MetaStock is known for its detailed charting, strong backtesting tools, and wide data coverage. It’s been a popular choice for traders who focus on technical analysis. However, it’s expensive, a bit complex for beginners, and mostly built for Windows users. Plus, you need to pay extra for quality data feeds.

So, if you’re looking for a MetaStock alternative that’s simpler, more flexible, or better priced, we tested and selected the best options for you.

MetaStock Overview

MetaStock is a well-known trading platform built mainly for technical analysis, charting, screening, and backtesting. It offers over 300 types of charts and indicators, advanced scanning tools, and strong historical data from Refinitiv. Traders can backtest strategies on stocks, Forex, commodities, and futures using powerful system testing tools. The platform also has a unique “Forecaster” tool to predict price movements based on past patterns.

However, despite its powerful features, many traders eventually look for a MetaStock alternative. First, MetaStock is expensive — you need to pay separately for the platform and for the data feeds, which can easily add up to hundreds of dollars monthly. Second, it works best on Windows PCs, meaning Mac users often struggle with compatibility unless they install extra software like Boot Camp.

Another common complaint is that MetaStock feels outdated. The interface looks old-fashioned, and while it’s very detailed, it’s not very beginner-friendly. You need time and patience to understand all its functions. Also, there is no direct broker integration, which means you cannot place trades directly from the platform — you have to switch between MetaStock and your broker’s platform manually.

Because of the high costs, complexity, and missing broker connection, many traders — especially newer ones — search for simpler, more affordable, and more practical replacements to MetaStock. And here we are to help you find it.

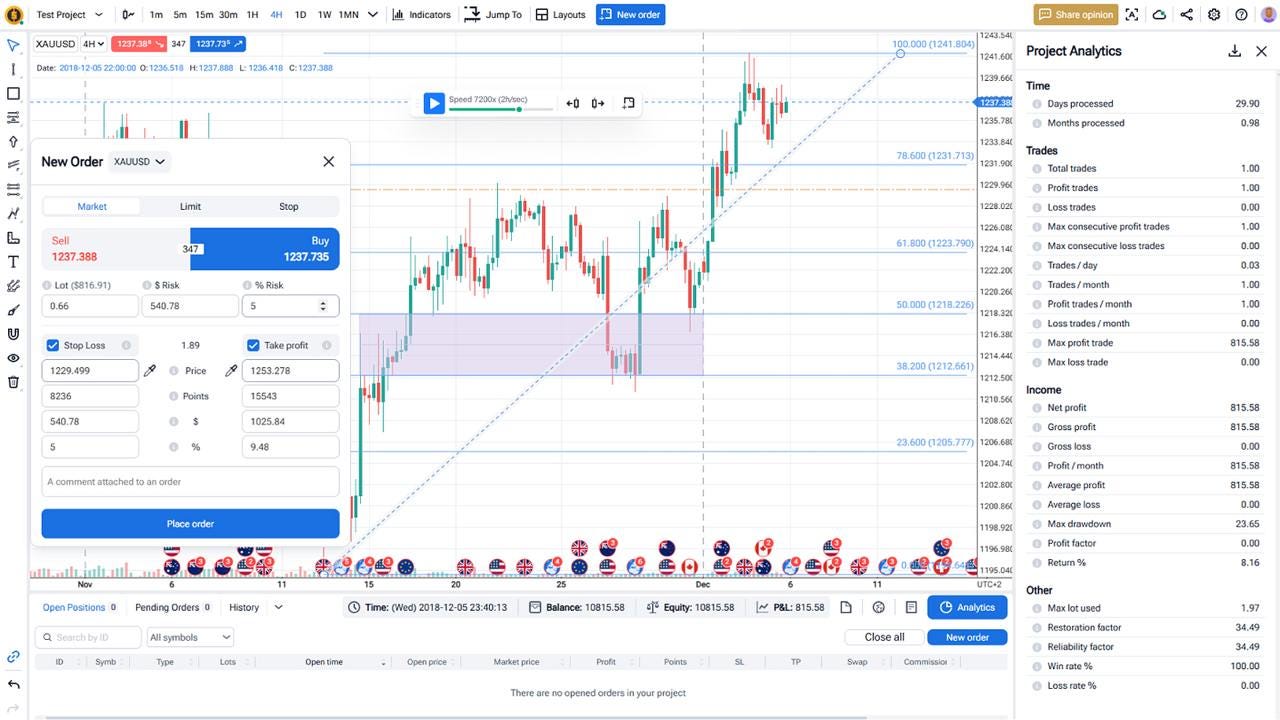

1 MetaStock vs Forex Tester Online (FTO)

When comparing MetaStock and Forex Tester Online, the biggest difference is how traders interact with each platform. MetaStock is highly detailed but can be overwhelming, especially for traders who want fast and simple backtesting. In contrast, FTO is built for traders who prefer hands-on, real-time strategy testing without needing complex setup or coding knowledge.

Here’s a closer look:

- Ease of Use. Forex Tester Online is much easier to use. You can start testing strategies within minutes. MetaStock, however, requires a long learning curve, and many beginners find it confusing at first.

- Backtesting Style. With Forex Tester Online, you manually simulate trades over historical data. This helps you truly practice decision-making as if you were trading live. MetaStock’s backtesting is automated but less interactive, mostly suited for coding and system testing.

- Historical Data. FTO offers 21+ years of tick-by-tick historical data for Forex, and also includes commodities, indexes, and futures. MetaStock provides broad historical data too, but you have to pay extra for different asset classes.

- Market Replay. Forex Tester Online includes a built-in market replay feature. You can replay any date and practice trading as if it were live. MetaStock doesn’t offer real-time replay in the same smooth, trader-focused way. It also has other advanced features such as Mystery Mode, custom indicators, “Jump to”, etc.

- Platforms Supported. FTO works through a browser, making it accessible on Mac, Windows, Linux, and even mobile devices. MetaStock officially supports only Windows, making it difficult for Mac users without using special software.

- Trading Integration. Forex Tester Online focuses fully on backtesting and simulation. It’s not for live trading. Well, MetaStock also doesn’t connect directly to brokers, meaning you can’t place trades directly through it either.

- Price and Flexibility. FTO offers a much lower cost. You can try Forex Tester Online for free, or subscribe for lifetime access. MetaStock’s full setup, including data, easily costs several hundred dollars every month.

In short:

If you want a fast, user-friendly tool to practice and improve your strategies on real historical data, Forex Tester Online is a strong replacement for MetaStock. It removes the need for complicated setups and high monthly costs, making it an ideal choice for Forex, stocks, futures, crypto, and commodities traders who want simplicity and power combined.

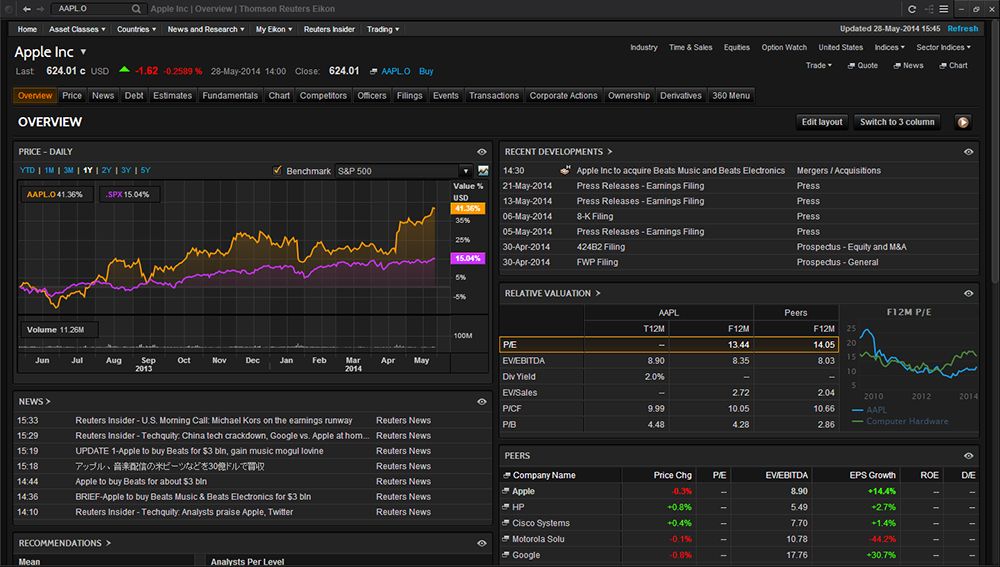

2 MetaStock vs TradingView

MetaStock and TradingView are two very different types of trading platforms. MetaStock is an old-school, Windows-based platform known for its deep technical analysis features. TradingView is a web-based, user-friendly tool that focuses on charting, social trading, and ease of use.

Here’s how they compare:

- Accessibility. TradingView runs directly in your browser. It works perfectly on Windows, Mac, Linux, and mobile devices. MetaStock, on the other hand, is tied to Windows and needs installation. Mac users must use workarounds like Boot Camp.

- Ease of Use. TradingView is much easier to start with. You can open an account and plot your first chart within minutes. MetaStock requires setup, configuration, and a lot of learning to get basic things done.

- Backtesting. MetaStock offers very strong system testing with deep optimization options. TradingView allows backtesting too, but it’s simpler and better suited for quick strategy checks. Serious quantitative traders might still prefer MetaStock’s heavy tools.

- Market Coverage. Both platforms offer different types of assets. However, TradingView integrates data feeds directly, often with less additional cost. In MetaStock, every extra data package costs extra.

- Community. TradingView is famous for its large social community where traders share ideas, scripts, and analysis. MetaStock doesn’t have built-in social features.

- Price. TradingView offers a free plan and several affordable subscriptions. MetaStock subscriptions can become expensive very fast, especially if you need live data.

In short:

If you prefer easy setup, social interaction, and good-looking charts, TradingView is a strong MetaStock alternative. However, for traders needing deep system testing and traditional technical analysis tools, MetaStock is still a good — though more complex — option.

3 AmiBroker vs MetaStock

AmiBroker and MetaStock are both serious tools for technical analysis and backtesting, but they serve a slightly different type of user.

Here’s the comparison:

- Setup. Both AmiBroker and MetaStock are Windows-based. But AmiBroker is lighter, faster to install, and runs more smoothly on older hardware compared to the heavier MetaStock.

- Customization. AmiBroker offers deep customization with its own coding language (AFL). You can create very complex systems if you are ready to learn a bit of scripting. MetaStock also allows custom indicators and systems, but it is more rigid and less flexible than AmiBroker.

- Backtesting. Both are strong, but AmiBroker is lightning fast. You can backtest thousands of stocks or strategies in minutes. MetaStock is slower and more resource-hungry for large simulations.

- User Experience. AmiBroker can be hard to learn if you don’t know coding, but once you do, it’s extremely powerful. MetaStock has a more traditional interface with lots of menu options, but can feel outdated and clunky.

- Cost. AmiBroker is much cheaper in the long run. You pay a one-time fee. MetaStock requires ongoing subscriptions, especially if you want to access real-time data.

In short:

AmiBroker is a better MetaStock alternative for tech-savvy traders who want fast, flexible backtesting. But if you want a complete “out-of-the-box” charting solution without coding, MetaStock still holds value — at a higher cost.

4 MetaStock vs MetaTrader

MetaStock and MetaTrader are two very different platforms, built for different audiences.

Here’s the comparison:

- Purpose. MetaStock is focused on deep technical analysis, backtesting, and forecasting. MetaTrader (mostly MT4 and MT5) is designed primarily for Forex and CFD trading, with real-time execution.

- Backtesting. MetaTrader has basic built-in backtesting for Forex strategies but it’s limited compared to the advanced system testing in MetaStock. MetaStock offers detailed, multi-asset historical testing with flexible custom settings.

- Charting and Analysis. MetaStock offers much more powerful charting and hundreds of built-in studies. MetaTrader charts are functional but more basic, especially for non-Forex assets.

- Data Access. MetaStock uses Refinitiv, one of the best data providers, but you have to pay extra. MetaTrader’s data depends on your broker — sometimes it’s good, sometimes not.

- Ease of Use. MetaTrader is much easier for beginners. MetaStock has a steeper learning curve and feels more like professional software.

In short:

If you mainly trade Forex and want fast, free charts, MetaTrader is enough. But if you need serious technical analysis across stocks, futures, or commodities, and don’t mind the extra cost and complexity, MetaStock is stronger.

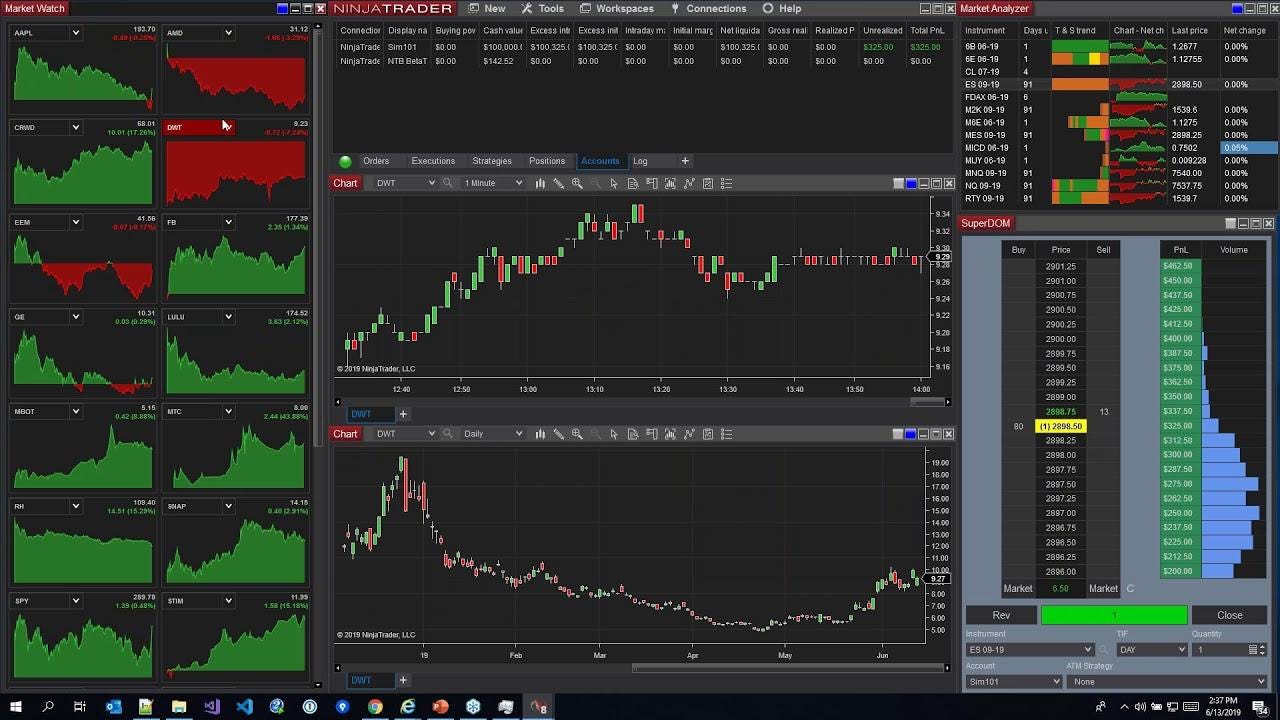

5 NinjaTrader vs MetaStock

NinjaTrader and MetaStock both serve active traders but offer very different experiences.

Here’s the comparison:

- Market Focus. MetaStock is built for stocks, commodities, futures, and Forex. NinjaTrader is mainly focused on futures and Forex trading, especially for active day traders.

- Backtesting. Both offer strong backtesting tools. NinjaTrader’s Strategy Analyzer is very detailed for futures and intraday testing. MetaStock shines in multi-asset historical testing and forecasting across different markets.

- Charting and Analysis. MetaStock delivers cleaner and more advanced chart setups for technical analysis. NinjaTrader’s charting is powerful too but requires more customization and plug-ins to match MetaStock’s depth.

- Costs. NinjaTrader’s basic version is free for charting and simulation. To unlock full features, including automated trading and better backtesting, you need a paid license. MetaStock always requires a paid subscription, plus separate data feeds.

- Ease of Use. Both platforms have a learning curve, but many users find NinjaTrader slightly easier for fast setup and futures trading. MetaStock is heavier and better suited for detailed, slower research work.

In short:

NinjaTrader is better if you want a cost-effective tool for futures and active day trading. MetaStock is a stronger pick for those needing in-depth technical analysis across global markets.

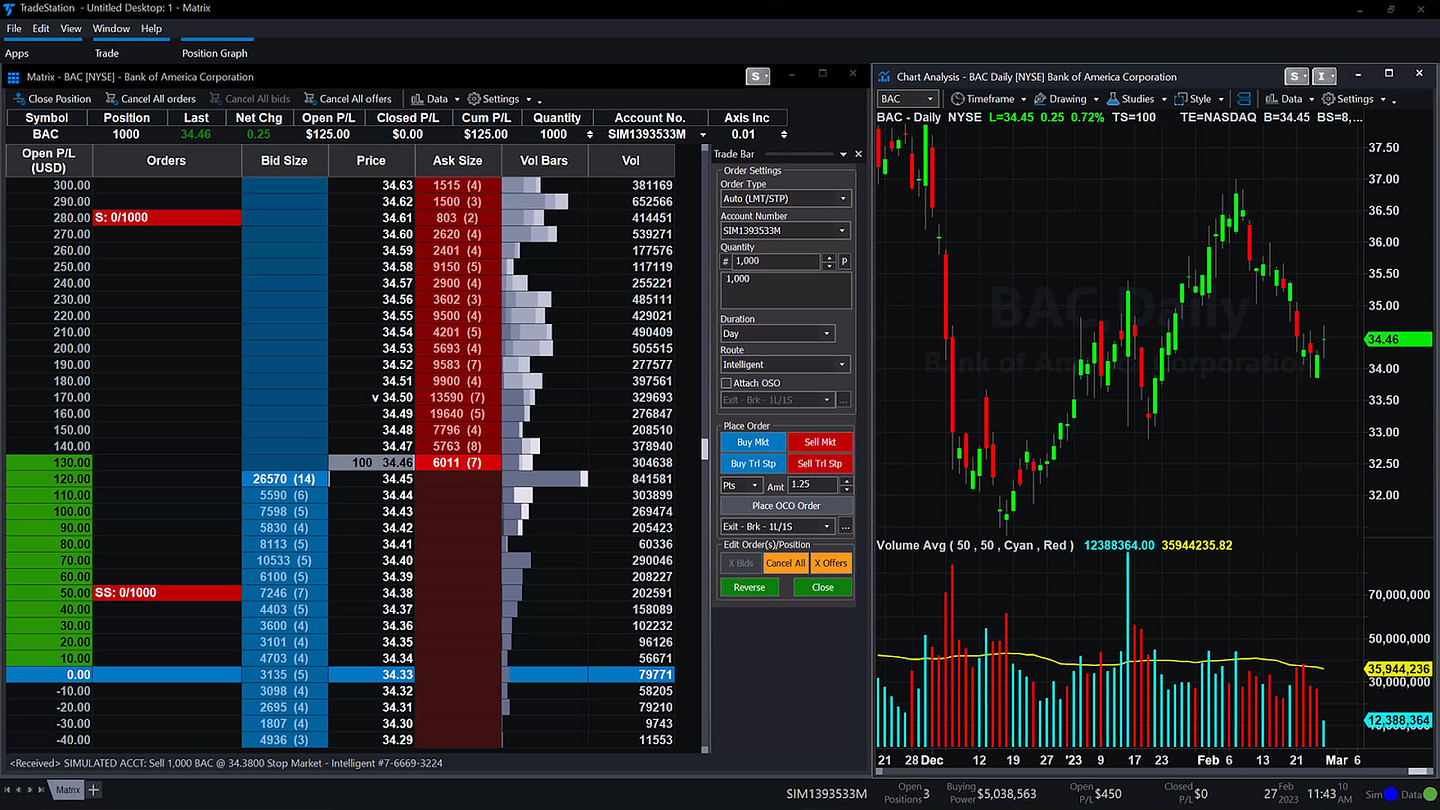

6 MetaStock vs TradeStation

MetaStock and TradeStation are both popular platforms, but they serve slightly different types of traders.

Here’s a quick breakdown:

- Market Focus. MetaStock supports all types of assets through external brokers. TradeStation is a full trading platform and a broker, mainly strong in US stocks, futures, options, and crypto.

- Backtesting. Both have excellent backtesting. MetaStock uses its System Tester, ideal for detailed technical system testing. TradeStation’s EasyLanguage scripting and portfolio backtesting make it one of the best choices for strategy automation.

- Charting and Analysis. MetaStock offers powerful, customizable technical charts and analysis tools with over 300+ indicators. TradeStation also offers strong charting but puts more focus on real-time market access and integrated live trading.

- Costs. TradeStation can be cheaper since its platform fees are often waived if you meet minimum balance or trading activity requirements. MetaStock requires ongoing subscription fees plus data packages.

- Ease of Use. TradeStation feels more modern and integrated, especially for US traders. MetaStock is a little outdated in design and feels heavier, especially for those who want fast execution.

In short:

TradeStation is a great MetaStock alternative if you want everything (analysis, trading, broker access) in one platform. MetaStock is better if you prioritize technical analysis and system testing across multiple global markets.

Conclusion

MetaStock is still a strong platform for technical analysis and system backtesting, especially for traders who need powerful forecasting tools and access to global markets. However, it’s expensive, Windows-only, and a bit outdated compared to newer solutions.

If you are looking for a MetaStock alternative that is simpler, faster to set up, and much more affordable, Forex Tester Online is the best choice. It is perfect for traders who want manual backtesting, realistic simulation, and clear results without complicated setups.

- TradingView is a good pick for those who want a flexible cloud-based platform with a huge community and quick chart access.

- AmiBroker is ideal for traders who like coding their own systems with a focus on speed and detailed analysis.

- MetaTrader is more for Forex and CFD traders who want free backtesting and simple automation.

- NinjaTrader is a good solution if you are focused on futures and need solid live trading tools.

- TradeStation is a strong replacement if you prefer an all-in-one broker and trading platform, especially for US stocks and futures.

Each option offers something different. But if ease of use, manual backtesting, and real trading practice are your goals, FTO stands out as the most practical option in 2025.

FAQ

What is MetaStock used for?

MetaStock is mainly used for technical analysis, charting, scanning stocks, and strategy backtesting. Traders use it to analyze market trends, test strategies with historical data, and make more informed trading decisions.

What is the difference between MetaStock and TradingView?

MetaStock is a downloadable desktop platform focused on detailed analysis and system testing, while TradingView is cloud-based, faster to access, and built around a large social trading community. MetaStock has deeper tools for professionals, but TradingView is easier and more flexible for most users.

How does MetaStock work?

MetaStock connects to Refinitiv’s global data feed and offers end-of-day or real-time data. Users can backtest strategies, analyze charts, scan for setups, and even forecast future price movements using its built-in Forecaster tool.

Is MetaStock good for Forex, crypto, and commodities analysis?

Yes, MetaStock supports a wide range of assets (including commodities). However, alternatives offer easier access and lower costs for testing and trading across these asset classes.

Which MetaStock alternative offers the best price/performance?

For traders looking for a cost-effective solution that doesn’t sacrifice features, Forex Tester Online offers the best price-to-performance ratio. It allows realistic manual backtesting, deep historical simulation, and does not require expensive data subscriptions.

Try our best MetaStock Alternative

Try our best MetaStock Alternative

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska