Every trader has experienced that spine-tingling moment when the market approaches a significant price level – perhaps it’s a previous high that everyone’s watching, or maybe it’s that round number where big players supposedly have their orders clustered. These psychological levels in forex trading go far beyond simple round numbers – they’re points where market sentiment, technical analysis, and trading behavior converge to create potential opportunities. In a market where over $6.6 trillion changes hands daily, understanding how to properly identify and trade these levels could be the difference between consistent profits and frustrated hopes.

But here’s the real question that separates successful traders from the crowd. How do you know which Forex psychological levels actually matter?

While everyone can spot obvious levels like 1.2000 on EUR/USD or the much-anticipated Bitcoin $100,000 mark, the true edge comes from knowing how to test and verify which levels genuinely influence price action. It’s not about predicting where price will stop – it’s about understanding how to react when it gets there.

Understanding Forex Psychological Levels

Psychological levels in forex and other markets represent points where market history, collective memory, and actual order flow converge to influence price action. Let’s examine the three most significant types of psychological levels, backed by real market examples.

Round Numbers

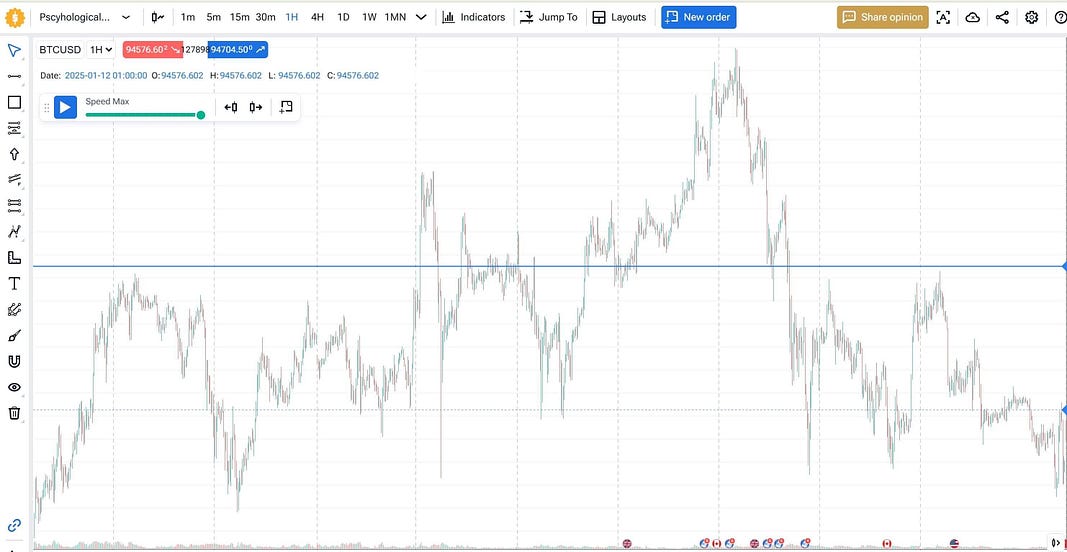

The most straightforward psychological levels are significant round numbers. Bitcoin’s $100,000 level provides a perfect current example. Looking at recent price action, we can observe increased activity and volatility as price approaches this major round number. What’s particularly interesting is that we don’t always see simple, clean bounces or breakouts. Instead, the level acts as a multipivot point where price gravitates back and forth, creating zones of active price interaction.

Other examples of forex psychological levels include $50,000 in gold or ¥150.00 in USD/JPY. These levels gain significance primarily because they’re clean, memorable numbers that naturally attract attention and order placement. However, their actual market impact varies greatly and requires careful testing to verify.

Social Consensus Levels

These levels emerge through market experience and collective trader focus over time. EUR/USD 1.2000 is a prime example – while it appears to be just another round number, its significance has been reinforced through years of market reactions, analyst attention, and institutional focus. The level has become a key reference point not just because it’s round, but because market participants have collectively assigned it importance through their trading behavior and attention.

What makes social consensus levels particularly interesting is their self-reinforcing nature. As more traders recognize and react to these levels, they become increasingly significant in market psychology. However, this doesn’t guarantee predictable price reactions – often, these levels become zones of complex price action rather than simple support or resistance.

Event-Driven Levels

The most powerful Forex psychological levels often emerge from major market events. Consider EUR/USD 1.0340 – the 2017 low that became crucially important later in 2022 and 2024. This level gained significance not because of its numerical value, but because it represented a point where major market decisions were made under stress.

Similarly, USD/JPY 151.94 – the 1990 high – remained a crucial reference point for decades. When prices approached this level later in 2022 and again later, the mere memory of previous Bank of Japan interventions influenced trading decisions, eventually leading to actual intervention.

The real edge in trading Forex psychological levels comes not from simply knowing where they are, but from understanding how price typically behaves around them. This is where systematic testing becomes invaluable. By examining hundreds of interactions with these levels across different market conditions, traders can develop a nuanced understanding of which levels matter for their specific trading approach.

How to Use Psychological Levels When Trading

The key to utilizing Forex psychological levels effectively lies not in blind acceptance but in rigorous verification. A systematic approach to analyzing these barriers can transform vague concepts into testable trading strategies.

Strategy development begins with identifying potential psychological levels on your chart. But rather than assuming their significance, treat each level as a hypothesis to be tested. Does price actually behave differently around these barriers? Do order flows show unusual patterns near round numbers?

How to Implement Forex Psychological Levels in Forex Tester Online

Once you’ve identified potential psychological levels in your markets of interest, the crucial next step is testing how price actually behaves around them. Forex Tester Online (FTO) provides the ideal environment for this research, offering tools that make testing efficient and systematic.

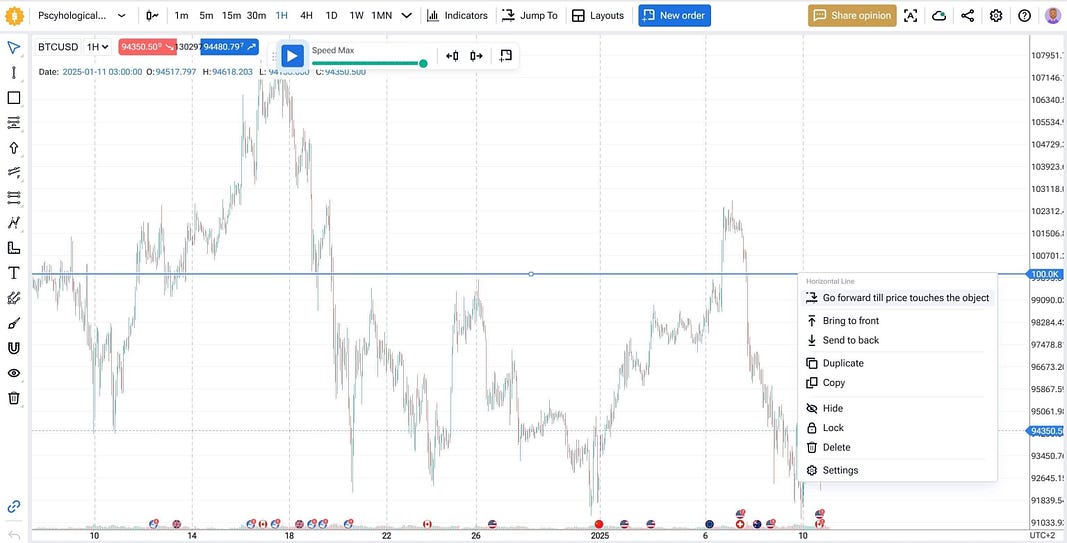

The platform’s “forward to next touch” feature transforms how you can study these levels. Instead of manually scrolling through charts looking for interactions, you can instantly jump to moments where price meets your levels of interest. This efficiency allows you to examine dozens of cases in the time it would normally take to study just a few.

FTO’s comprehensive order management system lets you go beyond simple observation to test actual trading scenarios. You can place pending orders around levels, experiment with different stop loss and take profit combinations, and see how various position sizing approaches affect your results. The ability to save multiple projects means you can test different hypotheses separately, comparing results to understand what works best for your trading style.

Forex Tester online offers 70+ symbols and lots of advanced features that other tool don’t have. This includes custom indicators, EAs, scenarios, news integration, “jump to”, and others.

Effective Trading Approaches to Psychological Levels

Through your testing in FTO, you’ll likely discover that Forex psychological levels present three main trading opportunities: reversals, breakouts, and false breakouts. A reversal setup might emerge when price approaches a significant level and exhausts its momentum. Breakout scenarios occur when price pushes decisively through a psychological level, often leading to sustained movement as other traders adjust their positions. False breakouts can provide particularly interesting opportunities, as price briefly crosses a level only to reverse sharply.

What makes trading truly personal is how each trader confirms these potential setups. While the scenarios might be common, the ways traders validate them are as unique as fingerprints. Some traders rely purely on candlestick patterns, having found specific formations that they trust through testing. Others prefer technical indicators, watching for divergences or specific signal combinations. Many successful traders develop their own unique combinations of confirmation methods, perhaps combining price action patterns with their favorite indicators.

The effectiveness of each approach varies with market conditions and the specific Forex psychological level in question. What works at the Bitcoin $100,000 level might differ from what works at EUR/USD 1.2000. With so many possible combinations of strategies, confirmation methods, and market conditions, the only way to find what truly works for you is through systematic testing. This is where a powerful backtesting platform becomes invaluable – it lets you verify your ideas without risking real capital, helping you develop confidence in your unique trading approach.

How Does Technical Analysis Help Identify Psychological Levels?

Technical analysis can provide additional context for psychological levels, helping traders understand whether a level might be significant in current market conditions. Rather than relying on a single tool or indicator, consider how various aspects of technical analysis might confirm or challenge your observations about a psychological level.

Chart patterns often develop around significant Forex psychological levels, potentially offering clues about future price behavior. For instance, when multiple technical patterns converge with a psychological level, it might suggest increased significance. However, remember that these patterns, like the levels themselves, require verification through testing.

Sometimes, psychological levels align with other technical elements like trend lines or moving averages. While this confluence might appear meaningful, its actual significance varies by market and conditions. Some traders find that Forex psychological levels become more reliable when supported by multiple technical factors, but again, this is something each trader needs to verify through their own testing.

Complex cross timeframe analysis of BTC $100 000 level test in FTO

The relationship between time frames also deserves attention. A psychological level that appears significant on a daily chart might show different characteristics on hourly or weekly charts. Understanding these multi-timeframe relationships can add depth to your analysis, but avoid becoming overwhelmed by too many variables.

Conclusion

Trading psychological levels effectively requires a blend of understanding, testing, and personal experience. These levels, whether round numbers, social consensus points, or event-driven markers, can influence market behavior in complex ways. However, their impact isn’t uniform or predictable – what works in one market condition might fail in another.

Success in trading psychological levels comes not from memorizing rules or copying others’ methods, but from developing and testing your own approach. The availability of sophisticated testing platforms means traders can now verify their ideas before risking real capital. This systematic testing, combined with careful observation and continuous learning, forms the foundation of reliable trading strategies.

Remember that markets evolve, and the significance of psychological levels can change over time. What worked last year might need adjustment today. That’s why successful traders maintain a testing mindset, regularly reviewing and refining their approaches to stay aligned with current market conditions.

Your journey in understanding and trading psychological levels is unique. While others’ experiences can provide insights, your success will ultimately come from developing approaches that match your trading style and risk tolerance. Keep testing, keep learning, and most importantly, keep verifying what works for you.

Frequently Asked Questions

What are psychological levels in forex?

Psychological levels are price points that attract significant market attention for various reasons. These include round numbers (like 1.2000 in EUR/USD or $50,000 in gold), historically significant levels where major market events occurred (like the 2017 EUR/USD low at 1.0340), and social consensus levels that gained importance through repeated market reactions.

However, not all such levels are equally significant – their true importance can only be verified through systematic testing.

How to identify psychological levels in forex?

While obvious starting points include round numbers and widely-discussed price points, truly significant psychological levels reveal themselves through careful market observation and testing. Each trader might notice different levels becoming important in their markets of interest. Using tools like Forex Tester Online can help you verify which levels consistently influence price action in your chosen trading instruments. Remember, a level’s significance often changes with market conditions.

How to trade psychological levels in forex?

Trading psychological levels successfully requires developing your own tested approach rather than following generic rules. Common scenarios include trading reversals when price approaches important levels, breakouts when price pushes through them, or false breakouts when price briefly crosses a level before reversing. The key lies in finding setups that make sense to you and confirming them in ways that match your trading style. Backtesting platforms allow you to develop and verify your approach without risking real capital.

What are examples of psychological levels?

Current market examples include Bitcoin’s $100,000 level, where we see increased price activity and multi-pivot behavior even before the level is reached. Historical examples include USD/JPY 151.94, which remained significant for decades due to central bank intervention. EUR/USD 1.2000 demonstrates how a round number can gain additional significance through repeated market reactions over time.

However, remember that the importance of any level needs verification through testing in current market conditions.

What are support and resistance levels, and why are they considered key psychological barriers?

Support and resistance levels become psychological barriers when market participants collectively recognize and react to them. While technical analysis might identify these levels through various methods, their psychological importance grows through repeated price interactions and market memory.

Sometimes, technical support/resistance aligns with psychological levels (like round numbers or previous market extremes), potentially creating zones of particular interest. However, the reliability of these confluences needs verification through testing in your specific trading approach.

What are the benefits of using psychological levels in trading?

When properly tested and understood, psychological levels can enhance your trading in several ways. They can help you identify potential areas of market interest, manage risk by anticipating possible price reactions, and develop more systematic trading approaches.

However, the greatest benefit comes not from the levels themselves, but from the process of testing and verifying how they work in your trading. This systematic approach to testing helps build confidence in your trading decisions and deepens your understanding of market behavior.

Forex Tester Online

Study and identify psychological levels via backtesting actual trading scenarios in FTO

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska