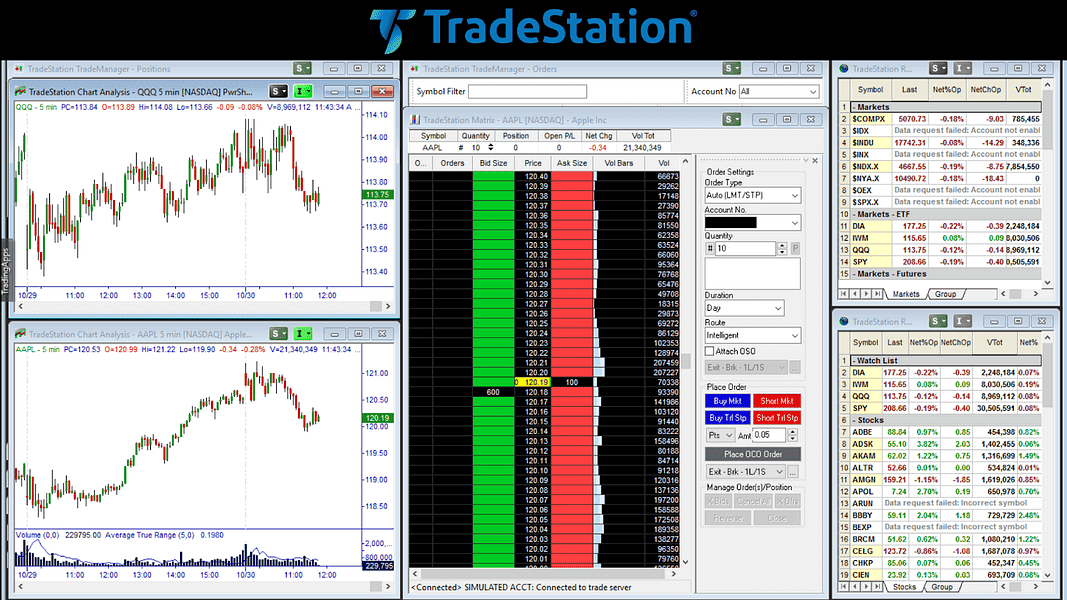

You’ve probably heard traders raving about TradeStation’s powerful backtesting engine and EasyLanguage programming. And while the platform dominates certain segments of the market, several TradeStation competitors have emerged offering unique advantages for different types of traders.

And they’re right — TradeStation has earned its reputation as a professional-grade platform that institutional traders swear by. The ability to develop automated strategies, test them on historical data, and execute trades all in one place made it a go-to choice for serious traders.

Why Look for a TradeStation Alternative?

While TradeStation offers robust features, some traders find themselves exploring alternatives for several specific reasons:

TradeStation Platform Access & Costs

TradeStation’s pricing model offers several routes to access the platform — you can either pay a monthly platform fee of around $150, maintain a sufficient brokerage account balance (over $1,000), or commit to regular trading activity where your commissions help waive the platform fees. While these options provide flexibility, some traders prefer platforms with simpler pricing structures.

Difficulties With TradeStation Setup and Usage

Despite its powerful capabilities, TradeStation’s interface has a steeper learning curve. The platform’s search functionality and overall navigation can be challenging for new users. The installation process can be complex, and Mac users need additional setup since there’s no native version available.

Platform Architecture

While TradeStation offers excellent customizability for charts and workspaces, plus a diverse range of order types, you’re tied to using their brokerage services. Some traders prefer platforms that can connect to their broker of choice.

Programming Requirements

Though EasyLanguage is powerful for developing custom indicators and automated strategies, traders often look for solutions that offer similar capabilities without requiring extensive programming knowledge.

The good news is that modern alternatives have emerged that provide professional-grade features while addressing these specific needs, often with more intuitive interfaces for different types of traders.

Top TradeStation Alternatives in 2026

Let’s examine the leading TradeStation competitors that have gained significant market share by addressing specific trader needs.

1. Forex Tester Online (FTO) — Best for Advanced Backtesting

When it comes to pure backtesting capabilities, Forex Tester Online (FTO) stands out as the leading TradeStation alternative. While TradeStation offers backtesting as part of its full brokerage platform, FTO focuses exclusively on strategy testing and refinement, making it a more specialized and cost-effective choice for traders.

Key Advantages:

- Purpose-built for backtesting with tick-by-tick replay accuracy

- Comprehensive preset system allowing traders to save chart templates across projects and share them

- Enhanced Jump-To navigation that doubles backtesting efficiency, letting users instantly navigate to specific price points, sessions, order executions, breakeven points, news events, and drawing tools

- Advanced trading condition customization with configurable swap rates, commissions, and spreads

- Specialized indicators for ICT and SMC traders

- Real-time trading mode with negative balance protection and margin call verification

- Built-in educational tools including homework/assignments capabilities

- Customizable hotkeys for streamlined workflow

- Clean, modern interface designed specifically for testing trading strategies

- No brokerage account required — focus purely on strategy development

- Lifetime access available at $250 (comparable to just over a month of TradeStation fees)

FTO’s development team maintains a tight feature release schedule. Advanced order window, smart chart navigation for instant jumping to where price touches specific chart drawings, specialized indicators for ICT and SMC traders, and expanded hotkey functionality – that’s just a short list of recent features that complement the initially well-thought-out platform for precise backtesting. The platform’s roadmap is largely driven by user feedback, with highly-requested features like no-code strategy automation currently in development.

The platform combines practical tools like eyedropper functionality for precise price selection, barback capability for retesting specific moments, and in-project analytics with sophisticated features like order filtering and direct customer support through live chat integrated directly in the interface. For traders serious about developing and refining their strategies, FTO offers unmatched value with its lifetime license model versus the recurring costs of most alternatives.

2. NinjaTrader — Comprehensive Trading Suite

NinjaTrader offers a comprehensive alternative to TradeStation, particularly popular among futures traders. While it offers its own brokerage service, the platform can be used independently with supported brokers.

Key Advantages:

- Free version available for basic charting and analysis

- Popular among futures traders

- NinjaScript for custom indicator development

- Extensive educational resources

- Works with multiple supported brokers

While NinjaTrader provides solid functionality, traders should consider several factors before switching. The full platform capabilities require a significant investment, with a lifetime license costing around $1,000. Those coming from other platforms may need time to adapt to NinjaScript programming, and the choice of compatible brokers is more limited compared to some other platforms. However, many traders find these tradeoffs acceptable given the platform’s robust features and established reputation in the futures trading community.

3. TradingView — Charting and Analysis Alternative

TradingView offers a different approach to trading platform functionality compared to TradeStation. Its web-based platform has gained popularity primarily due to its accessible charting tools and social features.

Key Advantages:

- Browser-based platform with no installation required

- Multiple pricing tiers including a free plan

- Integration options with various brokers

- Community-driven indicator library

- Pine Script for custom indicators

While TradingView does include backtesting capabilities through Pine Script, these are more basic compared to TradeStation or specialized platforms like FTO. However, for traders focused primarily on technical analysis and chart patterns, TradingView provides a practical alternative with lower entry barriers.

4. Sierra Chart — Advanced Desktop Trading Platform

For traders seeking a robust desktop alternative to TradeStation, Sierra Chart offers comprehensive trading and analysis capabilities with a focus on performance.

Key Advantages:

- Advanced real-time trading and market data analysis

- Extensive customization options for studies and indicators

- Lower monthly fees compared to TradeStation

- Direct market access (DMA) support

- Strong emphasis on futures trading

- Native C++ API for custom development

While Sierra Chart’s interface might appear dated compared to modern platforms, it compensates with powerful features and reliable performance. The platform is particularly popular among futures traders who appreciate its depth of market analysis tools and low-latency execution capabilities.

Like TradeStation, Sierra Chart requires a learning curve to master its extensive features, but many traders find its pricing structure more approachable for long-term use.

5. TrendSpider — Automated Technical Analysis Platform

TrendSpider offers a modern approach to trading analysis, standing out with its AI-powered technical analysis tools and unique pattern recognition capabilities.

Key Advantages:

- Automated pattern recognition and trendline detection

- Multi-timeframe analysis on a single chart

- Dynamic price alerts with smart triggers

- Automated Raindrop Charts for volume analysis

- Real-time scanning and backtesting capabilities

TrendSpider takes a different approach from TradeStation’s all-in-one trading solution. Instead of focusing on order execution, it specializes in automated chart analysis and pattern detection. The platform’s machine learning algorithms can identify chart patterns and automatically draw trendlines, potentially saving hours of manual analysis. However, traders should note that this automation comes at a cost, with subscription plans that can be significant for retail traders. Additionally, since TrendSpider isn’t a broker platform, you’ll need separate arrangements for actual trading execution.

Free TradeStation Alternatives

For traders seeking cost-effective solutions, several platforms offer solid functionality without the expense of TradeStation or other premium platforms.

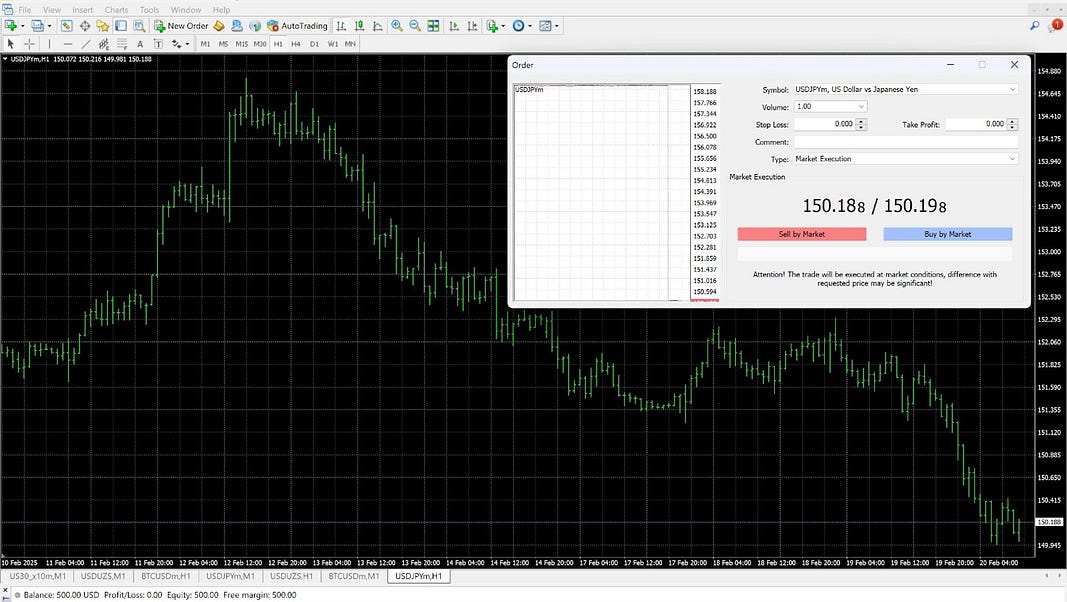

MetaTrader 4/5

MetaTrader 4/5 remains the most popular free trading platform globally, particularly in the forex market. Available through most forex brokers at no additional cost, it provides a robust set of charting tools, the ability to run automated strategies through MQL programming, and access to thousands of community-created indicators.

While MT4 is the legacy version favored by many traders, MT5 offers additional features and multi-asset trading capabilities.

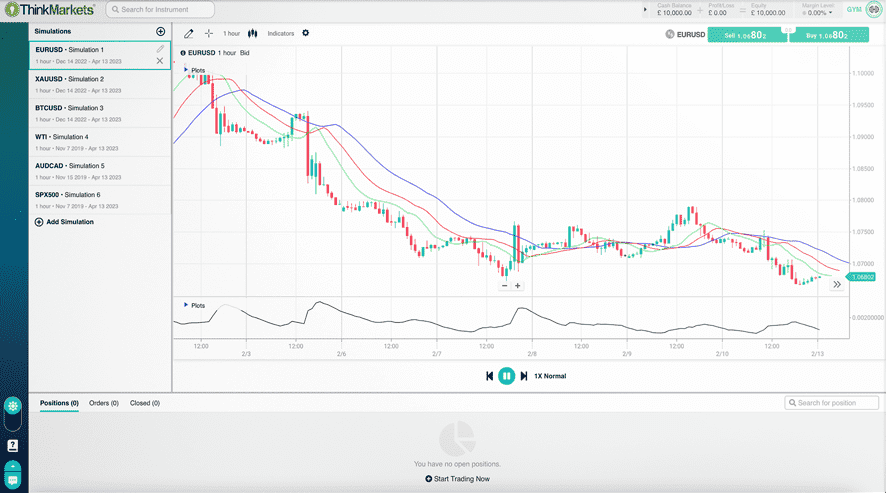

ThinkTrader Traders Gym

ThinkTrader’s Traders Gym feature also provides a basic free alternative for TradeStation for practice trading and backtesting. While it offers simple chart analysis and paper trading capabilities, users should be aware of significant limitations: required internet connection for backtesting, single data source, no custom indicators, and potential connectivity issues.

The platform might serve as an entry point for beginners, but traders requiring reliable backtesting or advanced analysis tools would need to look elsewhere.

Choosing Your TradeStation Alternative: Summary

While many TradeStation competitors have entered the market, each platform specializes in different aspects of trading. When selecting a TradeStation alternative, your choice should align with your primary trading goals. For comprehensive backtesting capabilities, Forex Tester Online (FTO) stands out as the leading specialized solution, offering unlimited lifetime access at a reasonable price through regular promotions unlike other alternatives such as FX Replay.

Other alternatives serve different specific needs:

- TradingView excels in charting and community features

- Sierra Chart offers powerful desktop-based analysis

- NinjaTrader provides comprehensive futures trading capabilities

- TrendSpider specializes in automated technical analysis

- Free options like MetaTrader serve basic trading needs

Ready to start with FTO? Check out our detailed guide on getting started with Forex Tester Online to begin your trading journey.

Frequently Asked Questions

Is TradeStation good for backtesting?

TradeStation offers solid backtesting capabilities through its EasyLanguage programming. However, dedicated backtesting platforms like Forex Tester Online may provide more specialized features and a more focused testing environment without requiring brokerage commitments.

Can I use TradeStation on Mac?

TradeStation doesn’t have a native Mac version. Mac users need to use Boot Camp or virtual machine software to run Windows, which can impact performance. Web-based alternatives like TradingView or FTO offer native Mac compatibility.

How much does TradeStation really cost?

TradeStation’s cost structure varies — you can either pay monthly platform fees, maintain a minimum account balance, or meet regular trading activity requirements to waive the fees. It’s best to check their current pricing as terms may change.

Which TradeStation alternative is best for beginners?

TradingView offers one of the most user-friendly experiences for beginners, with a free tier and intuitive interface. However, if you’re specifically looking to learn through backtesting, FTO provides a more structured approach to strategy development.

Can I automate my trading strategies without coding?

While TradeStation requires EasyLanguage programming for automation, some alternatives are developing no-code solutions. FTO, for instance, is working on no-code strategy automation features, while TradingView offers some basic strategy templates without coding.

Forex Tester Online

Make technical analysis of your trading strategies easier with the best TradeStation alternative

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska