In this article, we will explore the best alternatives to QuantConnect for traders who want a more user-friendly backtesting platform, deeper historical data, or a different approach to strategy development. While QuantConnect is a powerful algorithmic trading tool, its coding-heavy structure can be a challenge for those who prefer a simpler interface. Whether you need a dedicated backtesting tool, a web-based solution, or an automated trading system, here are five of the best alternatives to consider.

Why Traders Look for QuantConnect Alternatives

QuantConnect is a powerful algorithmic trading platform that provides traders with the tools to develop, test, and deploy automated trading strategies. It supports multiple asset classes, including stocks, Forex, futures, and cryptocurrencies, making it a versatile choice for traders who rely on quantitative analysis. The platform also offers access to institutional-grade data, allowing users to build complex strategies using historical market trends and real-time execution. However, despite its capabilities, some traders find that QuantConnect is not the best fit for their needs.

One of the main reasons traders seek alternatives is the platform’s coding-heavy approach. QuantConnect requires users to write strategies in programming languages like Python and C#, which can be a barrier for those who prefer a more intuitive, no-code or low-code environment. Some traders may prefer platforms that offer manual backtesting tools, drag-and-drop strategy builders, or pre-configured testing environments that do not require programming knowledge. A user-friendly interface can make the process of strategy development and optimization more efficient, especially for traders who want to focus on market analysis rather than coding.

Another factor that leads traders to explore alternatives is the availability of historical data and backtesting capabilities. While QuantConnect provides access to a large dataset, some traders require more customization, deeper market history, or a different approach to data analysis. Backtesting speed and execution accuracy are also important, as traders need to ensure that their strategies perform well under different market conditions. If QuantConnect doesn’t fully meet your needs, there are several strong alternatives that offer a mix of advanced backtesting tools, more accessible interfaces, and flexible strategy development options.

Best QuantConnect Alternatives

So, here are our TOP 5 alternatives based on functionality, price, and customer reviews.

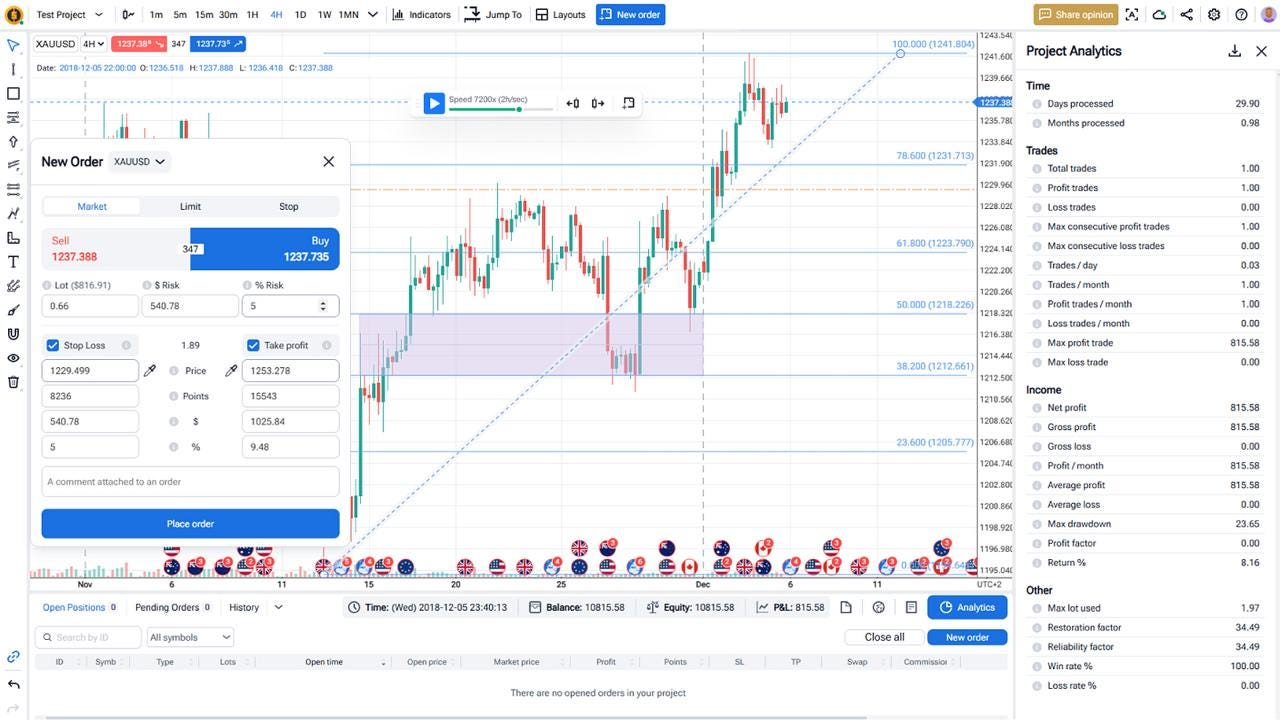

1) Forex Tester Online (Best Alternative)

Forex Tester Online is a dedicated backtesting tool designed to help traders refine their strategies with realistic simulations and deep historical data.

- Fast, Accurate Testing – Simulate months of trading in minutes with detailed tick-by-tick data.

- Large Historical Database – Access 20+ years of data across 50+ symbols, including Forex, stocks, indices, and crypto.

- Easy-to-Use Interface – No coding required; place and manage trades directly on the chart.

- Customizable Backtesting – Sync multiple charts, test across different timeframes, and adjust speed for precise analysis.

- Real-World Trading Conditions – Includes real spreads, commissions, and margin requirements.

- Advanced Trading Features – news integration, scenarios, watchlist, notes, custom EAs & indicators, etc.

Unlike QuantConnect, Forex Tester Online doesn’t require programming skills, making it ideal for traders who want to focus on strategy development without coding.

2) Backtrader

Backtrader is an open-source Python-based backtesting framework. It’s powerful but requires coding knowledge.

- Supports multiple asset classes, including Forex, stocks, and futures.

- Offers extensive customization for strategy development.

- Requires programming skills, making it less beginner-friendly.

3) TradingView Strategy Tester

TradingView’s built-in backtesting tool allows traders to test strategies using Pine Script. It’s a good QuantConnect alternative for those who prefer a web-based platform.

- Integrated directly into TradingView’s charting system.

- Supports various markets, including Forex, stocks, and crypto.

- Limited historical data compared to dedicated backtesting tools.

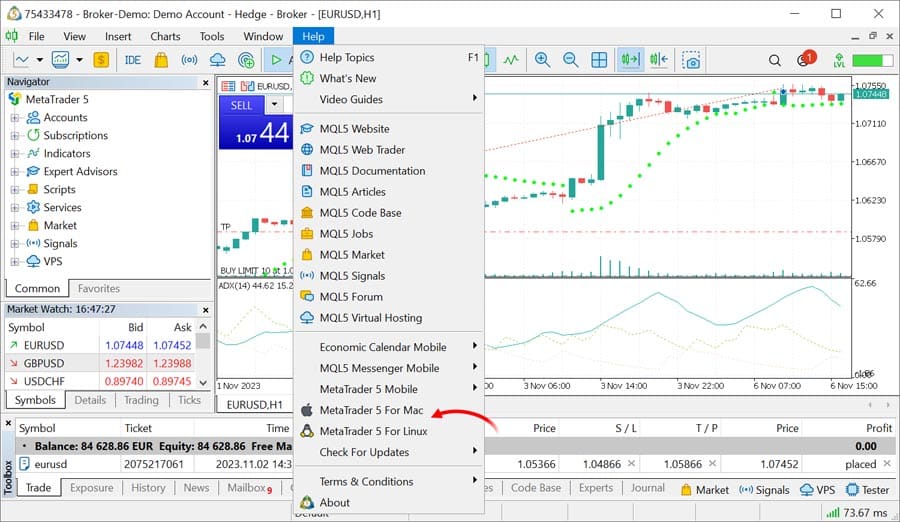

4) MetaTrader Strategy Tester

MetaTrader’s built-in backtester allows traders to test strategies using MQL4 or MQL5. It’s a solid choice for those already using MetaTrader.

- Supports automated trading strategies within MT4 and MT5.

- Offers a familiar environment for MetaTrader users.

- Limited to assets supported by a trader’s broker.

5) AmiBroker

AmiBroker is a technical analysis and backtesting platform that provides a strong alternative for traders looking for deep market insights.

- Supports multiple asset classes with advanced charting and analytics.

- Requires scripting for full functionality.

- Higher learning curve than simpler backtesting tools.

Conclusion

If QuantConnect isn’t the right fit for you, there are plenty of alternatives. Forex Tester Online is the best choice for traders who want a dedicated backtesting platform with accurate data and an easy-to-use interface—without coding. Backtrader and AmiBroker are good for those comfortable with programming, while TradingView Strategy Tester and MetaTrader Strategy Tester work well for traders who prefer simpler, integrated solutions.

Pick the platform that matches your trading style and skill level.

FAQ

Why do traders look for alternatives to QuantConnect?

QuantConnect is designed for algorithmic trading, meaning it requires coding skills to build and test strategies. Traders who prefer a no-code or low-code approach often seek alternatives with a more user-friendly interface and pre-built backtesting tools.

How does QuantConnect’s coding requirement affect traders compared to its alternatives?

QuantConnect needs you to code in Python or C#. Some alternatives use drag-and-drop tools that are much simpler.

What are the cost differences between QuantConnect and other backtesting tools?

QuantConnect often charges by usage. Some alternatives use fixed monthly fees or free tiers.

What’s the best open-source alternative to QuantConnect?

Backtrader is the top choice for traders who prefer an open-source Python-based framework for backtesting. However, it still requires coding knowledge to use effectively.

Does QuantConnect offer manual testing options as well as coding options?

Yes it does, but it is not very advanced. If you need manual backtesting (not algorithmic trading), try Forex Tester Online instead.

Forex Tester Online

Top QuantConnect alternative for backtesting and refining your trading strategies

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska