In this article, we will explore the best alternatives to TradeEdge for traders looking for more advanced backtesting, better historical data, or a more intuitive platform.

Why Look for a TradeEdge Alternative

TradeEdge is a well-known trading and backtesting platform that helps traders analyze and refine their strategies before applying them in live markets. It provides a range of tools designed to simulate real trading conditions, allowing users to test different approaches and improve their decision-making skills. Many traders rely on TradeEdge for its ability to run backtests using historical data, but some find that it lacks certain features or customization options needed for more in-depth strategy development.

One of the main reasons traders seek alternatives to TradeEdge is the need for more accurate market simulations and deeper historical data. Backtesting is only as good as the data it relies on, and some platforms offer a more extensive range of historical market information, including tick-by-tick price movements, realistic spreads, and customizable trading conditions. This level of detail is crucial for traders who want to test strategies under different market scenarios and ensure their approach works across various conditions.

Another key factor traders consider is usability and advanced analytics. Some platforms provide more intuitive interfaces, automated reporting tools, and enhanced visualizations that make it easier to understand strategy performance. Others offer features such as multi-timeframe analysis, customizable indicators, and synchronized charting, allowing traders to fine-tune their strategies with greater precision. If TradeEdge doesn’t fully meet your needs, there are several strong alternatives that offer better market simulations, deeper analytics, and more control over your backtesting process.

Best TradeEdge Alternatives

So, here are our TOP 5 alternatives based on functionality, price, and customer reviews.

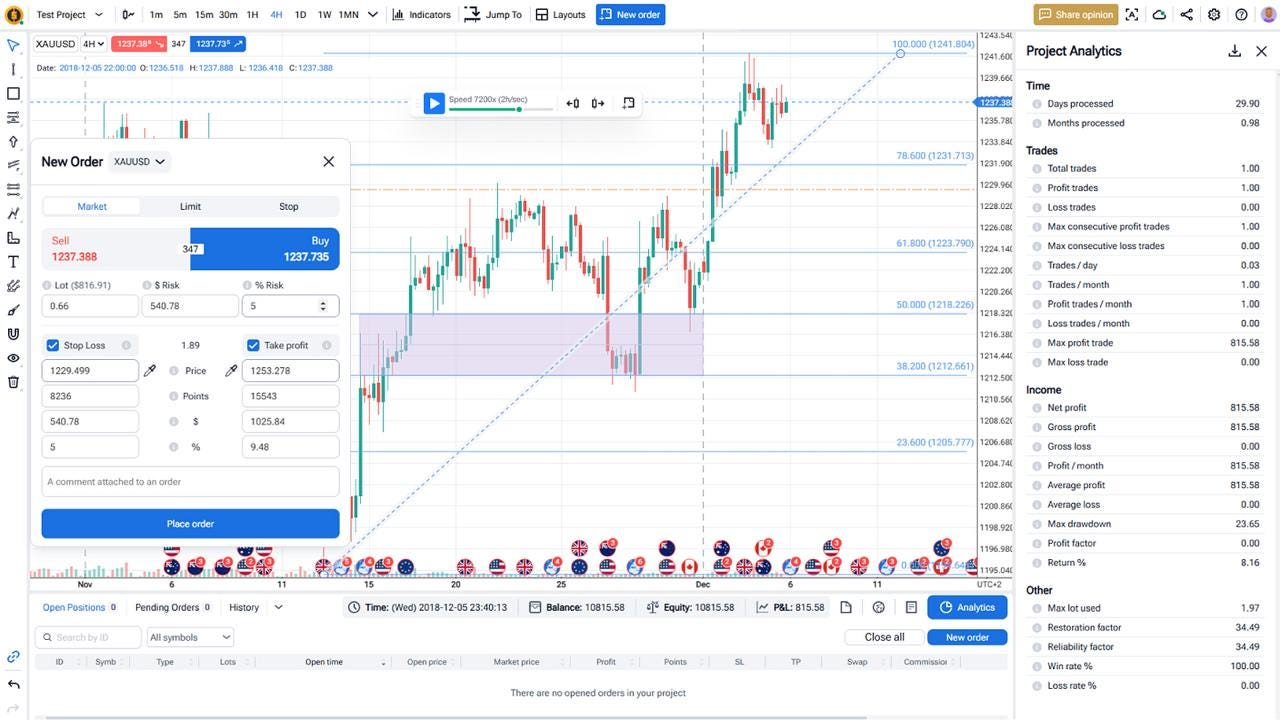

1) Forex Tester Online (Recommended)

Forex Tester Online is a dedicated backtesting platform designed specifically for traders who want accurate market simulations and a seamless user experience.

- Fast and Accurate Backtesting – Test months of trading performance in minutes using realistic tick-by-tick data.

- Extensive Historical Data – Access over 20 years of data for 50+ symbols, including Forex, stocks, indices, and crypto.

- Advanced Order Management – Place and manage orders directly on the chart with an intuitive interface.

- Customizable Testing – Adjust speed up to one day per second, sync multiple charts, and analyze detailed reports.

- Realistic Trading Conditions – Includes accurate spreads, commissions, swaps, and margin requirements for precise testing.

- Use Scenarios – Simulate fundamental events such as Covid-19 market crush to learn acting in stress conditions.

Forex Tester Online is a great option for both beginner and experienced traders. It focuses entirely on backtesting, making it easier to use than many multi-purpose trading platforms.

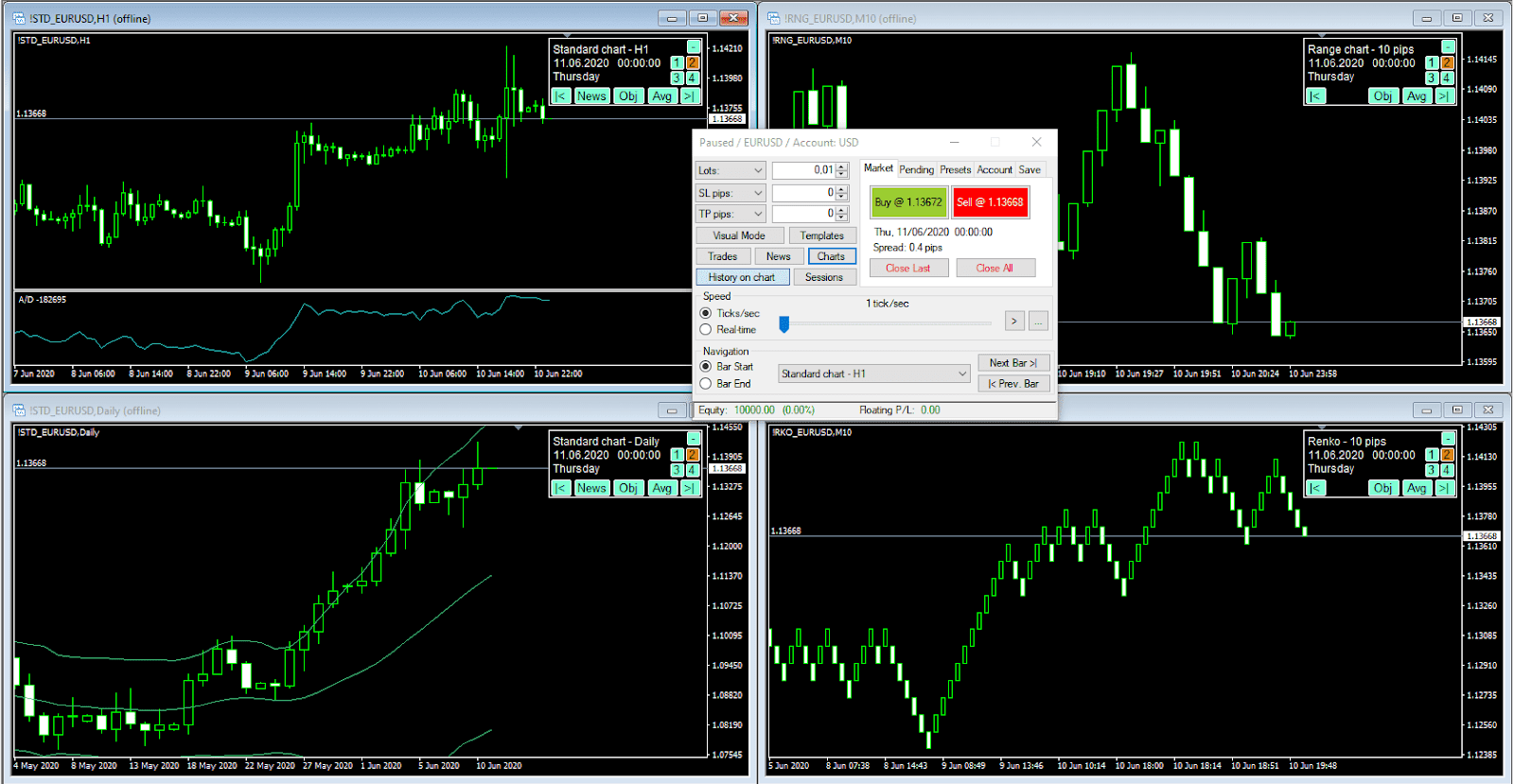

2) Soft4FX

Soft4FX is a MetaTrader add-on that lets traders backtest their strategies using historical data within MT4 or MT5. It’s a budget-friendly alternative but requires manual setup.

- Works within MetaTrader, making it familiar for existing users.

- Supports various Forex pairs and customizable spread settings.

- Requires more manual effort compared to dedicated backtesting platforms.

3) TradingView

TradingView offers a built-in strategy tester that allows traders to analyze their strategies using historical data. While useful, it has limitations in terms of available data and execution control.

- Integrated directly into TradingView’s charting platform.

- Supports multiple asset classes, including Forex, stocks, and crypto.

- Limited historical data and fewer customization options compared to dedicated backtesters.

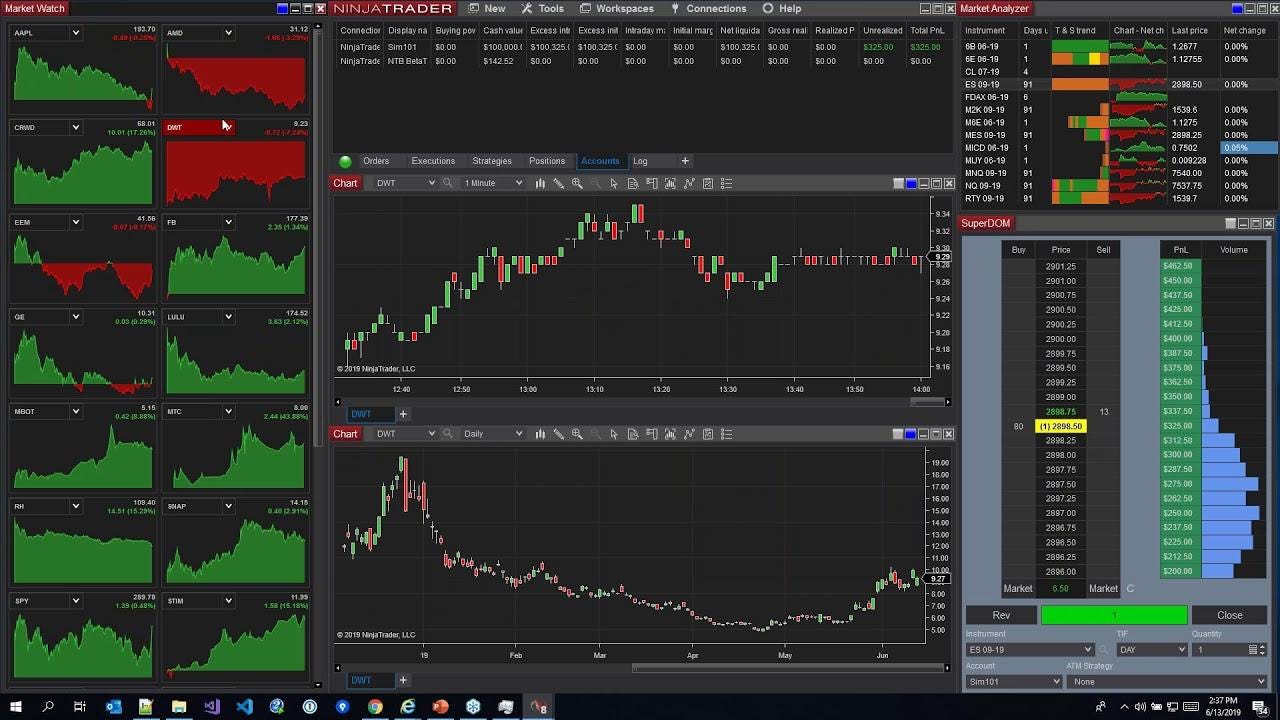

4) NinjaTrader

NinjaTrader provides advanced backtesting and trading automation features, making it a strong choice for professional traders.

- Offers deep market data and automated trading options.

- Includes detailed performance reports and trade analysis.

- Higher learning curve and more expensive than other TradeEdge alternatives.

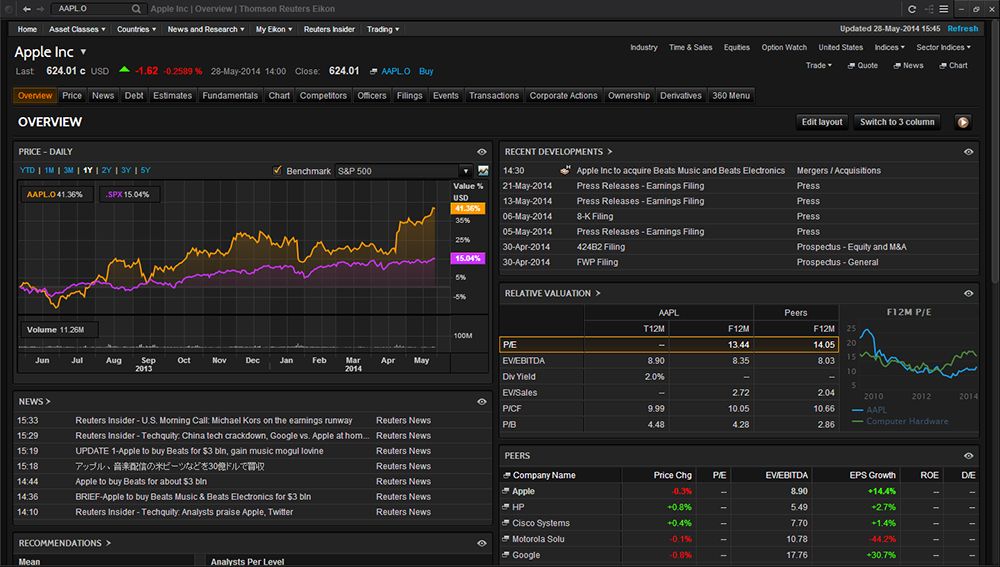

5) MetaStock

MetaStock is another trading and backtesting tool known for its advanced charting and technical analysis features.

- Provides a wide range of indicators and market scanning tools.

- Works best for traders focused on stocks and futures.

- More expensive and less intuitive compared to other TradeEdge alternatives.

Conclusion

If you’re looking for an alternative to TradeEdge, there are plenty of options. Forex Tester Online stands out as the best choice due to its dedicated backtesting features, large historical data set, and realistic market simulations.

Soft4FX and TradingView Backtester are good options for those who prefer working within MetaTrader or TradingView. Meanwhile, NinjaTrader and MetaStock cater to more advanced traders looking for in-depth analytics and automation.

Choose the platform that best fits your trading style and backtesting needs.

FAQ

How does TradeEdge compare to its alternatives for backtesting?

TradeEdge runs tests using past market data. Some alternatives use tick-by-tick data for more detailed tests.

How do TradeEdge alternatives support mobile use?

TradeEdge is mainly for desktop. Some alternatives have mobile apps or web designs that work well on phones.

How does the user interface of TradeEdge compare with its alternatives?

TradeEdge has a simple layout which is fairly good. Other tools use modern screens that some users find easier to use.

Is there a TradeEdge alternative better suited for stock traders?

Yes, MetaStock is a strong option for traders focused on stocks and futures. It offers advanced technical analysis and market scanning tools, though it is more expensive than some other alternatives.

Which tool is better for manual backtesting: TradeEdge or Forex Tester Online?

Forex Tester Online is the best choice for traders who need a dedicated backtesting platform with realistic market conditions, advanced order management, and deep historical data.

If you’re searching for a TradeEdge alternative, explore these options and choose the one that best matches your trading style and strategy development needs!

Forex Tester Online

Top TradeEdge alternative for strategies backtesting

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska