Momentum indicators help traders measure how fast price moves and in which direction. They’re one of the most useful technical tools for spotting trends early, confirming strength, and deciding when to enter or exit a trade.

Used by both retail and institutional traders, these indicators are part of most modern trading platforms. Why? Because the price momentum indicator often signals the start – or end – of a move.

In this guide, we’ll explain what momentum indicators are, how they work, and show you the most popular ones (like RSI and MACD). You’ll learn how to use them in different market conditions and how to backtest them for better accuracy.

👉 And at the end, we’ll show you a simple way to test any momentum indicator risk-free before using it live.

What Is a Momentum Indicator?

A momentum indicator is a technical tool that shows the speed of price movement over time. It helps you understand whether a trend is getting stronger or weaker. Momentum indicators don’t show trend direction directly – they show how quickly the price is changing.

In technical analysis, momentum often leads price. That’s why traders use momentum indicators to spot early signals of a trend starting or ending. These tools are based on recent price movements, and they work well in both trending and ranging markets.

List of Momentum Indicators

Below are some of the most popular momentum technical indicators used by traders. Each one helps you see different aspects of price behavior – like strength, speed, or potential reversal points.

Relative Strength Index (RSI)

RSI measures how strong recent price moves are. It compares average gains to losses over a period – usually 14 days.

- Signals: RSI above 70 is considered overbought. Below 30 is oversold. These can signal a market trend conditions reversal or a pullback.

- Why it’s useful: RSI is simple and effective. It shows if the market is stretched too far in one direction.

- Pros: works well for spotting reversals and confirming trends.

- Cons: can give false signals in strong trends.

📌 Learn more:

- RSI vs MACD

- Market and RSI

- RSI + Awesome Oscillator Strategy

- RSI + Ichimoku on GBPJPY

- RSI with 2 Moving Averages

- EMA + RSI Strategy

- RSI, Bollinger Bands & Stochastic

Moving Average Convergence Divergence (MACD)

MACD shows momentum and trend direction. It tracks the difference between two moving averages (usually 12- and 26-period EMAs).

- Signals: the MACD line crossing the signal line can show a change in momentum. Histogram bars show the strength of that move.

- Why it’s useful: it combines momentum and trend signals in one tool.

- Pros: good for spotting shifts early. Simple to read.

- Cons: can lag during choppy markets.

📌 Learn more:

Momentum Oscillator (MOM)

The Momentum Indicator (MOM), also known as Momentum Oscillator measures how much price has changed over a given time.

- Signals: when momentum rises, it means the trend has energy. If momentum slows while price still rises, a reversal could be near.

- Why it’s useful: simple way to confirm price direction and strength.

- Pros: quick to react. Good for short-term setups.

- Cons: no overbought/oversold levels.

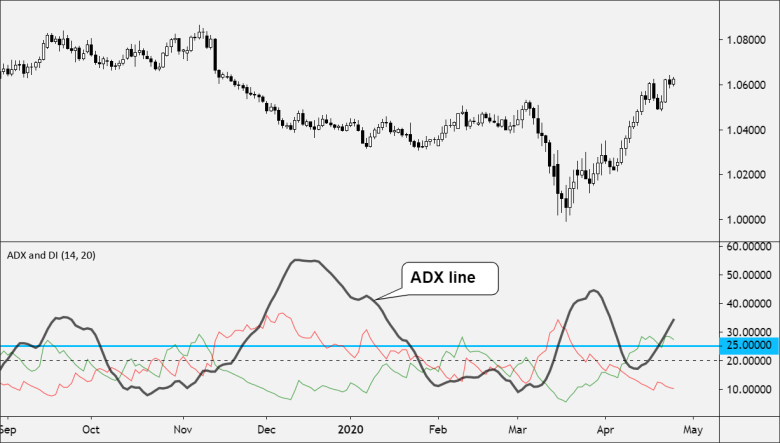

Average Directional Index (ADX)

ADX doesn’t show trend direction. Only how strong the trend is.

- Signals: ADX above 20 or 25 usually means a trend is forming. Below 20 signals a weak or sideways market.

- Why it’s useful: helps you avoid trading in weak markets.

- Pros: great filter for trend-based strategies.

- Cons: doesn’t tell you if the trend is up or down.

📌 Learn more:

Stochastic Oscillator

Stochastic compares a closing price to the range of prices over a set period, usually 14 days.

- Signals: readings over 80 are overbought, under 20 are oversold.

- Why it’s useful: helps find possible reversals and confirm momentum shifts.

- Pros: good for spotting entry points in range-bound markets.

- Cons: can give many false signals in trending markets.

📌 Learn more:

Next, we’ll look at what to avoid when using these indicators.

What Are the Common Pitfalls When Using Momentum Indicators?

Momentum indicators are powerful, but they’re not perfect. Here are some common mistakes traders make:

- Trusting signals too blindly. Just because an indicator shows overbought or oversold doesn’t mean price will reverse. Trends can keep going.

- Using momentum tools in the wrong market. Some indicators work better in trending markets, others in ranges. Know when and where to use them.

- Ignoring other factors. Price action, volume, and news all matter. Don’t rely on momentum alone to make your trading decisions.

- Overcomplicating things. Using too many indicators at once can cause confusion. Stick with what you understand and test it properly.

Always backtest your setup to see how it works in different market conditions. That’s where tools like Forex Tester Online help a lot.

Backtest Momentum Indicators via FTO

Using momentum indicators without testing them first is risky. What works on one chart might fail on another. That’s why backtesting is so important.

With Forex Tester Online (FTO), you can test your momentum strategies using real historical data. It’s not just charts – it’s a full trading simulator that lets you replay the market as if it were live. You can check how RSI, MACD, or ADX would have worked in different conditions, timeframes, or assets.

✅ Choose any asset – forex, crypto, indices, or stocks.

✅ Use tick or minute-by-minute data going back 21+ years.

✅ Apply momentum indicators directly to your chart.

✅ Practice entries, exits, and risk management.

✅ Get detailed stats on what works and what doesn’t.

This kind of strategy testing helps traders build confidence. Instead of guessing, you base your trades on actual performance.

Want to see how your indicator setup holds up in real market conditions? Try Forex Tester Online now and start backtesting smarter.

Conclusion

Momentum indicators are essential tools for spotting trend strength, timing entries, and managing exits. Whether you’re using RSI for overbought signals, MACD for trend shifts, or ADX to measure strength, these tools can guide better trading decisions. But they’re not magic – they work best when used with a clear plan and confirmed by price action or volume.

Before applying any market momentum indicator in a live account, test your strategy. Use a backtesting tool like Forex Tester Online to see how it performs in different market conditions. That’s how experienced traders gain an edge – not just by knowing the indicators, but by proving what works.

Disclaimer

This article is for educational purposes only. Trading involves risk, and past performance of any indicator or strategy does not guarantee future results. Always do your own research and test any system before using it with real money.

FAQ

What is the best momentum indicator?

There’s no single best Forex momentum indicator – it depends on your trading style. RSI is great for spotting reversals, while MACD works well for trend shifts. Many traders combine two or more indicators for confirmation.

How does the MACD compare to other momentum indicators?

MACD is smoother and slower than something like RSI. It’s better at confirming trends than catching quick reversals. Some traders use MACD with faster tools like Stochastic for better timing.

How does RSI differ from other momentum indicators?

RSI focuses on overbought and oversold zones. It reacts faster than MACD and gives more signals in shorter timeframes. It’s useful for spotting momentum shifts before they fully show in the trend.

What types of assets are traded using momentum indicators?

Momentum indicators work on most assets – stocks, forex, crypto, commodities. They’re popular in swing trading, day trading, and even longer-term strategies when used with other tools.

Backtest Trading Indicators on FTO

Backtest Trading Indicators on FTO

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska