Looking for eSignal alternatives for easier and more flexible strategy testing? You’re not alone. Many traders today want faster, simpler, and (most importantly) more affordable platforms. After reviewing the options, we picked out five great choices. In this article, we’ll quickly go over eSignal, its pros and cons, and help you choose the best tool for backtesting, market replay, and chart analysis.

About eSignal (and why traders look for alternatives)

eSignal is a trading and charting platform offering real-time data, advanced charting, and backtesting tools. It supports stocks, Forex, futures, and commodities trading. Users can access hundreds of global markets with fast updates and a wide range of technical analysis features.

However, eSignal comes with high subscription costs and is only available for Windows. Many users on TrustPilot report issues like lagging charts, poor customer service, refund problems, and outdated documentation. These downsides make many traders look for an alternative to eSignal that is simpler, more reliable, and offers better value. Let’s take a look at the best options to replace it.

5 Best eSignal Alternatives in 2026

1 eSignal vs Forex Tester Online (FTO)

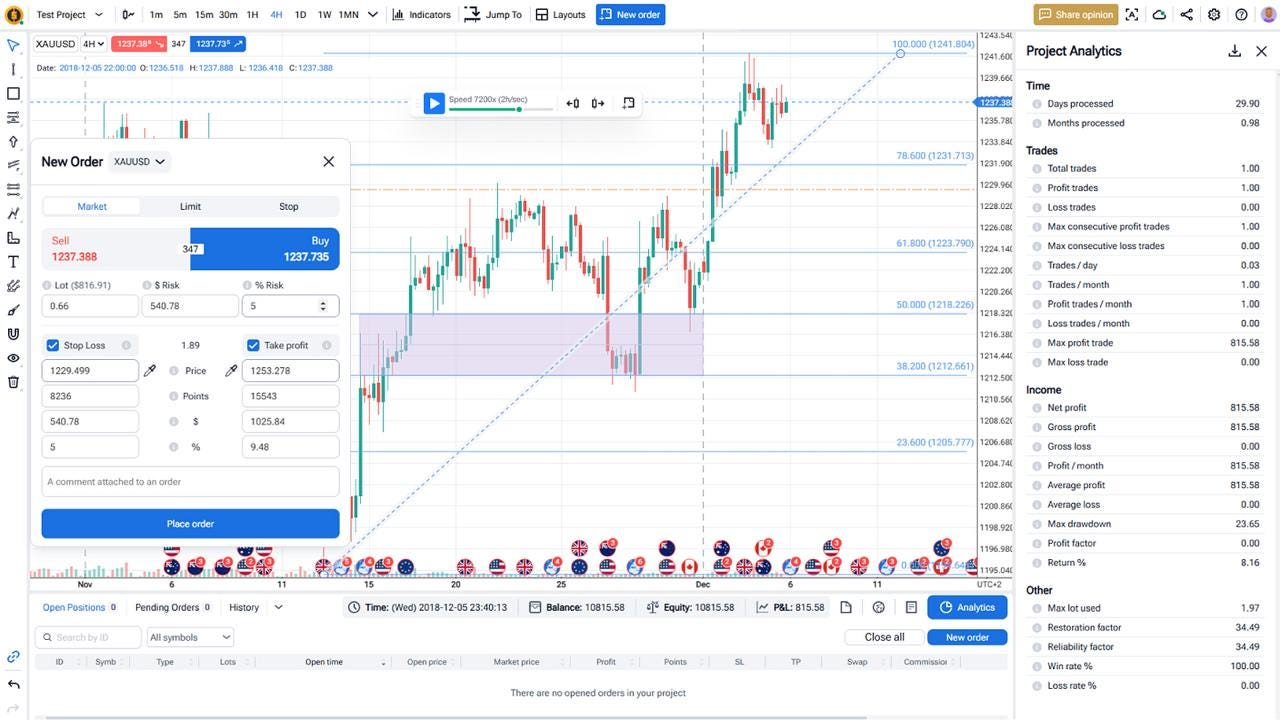

If you are looking for an easier and more affordable alternative to eSignal, Forex Tester Online is one of the best choices. It focuses on manual and semi-automatic backtesting without requiring coding skills. Instead of expensive subscriptions and complicated setups, you get an intuitive trading simulator with 21+ years of tick-by-tick historical data across Forex, stocks, futures, crypto, and commodities.

Here’s a quick comparison:

| Feature | eSignal | Forex Tester Online (FTO) |

|---|---|---|

| Platform | Windows only | Browser-based, works on Windows, Mac, Linux |

| Backtesting Type | Requires setup and technical skills | Easy manual and semi-auto backtesting |

| Historical Data | Up to 1 year intraday (depends on plan) | 20+ years of tick-by-tick data included |

| Ease of Use | Complex | Beginner-friendly |

| Best For | Active traders with technical needs | Traders wanting simple, fast manual backtesting with advanced tools |

Forex Tester Online is ideal if you want to backtest trading strategies without complicated settings or waiting for slow customer service. You can simulate realistic trading conditions quickly and easily.

2 eSignal vs TradingView

TradingView is one of the most popular charting and strategy testing platforms today. Unlike eSignal, which only runs on Windows, TradingView works in any web browser and on any device. It’s simple to use, much more affordable, and has a huge community of users sharing strategies and ideas.

While eSignal requires using its own scripting language for testing strategies, TradingView uses Pine Script, which many traders find easier to learn. TradingView also offers a free version with decent features, while eSignal requires a paid subscription from the start.

In short: if you are looking for an alternative to eSignal that is easier to use, costs less (even if it has some limitations), TradingView is a good choice.

3 Ninjatrader vs eSignal

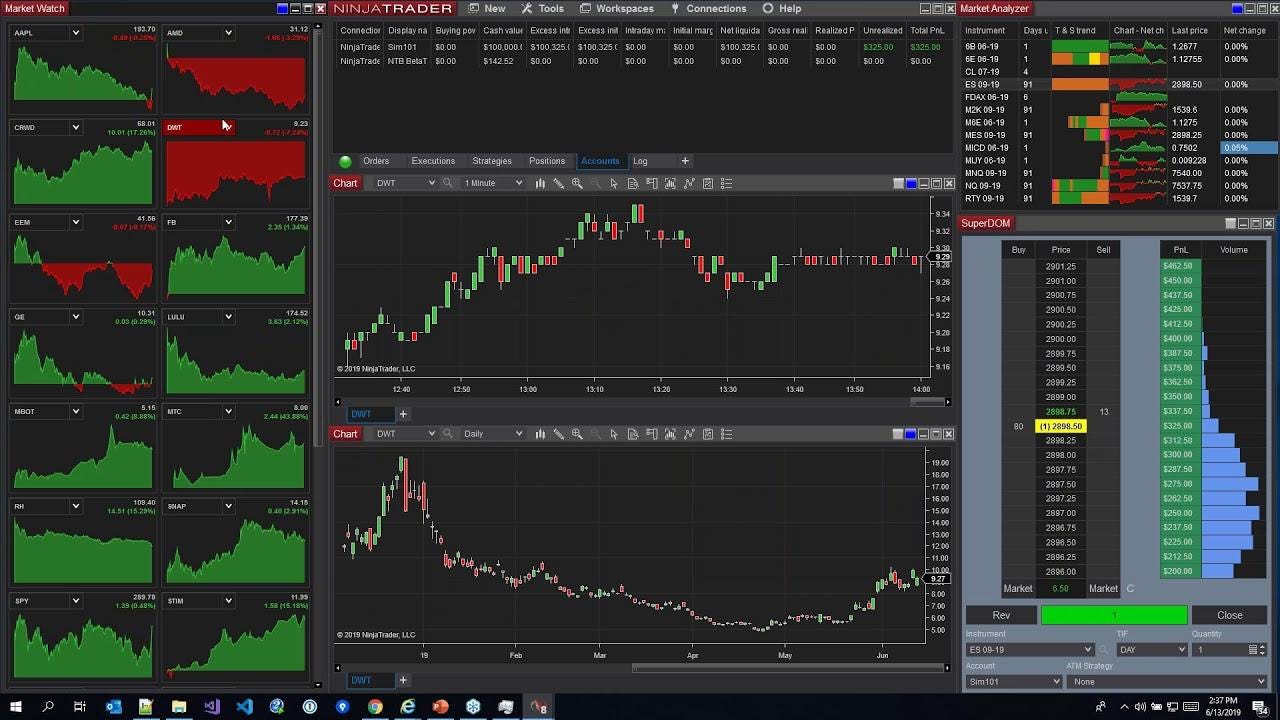

Ninjatrader is a well-known trading platform, especially among futures and Forex traders. It offers strong charting, a built-in market replay feature, and extensive backtesting options. Unlike eSignal, Ninjatrader has a free version for basic use, although you’ll need a paid license to unlock advanced features.

In terms of strategy development, Ninjatrader uses NinjaScript, a version of C#. It requires some coding knowledge, but many traders find it more flexible than eSignal’s scripting tools. Ninjatrader is also generally cheaper for active traders compared to eSignal’s higher subscription costs and extra fees.

In short: if you want deeper futures trading tools and strong backtesting at a lower cost, Ninjatrader is a solid alternative to eSignal.

4 TC2000 vs eSignal

TC2000 is a simpler and cheaper trading platform compared to eSignal. It focuses mainly on stocks and options trading. TC2000 offers good charting, scanning, and a basic simulation environment. Many users appreciate its clean interface and fast setup without needing heavy hardware.

Unlike eSignal, TC2000 does not charge high monthly fees or require expensive real-time data subscriptions. However, TC2000 is mostly designed for US markets and may not support futures, Forex, or crypto trading like eSignal.

In short: if you are looking for an easy-to-use eSignal alternative for stocks and options, TC2000 could be a better and more affordable choice.

5 Thinkorswim vs eSignal

Thinkorswim by Charles Schwab is a trading platform offering advanced charting, paper trading, market analysis, and strategy testing tools. It’s free for Schwab and TD Ameritrade clients, which already makes it a strong alternative to eSignal.

While eSignal focuses more on selling premium real-time data and expensive charting services, Thinkorswim provides many similar features — like custom indicators, technical analysis, and options trading — at no extra cost beyond trading fees. Thinkorswim also includes paper trading (paperMoney), a strong plus for those who want to practice trading without risking real money.

In short: Thinkorswim is a great eSignal replacement if you want a full-featured, free trading platform that covers stocks, futures, Forex, and options.

Conclusion

eSignal offers good charting and real-time data, but it comes at a high price and can be frustrating for many traders due to lag, refund issues, and difficult customer service. That’s why many traders look for eSignal alternatives that are more affordable, easier to use, and still powerful for backtesting and market analysis.

- If you want a strong replacement, Forex Tester Online is the best choice. It provides manual and semi-automatic backtesting, 21+ years of tick-by-tick historical data, market replay, and works on any operating system — all without complicated setup or hidden fees. When it comes to backtesting, FTO is as advanced as eSignal, but is much more affordable and has a lifetime access option.

- TradingView is another solid option for those who prefer browser-based charting and social trading.

- NinjaTrader is good if you focus on futures trading and need strong market replay tools.

- TC2000 is a good pick for stock traders who want a simple layout with built-in scanners.

- Thinkorswim works well if you want a free, all-in-one platform for testing, trading, and practicing.

Choose the tool that matches your trading style, budget, and technical skills — and avoid overpaying for something that doesn’t deliver.

Also read: TOP Forex Signal Providers

FAQ

Can you trade on eSignal?

eSignal is mainly a charting and market data platform. It is not a broker itself, but it allows you to connect to supported brokers for order execution. You can analyze, backtest strategies, and send trades through the linked broker.

What is the market depth in eSignal?

Market depth in eSignal shows the number of buy and sell orders at different price levels. It helps traders see supply and demand zones. This feature is available in their higher-tier plans and gives deeper insight into price movements for stocks, Forex, futures, and commodities.

Is eSignal worth it?

Many traders find eSignal powerful for technical analysis and historical data access. However, because of its high price, outdated interface, and customer support issues, many are searching for an eSignal alternative that offers better value. Today, many of them provide similar or even better features at lower costs.

What is the eSignal formula?

The eSignal formula is their scripting tool called EFS (eSignal Formula Script). It allows users to create custom indicators, strategies, and alerts inside the platform. Some coding knowledge is needed to use it fully.

Does eSignal support Forex and crypto?

Yes, eSignal offers charting and market data for Forex and crypto, alongside stocks, futures, and commodities. But if you want a simpler way to test and analyze Forex and crypto strategies without complex setup, using a replacement like Forex Tester Online could be a better fit.

Forex Tester Online

Perform market replay easily with our best alternative to eSignal

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska