If you’re searching for StrategyQuant alternatives, you’re likely looking for easier, cheaper, or more specialized tools for backtesting and algorithmic trading. StrategyQuant is a powerful platform for building and testing trading systems, but it’s not ideal for everyone. In this article, we’ll compare it with three strong competitors to help you find a replacement that better fits your needs – especially if you’re a forex trader or prefer a simpler tool.

We will only review TOP-3 tools so that you don’t need to go through tens of options. We did it for you already. Here are our three top picks – different, but all good in their own way.

What is StrategyQuant?

StrategyQuant is a professional-level backtesting software for building and analyzing automated strategies. It uses machine learning and genetic algorithms to generate thousands of trading strategies and test them across different markets using historical data. It supports advanced testing, walk-forward analysis, and exports strategies directly into platforms like MetaTrader.

Despite its power, many traders look for an alternative to StrategyQuant because it’s expensive, resource-intensive, and hard to master. It also requires time to understand its workflow. Many give up in the beginning (and you have right for this – software in 2026 must be intuitive). Eventually, traders who want a simpler interface, lower price, or more focused features often seek alternatives that are easier to use or more tailored to Forex strategy testing.

1. StrategyQuant vs Forex Tester Online (FTO)

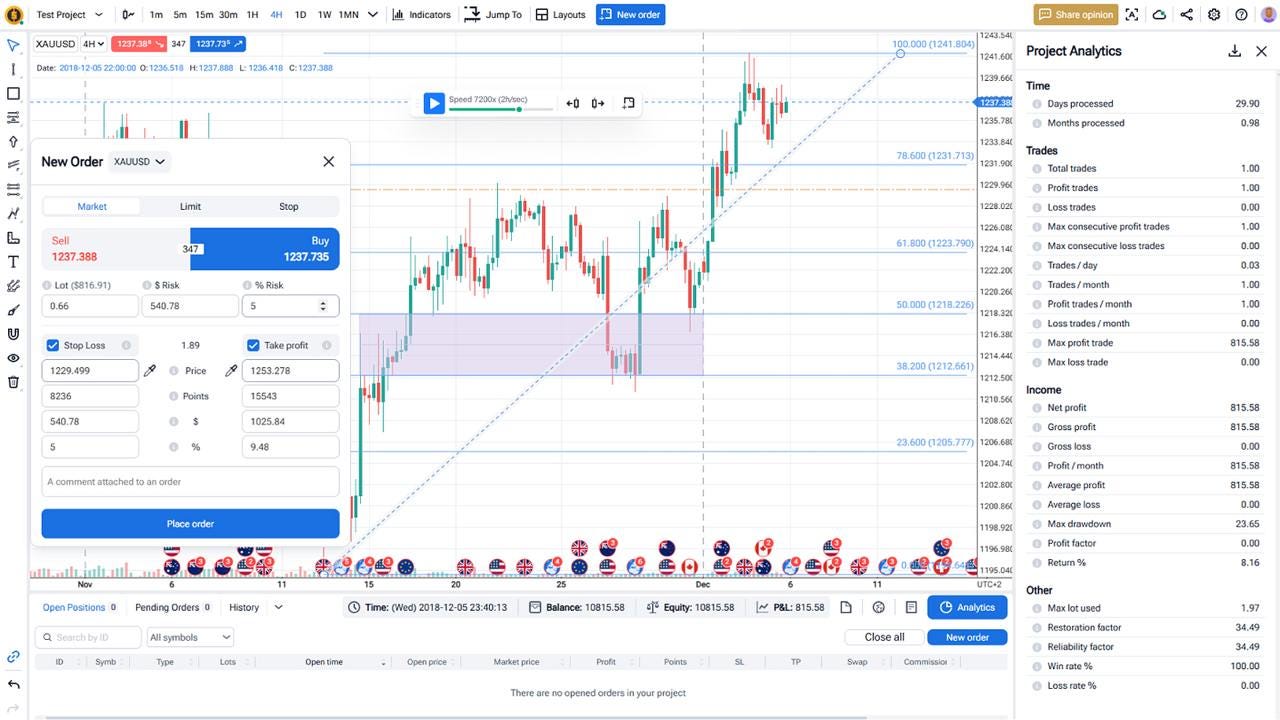

If you’re looking for a simpler and more accessible StrategyQuant alternative, Forex Tester Online (FTO) is worth serious consideration — especially for manual strategy backtesting and forex simulation.

Why choose FTO over StrategyQuant?

Unlike StrategyQuant, Forex Tester Online doesn’t rely on algorithmic generation or machine learning. Instead, it gives traders full control over strategy testing in a visual, interactive environment. You can manually test strategies, simulate trades with 20+ years of tick-by-tick historical data, and evaluate performance in real market conditions.

There’s no need to write code, manage Java plugins, or configure complex workflows. You just open the chart, place trades, and analyze results using built-in stats and reports. It’s ideal for traders who prefer practical testing over automation or who want to focus on discretionary systems.

Key benefits of Forex Tester Online:

- No coding needed

- Works on both Windows and Mac (via browser)

- Includes strategy statistics and visual trade logs

- Realistic market simulation with market replay mode

- Advanced backtesting tools for experienced traders (Mystery Mode, Exit Optimizer, custom indicators, “Jump to”, and more).

- Easy to use, intuitive.

- Ideal for forex traders at all levels

If you’re tired of the heavy setup and want to test strategies fast, manually, and realistically — try Forex Tester Online.

2. QuantAnalyzer vs StrategyQuant

QuantAnalyzer is actually part of the StrategyQuant suite, but it can also be used as a standalone tool. Its main purpose is to help traders analyze the performance and risk profile of trading strategies. While StrategyQuant is focused on charting, generating and backtesting systems, QuantAnalyzer dives into detailed performance metrics.

Users who already have strategies — created either manually or with other tools — often turn to QuantAnalyzer to better understand how those strategies behave under various conditions. It provides tools for Monte Carlo analysis, strategy filtering, portfolio creation, and walk-forward analysis.

The downside? QuantAnalyzer does not generate strategies on its own. It’s only useful if you already have existing strategies to evaluate. For traders who want an all-in-one tool that includes both generation and testing, this can feel limited.

In short:

If you’re only looking to analyze and optimize strategies, QuantAnalyzer can be a useful companion. But for those seeking a full StrategyQuant replacement, it’s not enough by itself.

3. Adaptrade vs StrategyQuant

Adaptrade Builder is another popular backtesting software for traders who want to create and test algorithmic strategies without coding. Like StrategyQuant, it uses machine learning and rule-based logic to generate automated trading strategies, especially for platforms like MetaTrader and TradeStation.

Where Adaptrade stands out is in its flexibility and transparency. You can see and customize the logic used to create each strategy, and it supports a variety of markets — including forex, futures, and stocks. It also has tools for walk-forward testing and robustness validation.

However, Adaptrade lacks the large community, continuous feature updates, and extensive add-ons that come with StrategyQuant. The interface also feels a bit dated (same as with StrategyQuant itself), and users have mentioned it may require more manual input compared to SQ’s automated workflows.

In short:

Adaptrade is a decent option similar to StrategyQuant for experienced traders who want more control over the strategy-building process. But for those who prefer automation and a more modern interface, it might feel like a step back.

Conclusion

StrategyQuant is a powerful tool for creating and testing trading algorithms, especially for users focused on Forex algorithm development and automated strategy generation. But its complexity, high price, and resource demands make some traders search for simpler or more affordable alternatives.

- Forex Tester Online is a great StrategyQuant alternative for those who want an intuitive, hands-on experience with strategy backtesting and market simulation. It doesn’t require coding skills and comes with detailed historical tick data, making it ideal for manual strategy refinement.

- QuantAnalyzer is a helpful add-on for analyzing and optimizing portfolios, but not a full replacement on its own.

- Adaptrade offers solid features for building trading strategies but might feel outdated or too manual for some.

Each tool has a different focus. If ease of use and deep market replay are your top priorities, Forex Tester Online is your best bet.

FAQ

What are the system requirements for StrategyQuant?

StrategyQuant runs on Windows (7, 8.1, 10, 11), macOS, and Linux. It needs at least 8 GB RAM, though 16+ GB is recommended for faster processing. It also requires 2 GHz processor 2 cores and 10 GB+ of free disk space. A multi-core CPU and a stable internet connection are also essential for downloading data and updates.

What is StrategyQuant cost?

StrategyQuant has multiple pricing tiers. A lifetime license usually ranges from $1,290 to $2,900. The final cost depends on the version and whether any discounts or bundles (like with QuantAnalyzer or AlgoWizard) are included. This is expensive even compared to other backtesting tools. FTO is much cheaper (check pricing here).

Does StrategyQuant work without programming knowledge?

Yes. StrategyQuant is designed to be used without coding. You can build and test trading strategies using its visual interface, pre-built modules, and drag-and-drop features. But advanced customization (like adding custom indicators) may still require some scripting.

Is StrategyQuant only for Forex?

No. While StrategyQuant is often used for Forex algorithm development, it supports futures, stocks, commodities, and crypto. It works across multiple asset classes and timeframes, making it flexible for different types of traders and systems.

Are there any better alternatives to StrategyQuant for Forex algorithm development?

Yes. Forex Tester Online is a strong alternative to StrategyQuant, especially for traders who want to manually test strategies without writing code. It offers reliable tick data, simulation tools, and works well for Forex-focused strategy development and learning.

Forex Tester Online

Top StrategyQuant alternative for managing risks through backtesting, refining and optimizing your trading strategies

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska