Tradewell is a trading and strategy development platform, but it doesn’t meet the needs of all traders. Let’s take a look at its alternatives and competitors.

Why Traders Look for Tradewell Alternatives

Some traders look for alternatives to Tradewell because they need more advanced backtesting features that allow for precise strategy refinement. A strong backtesting platform should provide detailed trade analysis, realistic market conditions, and the ability to test multiple strategies simultaneously. Some alternatives offer deeper customization, such as adjustable execution speeds, spread settings, and commission structures, which can significantly improve the accuracy of backtesting results.

Another reason traders seek alternatives is the availability of better historical data and broader asset coverage. While Tradewell supports certain markets, some traders require access to a wider range of Forex pairs, stocks, indices, and commodities to develop more diversified strategies. The ability to analyze decades of tick-by-tick data can provide more reliable insights, helping traders refine their approaches under different market conditions.

Additionally, ease of use and interface design play a major role in selecting a backtesting platform. Some alternatives prioritize a more intuitive layout, streamlined order execution, and advanced charting tools to enhance user experience. Platforms that integrate multi-timeframe analysis, synchronized charting, and customizable performance reports can help traders gain a deeper understanding of their strategies. If Tradewell doesn’t fully meet your needs, there are several strong alternatives that provide better historical data, enhanced backtesting capabilities, and a more user-friendly experience.

Best Tradewell Alternatives

Time to move on to alternatives. Here are the TOP 5 best tools based on the sum of criteria.

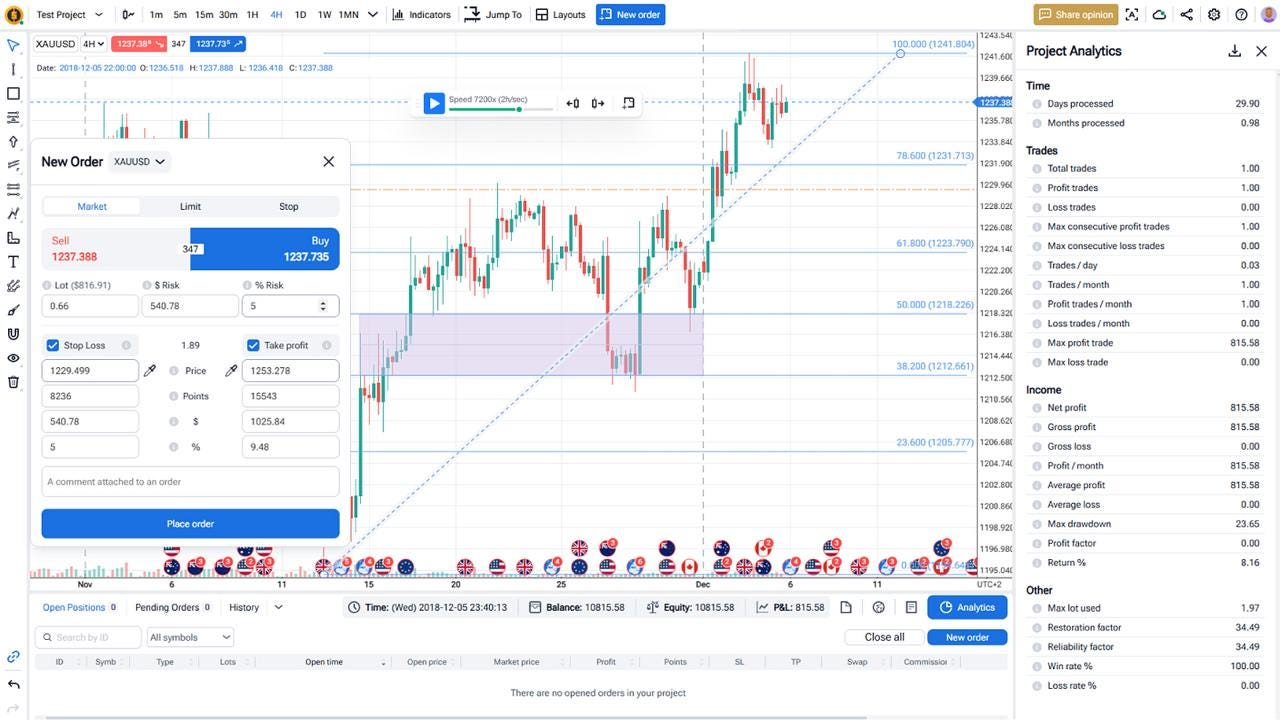

1) Forex Tester Online (Recommended)

Forex Tester Online is a dedicated backtesting platform that helps traders refine their strategies with realistic simulations and detailed performance analysis.

- Fast and Accurate Testing – Simulate months of trading in minutes using tick-by-tick historical data.

- Large Market Data – Access 20+ years of data for 45+ symbols, including Forex, stocks, indices, and crypto.

- User-Friendly Interface – No coding required; place and manage trades directly on the chart.

- Customizable Strategy Testing – Sync multiple charts, adjust backtesting speed, and analyze performance with detailed reports.

- Real Trading Conditions – Includes real spreads, commissions, swaps, and margin requirements for precise testing.

- Use Scenarios – Simulate fundamental events such as Covid-19 market crush to learn acting in stress conditions.

Unlike Tradewell, which offers a mix of trading tools, Forex Tester Online is focused entirely on backtesting, making it a better option for traders who want full control over their strategy testing.

2) TradingView Strategy Tester

TradingView’s built-in strategy tester lets traders analyze their strategies using historical market data.

- Integrated directly into TradingView’s charting platform.

- Supports multiple asset classes, including Forex, stocks, and crypto.

- Less detailed backtesting options compared to dedicated platforms.

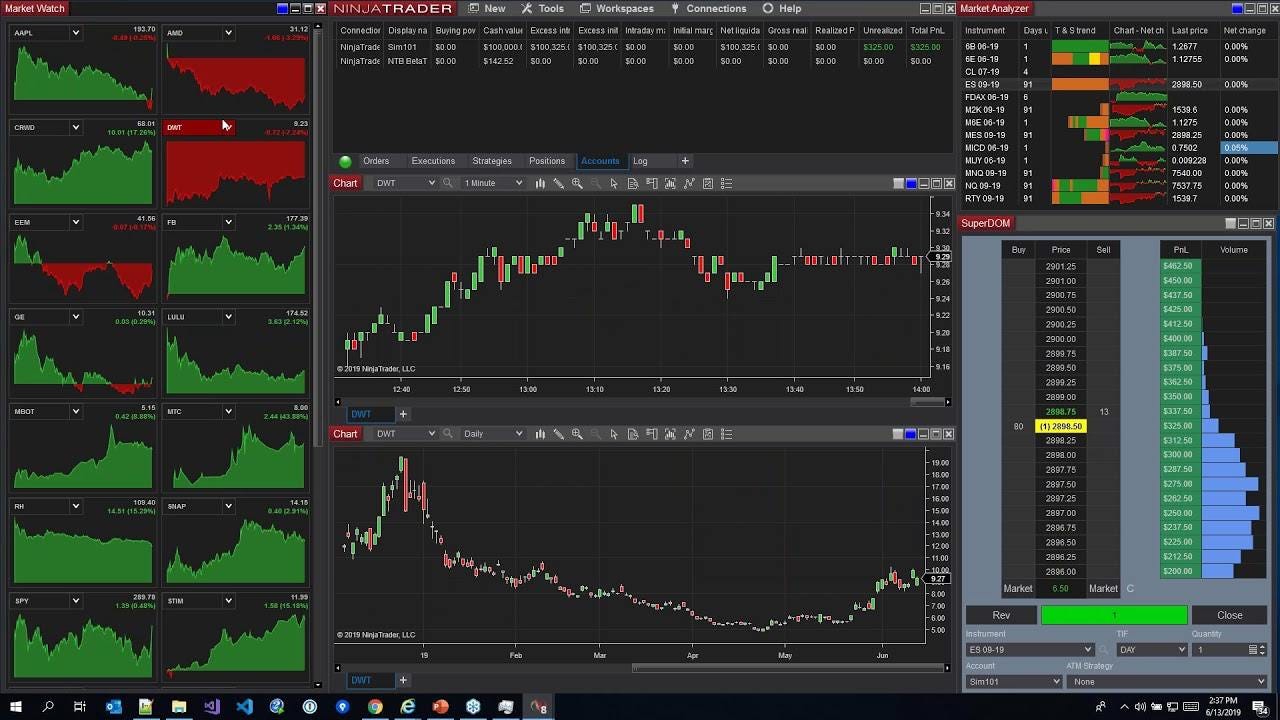

3) NinjaTrader

NinjaTrader is a trading platform with advanced backtesting and automation features.

- Supports Forex, futures, and stocks with deep market data.

- Includes customizable strategy testing and automated trading options.

- Higher learning curve and requires a subscription for full features.

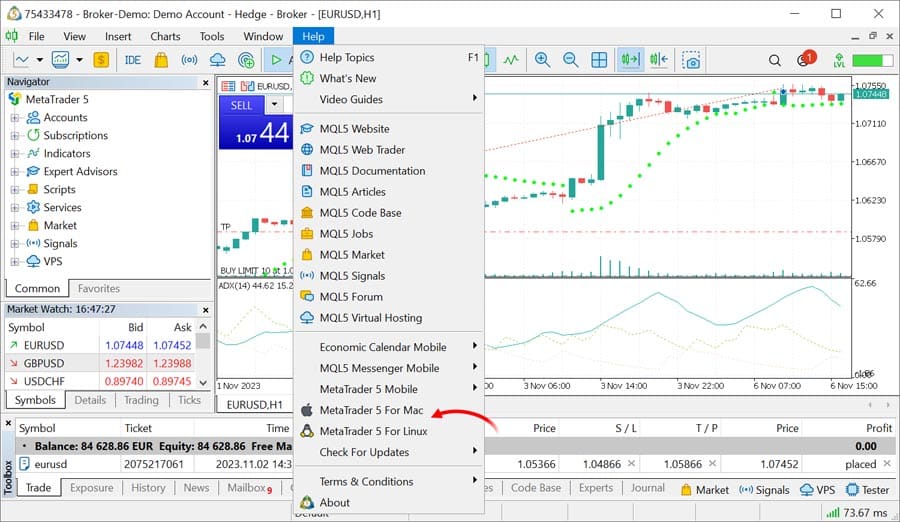

4) MetaTrader Strategy Tester

MetaTrader’s built-in strategy tester allows traders to test automated strategies using MQL4 or MQL5.

- Works within MT4 and MT5, making it familiar for existing users.

- Allows testing of automated trading strategies.

- Limited stock trading support compared to Tradewell.

5) QuantConnect

QuantConnect is an algorithmic trading platform that allows traders to develop and backtest strategies using programming languages.

- Supports multiple asset classes, including Forex, stocks, and crypto.

- Provides institutional-grade market data for in-depth analysis.

- Requires coding knowledge, making it less beginner-friendly.

Conclusion

If Tradewell doesn’t fully meet your needs, there are several great Tradewell alternatives. Forex Tester Online is the best option for traders looking for an easy-to-use, dedicated backtesting platform with precise market simulations. TradingView and NinjaTrader offer strong charting and strategy testing tools, while MetaTrader and QuantConnect provide more automation and algorithmic trading capabilities.

Choose the platform that best matches your trading style and goals.

FAQ

How does Tradewell’s backtesting speed compare with its alternatives?

Tradewell runs tests at a moderate pace. Some competitors test faster, which is one of the reasons to look for alternatives.

What asset classes does Tradewell cover compared to its alternatives?

Tradewell mainly handles stocks and futures. Many alternatives also cover Forex, crypto, and indices.

Can TradingView replace Tradewell?

TradingView Strategy Tester is useful for chart-based backtesting, but it lacks the deep historical simulations and execution control found in dedicated platforms like Forex Tester Online or NinjaTrader.

Does Tradewell support automated trading, and how do its alternatives compare?

Tradewell (as well as Forex Tester Online and many other tools) focuses on testing strategies. However, there are also some alternatives like QuantConnect support coding for automated trades.

Is MetaTrader a good alternative to Tradewell?

MetaTrader Strategy Tester is a strong option for traders who use MT4 or MT5 and want to backtest automated strategies. However, it has limited stock trading support and is more focused on Forex and CFDs.

Forex Tester Online

The best Tradewell alternative for high-level backtesting of your strategy and its data-driven optimization

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska