How to Fuse Hard-Number Positioning Data with a Fresh Sentiment Flip and Let the Market Carry You

Author: Paul Sanders, Financial Source, specially for Forex Tester Online.

Prologue – When March Welcomed the Euro

London, pre-dawn. The screens glow a sullen blue and the euro sits unloved beneath a ceiling it has failed to breach for three straight weeks. Energy headlines are still grim, and every retail forum hums with certainty that EUR/USD will crack lower “any day now.”

Instead of scrolling opinion, you open your Positioning Dashboard. Five metrics stare back:

- Return % Distribution: history says the euro finishes March positive almost two-thirds of the time.

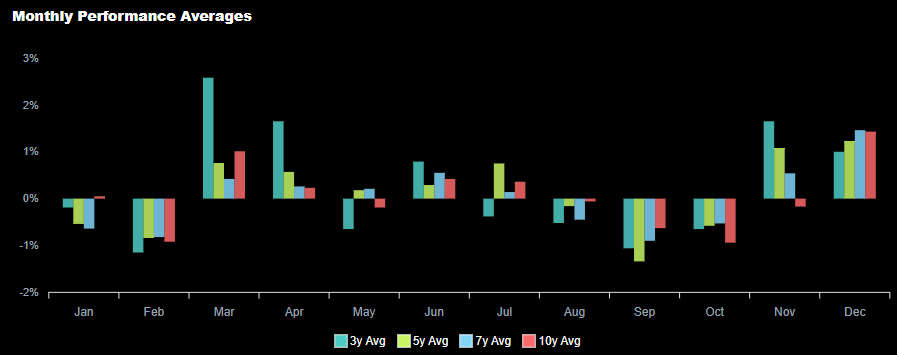

- Monthly Performance Averages: the four-look-back mean points to ≈ 1.2% upside.

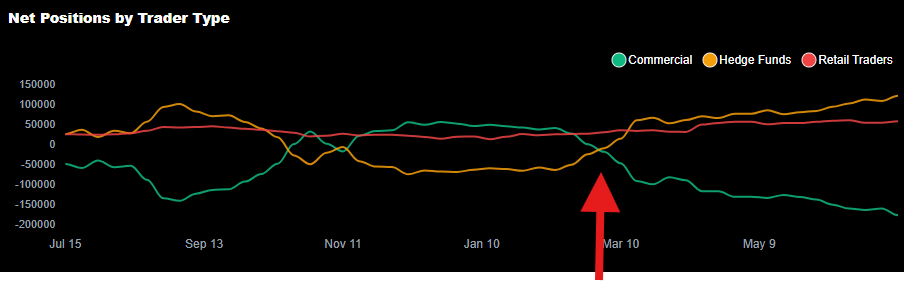

- Hedge-fund flow: the leveraged-fund line on the COT gauge has just crossed from net-short to net-long.

- Open-interest percentile: a sleepy 35%, nowhere near overheating.

- Price structure: a tight three-week box pressing under 1.0880.

Then, just after the Frankfurt open, something seismic happens.

On March 4, 2025, German political leaders announced a landmark agreement: a constitutional overhaul of the nation’s famed debt brake, and the creation of a €500 billion infrastructure and defense fund. For decades, Germany’s fiscal rigidity acted as a cap on eurozone growth. The announcement signals a structural shift — from surplus obsession to stimulus — and markets react instantly.

European credit spreads tighten. German Bund yields rise. Risk sentiment flips. The euro spikes.

Five minutes later you are long at 1.0892 with a stop of 70 pips beneath the daily low, and a plan not to flinch until the statistics prove false.

Twenty-one sessions later EUR/USD trades above 1.1050; blogs that mocked the euro now publish “why the rally made sense.”

Your swing trade was no fluke. It was the result of a five-step checklist designed to locate extremes, measure probability, and ride the release of pent-up energy.

Disclaimer: “The views and strategies discussed below represent the author’s opinion based on market analysis. This content is for educational purposes and does not constitute financial advice.”

Step 1 – Seasonality with Return % Distribution

Find the Month That Loves Your Idea

Every asset has months it naturally drifts higher and months it historically droops. A Return % Distribution tool distils an entire decade of monthly closes into a single binary: how often does this instrument end the month up or down?

In March the euro’s rose 64% of the time. February, by contrast, is blood-red at 91% down months. A seasoned swing trader doesn’t fight January headwinds or August doldrums; they hunt the friendly calendar windows first. That doesn’t guarantee success, but it tilts the opening odds before a trade ticket is even considered.

In our March euro example, history’s green tilt whispered, “Lean long unless a compelling reason screams otherwise.”

Step 2 – Scope and Sizing with Monthly Performance Averages

Translate Probabilities into Concrete Risk-Reward

Direction is useless without magnitude. The same bar that shows frequency also reveals four average returns — three-, five-, seven- and ten-year. Average them and you obtain a rough upside blueprint; for March EUR/USD it was 1.19%. That equals roughly 120 pips at current prices.

With a statistical target in hand, sizing is no longer gut feel. If you want a minimum two-to-one reward-to-risk, the stop can be no wider than sixty pips. Wider stop? Demand additional confluence or pass on the trade. In other words, the data dictates discipline long before emotions can.

Step 3 – Follow the Smart Money with the COT Hedge-Fund Lens

See the Conviction Before the Crowd Does

Each Friday, the Commitment of Traders (COT) report offers a clear snapshot of futures market positioning, breaking down players into categories. The group that matters most for active traders? Leveraged Funds — the hedge funds.

Unlike commercial hedgers, who are often price-insensitive and focused on managing business risk, hedge funds trade for profit. They chase trends, respond to macro shifts, and aggressively rotate between assets. That makes their positioning data one of the clearest reflections of institutional conviction in the market.

The key metric to watch is net positioning: when hedge funds shift from net short to net long (or vice versa), they are revealing a meaningful change in belief. The moment that line crosses above or below zero is a pivotal signal. It marks the transition from skepticism to bullishness, or optimism to bearishness.

In March 2025, that inflection came sharply. Hedge funds flipped from net short to net long EUR, adding nearly 50,000 contracts in just four weeks. This wasn’t a hedge. It was a declaration. A response to Germany’s fiscal pivot.

This provided two key benefits:

- Validation of Bias – The positioning shift confirmed what the price structure was already hinting at: the path of least resistance was up.

- Early Entry to Trend – Those who jumped in on the flip — before EUR/USD pushed through resistance — got in ahead of the masses and could ride the slow melt-up, powered by continued fund flows.

Once hedge funds commit, they often build positions over several weeks. This creates sustained flows that can push prices well beyond fair value. The market doesn’t just turn — it trends.

Step 4 – Check the Open-Interest Percentile

Confirm There’s Fuel Left in the Tank

Great trades die when everyone already owns them. Be sure to check open-interest when following the hedge funds’ activity. The Open-interest gauge shows where current futures exposure sits relative to its two-year history.

Readings above 80% warn that the bus is full; contrarian alarms should ring. Readings in the soft middle — 30% to 50% — mean plenty of room for latecomers, algorithm add-ons, and OTC flow to join without immediate exhaustion.

In our March trade, the open-interest percentile sat in the calm zone — nowhere near stretched, signaling that the road ahead was still open.

Step 5 – The 2 Triggers

And Manage the Journey like a Cartographer, Not a Tourist

Once the seasonal, statistical, positioning, and participation lights are all green, you still need a catalyst. The trigger is the moment probability turns into price. It comes in two flavours:

A. Trigger on a Fundamental or Sentiment Shift

Use a live macro catalyst to light the fuse:

- Major data surprise – A non-farm-payrolls print that smashes consensus, a CPI release that misses by a mile, or a flash PMI that flips from contraction to expansion.

- Central-bank pivot – An unexpected tweak in a policy statement, or a dovish governor suddenly preaching vigilance.

- Hawk-and-Dove flip in real time – When a renowned dove turns hawkish (or vice versa), especially against your positioning case.

A fundamental trigger is ideal when price is already leaning toward a breakout level but lacks spark.

In the EUR/USD trade, the real catalyst emerged on March 4, 2025, when Germany’s government struck a deal to overhaul its constitutional debt brake and fund €500 billion in infrastructure and defense.

For decades, Germany’s fiscal restraint had capped European growth. This pivot marked a structural shift toward domestic investment, cyclically stronger demand, and a eurozone less reliant on exports or the ECB. The market viewed it as bullish rebalancing — not reckless spending.

That was your moment. The compression box gave way.

B. Trigger on a Technical Breakout

Sometimes price itself delivers the catalyst:

- Identify the structure – Look for tight boxes, flags, or ranges that suggest compression.

- Wait for the breach – When price slices through resistance (or support) with conviction, the thesis is validated.

- Place the stop mechanically – Just beyond the breakout bar or structure, targeting a 2:1 ratio minimum.

In the EUR/USD example, the three-week box under 1.0880 finally gave way after the fiscal headline. The breakout wasn’t random. It was the result of well-aligned seasonal, statistical, and positioning forces. You didn’t chase a candle — you confirmed a thesis.

Conclusion: The Checklist is the Alpha

In short: let the catalyst wake the market — but let the checklist choose the trade.

From seasonal tailwinds to performance targets, from hedge-fund flips to under-crowded setups, the five-step positioning process creates a structured approach for capturing multi-session swings with institutional backing.

It’s not magic. It’s math, discipline, and a dashboard that tells the truth before the crowd catches on.

Get Macro Tools + Forex Tester

Get Macro Tools + Forex Tester

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska