As traders, we constantly seek tools and techniques that can give us an edge in the market, and indicators are among the most widely used assets in our trading toolkit. However, choosing the right indicators and knowing how to apply them effectively is crucial. This is where indicator backtesting steps in as an invaluable strategy.

In this article, we’ll delve deep into the mechanics of indicator backtesting. We’ll explore the types of indicators commonly used in forex trading, the best practices for conducting thorough backtests, and the common pitfalls to avoid.

What is Indicator Backtesting?

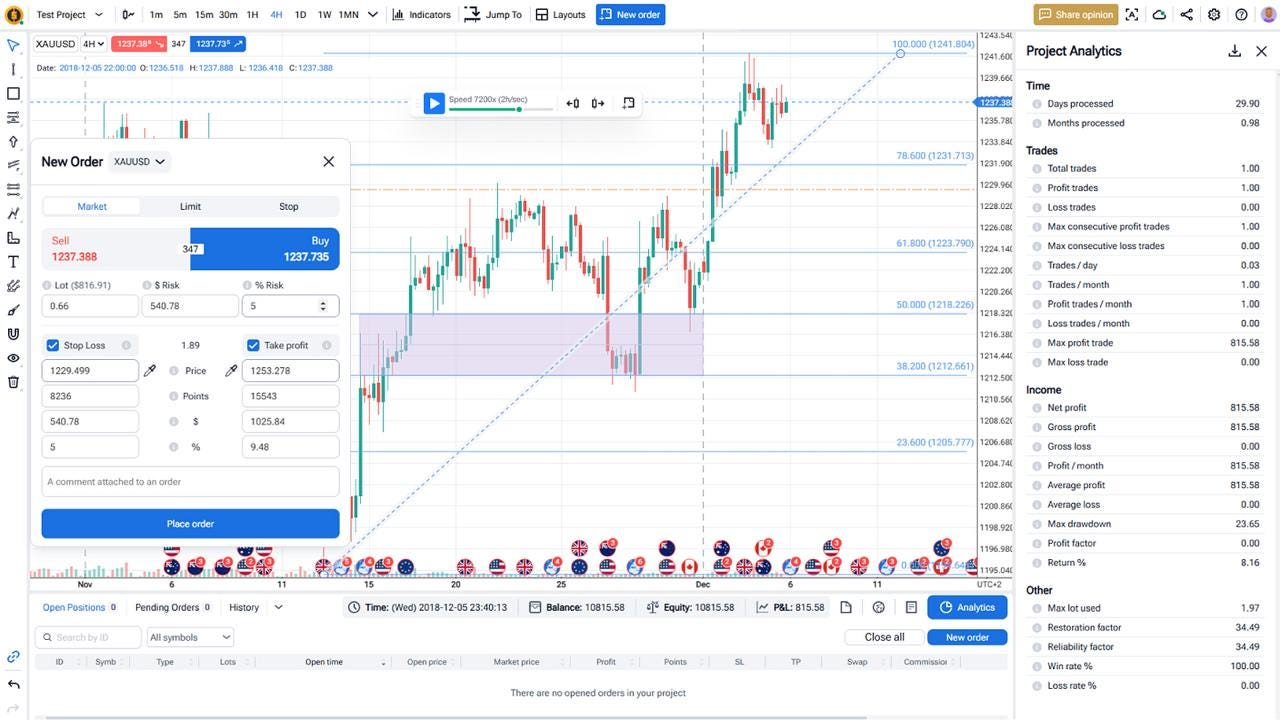

Indicator backtesting involves analyzing historical price data to evaluate how various indicators would have performed in past market conditions. By simulating trades based on this historical data, traders can assess the reliability and effectiveness of their chosen indicators before risking real capital. This process helps identify potential pitfalls and fine-tune strategies, ultimately leading to more informed trading decisions.

Give your strategy an indicator backtest and see how successful it was in the past. Not every indicator is suitable for all your trading needs but the good news is you are free to test any indicators as much as you need in Forex Tester Online.

Forex Tester Online has indicators divided into several groups:

- Trend Indicators

- Oscillators

- Volume Indicators

- Volatility Indicators

- Adaptive Indicators

- Custom Indicators

You can add your own indicators and they will appear in the Custom Indicators section. You can freely modify them as well.

Forex Tester Online has more than 60 built-in indicators with more to come!

All currently used indicators are depicted gathered into a list for convenient management: edit them, delete them — all options are there.

Want to try it yourself?

How to Backtest Trading Strategy with Technical Indicators

- Visit Forex Tester Online

- Select an asset from the available symbols.

- Choose the historical data range you wish to test.

- Configure the environment, including spreads, commissions, and market conditions.

- Use charting tools and indicators to define your strategy.

- Execute trades manually or automate certain testing processes.

Detailed Guide: How to Use Forex Tester Online

Try our Indicator Backtesting Software

Try our Indicator Backtesting Software

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska