1. Benefits of algo strategies

Algorithmic strategies become more popular among traders and professional market participants. Algo strategies have a number of undisputed advantages that are important to use for building profitable trading on the Forex market and other stocks. What is an algo strategy?

Algo strategy is a trading algorithm to serve as a base for a program which is also known as a trading robot or an advisor. The given trading robot can analyze the market, make decisions of opening or closing deals, choose the volume for each deal, and control risks — all by itself. By some estimates, 80% of the deals are made by trading robots on modern markets. This means that nowadays there are mostly robots trade with other robots. And if a trader wants to be successful, they need to master algo trading.

Benefits, which algo trading opens for a trader:

- Formalization of a trading strategy. To write an algorithm of a trading strategy that may be later implemented in a program code, a trader needs to formalize all the rules of entering and exiting the market, money management, and risk management. Distinct formalization of the own trading system is the first step toward profitable trading, and trading with algo strategies obliges a trader to conduct such formalization.

- Quick testing of algo strategies on the history. To test any manual trading strategy, one has to spend pretty much time. To test an algo strategy, one needs a few minutes. Forex Tester runs algo strategies through automated backtesting, which doesn’t require either much time or extra effort from a trader.

- Optimizing the parameters of algo strategies. After getting the testing results, a trader can change, improve the parameters of their algo strategy, with the goal of increasing the profit and decreasing the risks. Forex Tester allows optimizing trading strategies by automatically choosing the most optimal parameters.

- Testing algo strategies on a big history period. Automated Forex backtesting of algo strategies can be conducted over a 10-year or 20-year period. Which is basically impossible for a manual trading strategy. In this way, you can see how the algo strategy has been conducting during various periods of world history. Forex Tester allows testing an algo strategy from the year 2001 on qualitative historical data.

- Building algo strategies portfolios. One trader may trade, control the trading of dozens of algo strategies with which a portfolio can be built. Any portfolio will trade more steadily and effectively than a separate algo strategy.

Algo strategies give a trader undisputed benefits. A successful trader’s arsenal should include both algo strategies and manual strategies for a bigger diversity and a more steady profit on the trading account. But algo strategies are the future so if a trader wants to keep up with the times then it is important to develop in such direction.

2. How to test algo strategies

Let’s explore several steps which help a trader to create and test an algo strategy:

- Algorithm. You should create an algorithm of your strategy and define the trading system, money management, and risk management.

- Robot. Order the development of a trading robot according to your algorithm. The 4xDEV company can easily and precisely construct a trading advisor by your algorithm. Also, you can create a trading advisor by yourself, even with no programming skills, with the help of Easy Forex Builder.

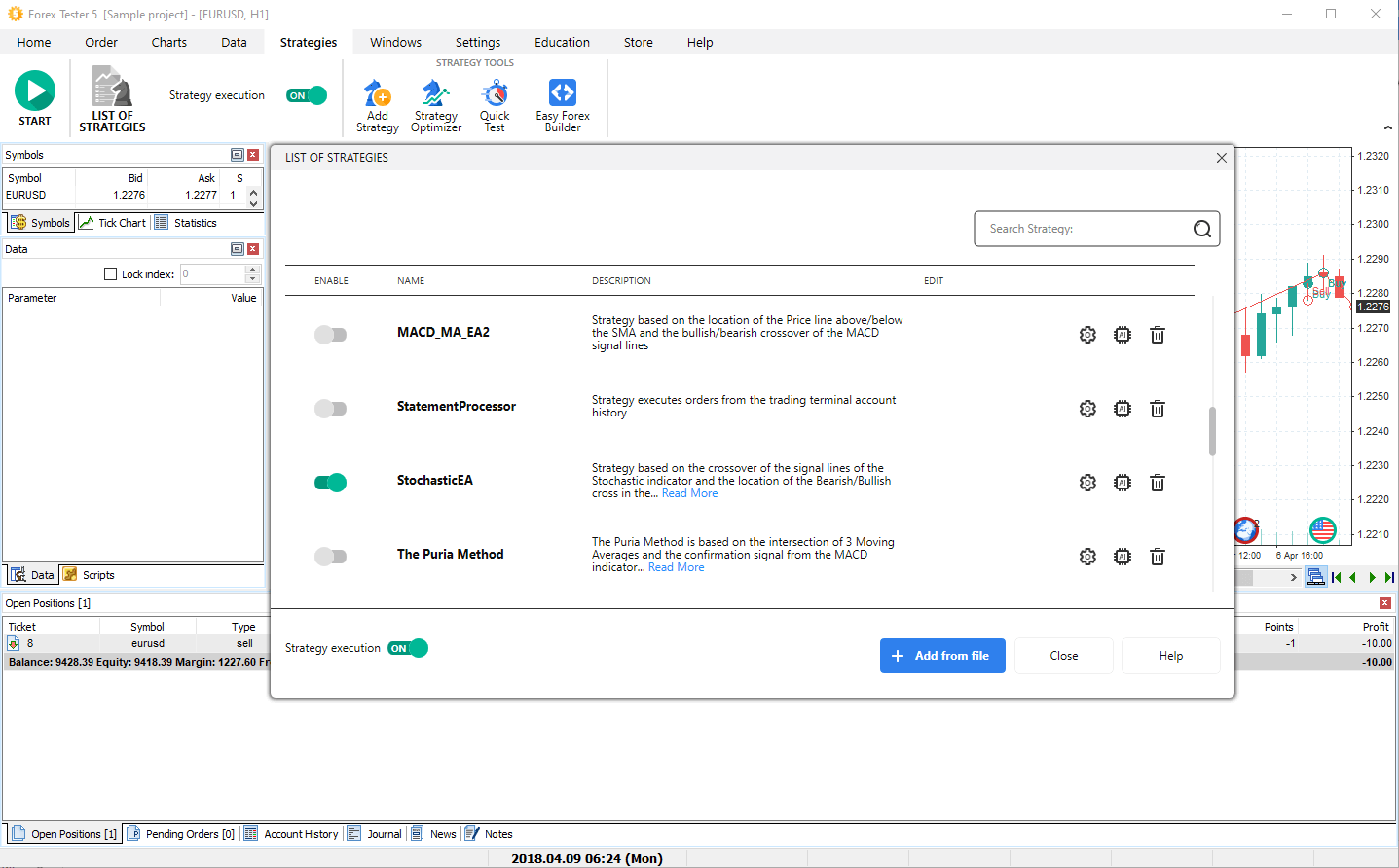

- Initial testing. An advisor may be imported in Forex Tester by choosing “Testing - Strategies list” in the menu:

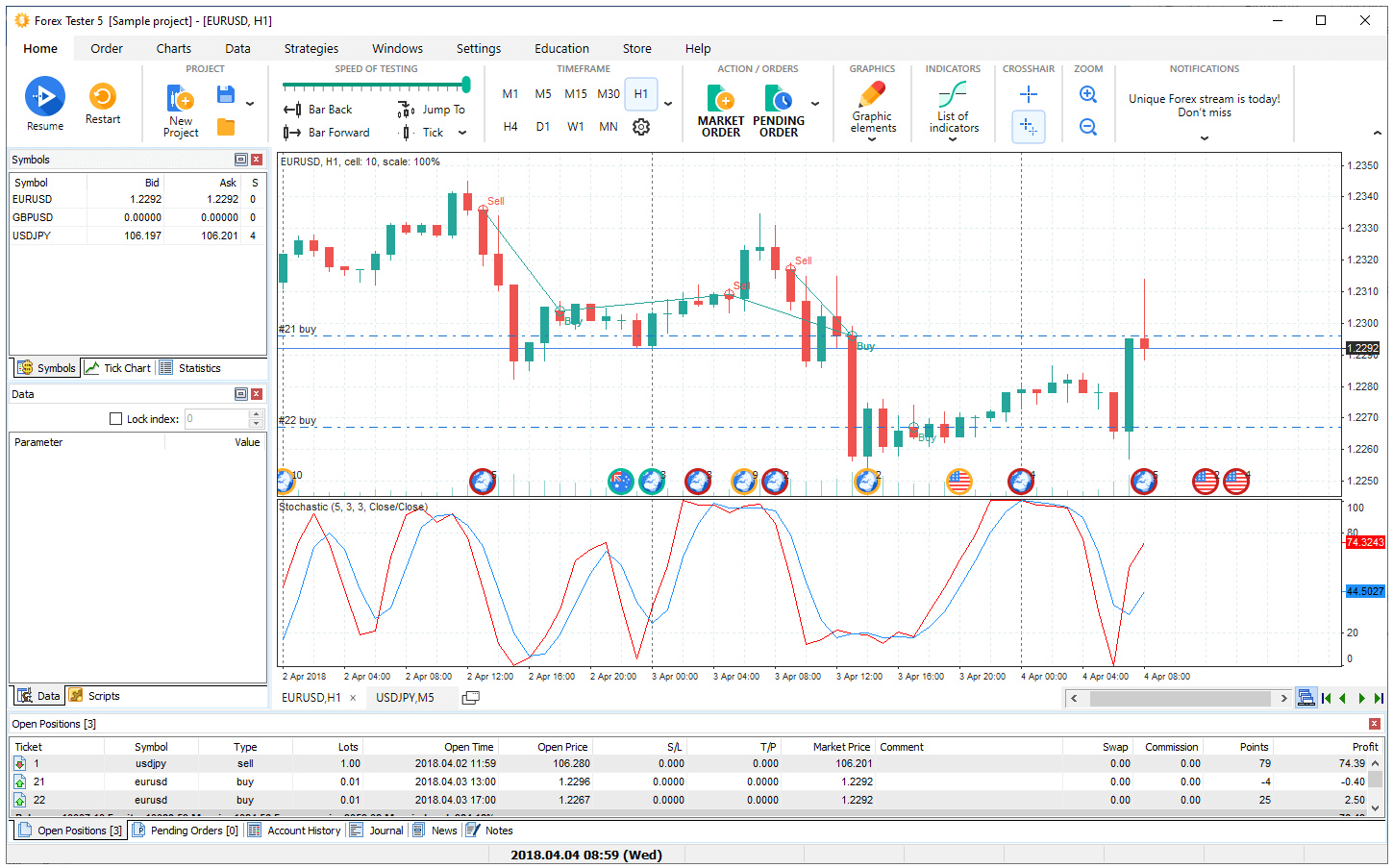

And after that, test it on a little historical area of 1-2 years. This preliminary testing will show you how the strategy has been conducting on the current market. After this, you can try to improve the profit-to-risk rate of the trading strategy with the help of optimization. - Stages of testing and optimizing. The whole available period of historical data may be separated into two areas. In the first area, you can conduct the optimization of your advisor choosing the best parameters. In the second historical area, you can make a confirmatory testing of an advisor, thereby checking it for the market trading, which the program ‘did not see’ during the optimization.

- Optimization. Improvement of the trading parameters of an advisor by the method of choosing the most suitable variables is a lengthy process. But with the help of special software, this process can be greatly eased and accelerated. As a result of optimization, a trader gets the report with the advisor parameters and the resulting profit from the given set of parameters. For further work, you should choose that set of parameters, which is not extremely profitable as it can be connected with some specific market events that can happen rarely. It’s better to choose sets of advisor parameters that take the middle of the selection, which means they are medium as for profitability among the other options.

-

Testing on the confirmatory stage. This is the check of the optimization quality. It is important to test the found parameters after the optimization in the new area of the market, with this approach, real trading of the advisor may be modeled. Also, in Forex Tester you can follow the already optimized advisor trading in different areas of the market.

All the deals made by the advisor will be displayed during the test.

For example. You have an available area with historical data from 2001 to 2020. Then you can conduct optimization on the period from 2001 to 2019, to use the longest historical period with crisis events on the world market for the strategy optimization. And the year 2020 may be used as the confirmatory period for testing by trading on the historical period that wasn’t used during the optimization. - Checking the testing results. If the advisor traded positively during the confirmatory period and its profitability is satisfying then it can be included in the trading portfolio. It is also important to check if the deal quantity in the test is enough to objectively estimate the advisor’s work. Good if there will be more than a thousand deals in history. The desirable profit-to-risk rate is higher than 2. If you are not alright with any parameters, then the optimization should be started all over, taking the new historical areas.

Using algo strategies in trading gives you huge advantages. Try test a trading advisor in Forex Tester right away! Download the free demo.

Want to dive into the full testing possibilities right away? Buy Forex Tester here.