Summarize at:

We are here again to make your trading more profitable and for this, we have decided to give the second breath to the Martingale strategy which is so invested in an air of controversial opinions.

Martingale strategy is covered by a lot of different opinions. Some people say that it absolutely doesn’t work and the trader can only lose his deposit by using it.

The opposite opinion consists in that it can be useful but the trader should carefully use certain elements of the Martingale trading strategy and increase the profit in the financial markets.

So what is the martingale strategy?

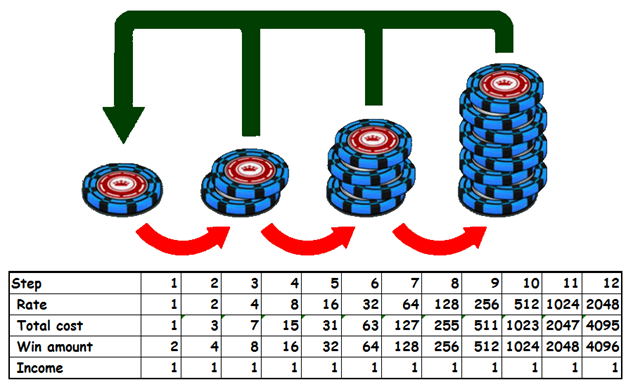

The Martingale system was invented for roulette gambling. The main point of such a system is if we place the initial bet of 1$ on red but the black wins then we double the next bet on red again. If the black wins again we place the third bet on red but making it double to 4$ and we keep on increasing our positions. And if the black wins again we keep on betting making it double until we win. The size of the initial bet depends on the depth of the stack.

And when our bet wins, our profit сovers all our previous losses including the initial bet.

The Martingale trading strategy is a recovery system. It is based on the statement that if a trader places winning trade, all his previous losses will be recovered by the profit he gained.

But, this aspect requires a big deposit. Without it, the idea of using the martingale system is pointless.

How does the martingale strategy work?

The Martingale system was firstly recommended by French mathematician Paul Pierre Levy. An American mathematician Joseph Leo Doob managed to refute the probability of a 100% profitable betting system.

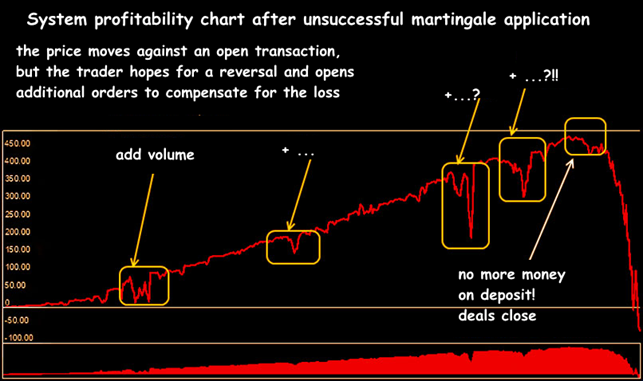

Theoretically the strategy looks quite effective, but in practice it’s quite doubtful. Due to the fact that the martingale system is very unsustainable the majority of trading strategies in this system is leading down to losses.

Because of keeping on increasing the positions here comes out an illusion that martingale system allows to avoid loss making deals.

But the biggest problem of the Martingale system is that a big lot size leads to a big risk and if the trader catches a longstanding trend the trader can lose his deposit.

Martingale Trading System: Pros and Cons

The Martingale trading system offers both notable advantages and significant drawbacks. On the pro side, the Martingale system can provide quick returns if a trader experiences a series of successful trades. It is relatively easy to understand and apply, making it attractive to novices.

Additionally, due to its inherent nature of doubling down on losses, it allows traders to potentially recoup their losses in one successful trade. On the downside, the system assumes the trader has virtually unlimited capital to withstand a potentially prolonged losing streak, which is not a realistic scenario for many. Moreover, markets often behave unpredictably, and the concept of always eventually winning a trade, upon which the Martingale strategy is based, can prove faulty.

Another significant disadvantage is that it encourages high-risk trading, with potential for significant losses. It’s important for traders to understand these pros and cons before employing such a trading system.

Risk Management in Martingale Trading

Risk management in the Martingale trading system is crucial, as it is inherently a high-risk strategy that can lead to significant losses. Traders double their investment following a losing trade, hoping to recoup the lost amount when they win. This can be sustainable as long as traders have a significant reserve of capital and the Forex market moves in their favor.

To manage the risk involved, traders should consider setting a cap on the number of consecutive losing trades they are willing to endure before stopping.

Additionally, they should only allocate a small portion of their total capital when using the Martingale strategy, reducing potential damages from a potential losing streak.

It’s also important to diversify their investment portfolio and use other less risky strategies alongside the Martingale system.

Finally, traders should always maintain a robust understanding of the Forex market and the assets they’re trading, as a sudden significant market shift can lead to substantial losses.

What is the Anti-Martingale System?

The Anti-Martingale system is a method of investing that contrasts the traditional Martingale strategy. Rather than doubling down after a loss, an Anti-Martingale strategy entails doubling down after a successful trade, and reducing the position size following a loss. This way, the strategy capitalizes on winning streaks and cuts losses short during a series of losses.

In other words, the Anti-Martingale system seeks to invest more heavily in trades that prove profitable, and reduce investment in trades that result in a loss. While this approach does not guarantee profits, it promotes the risk management principle of ‘let your profits run and cut your losses short’.

However, it’s crucial to note that like any other trading system, the Anti-Martingale strategy also comes with its own set of risks, and a strong understanding of the market and disciplined implementation is key to success.

Martingale System in Forex Trading: Heads or Tails

To describe the main point of the martingale system we can draw an analogy between the martingale trading and a simple flipping of the coin. Imagine that we are flipping the coin betting what side will win either heads or tails with a starting wager 1$.

There’s an equal probability that a coin will land on heads or tails and each flip is independent. Here is a conclusion that all the previous flips do not impact the outcome of the next flip.

And as long as you stick the same directional view each time you would eventually, given an infinite amount of money you can see the coin landing on heads and it covers all your previous losses, plus 1$.

Martingale trading is formed on the meaning that one trade turns the account around.

To get authentic results of backtesting we have tested Martingale strategy on Bullish, Bearish and Flat markets for two periods of time each using 5-steps plan of backtesting the strategies.

The idea is simple – first we make 50 trades at the Training set, then during another period we perform another 20 trades and compare the results. This way it should make backtesting the Martingale strategy faster

Market Training set Forward testing

- Bull 01/03/2011 – 23/06/2011 09/06/2010 – 10/08/2011

- Bear 01/01/15 – 27/03/2015 01/09/2014 – 27/10/2014

- Flat 01/09/2016 – 08/02/2017 04/05/2015 – 12/06/2015

Technical Information

The currency pair we’ve chosen was EUR/USD.

The Time frame – 1 hour.

To avoid losing the deposit, we used the pending orders to close the positions when they reach the stop loss and take profit levels. Besides we set the spread at the minimum meaning – 3.

Market Pending order type

- Bull Buy

- Bear Sell

The pending orders set includes 10 deals. The lot on the first position was 0,10; the Stop Loss – 1000; Take Profit – 100; Offset – none.

* Please, note: there are numerous types of Martingale system invented by the traders exploring the main idea (with lot multiplying after the loss), but with various additional settings included in the trading method.

We do not claim the approach we have backtested is the only one possible way to use the Martingale strategy in Forex trading. Feel free to explore different settings while backtesting and pick the one that is completely suitable for your trading needs. The Martingale strategy can be used with multiple currency pairs on different timeframes, while settings and parameters can be adjusted accordingly. On top of that, an anti Martingale system could be a reasonable alternative for the trading strategy.

As you can see on the table below this how we put all the settings for our trades.

Let us show you how the pending order menu looks like.

And the same way we set the pending order on the Bearish market but with the “sell type” of the pending order.

Sell type of pending order on the Bearish market looks like:

And on the third market, the Flat market we’ve set the “buy” type of the pending order.

Let us show you how we start the testing using pending orders.

We press the combination of Ctrl+O buttons and choose the buy type of pending order as you can see on the table above. Then we press the button “place orders” and continue simulating Forex trading on historical data.

As the position closes at the Take Profit level we take away the pending orders and continue testing from new candle. At this moment we set one more group of pending orders and continue testing.

Just take a look:

Then we keep setting pending orders until all our positions will not close.

Martingale strategy backtesting results

| Market | Training set | Forward testing |

|---|---|---|

| Bull | 730 pips | 100 pips |

| Bear | 80 pips | 220 pips |

| Flat | 457 pips | -350 pips |

The way from the casino to the exchange

A surge of interest in risky techniques has emerged with the development of a fast financial market. The idea of a jackpot in a million haunts many beginners, especially those who consider the ability to play cards, such as poker, a guarantee of success in trading. Plus, the “inspiring” popular culture is actively shaping the image of the exchange as a financial “casino”.

It is believed that the Martingale system has an advantage in the financial market – we can conduct a market analysis before opening the first transaction, thereby increasing the chances of success of a potential “chain” of orders.

The value of any stock (theoretically) can drop to zero, which is why only a few people are fond of Martingale on the stock market, which cannot be said about foreign exchange assets that, even in times of crisis, always have a non-zero value.

Forex is especially attractive for strategies with progressive growth in the transaction volume, for example, based on a price pullback. Besides, in currencies, you can earn money on the carry trade and use technical methods to avoid losses.

The idea is based on probability theory and the principle of returning to the average value. In practice, the increase of the gaming (trading) volume after each losing trade is assumed. As a result, after a long series of failures in the first case of winning (profit), the loss will be fully compensated.

In addition, the “pure” mathematics of roulette in trading is complicated by additional losses: with the increase in the transaction volume, the costs of its maintenance (spreads/swaps/commissions) increase.

No forecast can tell how long you will have to keep orders open and how many additional transactions will be required. Alas, money in the Forex casino departs from the account faster than at the same rates in the usual casino.

Those whom we have not yet been able to dissuade from this dangerous tactic should continue reading.

How does a classic Martingale look like?

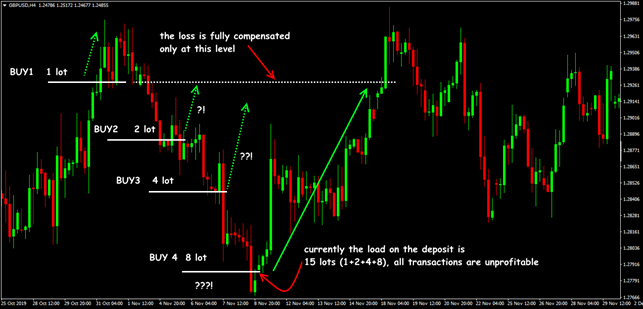

The simple logic is applied here: after the market goes against an active transaction, another position is opened in the same direction, but with a double volume. It is assumed that during a reversal, such a “strengthened” transaction compensates for current losses. Like that:

We will leave alone the so-called “joy” from the fact that at the fourth step, the market has eventually turned around, and all losses closed. This situation is real, but very close to ideal, and therefore unlikely.

We remind you: the picture to the right of the moment of opening the first BUY order is the market “future” that you DO NOT see after opening another transaction against the trend. Also, you DO NOT see the development of events after the opening of new transactions for the purchase. But the main problem is visible: an increase in the load on the deposit.

Note: the calculation on the diagram is shown in lots, and how much it will be in cash depends on the size of your deposit and leverage. As you know, it makes no sense to use Stop Loss in such a scheme, so the negative is aggravated by psychological stress from the actively growing losses.

Martingale fans, especially those who develop/advertise/sell automatic advisers or strategies with such a scheme, usually declare that such long unprofitable series are rare and need a maximum of 4-5 steps before turning towards profit.

Do not believe it. Areas of a strong trend on Forex are a standard phenomenon, and a rollback cannot always be equivalent, even a strong correction usually does not exceed 50-70%. Alas, the trend against you may be too “long” for your deposit.

But traders, as a rule, are stubborn people, so we offer you less dangerous options.

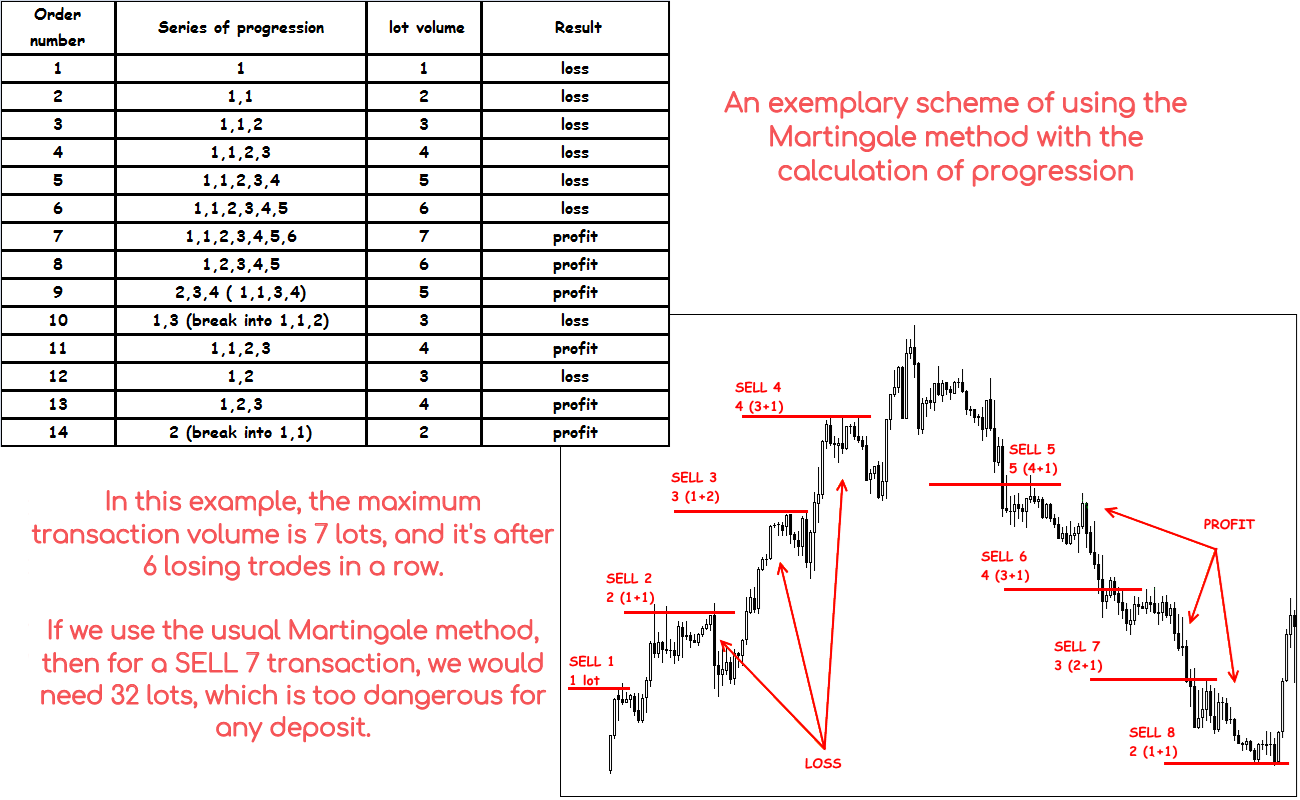

Martingale with progression

It is supposed to increase the position volume according to the progression method gradually, but without increasing the loss-making positions. The goal is to reduce the load’s growth rate of the deposit.

After a loss, the volume of the next transaction is determined as the sum of volumes of the first and last transactions. If the deal is profitable, the volume does not change.

After a loss, the volume of the next transaction is determined as the sum of volumes of the first and last transactions. If the deal is profitable, the volume does not change.

We close the series of transactions when at least one lot of profit is obtained. But the main problem remains – the more capital is occupied in the current transaction, the higher the risk for the next.

Anti-Martingale or Tricky Pyramiding

We argue against the classic tactics: we increase the lot after a profitable, not after a losing trade. It turns out an excellent alternative to the standard TralingStop scheme.

In the calculation, we use the size of the previous profit so that you can choose smaller coefficients.

In practice, it’s done like this:

- if Stop Loss worked – the volume of the next order (required!) is reduced by two times since the balance is “damaged”, and it is necessary to reduce the load on the deposit at the same level of overall risk;

- if the transaction was closed by Take Profit, we can afford to double the volume, as additional “operational” resources appeared on the trading account.

It seems to us that this is one of the reasonable Stop Loss schemes – it can be recommended for any money management system.

We remind you: All ideas to avoid losses at all costs draw a trader into a dangerous game over time, in which any of us always has less chance than the market. Martingale should be used only in a stably profitable system that provides profit in any trading conditions. And the current drawdown is just a statistical accident.

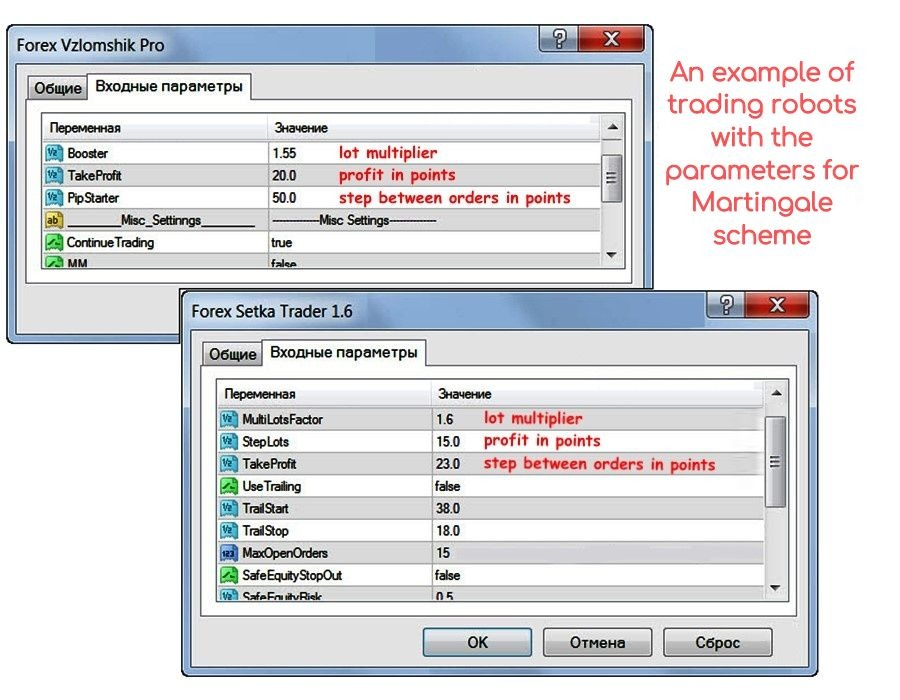

Trading robots with Martingale

Be sure to check whether your broker allows the use of Martingale and locking positions (in any form) – there are options when they “catch” the dynamics of orders and block accounts.

Using swap-free accounts in such schemes will significantly reduce the level of swap losses.

We only note the required parameters that should be available for fine-tuning any expert advisor:

- Lot multiplier (exponent lot, replicator, multi-lot): coefficient for increasing the next transaction volume. Increasing this parameter reduces the range to the general Take Profit when the EA closes the entire grid of orders. A decrease in the parameter leads to an increase in the number and duration of all transactions. The parameter needs to be adjusted to the current volatility. Recommended: 0.5-2.

- Maximum number of steps (levels, orders): with a small value, the EA will not be able to open the next, possibly profitable order, and will close the grid at a loss. Increasing the parameter raises the load on the deposit. Recommended: 3-10.

- Distance (step) between orders: a small step opens a lot of transactions with a small profit and is recommended for scalping. An increase in the parameter is necessary for medium-term strategies or weakly volatile assets.

- Take Profit size: determined by the general strategy.

Positive advisor test results should be for a period of at least two years from the current date; for time frames of H4 and higher, the price history range can be increased.

Those who have been “living inside Forex” for a long time know that the market changes dramatically every 2-4 years, so you should not use long periods for testing and checking these advisors.

A few practical notes

The Martingale methodology is not in demand by serious exchange speculators precisely because for probable (most often, insignificant) profit, it is necessary to risk significant capital, which neither private players nor corporate participants can allow.

Alas, it is almost impossible to convince every trader not to use Martingale, but 1-2 merged deposits will do just fine with this task.

Let us remind you:

- in the financial market, the role of current losses is played by the pledge on your open positions – the more open positions, the less available funds;

- as current losses increase, the moment of margin call is actively approaching – if the amount of available funds decreases to the level set by the broker, your positions will close automatically;

- in addition to the current loss and the blocking of collateral, it is necessary to take into account the costs of spreads/swaps/commissions, therefore the loss grows faster than with a conventional Martingale.

What is the result?

Martingale is a psychologically tricky tactic, and not suitable for everyone, which saves many deposits from a quick drain. For example, when you have already fallen into such a “trap”, but the market gives you a chance and has already compensated 50-70% of potential losses, then close a series of transactions and start living anew.

The market is not aware of your problems, and it is always better to accept several failures than to continue to lose. Even if you have a successful experience in using Martingale – do not bring the situation to disaster, you will save money, nerves, and self-confidence.

Conclusions

Due to the fact that the Martingale system is quite risky and unstable it is possible to use this system on Bullish and Bearish markets and gain the profit. Pending orders allow the trader to close the positions and prevent losing the deposit.

As we can see the results on the Bullish and Bearish markets disprove the statement that martingale strategy is absolutely detrimental.

On the Flat market the Martingale system didn’t show its worth compared with the Bullish and Bearish markets. The main disadvantage of the Martingale trading strategy is that all previous results do not influence the following ones. As an alternative, traders could backtest an anti Martingale system to compare the results.

To sum up, Martingale strategy is not the most reliable strategy. To trade successfully using Martingale strategy, a trader has to have a big deposit and to be very careful with increasing every upcoming position.

The testing of Martingale strategy was arranged in Forex Tester Online with the historical data that comes along with the subscription.

What kind of beast is Martingale?

The strategy has been known under the Martingale’s name since the mid-18th century. Sometimes the wording “D’Alembert system” is found; however, there is no evidence that the famous mathematician is related to this scheme.

With a positive outcome of the transaction, the volume is not adjusted.

The roulette of the casino with its bets on “equal chances”: red/black, even/odd turned out to be a fertile sphere for Martingale’s use. In case of failure, the player, as a rule, doubles bets (1-2-4-8-16-32-64) on the same game option, until he wins.

Despite the illusory 100% guarantee of compensation for losses, the method does not give any advantages. A series of losses can be lengthy, losses grow exponentially, and the real capital of a player, alas, is not infinite.

The risk in the transaction far exceeds the potential profit, as it is just redistributed over time. Bankruptcy comes much faster than a “compensatory” gain.

It was just a few significant wins on the Martingale system in Las Vegas casinos that made it necessary to modify the two-color roulette wheel and add two green zero sectors (“0” and “00”) to it.

As a result, this game received two additional results and regained the negative checkmate-expectation of winning. Most casinos introduced restrictions not only on one-time but also on maximum bets, which destroyed the chances of success.

What is«Soft» Martingale?

Risks are reduced due to corrective positions: we increase the volume not by two times (by 100%), but, for example, by 20-50% depending on the market situation.

Such a scheme (most often secretly!) is used in automatic expert advisors, the strategy of which allows linking lot increase coefficients to the data of technical indicators, for example, Fibonacci or Murray levels. Sometimes it immediately places corrective positions in key areas as pending orders with additional volumes (the “grid” method).

When turning towards profit, loss compensation is slower, but the load on the deposit will be more comfortable.

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska

Backtest Your Martingale Strategy Now

Backtest Your Martingale Strategy Now