Market replay tools let you practice trading by replaying past market data. They’re perfect for testing strategies, improving timing, or simply getting familiar with market conditions without risking real money. Forex Tester Online, and other platforms offer this feature. Here’s a guide on what market replay is and how to use it.

What is Market Replay

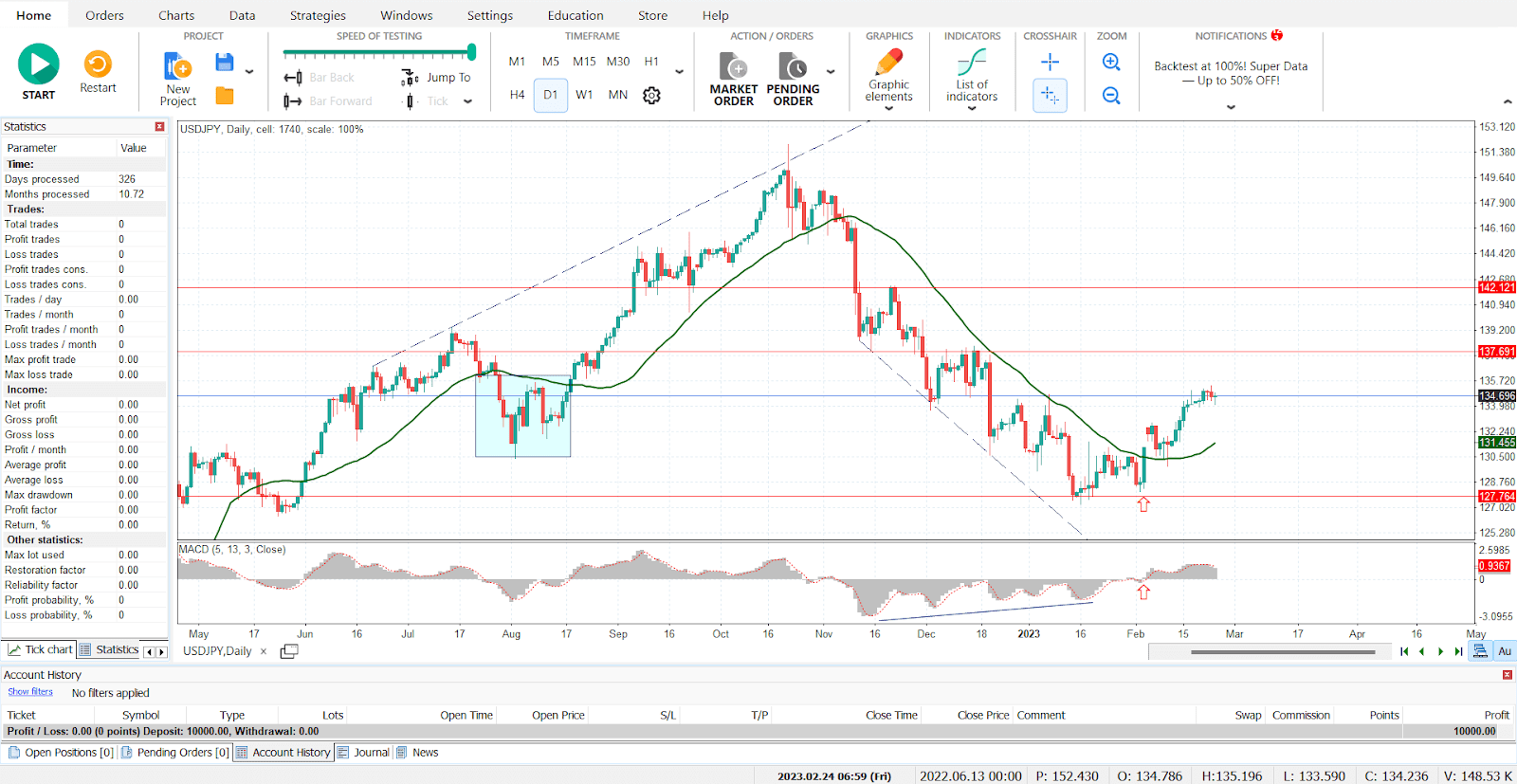

Market replay is a feature that lets you simulate past market conditions and practice trading as if it were happening in real-time. Instead of just analyzing historical charts, you actively place trades, adjust orders, and manage positions based on the market’s movement, just like in a live environment.

The key difference is you control the playback. You can rewind, fast forward, or slow down the price action, allowing you to focus on specific moments or trading setups. This is useful for testing strategies during volatile market conditions, like news events or sudden price swings, where timing is crucial.

Market replay tools use historical data to replicate real-world conditions. Most platforms offer tick data, which provides detailed price movements, making the experience more accurate. For example, Forex Tester Online uses tick data to simulate precise price fluctuations, letting you practice your strategy exactly as if you were in the market.

Forex Tester Online provides tick data for 29 currency pairs, 7 commodities, 10 indices, 22 stocks, and 2 cryptocurrencies. And this list is constantly updated.

It’s like a flight simulator for traders, giving you the ability to practice without any real risk.

What Historical Data is Used

Market replay tools rely on historical data to recreate past market conditions. This data includes price movements, volume, and market depth from previous trading sessions. For accurate simulations, these tools typically use tick data, which records every price change in the market. This level of detail allows you to experience each moment as it happened, offering more precision compared to basic daily or hourly data.

The more granular the data, the more accurate your replay experience. Using tick data helps you practice strategies that require precise entry and exit points, giving you a more realistic feel of live trading

Platforms like Forex Tester and Forex Tester Online use high-quality historical data to offer better simulations.

Types of Historical Data

Market replay tools generally rely on two types of historical data: bar data and tick data.

- Bar Data: This type of data summarizes price action over a specific time frame (e.g., one-minute, hourly, or daily bars). It’s good for long-term trend analysis, but it lacks the precision needed for detailed strategy testing. If you’re practicing swing trading or want to replay a day’s worth of trading quickly, bar data can work. However, it’s not ideal for short-term scalping or highly reactive trading strategies.

- Tick Data: Tick data captures every single price movement, offering the most accurate replay. This is the data type used by Forex Tester and Forex Tester Online, making them more precise for traders who want to simulate real-time conditions. With tick data, you can trade as if you’re live in the market, practicing with the most realistic replay possible.

If you’re serious about improving your trading, using tools with tick data is the way to go. It allows you to fine-tune your strategies, making it ideal for day traders, scalpers, or anyone looking for a detailed market replay experience.

What Are Timestamps and How to Add Them

Timestamps in trading replay tools mark specific moments in the market. They help you track when an event occurred and allow you to jump back to that exact time during replay trading.

When using market replay software, timestamps are usually integrated into the replay function. For example, in TradingView’s replay mode, you can add a timestamp to any point in the chart replay and easily skip to it. This is useful for setting specific points where you want to analyze a trade setup.

Adding timestamps is simple. In Forex Tester, you simply click on a specific bar or price level, and the system adds the timestamp for you. This makes it easy to analyze key moments during your market replay trading session.

These timestamps are especially useful when reviewing your strategies after a paper trading replay session. They help identify the exact time where a decision was made, allowing you to refine your approach for future trades.

How to Use Market Replay: Step-by-Step Guide

Using a market replay tool is straightforward, but it can vary slightly depending on the platform. Here’s a simple guide to get started with trading replay on any platform, whether it’s Forex Tester, TradingView, or another replay trading simulator.

1. Select Your Trading Replay Tool

First, pick a trading replay tool that suits your needs. Forex Tester, TradingView, and FX Replay are good options. Make sure the tool offers accurate historical data — ideally tick data — for realistic replay trading.

2. Load Historical Data

Once you’ve selected your trading platform, load the historical data you want to replay. This can range from days to months of past data. Forex Tester and Forex Tester Online, for example, allow you to download tick data for various markets, ensuring precision during your replay session.

3. Choose a Time Period

Select the exact date and time you want to start replaying the market. You can replay trading charts from any point in time, whether you’re looking to practice on a specific day or replay an entire trading week. TradingView allows you to go back in time and simulate paper trading replay for specific periods with their “bar replay” feature.

4. Start the Replay

Hit play, and the trading simulator replay will begin. You can speed up, slow down, or pause the replay depending on how you want to analyze the market. Platforms like Forex Tester and TradingView offer flexible controls, letting you move through the chart at your own pace.

5. Place Trades

As the market replays, you can place trades in real time, just like live trading. This lets you practice executing strategies without risking real capital. Trading platforms with replay functionality, such as TradingView, also allow paper trading in replay mode, making it perfect for honing skills.

6. Analyze Results

After completing the replay session, review your trades and strategies. Timestamps help you pinpoint the exact moments you made decisions. Most replay trading simulators, like Forex Tester, will log your trades, giving you a full breakdown to analyze.

7. Repeat and Refine

Replay the same time period or try another one to practice different strategies. The more you use the trading replay simulator, the better you’ll get at reacting to market conditions.

By following these steps, you can turn replay trading into a daily routine to sharpen your skills.

Tools That Have Market Replay Feature

Market replay is a must-have for traders who want to practice and test strategies without risking real money. Below are four platforms with strong market replay functionality.

1. Forex Tester

Forex Tester is a well-known trading simulator built for Forex, but it also supports futures and stocks. With Forex Tester, you can test strategies using over 20 years of accurate historical data, including tick data, making it a precise tool for backtesting. It allows users to simulate trades at high speed, pause, or slow down the market to analyze price movements in real-time. You can also set custom stop-loss and take-profit levels while watching how the market reacts. Forex Tester is ideal for anyone looking to practice manual trading, especially beginners who need a solid trading replay tool to refine their skills.

However, now we have a newer, most advanced online trading simulator! Continue reading to learn more.

2. Forex Tester Online

Forex Tester Online is a browser-based version of Forex Tester, specifically designed for Forex traders who need portability and convenience. It provides advanced backtesting with tick data, offering a realistic market replay experience. The platform’s key advantage is its accessibility — you can run it on any device without installation.

It’s perfect for traders who switch between devices or want a lightweight option for quick, data-intensive backtests. While it’s focused on Forex, it provides the depth necessary for rigorous testing, allowing traders to fine-tune strategies without the risk of losing real money.

3. FX Replay

FX Replay offers market replay functionality that’s easy to use but has limitations. It’s fully online, making it accessible from any browser, but users have reported slow performance in recent years, which can be frustrating for more advanced traders. The platform allows you to backtest using tick data but lacks the ability to run automatic strategies or use custom algorithms. If you’re a beginner or intermediate trader looking for basic replay trading charts, FX Replay is sufficient.

However, as your trading grows more advanced, you might find its limited features and smaller historical data range a drawback.

4. TradingView

TradingView is primarily a charting platform, but its “bar replay” feature is widely used by traders to backtest strategies. It supports multiple markets, including Forex, stocks, and crypto, offering flexibility that Forex-specific platforms don’t. You can use TradingView for free with basic chart replay functions or upgrade for more advanced features. The platform also offers paper trading replay, letting you test strategies without risking real capital.

While it may not have the in-depth backtesting capabilities of Forex Tester or FX Replay, TradingView stands out for its ease of use and accessibility across different asset classes, making it a solid choice for traders who need a versatile tool.

We hope this helps. Good luck with your market replay analysis!

Forex Tester Online

Advanced trading replay simulator

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska