Momentum Oscillator is one of the 10 most popular indicators for Forex and crypto traders. It is definitely not something you can ignore. It has always been regarded as an excellent gauge of the market strength, and its results do not depend on the type of the trading asset. So, let’s see how you can use the Momentum Oscillator indicator in technical analysis.

In the Forex market, the advanced properties of the indicator are somewhat reduced, but the speculators have learned to compensate for this shortcoming with the additional methods. Strategies that use Momentum Oscillator are always relevant.

What Is a Momentum Oscillator?

The traditional Momentum Oscillator determines the pace of the market by comparing the current closing price with the closing price of several periods ago.

Visually, this indicator represents a curve, the fluctuations of which make it possible to predict the moment of a trend reversal.

If the current closing prices are bigger than the previous prices, there is an upward trend. If the current prices are lower than the previous ones for a selected time interval – there is a downward movement.

At the same time, an overbought/oversold status is evaluated when the curve reaches the maximum or minimum values. Reliability of the signals increases significantly when combined with moving averages.

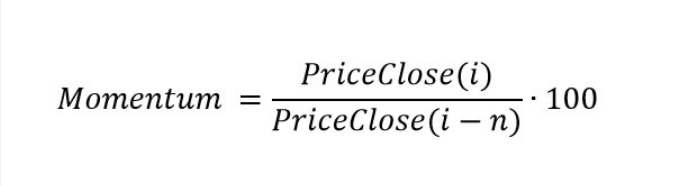

Momentum Oscillator Formula

The value of the MO is defined as

where:

PriceClose (i) is a closing price of the current bar;

PriceClose (i-n) is a closing price n bars ago.

This formula is indicated in J. Murphy’s book “Technical Analysis of the Futures Markets…” and is currently considered «correct», although there is a disagreement regarding the calculation of the Momentum Oscillator formulas in the modern textbooks.

Unfortunately, it was this formula that migrated to many automatic programs of technical analysis, so be careful.

The indicator value fluctuates in the range [0; 100]. Adding a smoothed moving average to the indicator simplifies further interpretation of signals.

Using Momentum Oscillator for Technical Analysis

The standard version of this indicator is included in the package of all popular trading platforms and represents a traditional oscillator line in an additional window under the price chart.

In addition to the color scheme settings, the calculation period and price type are also considered as basic parameters.

For all popular assets, the closing price is recommended. Experiments with other types of prices give stable results on the stock assets or exotic instruments − there is room for curious readers. Also, we recommend you to backtest every trading strategy on a trading simulator.

Standard version of the Momentum Oscillator indicator

You can optimize the indicator’s parameters for your working timeframe by yourself. Recommendations for the calculation period are standard.

Setting a shorter period will make the MO indicator more sensitive, but it will also increase the number of false signals. The increase of the parameter «cuts off» most fluctuations and identifies the main trend line.

Long and short period in the MO indicator

The default value (14) is considered optimal for the periods of at least H1. For the timeframes and for aggressive trading, the parameter can be reduced, then the signals will be more frequent, but less reliable.

For the convenience of analysis, you can use the multi-timeframe Momentum Oscillator, for example, this option:

Multi-timeframe version of Momentum Oscillator

And don’t forget to backtest and verify it on Forex Tester Online.

In the Forex market, using the Momentum Oscillator indicator for small periods is not recommended at all!

Calculation of the Momentum Oscillator indicator is too simple (even primitive), so any speculations reduce the reliability of its signals dramatically. In any case, the parameter should be selected depending on an older timeframe.

For example, if you trade and conduct analysis on the D1 timeframe, then it is recommended to use period 20-21 (1 month = 21 trading day), as it analyzes the trend for a trading month well.

Trade signals of the Momentum Oscillator indicator

First, let’s remember the simplest logic: Momentum Oscillator is positive if the current price is higher, negative if it is lower, and is equal to zero if prices are the same.

The slope of the line connecting the critical points of the indicator shows whether the market’s interest in the current direction is growing or falling.

Related: Best Forex signals providers (and how to verify them)

Momentum as an oscillator

For example, while the Momentum indicator (MOM) continues to show the new max values, positions for purchase will be more secure; we can apply similar arguments to the minimum values of the indicator on the downtrend.

When the prices are rising and the MO indicator stops (or is falling), it warns you that the top is close and it is time to fix positions, or at least move Stop Loss closer to the current price.

The first trading scheme is based on using the Momentum Oscillator as a regular oscillator: a turn from the critical zone and a confident movement of the indicator line.

Learn more: Momentum Indicators Explained: Types, Strategies, and How to Use Them in Trading

A signal to buy occurs if the indicator forms a hollow and begins to grow, while a signal to sell − when it reaches a peak and turns down.

The sequence of the max/min values of the Momentum Oscillator indicator assumes continuation of the current trend. But in any case, you shouldn’t hasten to open or close a position until the price confirms this signal.

It is recommended not to close the position according to the MO signal − it is usually late!

Trading signals of the Momentum Oscillator (MO) indicator

The intersection of the middle line 100 can also be considered a trading signal: purchase − breakdown from bottom up, sale – from top to bottom.

The leading properties of the indicator are based on the fundamental market theory, according to which the market begins to “brake” before the turn and price movements /move in the current direction is slowing down.

It is the Momentum Oscillator that should be the first to see this situation.

Momentum Oscillator as a trend indicator

Most of the time, price moves in synchronism with the MO. Any problems will mean a disruption in the power balance between sellers and buyers.

Classic situations of the indicator’s line divergence with the price direction remain the strongest signal of a reversal.

Trading schemes of divergence and flat for the Momentum Oscillator

Trading Strategies Where You Can Use This Indicator

In fact, this oscillator also allows you to trade from the overbought/oversold levels, but it has no clear boundaries of the critical zones – you will have to determine them by yourself.

Momentum Oscillator and Envelopes or Bollinger Bands Trading Strategies

Sometimes it will be useful to combine the Momentum Oscillator with the Envelopes or Bollinger Bands indicator, then their dynamic lines will determine the levels we need.

Example of using the modified MO indicator

We act in a traditional way with the channel indicators: a signal for purchase appears when the MO values come out of the critical sales area.

A signal for sale is generated similarly: when the indicator leaves the overbought zone.

Example of using the Momentum Oscillator with a channel indicator

You can trade using this scheme only in a wide flat. On a strong trend, this approach will bring many false signals.

Momentum Oscillator and Moving Averages Trading System

The Elder’s Momentum strategy can be a good example of a reliable set with moving averages, as it uses only two indicators and shows stable results on a timeframe from H1 and higher.

Example of using the Momentum Oscillator with MA

Conditions for a purchase signal:

- Price breaks the moving average from bottom up;

- Most of the key bar’s «body» is above the EMA line;

- The Momentum is above level 100.

Conditions for a sale order:

- Price breaks the moving average from top to bottom;

- Most of the key bar’s «body» is below the EMA line;

- The Momentum is below level 100.

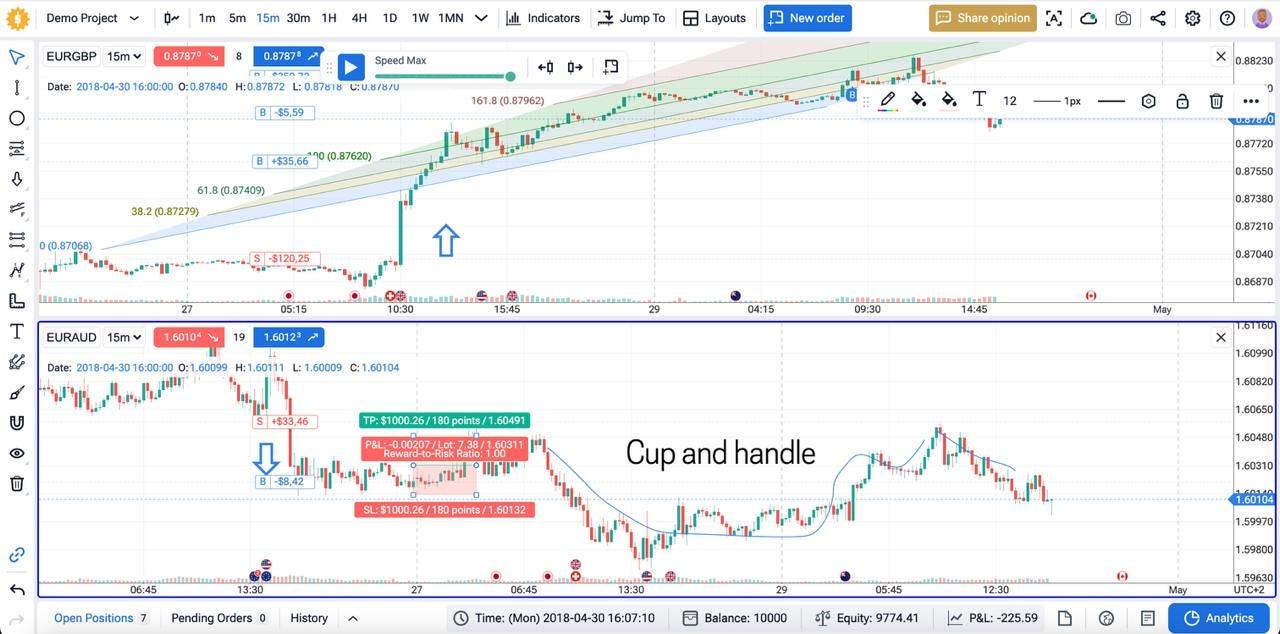

Backtest Indicators on Forex Tester Online

Applying trading strategies without testing them first is risky. What works on one chart might completely fail on another. That’s why backtesting matters.

With Forex Tester Online, you can test your MO-based strategies using real historical data. It’s more than just charts – it’s a full trading simulator where you replay the market as if it were live. You can see how different indicators perform across timeframes, market conditions, and asset classes.

✅ Choose any asset – forex, crypto, indices, or stocks.

✅ Use tick or minute-by-minute data going back 21+ years.

✅ Apply indicators directly to your chart.

✅ Practice entries, exits, and risk management.

✅ Get detailed stats on what works and what doesn’t.

✅ Use advanced tools, such as custom indicators, Mystery Mode, scenarios, and more.

This kind of strategy testing helps traders build confidence. Instead of guessing, you base your trades on actual performance.

Want to see how your indicator setup holds up in real market conditions? Try Forex Tester Online now and improve your trading results

How to Backtest Momentum Oscillator on FTO: Mini-Guide

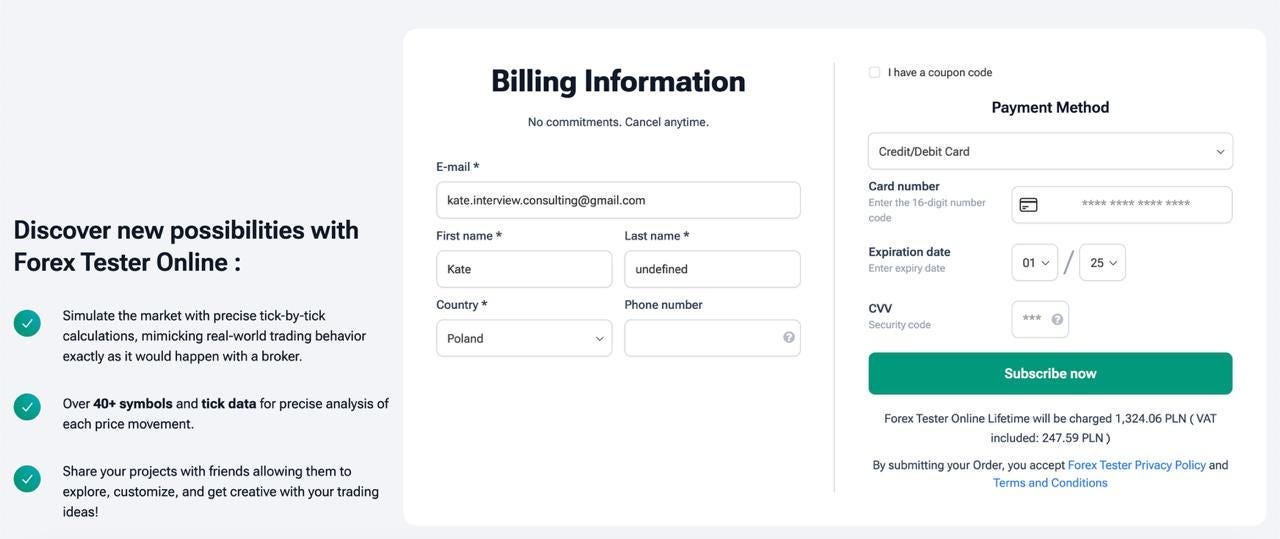

Step 1: Getting Access

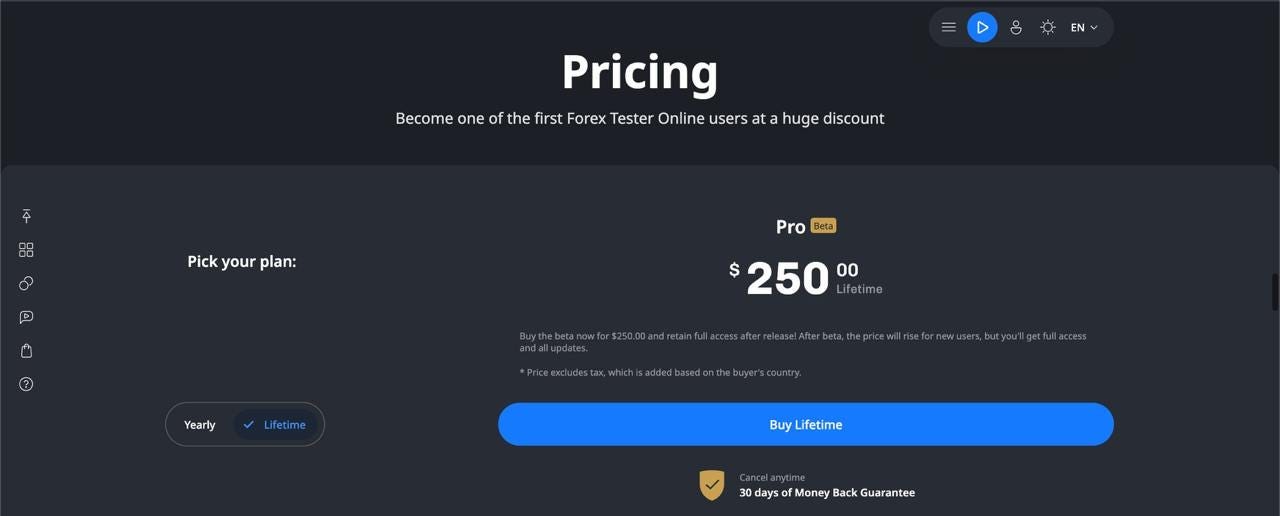

1) Go to the FTO website to see features, currency pairs, and assets. Check user reviews and subscription options.

Click the “Get Started” button to get access to the backtesting tool.

2) Choose a subscription plan (annual or lifetime).

3) Sign Up.

4) Proceed payment to activate your subscription.

Sign in to your FTO account

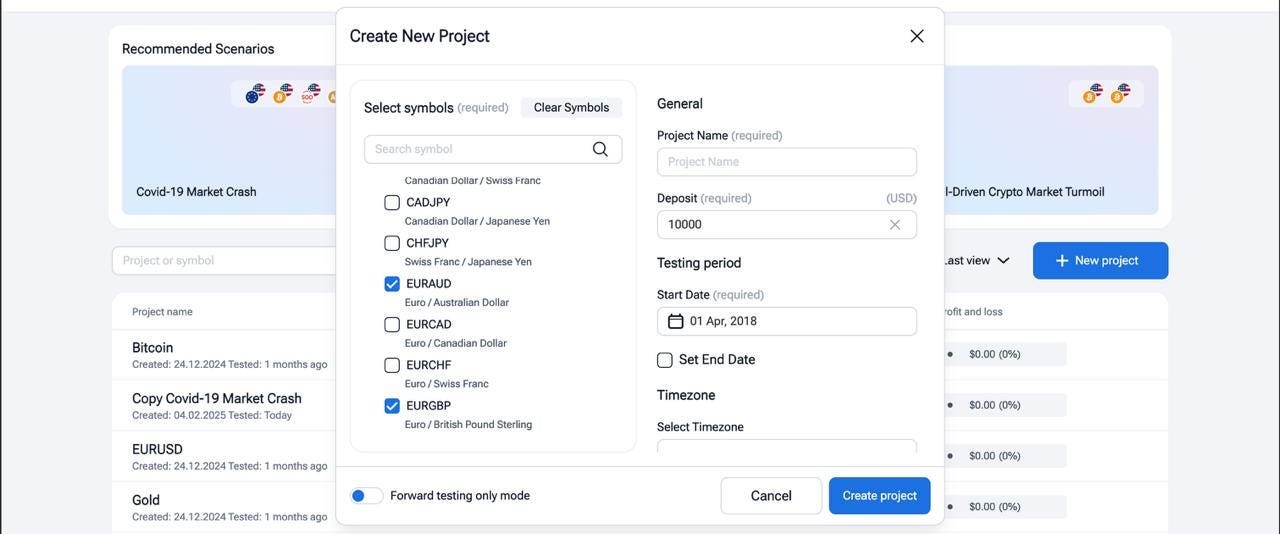

Step 2: Create a Project

After creating an account and getting a subscription, you will see the dashboard screen. To start backtesting the MO indicator, click “+ New Project”.

- Name project

- Select symbols

- Select deposit amount (an amount of virtual money on your initial balance).

- Set testing period

- Select time zone

After creating your project, find it in the list below and click “Play”.

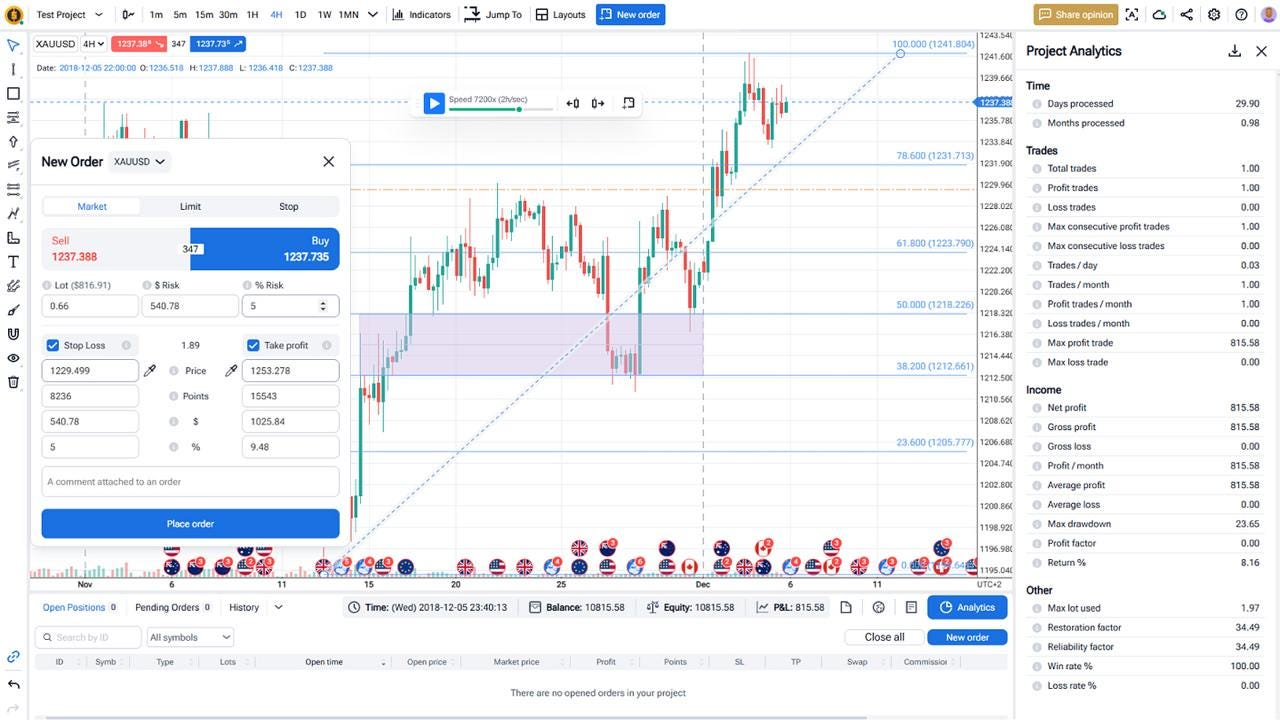

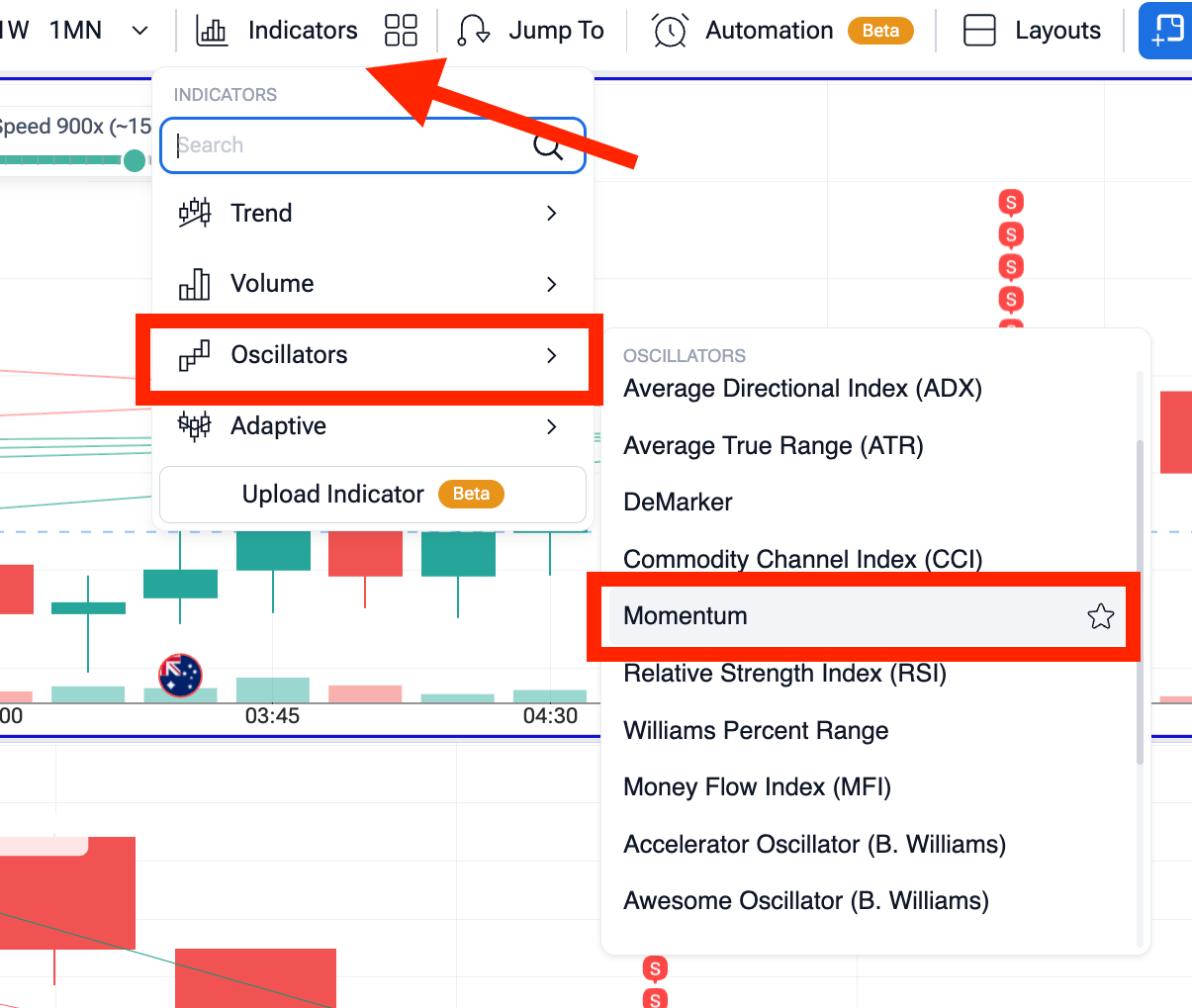

Step 3: Start Backtesting

Use our backtesting features, indicators, graphical tools, and analytic panels to perform proper backtesting.

To add the Momentum Oscillator indicator, find it in the “Indicators” tap on the upper menu. Then, go to “Oscillators”, and select “Momentum”.

You can also add other indicators in the same way.

Watch this video to see how backtesting works on Forex Tester Online:

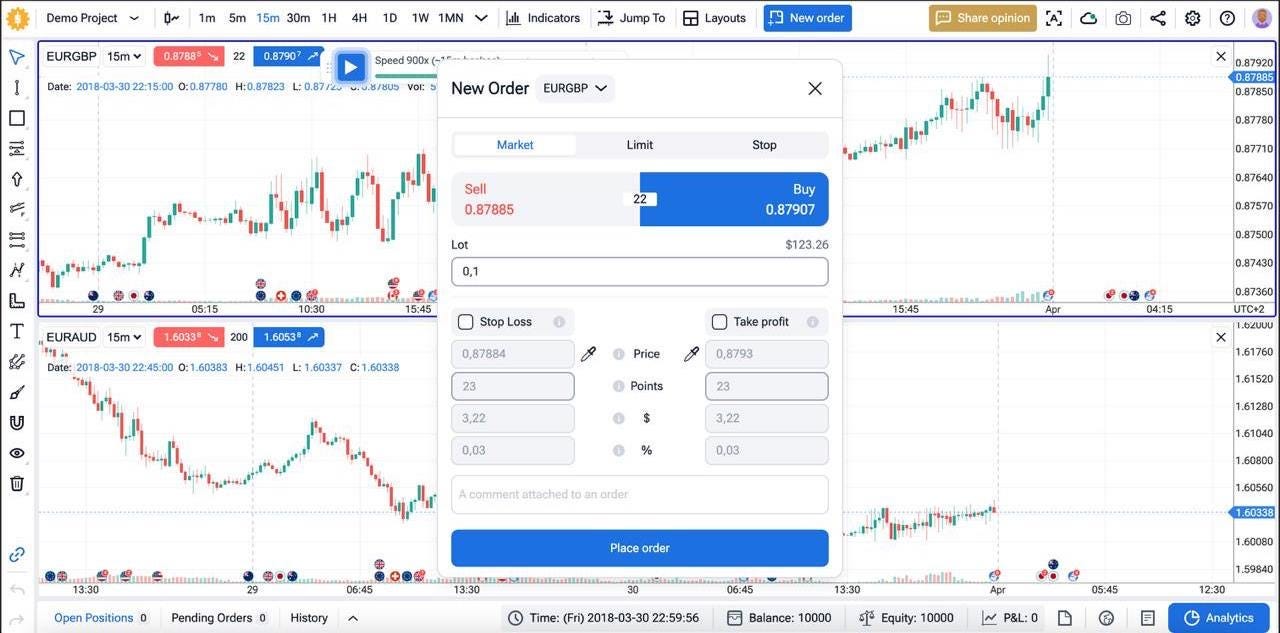

To create a new demo order, click “New Order” on the upper panel and set the order details.

Besides basic features, we also have some advanced tools.

- Use the watchlist, and analytics sections to track events and data.

- Select “Mystery Mode” to test your strategies without seeing symbols and time frames to avoid bias.

- Choose scenarios to stress-test your strategies.

- Integrated news allows you to see how fundamental events affected prices in the past to prepare for similar events in the future.

- Create your own indicators and add them to FTO.

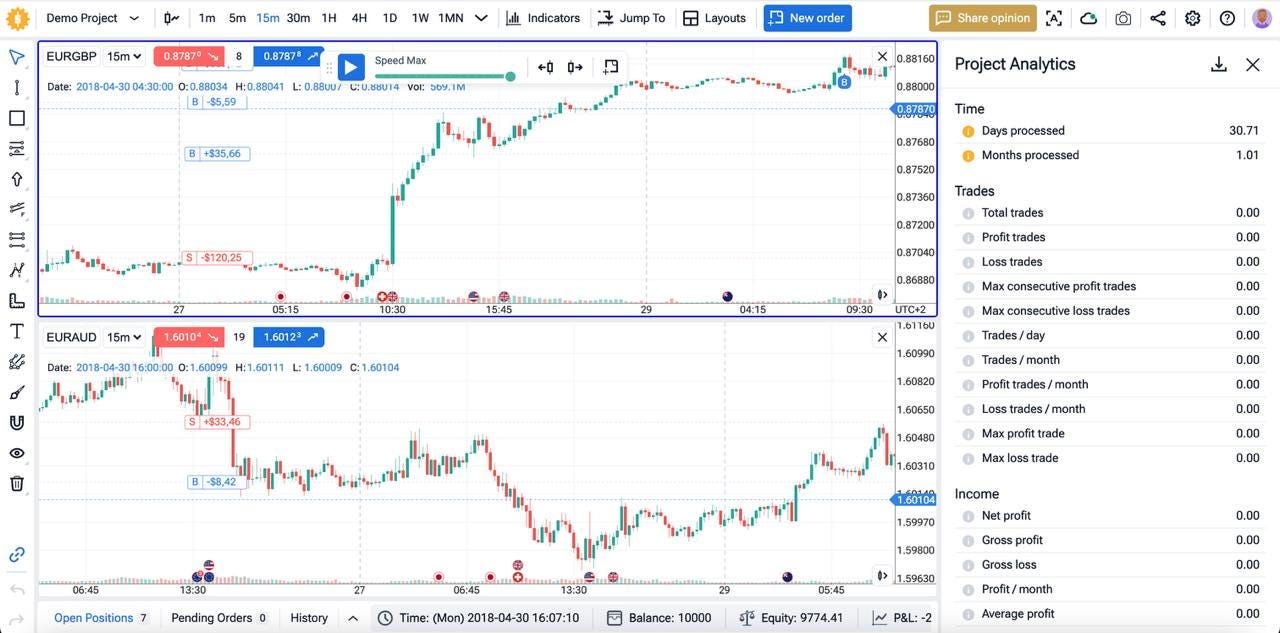

Click “Analytics” in the bottom-left corner to see your performance.

This chart is all yours. Use the full power of the tool to conduct all the tests you need.

Test, trade, learn, backtest – use Forex Tester Online in your own way!

Conclusion

Like any oscillator, the Momentum Oscillator gives an incorrect response to the speculative price swings, for example, during the news period or at the opening/closing of trading sessions.

What this means is that for high efficiency, the MO indicator must be carefully tested for the specific conditions: trading asset, volatility, period, influence of the fundamental factors.

The modern speculative market proves that the advanced features of the indicator are greatly exaggerated. It gives a lot of false signals on small periods.

It cannot be used for scalping (in any form). Moreover, it has no connection with the trading volumes (even the tick data is not taken into account!)

This indicator does not have parameters for offset and smoothing the result. Its calculation is only based on the historical data, so its forecasts only make sense for long-term trading and only as part of an integrated trading system.

Forex Tester Online

Backtest Momentum Oscillator on FTO

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska