The ORB in trading targets the day’s first move. We map the opening range, then trade the breakout as volatility expands. ORB trading is popular in intraday markets because the open sets direction and offers clean risk. You’ll learn setup rules, entries and exits, risk control, and advanced tips. We also show how trading the ORB in a simulator builds confidence.

What Is ORB in Trading?

Opening Range Breakout (or just ORB) is a simple idea: define the day’s first range, then trade the break. The opening range is the highest high and lowest low made in the first block of time after the session opens – often 5, 15, or 30 minutes. Many traders use the first 1-, 3-, or 5-minute candle as well.

Why it matters: the open packs orders from overnight. Liquidity jumps, spreads tighten, and price can move fast. First comes uncertainty as buyers and sellers test levels. Then one side wins and a directional move often starts. ORB trading tries to catch that push.

Where ORB in trading works well:

- Stocks and index futures at the New York open (high volume, clear gaps).

- Forex around London and New York session starts when flows increase.

- Commodities and crypto when you define a “session” (e.g., futures pit open, or 00:00 UTC for crypto) to anchor the range.

In short, trading the ORB means you mark the first range, wait, and act only when price breaks above or below it with confirmation. It’s popular because risk is defined by the range, and the reward can be the day’s early trend. This is the core of ORB range trading and the base for many intraday playbooks.

How Does the ORB Strategy Work?

ORB trading follows a clear routine. Mark the opening range. Wait for price to leave it. Trade the break with rules.

Step 1 – Set the opening window

Pick a window that fits your market and speed: 5, 15, or 30 minutes are common. On 1-, 3-, or 5-minute charts, draw the high and low of that window. That box is your opening range.

Step 2 – Define bullish vs. bearish setups

- Bullish ORB: price closes above the range high.

- Bearish ORB: price closes below the range low.

Wicks alone are not enough. Wait for a candle close to reduce fake breaks.

Step 3 – Choose your timeframe

- Fast execution: 1–3 min charts (more signals, more noise).

- Balanced: 5 min (popular for stocks, index futures, and forex).

- Selective: 15–30 min (fewer trades, cleaner moves).

Step 4 – Plan entries

Enter on the breakout close or on a retest of the broken level. The retest often gives tighter risk. Use stop orders if you prefer automation when trading the ORB.

Step 5 – Place the stop

Set the stop on the other side of the range (or 0.5–1.0× range inside, if you scale in). Your risk per trade is tied to the range size. Wider range = smaller position.

Step 6 – Manage the trade

The first target can be 1× the range. Next targets can be 2× the range or a nearby session level (pre-market high/low, previous day’s high/low, VWAP). Trail the stop behind new swing points if momentum stays strong.

Notes on time and sessions

The ORB is session-driven. For stocks, use the New York open. For forex, many traders use London or New York opens. For crypto, define a daily anchor (e.g., 00:00 UTC) to keep ORB range trading consistent.

ORB Indicators

Good ORB trading needs clean filters. Use tools that confirm trading the ORB instead of guessing.

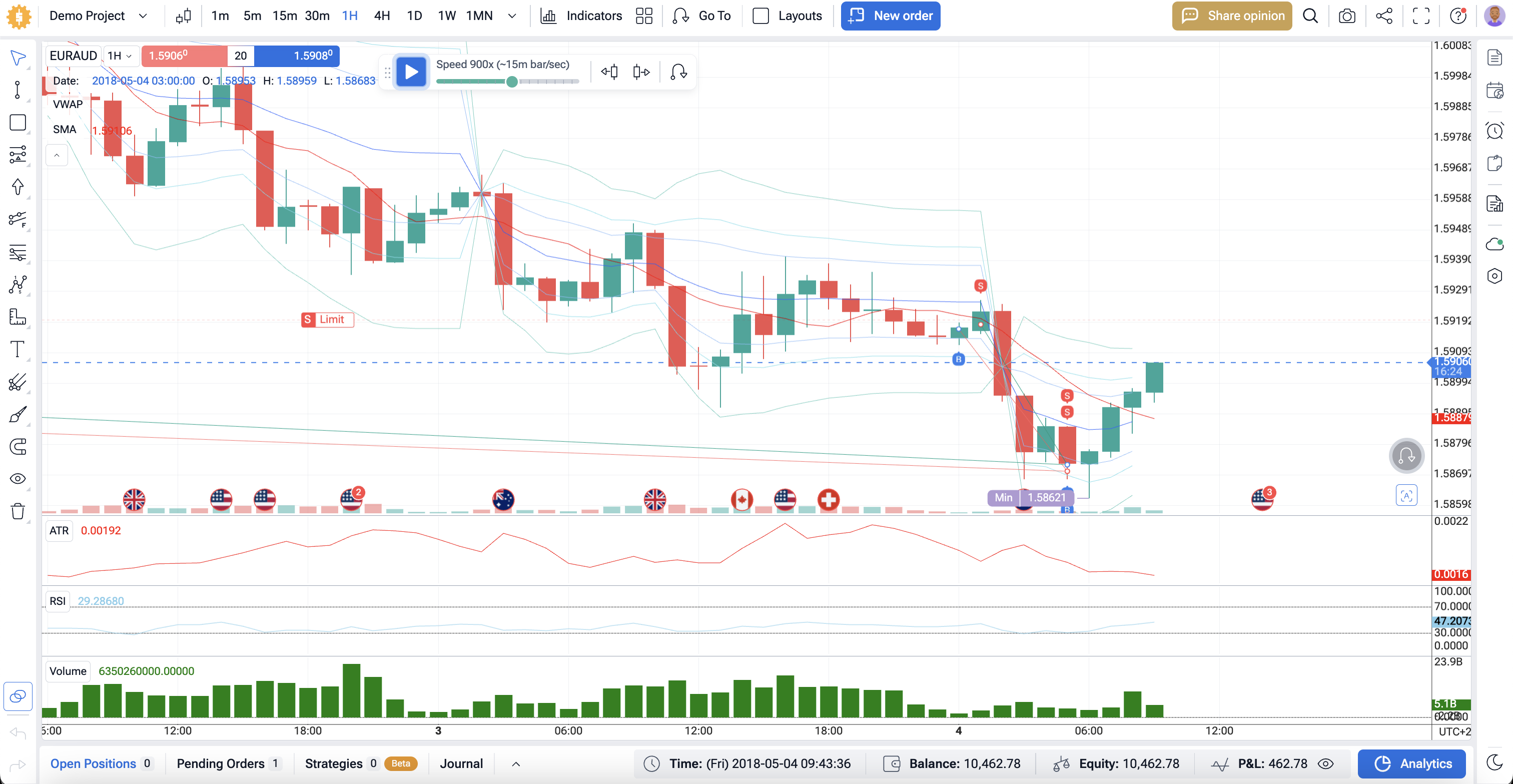

All required indicators applied to a Forex Tester Online chart

Volume confirmation

Breakouts work best with volume. Look for relative volume (RVOL) above 1.5 during the break. A candle that closes beyond the range with higher volume than the prior 5–10 bars is a stronger signal. Weak volume = higher fake-out risk in ORB range trading.

VWAP

VWAP is your intraday anchor.

- Longs: price above VWAP and breaking the range high.

- Shorts: price below VWAP and breaking the range low.

A retest of VWAP after the break can be a second entry.

Moving averages

Use a fast moving average like the 20-EMA to read trend. Slope up and price above it favors a bullish ORB. Slope down favors a bearish ORB. Flat MA warns of chop.

RSI

RSI helps with momentum and mean reversion. On a fresh break, RSI pushing through 55–60 supports longs; under 45 supports shorts. If RSI is already >70 or <30, consider a pullback entry instead of chasing.

ATR and range filters

Measure the opening range size with ATR. If the box is very wide, reduce size or skip. Your stop and exit distances come from this box, so risk grows with range.

Market structure (smart levels)

Mark yesterday’s high/low, overnight high/low, pre-market levels, and session support/resistance. A break that also clears one of these levels tends to run further. Rejections at those levels warn of traps.

Bollinger Bands (optional)

A break that also steps outside a band can show strong impulse. A quick snap back inside the band warns of a failed ORB.

Putting it together (rules idea)

Bullish ORB = close above range high and RVOL > 1.5 and price above VWAP and 20-EMA rising.

Bearish ORB = mirror rules.

These simple filters also fit an ORB trading bot if you automate ORB in trading.

How to Trade Opening Range Breakout

Trading the ORB is simple on paper. We define the box, wait for a clean break, and manage risk. Here is a clear plan you can apply to ORB trading on any liquid market.

Note: don’t risk real money before you backtest your strategy!

Entry rules

- Wait for a candle to close outside the opening range.

- Bullish ORB: close above the range high with higher volume, price above VWAP, and a rising 20-EMA.

- Bearish ORB: close below the range low, volume pickup, price under VWAP, 20-EMA sloping down.

- Optional: use a stop order a tick beyond the break, or trade a quick retest of the broken level. Avoid chasing long wicks.

Stop-loss placement

- Standard: a few ticks inside the range (under the high for longs, above the low for shorts).

- ATR-based: 0.5–1.0 ATR from entry, if the range is very tight.

- Time stop: if price re-enters the box and sits there for N bars, exit. Failed ORBs tend to reverse fast.

Profit targets and exits

- Target 1: the range height projected from the breakout (measured move).

- Target 2: next support/resistance (prior day high/low, overnight levels).

- Trail: below/above the 9/20-EMA or VWAP after Target 1.

- Aim for at least 1.5R–2R. If the box is wide, cut size so the stop keeps R sensible.

Risk and trade management

- One trade per side per session is a good rule for trading the ORB.

- Skip breaks that fire into nearby major levels.

- News at the open? Trade smaller or stand aside.

- If a candle closes back inside the box after entry, consider a quick exit. That’s a common failure tell in ORB range trading.

Example: bullish ORB (stocks, 5-min)

- Opening range: 9:30–9:35. High 101.20, low 99.80 (range = 1.40).

- 9:41 bar closes at 101.32, RVOL 1.8, price above VWAP, 20-EMA rising.

- Entry long: stop order at 101.34.

- Stop: 101.10 (back inside the range).

- Target 1: 102.74 (add 1.40 to 101.34 ≈ measured move).

- After T1 hits, trail under 20-EMA. Exit on close under the EMA or near the next resistance.

Example: bearish ORB (forex, London 15-min)

- Opening range: 08:00–08:15 London. High 1.2755, low 1.2728.

- Break bar closes 1.2723, below VWAP, RVOL strong.

- Entry short 1.2721. Stop 1.2732 (inside the box).

- Target 1: range height (27 pips) → 1.2694.

- Trail above 9-EMA until exit or NY session shift.

Automation tip

If you run an ORB trading bot, codify: opening window, breakout close filter, RVOL threshold, VWAP/EMA alignment, one-trade-per-side rule, ATR-scaled stops, and session lockout around major news. This keeps ORB in trading consistent and repeatable.

Also read: Algorithmic Forex Trading Guide

ORB Trading Strategies

Multi-timeframe ORB. Define the opening range on 15-min. Trigger on 5-min or 1-min. This keeps the box stable and the entry precise. It works well for trading the ORB on stocks and forex.

Retest ORB. Wait for a close outside the box, then buy/sell the first pullback to the broken edge. Add VWAP and moving average slope as a trend filter. This cuts false breaks in ORB range trading.

Session-aware ORB. Trade the London open on majors or the New York cash open on U.S. names. Respect overnight high/low and pre-market levels. Avoid big news minutes.

Volatility filter. Only trade when the box is not tiny. Use ADR or ATR. If the range is too small, expect noise; if too big, size down.

VWAP + momentum stack. For longs, price above VWAP, 20-EMA rising, RSI > 55, and volume up. Reverse for shorts. This stack keeps ORB in trading aligned with flow.

Gap play. Gap-and-go favors continuation ORBs; gap-and-fade favors retests. Read tape vs VWAP to decide.

ORB Strategy Backtest

Backtesting tells you if your rules make sense before money is at risk. Pick one asset, one session, one opening window, and test it clean.

Define the window (e.g., 5, 15, or 30 minutes). Mark the high/low. Codify entries: close outside the box, RVOL > 1.5, VWAP alignment. Codify exits: stop just inside the range or 0.7–1.0 ATR, target = range height, then trail with 9/20-EMA or VWAP.

Test at least 200 trades across different months. Track win rate, average R, expectancy, max drawdown, and time-in-trade. Add costs: spread, slippage, and commissions. Split the data: build on one period, verify on a later period. If results swing wildly across assets or sessions, tighten filters or trade less.

Do not curve-fit. Change one parameter at a time. Keep settings that hold up across quiet, normal, and high-vol days. Write the final rules so you can execute them fast.

Using Forex Tester Online for Backtesting

Forex Tester Online helps traders quickly turn ideas into measurable results. Main features:

✅ 20+ years of tick data

✅ Integrated news feed

✅ Mystery Mode to hide future bars

✅ Custom technical indicators

✅ Prebuilt market scenarios

✅ Detailed analytics and latency logs

✅ Automation with Python or no-code rules

Running a strategy without backtesting is risky. Use Forex Tester Online to verify your idea on 21+ years of historical data before trading it live.

Step-by-step Guide to Backtest the ORB Trading Strategy via FTO

Step-by-step: testing in FTO

1) Get access

Go to the FTO website, click Get Started, create an account, pick a plan, and sign in.

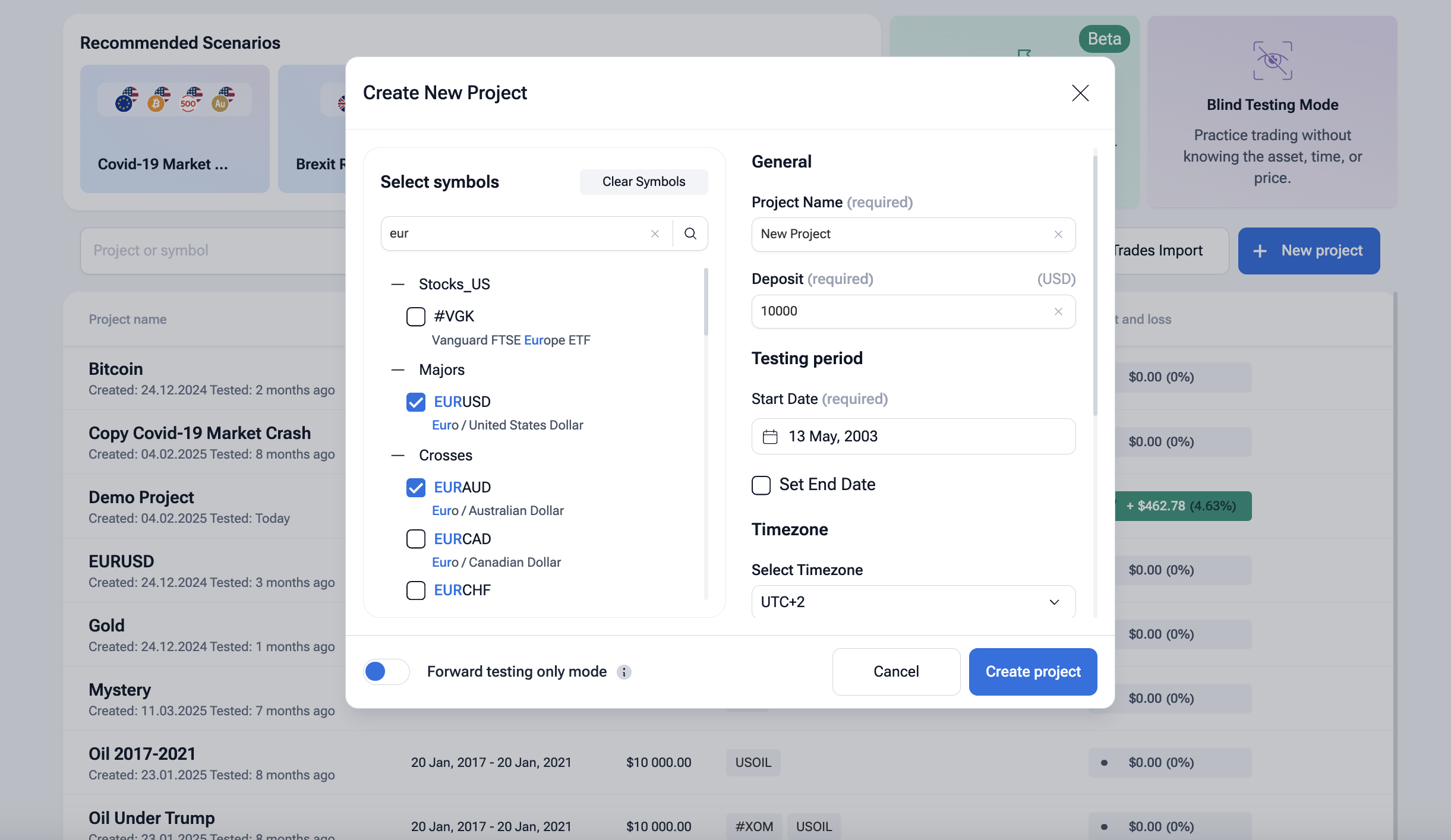

2) Create a project

Click + New Project. Select symbols (Forex majors, US stocks, crypto, or indices). Set start/end dates and your time zone.

Tip: choose the session you will trade the ORB on (e.g., London, New York, or the exchange open for stocks). This matters for ORB range trading.

3) Add indicators

Open Indicators.

- Add Session/Opening markers (or vertical lines at the open).

- Add VWAP (bias), 9/20 EMA (trend filter), RSI, ATR, and Volume (for relative volume checks).

Save this as a template to reuse on any symbol.

4) Define your trading rules

Write clear, simple rules in a note. No guessing mid-test.

Set session rules too: max one trade per side in the first hour, fixed daily loss cap, and stand down after three whipsaws. This keeps trading the ORB disciplined.

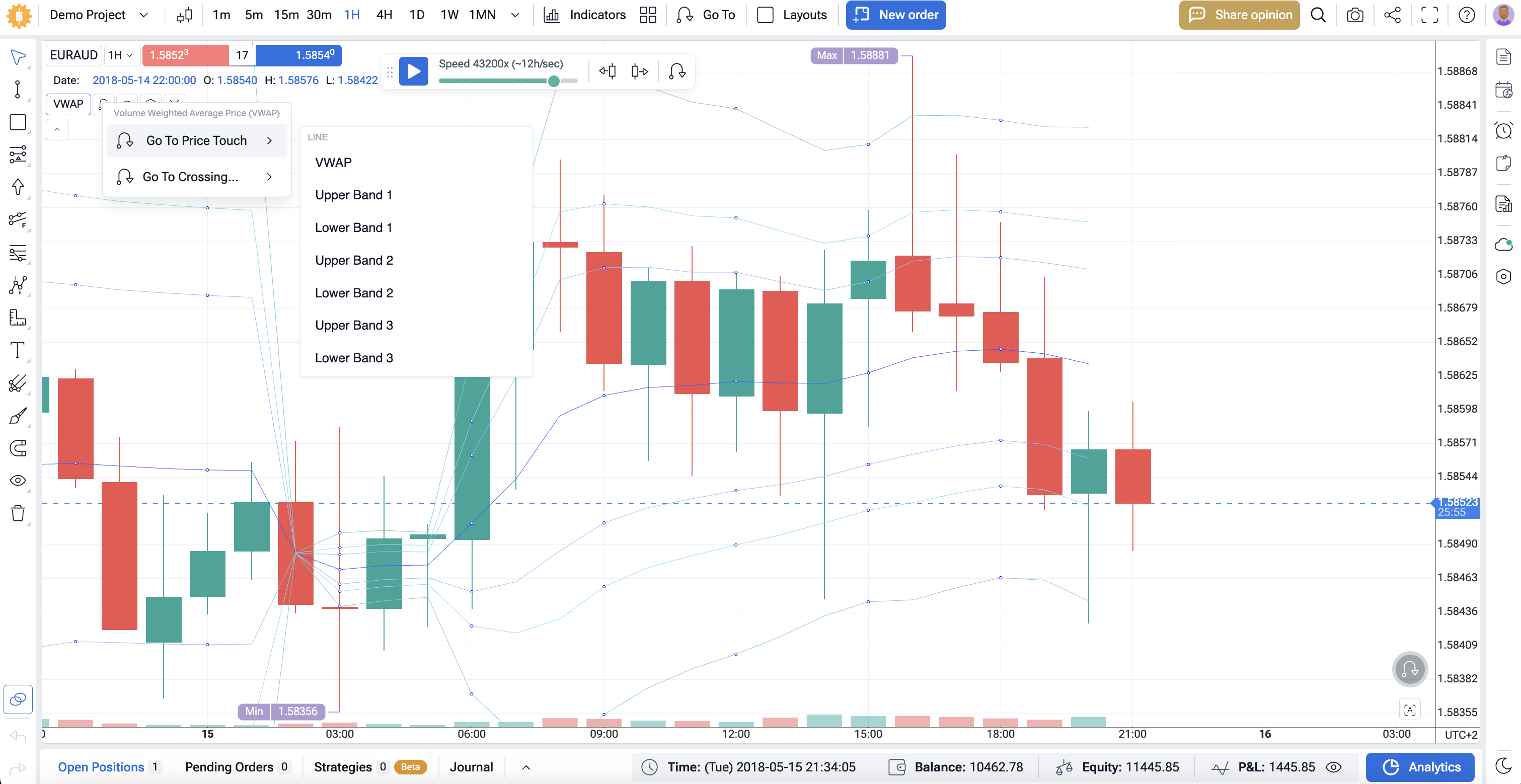

5) Replay and trade

Click Play to start the simulation. Use the speed slider for bar-by-bar or fast ticks. Place orders with New Order as your signal appears.

Use Jump To to move between sessions and news days.

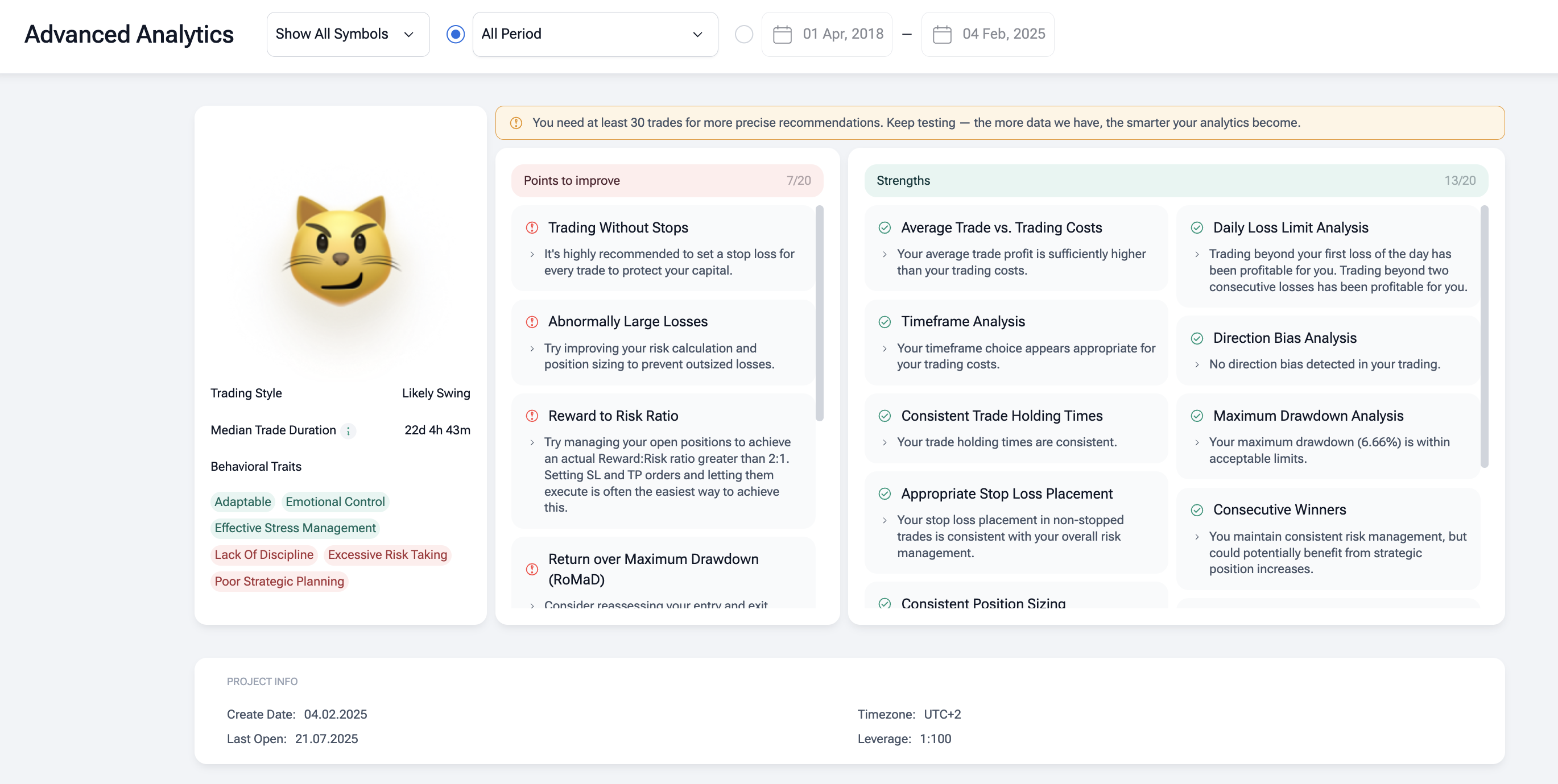

6) Review analytics

Open Analytics after each run.

Note win rate, average trade, and drawdown.

Check MAE/MFE to see if stops are too tight or too loose.

The Advanced Analytics on FTO will also show your strengths and points to improve which is very useful to gain skills.

Tag results by time of day (first hour, lunch, power hour). VWAP acts differently in each window. Export trades to CSV and review “above vs below ” outcomes.

7) Iterate and refine

Change one variable at a time: box length, volume threshold, stop model, or target logic. Retest across symbols and months.

Conclusion

Opening Range Breakout trading captures the day’s first clean move. We define the box, wait for a confirmed break, set the stop near the opposite edge, and let price work. Discipline wins here: one plan, fixed risk, no chasing. Backtest your ORB trading rules in Forex Tester Online, review win rate and drawdowns, then take them to demo. When the data holds, consider scripting an ORB trading bot to keep execution strict. Trading the ORB is simple, but only if you keep the rules simple and protect capital every session.

Disclaimer

Trading involves risk. The indicators in this article are for educational purposes only and are not financial advice. Past performance does not guarantee future results. Always test strategies before using real money.

FAQ

What is the best timeframe for ORB trading?

Common windows are 5, 15, or 30 minutes to define the opening range. Many traders mark the box on 15-min and trigger entries on 1–5-min for precision. Pick one and stick to it; consistency matters for ORB range trading.

Can ORB work in all asset classes?

Yes. ORB works in stocks, futures, forex, and crypto. It shines when a session open creates fresh volatility. For 24/5 markets, anchor to key sessions (London or New York) to define the opening range.

How do I avoid fake breakouts in ORB trading?

Wait for a candle close outside the box. Add volume filters (RVOL > 1.5), check VWAP direction, and avoid tiny ranges. A retest entry at the broken edge often reduces whipsaw when trading ORB setups.

Which indicators pair best with ORB?

VWAP for bias, a short moving average (9/20-EMA) for trend, RSI for momentum, and ATR for stop and target sizing. This stack helps filter weak breaks when trading the ORB.

Is ORB suitable for beginners?

Yes – if you keep risks small and rules clear. Backtest first in Forex Tester Online, then demo trade. One trade per side, fixed stop, fixed target or trail. Log every session and refine.

Forex Tester Online

Backtest and refine your ORB trading strategy via FTO

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska