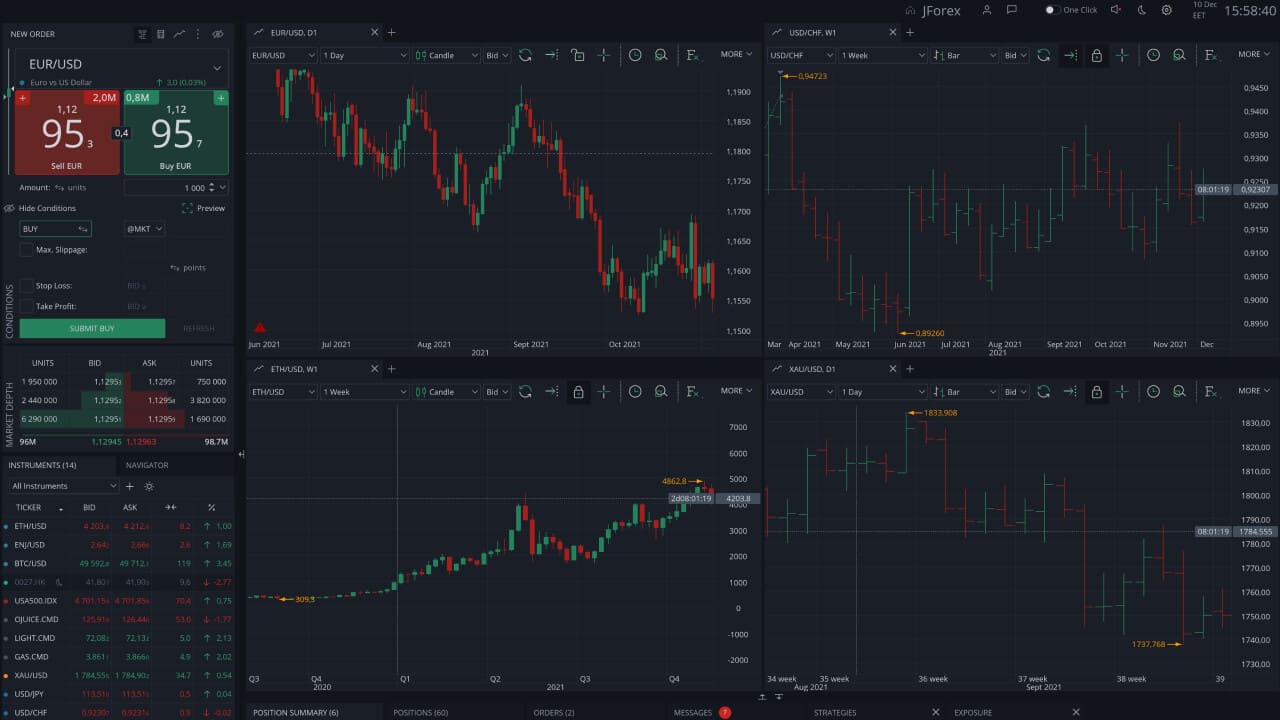

If you’re exploring JForex alternatives for backtesting, you’re likely seeking a more efficient, flexible, or user-friendly platform. While Dukascopy JForex is a known name in the industry, offering solid tools and access to SWFX liquidity, it isn’t always the best fit for backtesting purposes.

In 2026, several advanced tools can replace or supplement JForex backtesting. They come with different strengths, making them worth considering, especially if you’re dissatisfied with JForex’s current features, performance, or usability.

Why Look for a JForex Alternative?

JForex has some good points. It integrates real-time Level 2 quotes, has a broad range of order types, and supports both manual and automated trading. However, many users, especially those using JForex 4, face significant drawbacks when using it for backtesting. Here’s why.

Performance Issues

JForex backtest capabilities can be slow. Lag, app freezes, and crashes are frequent complaints in JForex download reviews, especially for mobile users. In an age of superfast internet, these issues make the platform feel outdated.

The JForex web and mobile versions also struggle with login issues and slow chart updates, as noted by users on Google Play Market.

Limited Customization and Usability

While JForex supports a decent range of indicators, it lacks flexibility. For example, users have criticized the inability to rearrange instruments or adjust chart elements easily.

The JForex API documentation is thorough but often too technical for traders not familiar with Java. This limits its accessibility for those preferring simpler coding options like Python or C#.

Best alternative for Forex Backtesting – Forex Tester Online

User Experience Gaps

Compared to other platforms, JForex web has a less intuitive interface. The desktop version is solid, but the mobile version falls short, frequently lagging and causing frustration.

Reviews frequently mention poor responsiveness during high-traffic events, which is critical when timing matters. In contrast, competitors offer smoother, more intuitive experiences.

Lack of Key Features

Traders expect advanced tools such as multiple timeframes, automated strategy testing, and detailed performance analytics. Backtest in JForex may not always meet these expectations, especially when compared to platforms with more advanced features like TradingView or Forex Tester Online.

Some niche chart types like Point & Figure are still unavailable, which frustrates those who rely on them for strategy development.

Overall JForex Rating is:

In short, while Dukascopy JForex has its merits, its limitations, especially in speed, flexibility, and user experience, push many traders to look for better, more modern options. Exploring JForex alternatives can open doors to platforms that are faster, easier to use, and provide more comprehensive features.

Best JForex Alternatives

If you’re looking for the best JForex alternatives, there are plenty of options that offer faster performance, better customization, and more advanced backtesting tools. Whether you’re an experienced trader or just starting, finding a platform that fits your needs is crucial.

Let’s explore some of the top JForex backtesting alternatives available today.

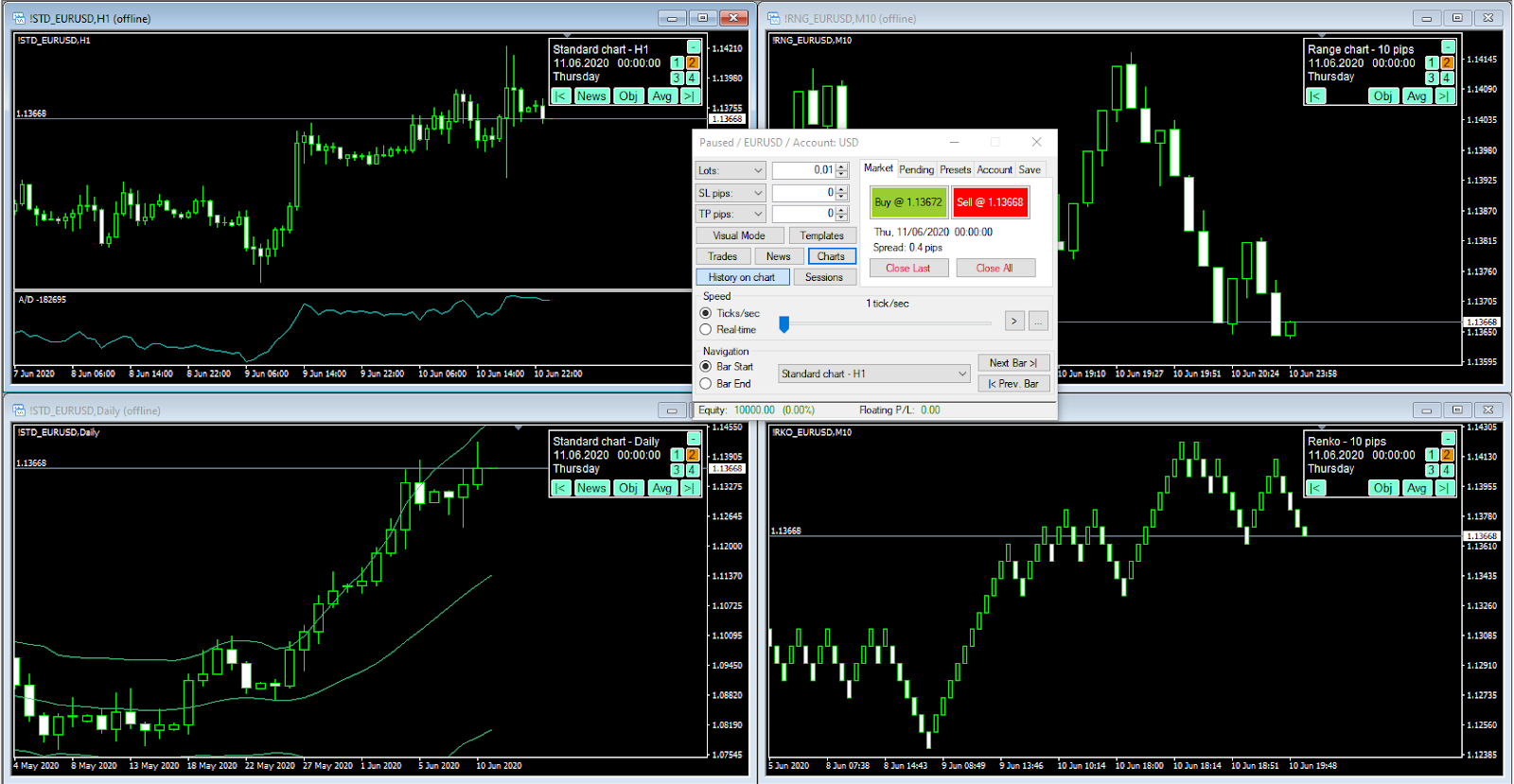

1. Forex Tester Online

When comparing JForex backtest features with Forex Tester Online (FTO), FTO frequently comes out on top, particularly in terms of speed, accessibility, and advanced features.

Below is a detailed comparison table highlighting the differences:

| Feature | JForex | Forex Tester Online |

|---|---|---|

| Performance and Speed | Often lags and freezes, especially on mobile and web versions. Slower execution during high-traffic events. | 10x faster than traditional demo accounts. Backtests months of data in minutes with no lag. |

| Accessibility | Requires specific setup for desktop and mobile; struggles with responsiveness on mobile. | Browser-based; works on any device (Windows, MacOS, Linux, Android, iOS) with consistent performance. |

| Customization Options | Limited in mobile versions; technical knowledge of Java needed for API integration. | Supports a wide range of custom indicators; allows for simpler coding languages (Python, C#). |

| Data Availability | Tick-by-tick data with historical data depth but inconsistent performance in accessing it smoothly. | Offers 1-minute data and tick data with up to 20 years of history; easy and quick access. |

| User Interface | Desktop version is strong, but mobile and web versions have an outdated, less intuitive interface. | Modern and user-friendly interface with smooth navigation across all devices. |

| Automated Strategy Testing | Requires Java for API integration; setup can be complex. | Provides straightforward setup options for automated strategies. |

According to the reviews and our customer feedback research, Forex Tester Online outperforms JForex in key areas like speed, ease of access, and versatility. If you’re looking for a more efficient and user-friendly alternative, Forex Tester Online is a top choice. With faster testing speeds, broad device compatibility, and simpler customization, it surpasses the limitations seen in JForex web and mobile versions.

2. TradingView

TradingView is a versatile JForex alternative with advanced charting tools and wide customization options. It offers more flexibility, supporting various chart types like Renko and Point & Figure, and thousands of indicators, including the ability to create custom ones using Pine Script, which is simpler than JForex’s Java-based approach.

Key Advantages:

- Fast, responsive platform across devices; real-time updates.

- Highly intuitive, drag-and-drop interface, ideal for both beginners and pros.

Disadvantages:

- Free version has limitations; pro features start at $14.95/month.

- Custom automated strategies require learning Pine Script.

- Limited historical data that makes backtesting short termed.

Difference: While JForex has strong desktop capabilities, its mobile and web versions lag, making TradingView a superior choice for ease of use and flexibility but not for backtesting.

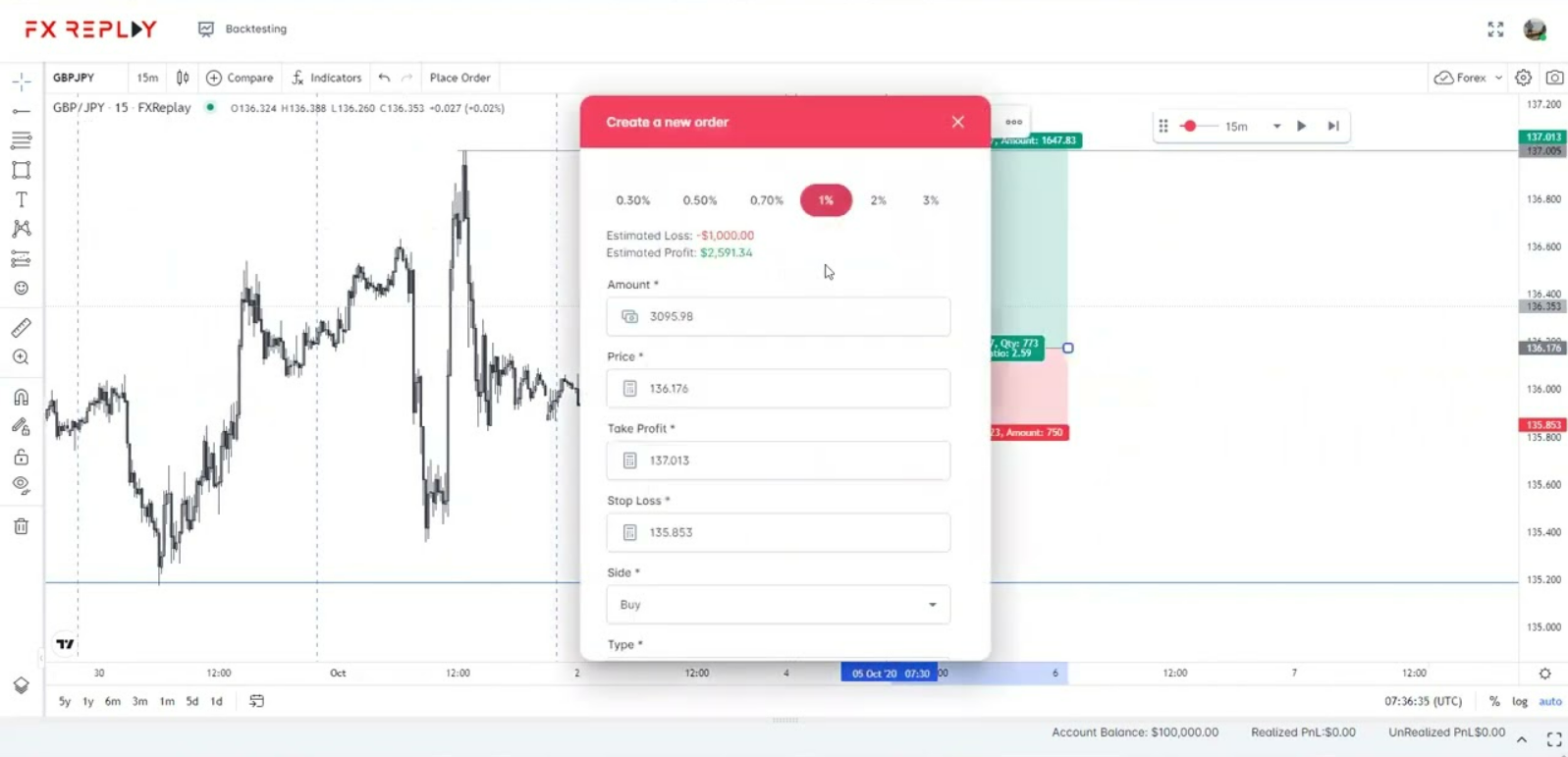

3. FXReplay

FXReplay is another strong option, designed for traders who want a modern, straightforward platform. It offers a smooth interface and user-friendly navigation, but it doesn’t completely surpass JForex in technical features.

Key Advantages:

- Sleek, modern design similar to TradingView.

- Fast performance, though occasional slowdowns occur with complex setups.

Disadvantages:

- Limited historical data depth (some pairs under 10 years).

- Lacks advanced automation and customization found in competitors.

Difference: FXReplay is faster and more intuitive than JForex web, but falls short for advanced traders seeking deeper historical data and more sophisticated backtesting tools. It’s suitable for those who prefer a quick and visually appealing trading experience but need less technical complexity.

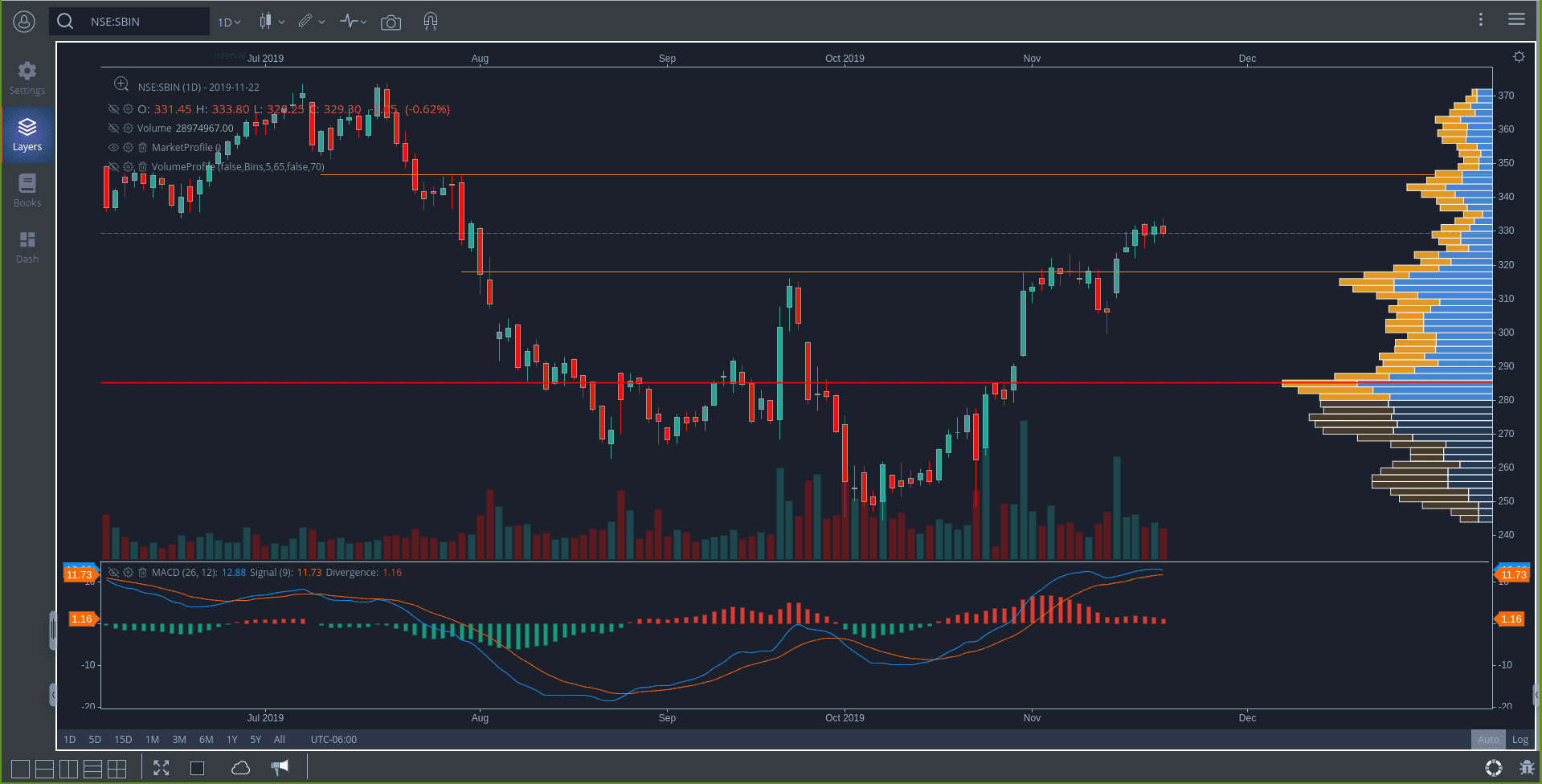

4. Gocharting

Gocharting is a web-based platform often considered a JForex alternative for those focused on chart analysis. It offers various chart types, including volume-based charts, and supports advanced tools like market profiles, which are useful for traders relying on visual data analysis.

Key Advantages:

- Fully browser-based, so no downloads or installations are needed.

- Supports a variety of chart types and visual trading tools, such as market profiles and heat maps.

- Easy access to global markets, including Forex, stocks, and commodities.

Disadvantages:

- Limited historical data compared to JForex backtesting capabilities.

- Some users report that it lacks advanced customization for indicators and drawing tools.

- Can experience slow loading times when multiple charts are open.

Difference: Gocharting works well for traders who want quick, browser-based access to visual tools, but it falls short when it comes to data depth and advanced strategy testing, where JForex might still have the upper hand.

5. Stockcharts

Stockcharts is another option for those seeking JForex alternatives, especially if they prefer a focus on technical analysis rather than full trading automation. It’s a simpler platform aimed at those who need efficient chart analysis without complicated setups.

Key Advantages:

- Simple, clean interface that’s easy for beginners.

- Extensive selection of technical indicators, such as moving averages, RSI, and MACD, making it suitable for basic strategy development.

- Offers historical data for various assets like stocks and commodities.

Disadvantages:

- Limited support for Forex and cryptocurrency backtesting, making it less versatile than JForex backtest options.

- No support for automated trading or advanced strategy customization.

Lacks mobile app functionality, making it less flexible for on-the-go traders.

Difference: Stockcharts is good for basic chart analysis, especially for those trading stocks or simple assets. However, it doesn’t match the depth or flexibility of Dukascopy JForex, particularly for Forex or automated trading setups. It’s a straightforward tool but isn’t ideal for professional or advanced backtesting.

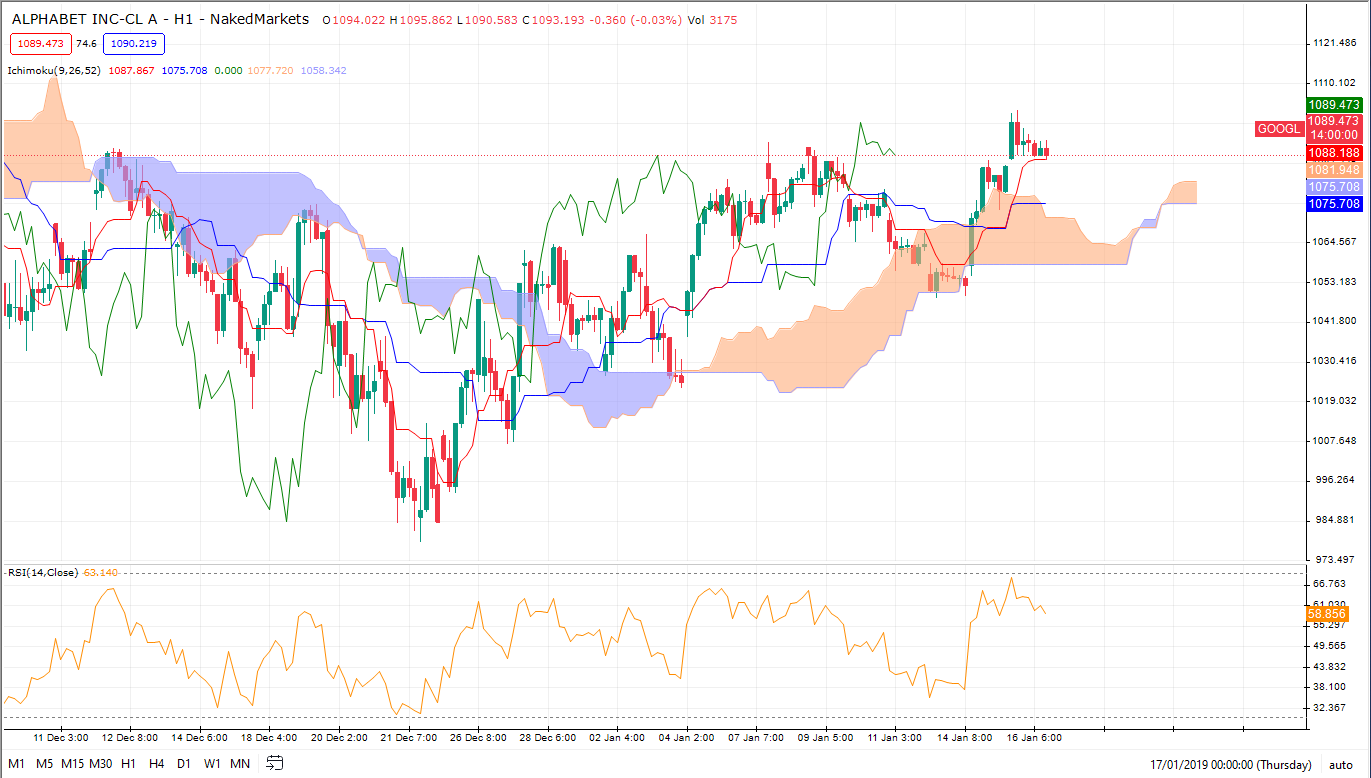

6. NakedMarkets

NakedMarkets is a streamlined trading platform that focuses on simplicity and efficiency, making it an interesting JForex alternative for traders who prefer a minimalistic approach. It supports various asset classes, including Forex, stocks, and cryptocurrencies, and provides tools that are straightforward but effective.

Key Advantages:

- Clean, uncluttered interface with a focus on speed and ease of use.

- Offers multi-timeframe analysis and supports basic drawing tools, making it good for quick visual assessments.

- Allows for price action trading, which appeals to traders who want to avoid indicator-heavy setups.

Disadvantages:

- Limited support for advanced indicators and automated strategy testing, making it less suitable for those looking for a comprehensive JForex backtest solution.

- Historical data availability is not as extensive, with fewer years of data compared to Dukascopy JForex.

- Lack of mobile app and browser-based access restricts usage flexibility.

Difference: NakedMarkets is ideal for traders who want a simple, fast tool for manual trading and visual analysis. However, it doesn’t compete with JForex 4 in terms of backtesting capabilities, automated trading options, or data depth, making it a better fit for traders who prefer manual strategies and minimal tools.

7. Soft4FX

Soft4FX is a popular option among manual traders looking for an effective JForex backtesting alternative. This software is designed for Forex traders who want to simulate trades using MetaTrader data and practice their strategies without a live account.

Key Advantages:

- Integrates well with MetaTrader platforms, making it convenient for users familiar with MT4 and MT5.

- Provides extensive historical data, allowing traders to test strategies across different market conditions and timeframes.

- Supports custom indicators and allows users to import external data, which adds flexibility for personalized testing setups.

Disadvantages:

- Doesn’t offer full automation for strategies, so it’s not suitable for traders looking for advanced algorithmic testing like in JForex API documentation.

The platform requires a one-time license fee, which may not be as flexible as the subscription models offered by other JForex alternatives. - Lacks real-time data integration, making it purely a backtesting tool rather than a full trading solution.

Difference: Soft4FX is strong for manual backtesting, especially for those already using MetaTrader. While it matches JForex download in terms of historical data support, it doesn’t offer the same automated capabilities or advanced customization options. It’s a practical choice for manual traders but lacks the comprehensive tools that JForex web provides for automation and strategy development.

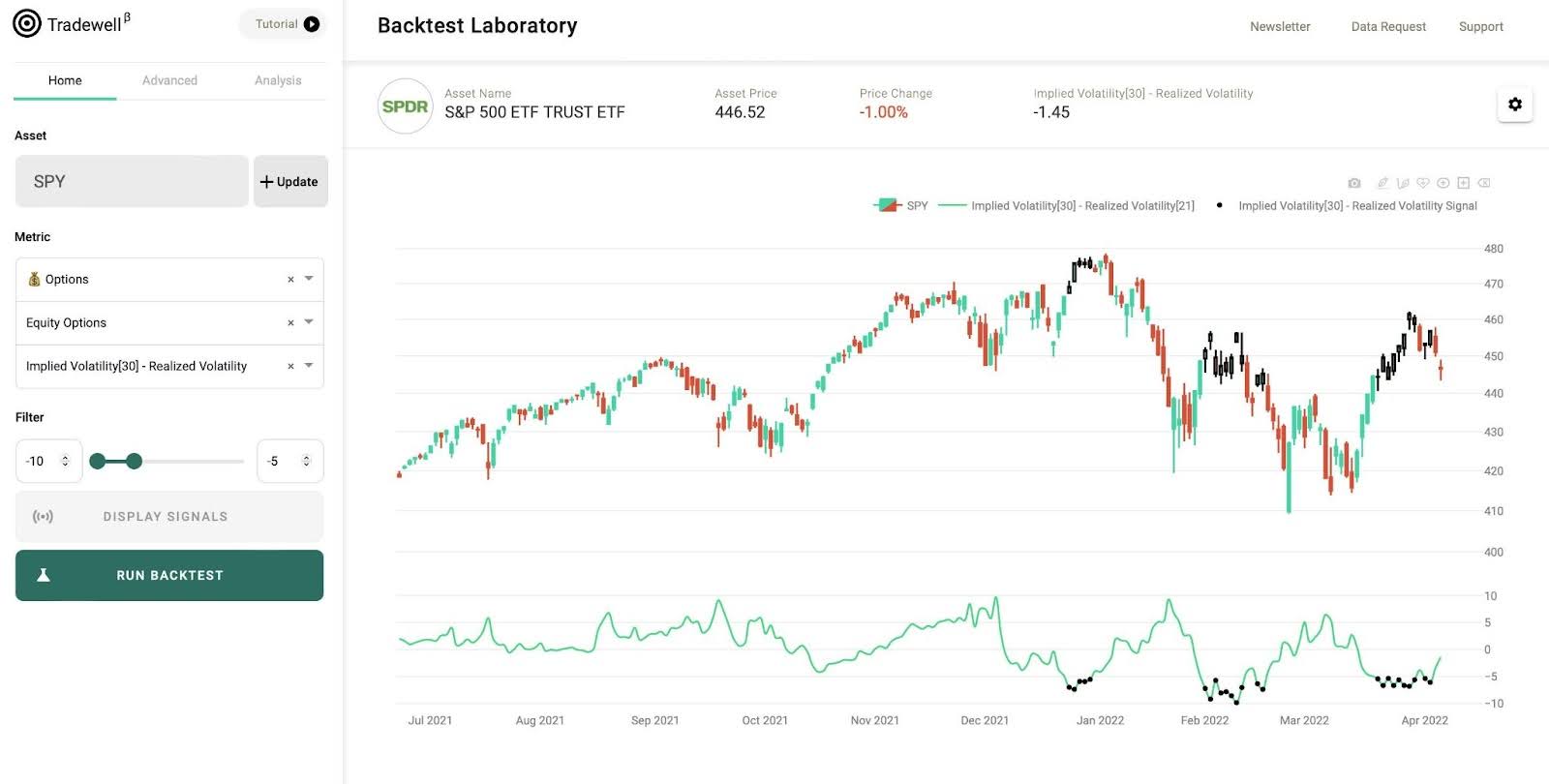

8. Tradewell.app

Tradewell.app is a newer entrant in the backtesting space, positioned as a simple and intuitive JForex alternative. It’s designed for traders who want to test their strategies quickly without dealing with complex setups. The platform provides a lightweight and browser-based solution, allowing users to simulate trading environments efficiently.

Key Advantages:

- Fully browser-based, requiring no downloads, which makes it accessible on any device with internet access.

- Offers a straightforward interface with essential indicators and tools for basic backtesting, making it user-friendly for beginners.

- Provides a range of Forex, crypto, and stock market assets, giving traders flexibility in what they choose to test.

Disadvantages:

- Limited in customization options and doesn’t support automated trading or advanced strategy testing, unlike JForex API documentation, which offers more technical depth.

- Lacks the historical data range that other platforms provide; users may find fewer years available for backtesting compared to JForex 4.

- No mobile app, restricting its usage primarily to desktops and laptops.

Difference: Tradewell.app is suitable for those looking for a quick and basic backtesting tool. It is more convenient than JForex web for simple testing but doesn’t match the depth and technical capabilities offered by Dukascopy JForex, particularly for advanced users needing automation or deep historical analysis.

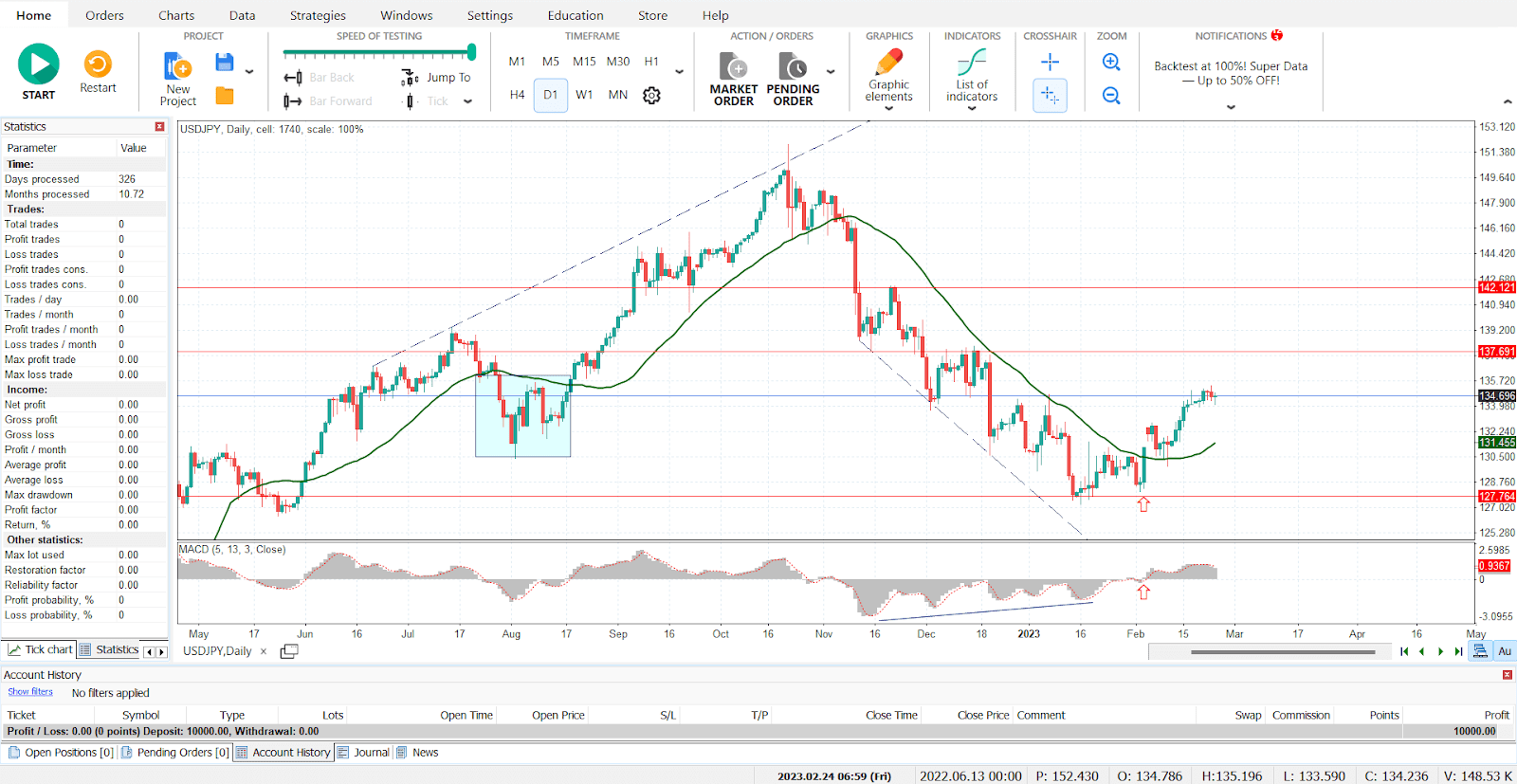

9. Forex Tester

Forex Tester is a well-established tool in the industry, specifically created for Forex backtesting. It’s often seen as one of the best JForex alternatives due to its realistic simulation of market conditions and extensive data offerings. This platform is built for traders who want a comprehensive, risk-free environment to practice and refine their trading strategies.

Key Advantages:

- Realistic market simulation. Offers a close replication of live trading conditions, allowing users to trade as if they were in the real market. This makes it effective for testing strategies under realistic scenarios.

- Extensive historical data. Provides over 20 years of high-quality Forex data, enabling traders to thoroughly backtest and optimize their strategies over different market cycles.

- Advanced features. Includes various technical indicators, drawing tools, and supports multi-currency pair testing, making it a versatile and comprehensive platform.

- User-friendly interface. Designed to be intuitive, making it accessible for both beginners and seasoned traders who want a professional JForex backtest experience without the complications.

Disadvantages:

- Doesn’t support other asset classes beyond Forex as extensively as JForex, which offers broader markets including CFDs and cryptocurrencies.

- Some users have reported technical issues, such as occasional challenges with margin and stop-loss settings. However, the support team is known for being responsive and quick to assist.

Difference: Forex Tester provides a more immersive and realistic trading environment than JForex download options, particularly for Forex traders. It’s a strong tool for those focusing on Forex alone, offering a deeper and more specialized approach.

Conclusion

In conclusion, the best JForex alternatives depend on your trading style. Forex Tester Online stands out for its fast, browser-based interface and comprehensive historical data, making it ideal for quick and realistic backtesting. TradingView is perfect for traders who prioritize flexible charting and a wide range of indicators, offering a user-friendly experience with community support.

Finally, Soft4FX is a strong option for MetaTrader users who want a reliable manual backtesting tool with integration and data customization options.

Forex Tester Online

Best JForex alternative for backtesting

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska