Smart Money Concepts (SMC) are based on decades of market wisdom about institutional trading patterns in financial markets. While the term “SMC” has gained renewed attention recently, its underlying principles trace back to the foundations of technical analysis, with roots in Richard Wyckoff’s work from the 1930s on market manipulation and institutional activity.

These time-tested concepts about understanding institutional order flow and market structure have evolved alongside other market analysis frameworks like Market Profile in the 1980s and Order Flow analysis in the 1990s. Through generations of market observation, these patterns have remained remarkably consistent, showing how institutional trading behavior continues to shape market movements in predictable ways.

What is SMC Forex Trading?

SMC Forex trading is fundamentally about observing and interpreting pure price action to understand institutional trading behavior. Similar to traditional price action analysis, it requires traders to develop a keen eye for market structure and price movement patterns. However, SMC specifically focuses on identifying areas where institutional traders might be placing their orders and how they move the market to achieve their objectives.

At its core, Smart Money Concepts trading is highly visual and interpretative. Traders spend hours observing how price moves around certain levels, how it breaks market structure, and how it behaves in areas of high liquidity. This observation-based approach means that no two traders will interpret the market exactly the same way, even when looking at the same price action patterns.

The challenge of SMC trading lies in developing the skill to read price action through an institutional lens. This requires significant screen time and practice, as traders need to train their eyes to spot subtle changes in market structure and potential institutional trading patterns. Tools like Forex Tester Online (FTO) become invaluable in this learning process, allowing traders to compress years of market observation into months of focused practice.

Unlike indicator-based trading systems, SMC relies purely on price action and market structure analysis. Traders learn to identify potential institutional interest areas, understand how large players might be accumulating or distributing positions, and recognize patterns that suggest smart money activity. This trading approach can’t be 100% automated but platforms like FTO suggest instruments that facilitate SMC Forex trading system optimization and practice.

Smart Money Concepts

Understanding the key components of Smart Money Concepts trading provides the foundation for analyzing market structure and institutional behavior. These concepts have evolved from decades of market observation and remain relevant in today’s trading environment.

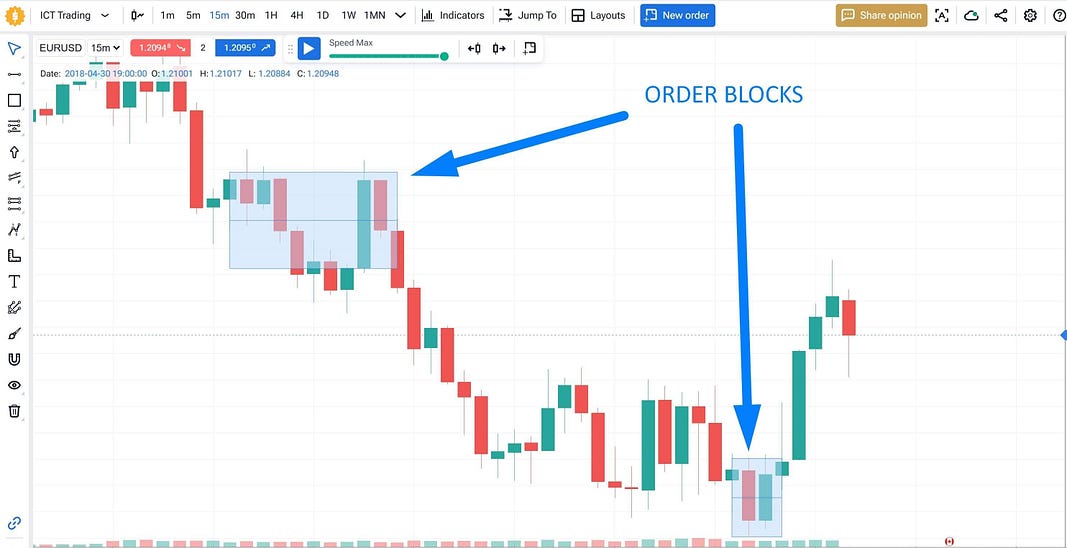

1. Order Blocks

Order Blocks represent zones where institutional traders have demonstrated significant interest through their trading activity. These areas often show strong price momentum and clean moves, indicating potential institutional order flow. In practice, traders identify these blocks by looking for strong momentum candles that precede major market moves, often serving as areas where price might return for subsequent reactions.

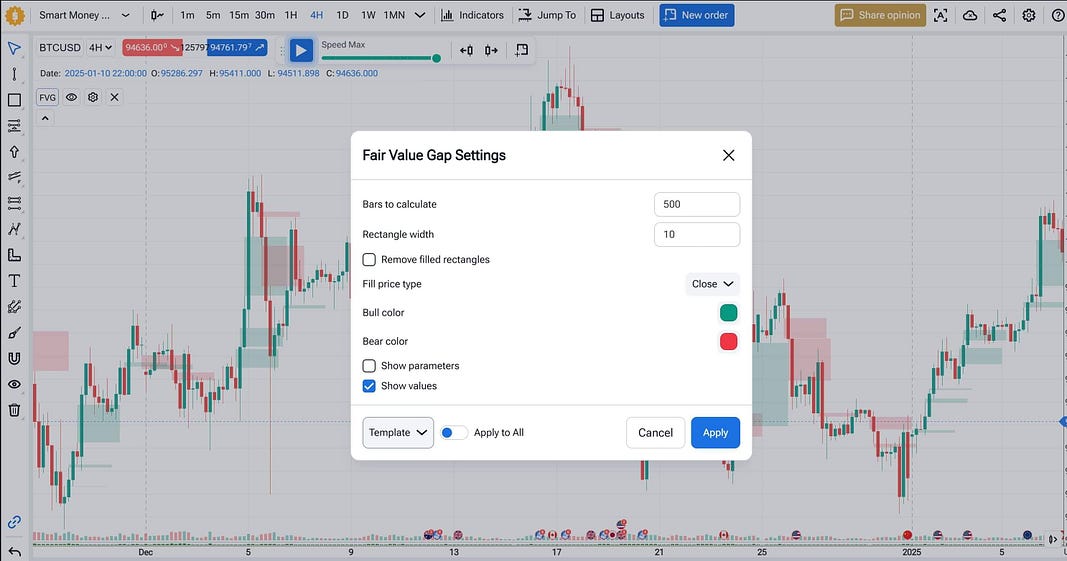

2. Fair Value Gap

Fair value gap occurs when price makes a sudden move, creating an imbalance in market structure. These gaps represent areas where price has moved so quickly that it hasn’t properly tested certain levels. Institutional traders often return to these areas to “fill the gap” and establish fair value. While FVGs can be identified by looking for rapid price movements that skip several price levels, Forex Tester Online simplifies this process with its built-in Fair Value Gap indicator. This tool automatically marks FVGs on your charts, helping you spot these important market structure imbalances more efficiently and validate your analysis.

3. Liquidity

Liquidity forms another crucial component of SMC trading. These are areas where large numbers of orders accumulate, often around significant swing points or key psychological levels. Smart money often engineers moves to capture this liquidity before initiating their intended price moves. Understanding liquidity helps traders avoid placing stops at obvious levels and potentially identify upcoming market moves.

4. Break of Structure

Break of Structure (BOS) signals a potential shift in market direction. This concept helps traders identify when smart money might be changing their directional bias. A break of structure occurs when price breaks a significant market structure level, often leading to new trends or major price moves.

5. Change of Character

Change of Character (ChoCH) represents a significant shift in price behavior that might indicate smart money’s change in positioning. This could appear as a change in the way price reacts to certain levels or a shift in momentum characteristics, often preceding major market moves.

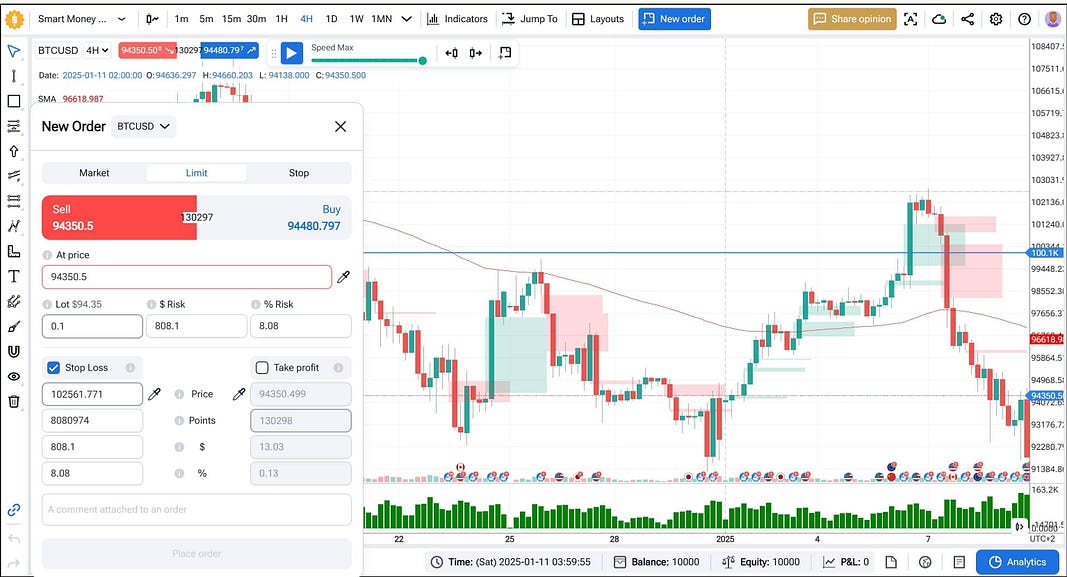

Steps to Trade Smart Money Concepts in Forex Tester Online

For beginners the journey of mastering Smart Money Concepts trading begins with testing simple strategies before incorporating more sophisticated rules and concepts. Forex Tester Online provides the ideal environment for this evolutionary process, offering tools that help traders develop their understanding of market structure and institutional behavior patterns that are reflected in the charts.

Traders can start with basic setups, focusing on identifying clear setups that include order blocks or obvious fair value gaps. As their understanding of price action deepens through observation and testing, they can gradually add more complex rules and filters to their strategy. This might include incorporating multiple timeframe analysis, considering specific trading sessions, or adding more nuanced entry and exit conditions.

Strategy refinement in Forex Tester Online isn’t just about finding what works – it’s about understanding why certain approaches succeed or fail. A strategy that shows poor initial results might contain valuable elements that can be improved through careful observation and adjustment. The platform’s comprehensive toolset allows traders to test various modifications, from different order types and stop-loss placements to sophisticated trade management techniques.

The platform’s specialized features, such as the ability to mark Fair Value Gaps, help traders identify important SMC and ICT concepts amid market noise. Multiple timeframe analysis capabilities enable traders to spot relationships between higher timeframe institutional activity and lower timeframe entry opportunities. The variety of order types and trade management tools allows for testing complex entry and exit strategies that align with institutional behavior patterns.

Importantly, Forex Tester Online’s reliable historical data ensures that strategy improvements are based on consistent market conditions. When a strategy shows suboptimal performance, traders can analyze the specific circumstances that led to drawdowns or poor risk-reward ratios, then test modified rules on the same data set to verify improvements. This iterative process of observation, modification, and retesting helps develop robust trading approaches that account for various market conditions.

Forex Tester Online also provides an excellent environment for testing strategies learned from external sources, such as trading courses, books, or online communities. Instead of blindly trusting someone else’s approach, traders can verify if these setups and strategies actually generate profits under real market conditions. This validation process helps traders understand which aspects of learned strategies work best for their trading style and which might need modification.

Smart Money vs. Retail Traders

Through extensive backtesting and market observation, traders often discover a fundamental truth: the way institutional players approach the market differs significantly from typical retail trading behavior. Understanding these differences becomes crucial for developing effective trading strategies, as it helps explain why certain setups work while others consistently fail.

Smart money typically accumulates positions gradually, often using market volatility to disguise their true intentions. They might engineer price moves to trigger retail stop losses before moving the market in their intended direction. Understanding these dynamics helps traders avoid common retail traps and align their trading with institutional movement.

Pros and Cons of SMC

SMC trading offers several advantages when properly understood and applied. It provides a framework for understanding institutional trading patterns and helps traders develop a deeper appreciation of market structure. The concepts can be applied across different markets and timeframes, making it a versatile approach for various trading styles.

However, SMC trading also presents challenges. The concepts require significant practice to master and can be subjective in their interpretation. Different traders might identify the same concepts differently, leading to varying results.

Additionally, the time required to develop proper pattern recognition skills can be substantial.

Conclusion

Making Smart Money Concepts work in real trading requires more than just theoretical knowledge. The path to success starts with understanding basic concepts and gradually incorporating more advanced elements as your skills develop. Validate your trading ideas: start with simple setups, test them thoroughly, and only then add complexity.

Pay attention to what specific market conditions work best for your strategy. Some SMC setups might perform better in ranging markets, while others excel during trends. Through systematic testing, you can identify these patterns and adjust your approach accordingly. Remember that failed trades often provide the most valuable learning opportunities – they help you spot areas for improvement and refine your strategy.

Keep detailed records of your backtesting results. Track not just wins and losses, but also how different market conditions affect your strategy’s performance. This data-driven approach will help you make informed decisions about when to trade and when to stay out of the market.

Most importantly, develop your own understanding of how institutional players move the market. While SMC provides a framework, your success will ultimately come from your ability to read market structure and adapt these concepts to changing market conditions. Forex Tester Online can become your best tool to gain that mastery.

Frequently Asked Questions

What Is SMC Strategy in Trading?

SMC strategy focuses on identifying and trading institutional order flow and key market structures. It provides a framework for understanding how large financial institutions operate in the market, helping traders spot potential trading opportunities based on institutional trading patterns rather than conventional technical indicators.

Where did SMC Forex trading come from?

The foundations of Smart Money Concepts trading trace back to Richard Wyckoff’s work in the 1930s on market manipulation and institutional behavior. While the term “SMC” may be relatively recent, its core concepts about market structure and institutional order flow have been observed and traded by successful market participants for nearly a century.

Is SMC Better Than Price Action?

SMC and price action aren’t competing methodologies – they’re complementary approaches. SMC incorporates traditional price action analysis while adding an institutional perspective. Many successful traders combine both approaches, using price action for general market context and SMC concepts for more specific trade setups and risk management.

Which Timeframe to Use for SMC Trading?

Most SMC traders start their analysis on higher timeframes (4H, Daily, Weekly) to identify major market structure and institutional interest areas. Lower timeframes (1H, 30M) can then be used for fine-tuning entries and exits. The key is to understand how different timeframes interconnect – what appears as noise on a lower timeframe might be part of a significant institutional move on a higher timeframe.

Should you trade using SMC?

Consider SMC if you’re willing to invest time in learning market structure and developing your analytical skills. Success requires patience, consistent practice, and the ability to think in probabilities rather than certainties. Use Forex Tester Online to validate whether SMC concepts align with your trading style and risk tolerance before committing real capital.

What Are the Common Signs of Smart Money Activity in the Market?

Look for clear order blocks preceding major moves, fair value gaps that get filled systematically, and strategic sweeps of liquidity before significant price movements. Pay attention to changes in market character – how price behaves around key levels often reveals institutional intentions. However, remember that these patterns require practice to identify correctly and should always be validated through thorough backtesting.

Forex Tester Online

Spot and backtest SMC setups of your strategies via our practice trading simulator

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska