1. Myths about trading stocks

With the progress of modern technologies, more and more people come to the world’s stock markets striving to earn money or to save them from inflation. Why the density of stock traders keeps growing?

- Many companies release mobile apps which ease access to financial markets and you can start trading stocks directly from your phone within a few clicks.

- Crisis events in the world economy encourage people to search for additional sources of income.

- A huge infusion of money supply into the economy of various countries scares people with possible inflation and makes them consider stock markets as a way to save their savings.

But everything is not as easy as it may look. Let’s look at some stock trading myths in a detail:

- Having a mobile app on your phone is enough to trade stocks at a profit. This is more a myth than the truth, as you shall need professional software and the knowledge using it to profitably trade or investing in stocks.

- Investing in stocks is easy — you need just to buy. Investing is easy only on paper. In reality, looking at historical data you can see that having bought stocks in the year 2000, your stock portfolio would gain a profit only in 2014. What beginner investors are willing to be facing losses for 14 years straight?

- Trading stocks is easy and you can begin right with the real account. Easily and quickly you can only lose, not earn. Trading stocks in a profit requires learning.

2. How to check the effectiveness of your own trading system for stock trading?

Before going into stock trading or investing, it’s important to understand the following idea:

Check everything!!!

Don’t trust ads, but figure out how to trade stocks yourself. But to check, you need to create your own trading approach which should include:

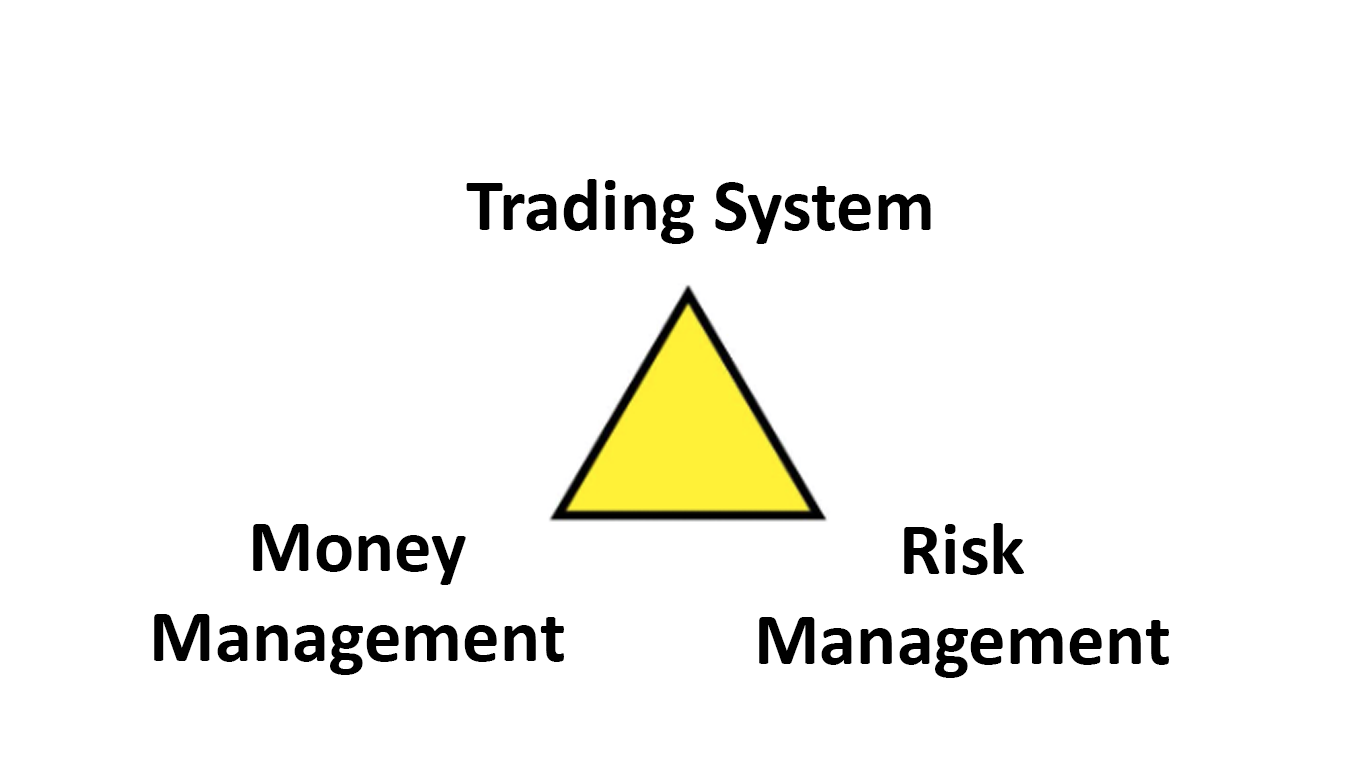

- Trading System. It is a set of rules, an algorithm of actions on which your trading will be based. It is preferable that the trading system is clearly formalized, written on paper, or on a computer. This is needed to spare your time thinking of the next move on the live moving market. The trading system must give unambiguous answers — to buy, to sell, or to do nothing. Such a system should give a clue on:

- Where to enter the market?

- Where to exit the market?

- With what instruments do you plan to trade?

- What time period — hour, day, week, month — will you analyze?

-

Money management. The second most important section for successful trading. Money management is an algorithm of volume selection for trading. If trading with too big volume in one deal regarding the deposit, then the trading account will face big risk. If trading with too small volume, then most of the capital will be not used, and the profit percentage will be low. Money management helps to choose the optimal volume for each deal under the current trading system. Money management answers the question:

- With what volume you will enter the market on each deal?

-

Risk management. The third, yet not less important, section is risk management. As the name suggests, this section stands for risks during trading. Long-term success in trading or investing is impossible without strict risk control. Before pressing the buttons on the trading terminal, a trader or an investor must decide what risk they allow for themselves. When the deals have been opened and the psychological impact from profits and losses has appeared, it can be hard to make adequate decisions. You can think of the following questions:

- What risk per one deal is acceptable for you?

- What is the highest dropdown on your account that you can bear with?

The trading system, money management, risk management — these are three integral elements of successful trading or investing, like the three corners in a triangle.

Neglecting any of these corners may be fatal.

So, if you have all the questions related to the trading system, money management and risk management answered, maybe it’s high time to start trading? NO.

Your trading or investing approach must be:

TESTED ON HISTORY!!!

3. Advantages of testing your trading systems for stock trading

Why you must test trading and investing approaches on history? Stock backtesting has a number of benefits:

- Saving money. Stock backtesting software helps you to save huge money.

Beginner traders very often lay their hopes for their own systems and start trading under them with no testing. Historical backtesting will save you thousands of dollars and you will simply not trade on a loss-making system.

- Saving time. Trading on an untested trading system, you can lose months or even years trying to refine it. But if backtest the stock strategy immediately, you can see if it is not promising in a few hours and save yourself years’ worth of time and avoid that disappointment.

- Saving nerves and health. Being in a drawdown for 14 years straight for an investor or 1 year for a trader is not a good perspective to have a steady mental state. Trading in a loss, a trader may stress out too much, fall into depression, and thus destroying their own health. Thanks to stock market backtesting, a trader has the opportunity to make their losses solely virtual, not affecting their real accounts, in a Forex trading simulator, like Forex Tester, which is not painful at all. On the contrary, it gives the possibility to train your own nerve on virtual money.

4. Conclusions. What to do in reality?

How to trade stocks in a profit:

- treat stock trading or investing seriously; this process is not easy and it requires both time and attention;

- describe your trading approach for stock trading;

- test your trading system on history;

- use professional trading software, like Forex Tester; in this software, you can test your trading system on stocks from various markets — AAPL, ABI, AC, AMZN, BARC, GOOG, LLOY, NXT;

- backtesting will save you MONEY, TIME, and NERVES.

Want to try it yourself? Download the free demo.

Want to dive into the full testing possibilities right away? Buy Forex Tester here.