Summarize at:

In this article, we will look at the best alternatives to FX Blue for traders who need more advanced backtesting, deeper analytics, or better trade performance tracking. Let’s get started!

Why Look for an FX Blue Alternative

FX Blue is a widely used trading tool that helps traders track performance, analyze trade history, and run basic simulations. It is especially popular among MetaTrader users because of its seamless integration with MT4 and MT5, making it a convenient choice for those who want real-time trade tracking and portfolio analysis. FX Blue provides valuable insights into win rates, drawdowns, risk exposure, and trade statistics, making it useful for traders looking to review and optimize their trading strategies.

However, despite its features, FX Blue has several limitations that lead traders to seek alternatives. One major drawback is the lack of deep historical data for backtesting strategies over extended periods. Many traders require access to high-quality tick data spanning years to properly evaluate how their strategies would have performed under different market conditions. FX Blue primarily focuses on real-time trade tracking rather than full-scale backtesting, which makes it less useful for traders who want to test strategies before deploying them in live markets.

Another concern is limited customization and analytics. While FX Blue provides trade performance metrics, it does not offer detailed risk analysis, Monte Carlo simulations, or customizable strategy optimization tools that are available on more advanced platforms. Traders who need greater control over data visualization, reporting, and strategy refinement may find FX Blue’s functionality restrictive.

Additionally, FX Blue is mainly built for Forex and CFD traders, with limited support for stocks, indices, and commodities compared to dedicated backtesting platforms. Those looking for multi-asset trading solutions or more robust analytics may prefer platforms that provide broader market coverage, advanced charting tools, and precise execution testing.

If you’re searching for an FX Blue alternative that offers more powerful backtesting, better historical data, and enhanced trade analysis tools, here are five of the best options to consider.

Best FX Blue Alternatives

Let’s get to the point. Here are our picks for the best alternative tools (in our opinion).

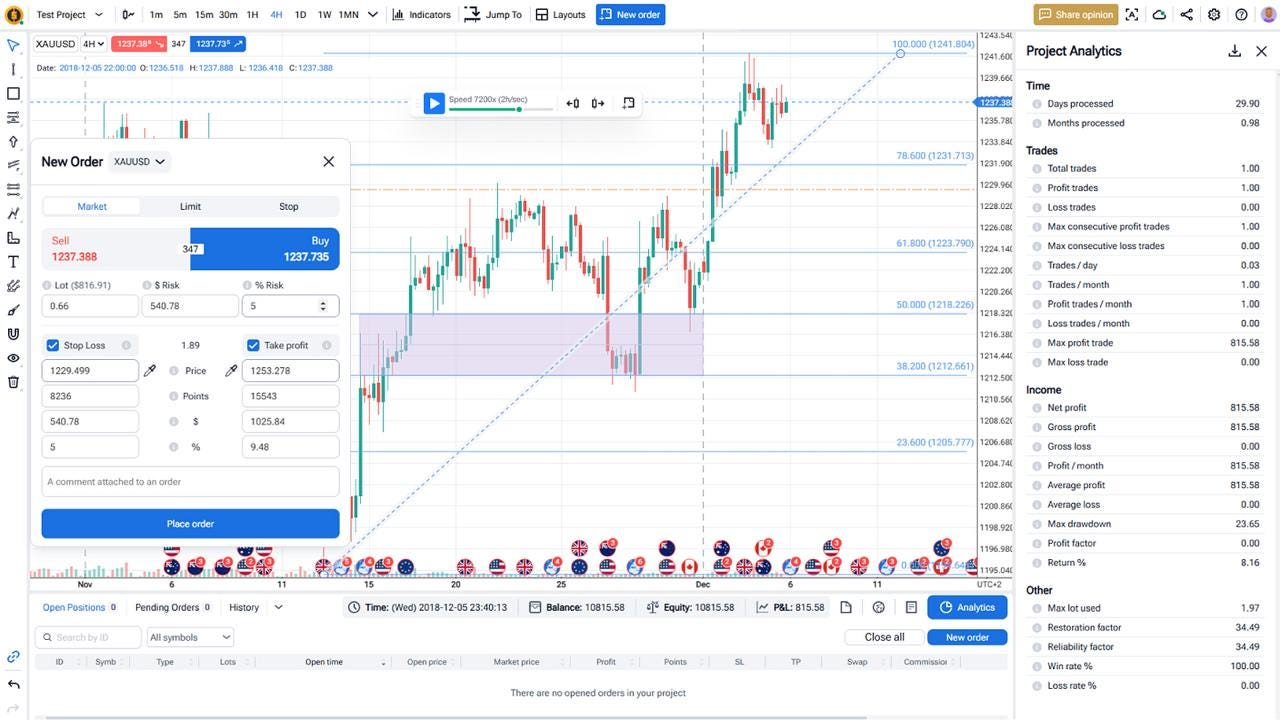

1) Forex Tester Online – Best for Backtesting and Strategy Development

Forex Tester Online is a professional backtesting platform designed for traders who want full control over testing their strategies before going live.

✔ Fast and Accurate Simulations – Run months and years of trades in minutes with tick-by-tick historical data.

✔ Deep Market Data – 20+ years of data for Forex, stocks, indices, and crypto.

✔ Detailed Performance Analysis – Track trade history, risk metrics, and strategy effectiveness. Use advanced analytic tools that are not available on other platforms.

✔ No Coding Needed – Unlike many backtesting tools, it’s built for manual strategy testing with an intuitive interface.

✔ Realistic Trading Conditions – Includes commissions, order history, spreads, and swaps for accurate results.

While FX Blue is focused on trade tracking, Forex Tester Online is a complete backtesting solution, making it a better fit for traders who want to refine their strategies before entering the market.

2) Myfxbook – Best for Social and Automated Trade Analytics

Myfxbook is a popular trade-tracking platform that connects to trading accounts and provides real-time analytics.

- Tracks live and demo accounts automatically.

- Offers detailed trade history, risk analysis, and performance reports.

- Includes a social aspect, allowing traders to share strategies.

- Not designed for manual backtesting, unlike Forex Tester Online.

3) TradingView Strategy Tester – Best for Integrated Backtesting

TradingView’s built-in strategy tester allows traders to evaluate trading strategies using historical data.

- Works seamlessly within TradingView’s advanced charting system.

- Supports Forex, stocks, crypto, and other assets.

- Allows traders to test strategies using Pine Script.

- Less detailed analytics than FX Blue or Myfxbook.

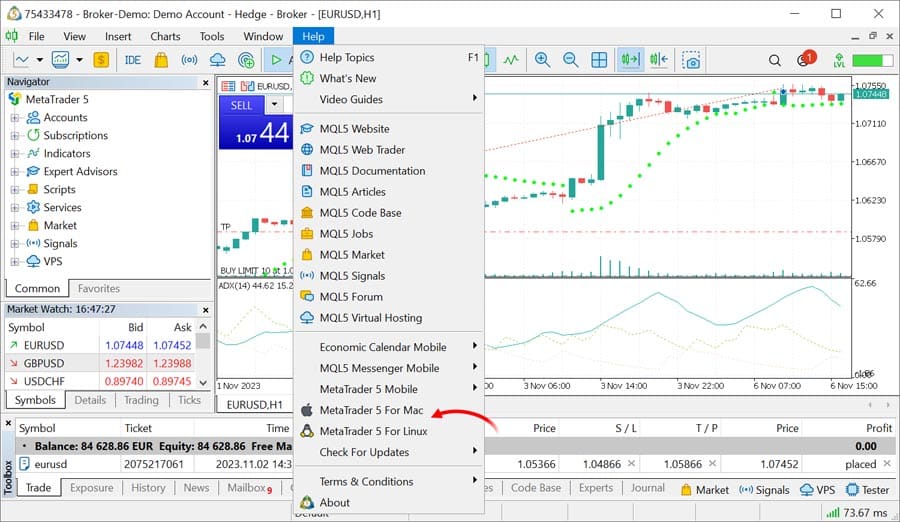

4) MetaTrader Strategy Tester – Best for Algorithmic Strategy Testing

MetaTrader’s built-in backtesting tool is useful for traders who develop automated strategies using MQL4 or MQL5.

- Works within MT4 and MT5 for strategy testing.

- Supports optimization of algorithmic trading systems.

- Lacks manual trade tracking features found in FX Blue.

5) QuantAnalyzer – Best for Risk and Performance Optimization

QuantAnalyzer is an advanced tool that helps traders refine their trading strategies by analyzing risk and performance metrics.

- Provides in-depth analytics, including Monte Carlo simulations.

- Works with multiple trading platforms, including MetaTrader and NinjaTrader.

- More focused on data analysis than direct backtesting.

Final Thoughts

FX Blue is a solid tool for tracking trading performance, but if you need a dedicated backtesting platform or deeper analytics, there are better options. Forex Tester Online is the top choice for traders who want accurate simulations and in-depth historical data. Myfxbook and QuantAnalyzer offer strong trade analytics, while TradingView and MetaTrader are great for integrated strategy testing.

Choose the FX Blue alternative that fits your trading style and analysis needs best.

FAQ

What are the main drawbacks of FX Blue?

FX Blue is useful for trade tracking and analytics, but it lacks in-depth backtesting tools, extensive historical data, and customization options. It’s more of a performance-tracking tool rather than a dedicated strategy testing platform.

Does TradingView offer a complete replacement for FX Blue?

Not exactly. TradingView’s Strategy Tester provides a simple way to backtest strategies within its charting platform, but it lacks the advanced trade analytics and detailed performance tracking that FX Blue offers.

Is FX Blue free or does it require a subscription?

FX Blue is free for personal use. Professional or enterprise-level features may require special arrangements, but most individual traders can access it at no cost.

Can I use MetaTrader’s built-in tools instead of FX Blue?

Yes, MetaTrader’s Strategy Tester allows you to test automated trading strategies (Expert Advisors), but it doesn’t provide the same level of trade tracking or analytics that FX Blue offers.

Which alternative is best for advanced manual backtesting?

We recommend Forex Tester Online. It simulates realistic trading conditions with tick-by-tick data and detailed performance metrics, making it the best choice for manual strategy testing.

Forex Tester Online

Best alternative to FX Blue to backtest and analyze trades

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska