pair with the prices for oil and oil products. Oil usually outperforms the pair USD/CADб and for Forex trades it is an indicator that shows the direction of entry. For example, the oil price increasing causes the fall of the pair USD/CAD.

At the moment, the correlation with the benchmark WTI is stronger, but the correlation with Brent mark can be also traced. The US dollar, unlike its northern counterpart, large players are buying up in any problem situations with oil.

Experienced players use the correlation between CAD and oil more efficiently and with less risk: using exchange-traded financial instruments, such as investment funds (ETFs). For example, the popular Canadian CurrencySharesCanadianDollarTrust (NYSE: FXC) index perfectly accompanies the daily change in the CAD rate, and iSharesMSCICanadaIndex (NYSE: EWC) is the basket of the leading white list stocks on the Toronto stock exchange.

Trade in cross-rates

Approximately 60% of trading transactions accounted for the main pair but crosses always have sufficient volatility. The movement should be caught in uncharacteristic for CAD periods − in European (EUR / CAD, GBP / CAD, and CHF / CAD) or in the Asian session (AUD / CAD, and CAD / JPY).

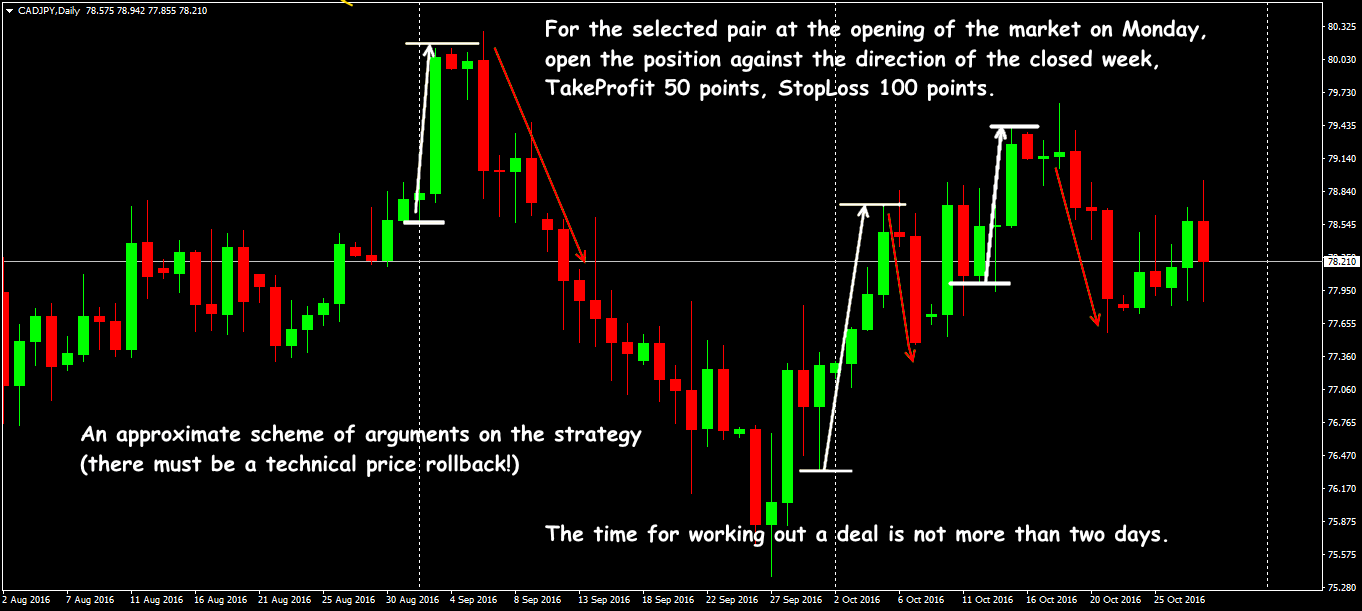

If you have enough deposit, you can offer a longer strategy: if the cross-pair for the previous week has passed no less than a figure (90-100 points), then you can expect a rollback of at least 50-70 points.

Trade on the news

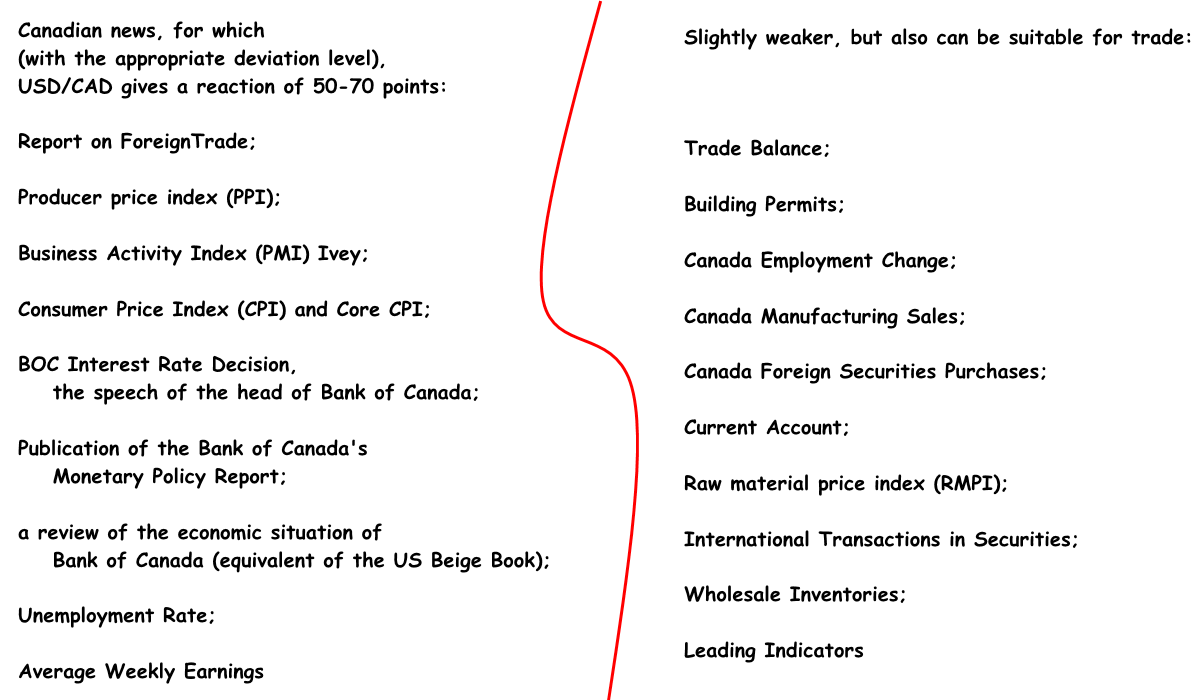

The base pair USD/CAD is actively responding to Canadian, and to American news, as well as to the signals of the commodity and stock market. The reaction has a clear direction, most often with spines, but without turns.

For example, bad news from the US and good news from Canada is a good reason to sell USD/CAD.

Trading methods on the news are traditional but adjusted for volatility. Usually USD/CAD does not provide speculative shots before the news release, but pending orders for the BuyStop/SellStop bond should be placed at a distance of at least 20-30 points. The best practice is to enter at the movement after the formation of the first spike.

Several practical remarks

A high CAD rate is unprofitable for the domestic economy, but it is not yet possible to overcome this. Reducing the price of oil, industrial raw materials, and a strong USD are the three main problems for the Canadian dollar, but many factors can be beneficial for a trader at Forex.

The main condition for normal trading is a rigid money management – the connection with oil requires this. Almost all technical indicators on the Canadian dollar behave as standard, the price in the most situations is not speculative, and therefore there is an opportunity to benefit from both technical and fundamental analysis. Well, and to earn, of course.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska