Practicing trading without risking your hard-earned money sounds like a no-brainer. That’s where demo trading simulators come in. These platforms let you practice, test strategies, and learn the ropes in a simulated environment that mirrors real market conditions. From new traders learning the basics to experienced traders fine-tuning their strategies, demo trading is an essential tool.

Here’s how demo trading simulators can help you level up your trading game.

What is a Demo Trading Simulator

A demo trading simulator is a platform that mimics real market conditions using virtual money. It’s basically a fake trading website that allows you to buy and sell assets like Forex pairs, stocks, and crypto without risking your actual capital. These platforms offer real-time or historical data so you can see how your trades would perform under normal market conditions.

Unlike live accounts, a demo trading app lets you make mistakes, test strategies, and learn the platform without financial risk. Think of it as training wheels for traders, providing the chance to get comfortable with the markets and your own trading style before diving into live trading.

How Are Demo Trading Apps Different from Demo Accounts

While demo trading apps and demo accounts might sound similar, they serve different purposes and offer varying levels of experience. A demo trading app is typically designed for a more in-depth trading simulation. It often includes features like backtesting with historical data, custom strategy testing, and sometimes even paper trading options. These apps provide a controlled, flexible environment to practice complex strategies or replay market conditions from the past. You get more freedom to tweak and analyze your trading methods.

On the other hand, a demo account is often offered by brokers as a basic training ground for traders. It’s usually connected to live market data, meaning you’re trading in real-time but with virtual money. However, it’s more limited compared to demo trading simulators. Demo accounts are mostly used for learning the broker’s platform and getting a feel for live market conditions without too much customization or backtesting options.

In short, demo trading apps are ideal for those who want more than just a simple practice account. They let you test strategies, replay charts, and dive deeper into trading techniques, while demo accounts are better for getting familiar with a broker’s interface.

So, you can’t replace a trading simulator with a demo account. These are two completely different things. Let’s take a deeper look at how you can use a demo trading simulator.

How We Chose the Best Demo Trading Simulators

To compile this list of the best demo trading simulators, we considered several key factors.

- First, popularity — these platforms are widely used by traders across the world, from beginners to professionals.

- Second, we looked at user ratings. A platform’s reputation among traders is important, so we dug into reviews and feedback to see which platforms consistently perform well.

- Next, we evaluated the features. The best demo trading simulators need to offer more than just basic functionality. They should include advanced tools like strategy backtesting, multiple asset classes, and detailed analytics.

- Lastly, this list is backed by my personal experience — we’ve tested every demo trading app listed here. And this is what we think.

Top Demo Trading Simulators for Forex Traders

1. Forex Tester Online

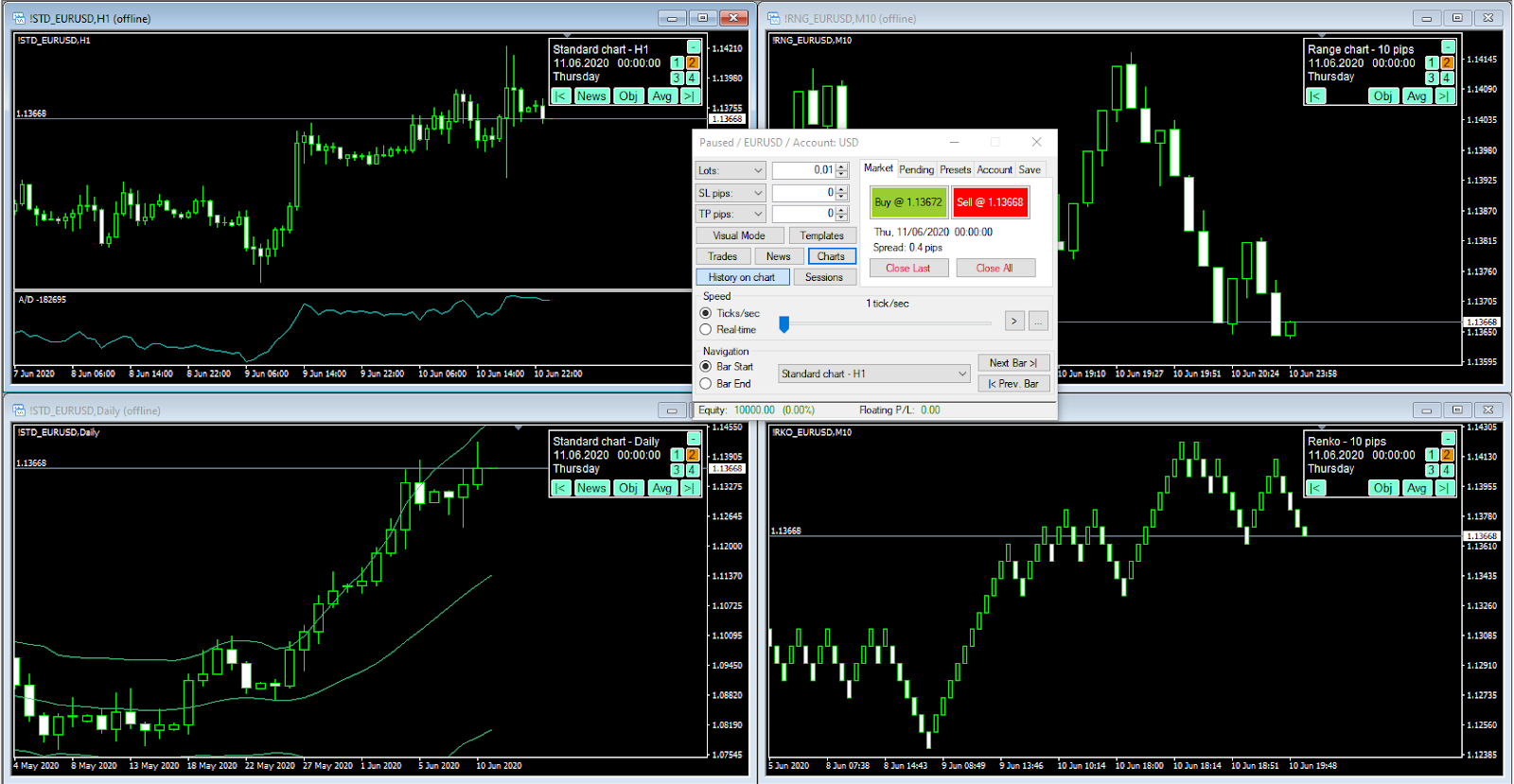

If you’re serious about mastering Forex trading without risking a dime, Forex Tester Online is your go-to tool. Unlike basic demo accounts, this platform offers a full-featured demo trading simulator designed to replicate real-world trading conditions using historical data. You can backtest strategies, replay past market events, and refine your skills — all within your browser.

Key Advantages:

- Advanced Tick-by-Tick Backtesting. Test strategies with precision on real market data. The list of assets covers Forex, stocks, indices, commodities, and crypto.

- Comprehensive Navigation System. Jump-to functionality saves up to 50% of analysis time by instantly navigating to specific price points, orders, news events, and drawing tools

- Complete Trading Settings Control. Configure swap rates, commissions, and spreads for realistic simulation

- Specialized Indicator Library. Built-in indicators for various trading methodologies including ICT and SMC

- Educational Integration. Homework and assignment capabilities for structured learning

- Customizable Workflow. Presets, custom EAs and indicators, chart templates, market scenarios, and hotkeys for personalized experience

- Direct Support Access. Live chat with support team directly through the interface

- Unmatched Value. One-time purchase for lifetime access at a reasonable price with frequent seasonal discounts

The best part? It’s easily accessible — no downloads, no installations — just fire it up and start demo trading online anytime, anywhere.

While other platforms might give you a glimpse of the market, Forex Tester Online offers a deep trading simulation experience. Whether you’re a beginner or a seasoned trader, it’s the closest thing to live trading, minus the pressure.

2. TradingView

TradingView is primarily known for its impressive charting capabilities, but it also shines as a demo trading app thanks to its bar replay feature. This allows traders to replay historical data and practice trades in a simulated environment. While it’s not as specialized as Forex Tester Online, TradingView is perfect for those who want an all-in-one solution for charting, analysis, and demo trading.

You can test strategies using real-time market data across multiple asset classes — stocks, Forex, crypto — and see how your ideas hold up without any financial risk. TradingView’s paper trading feature lets you execute trades on the chart itself, giving you a seamless experience when testing strategies or learning the basics of trading.

Though TradingView lacks some of the granular control of dedicated demo trading simulators, it’s still a solid option for traders who want to mix technical analysis with demo trading online. The platform is user-friendly, offers a broad range of markets, and is a popular choice for both new and experienced traders. However, if you’re looking for the most accurate, Forex-specific simulation, Forex Tester Online is still the top choice.

3. FX Replay

FX Replay is a solid option for traders looking to demo trade using historical data, especially in the Forex and CFD markets. This browser-based platform is easy to use and allows you to test strategies on past price movements without the need to install any software. What sets FX Replay apart is its straightforward interface and quick setup, making it accessible even for beginner traders.

However, while it’s a convenient platform for practicing basic strategies, FX Replay’s historical data is somewhat limited compared to some other platforms. Some currency pairs have fewer years of data available, which might not be enough for more in-depth backtesting or advanced strategy development.

FX Replay is great for traders who want a simple, demo trading app to practice in real-time or on past data, but for more comprehensive features, especially for long-term backtesting or detailed analytics, other platforms might offer more depth. Nonetheless, it remains a good option for traders just getting started with demo trading online.

4. Soft4FX

Soft4FX offers a specialized demo trading simulator that integrates directly with MetaTrader 4 (MT4), making it a great choice for traders already using this popular platform. The simulator is designed specifically for Forex traders and provides a realistic environment to practice day trading or longer-term strategies using historical data. Its biggest strength is its ease of use — since it works within MT4, there’s no need to learn new software, making it easy for users to dive right into demo trading.

Another plus is its affordability. For a one-time payment of $109, you get lifetime access to Soft4FX, which is a solid deal compared to many subscription-based demo trading platforms. However, it does come with a few limitations. The simulator is dependent on MT4, so if you’re not an MT4 user, you’ll have to switch platforms to take advantage of it. It’s also limited to Forex markets — no support for stocks, crypto, or other asset classes.

While it’s a versatile and affordable option for Forex demo trading, the design and interface could use an update, and it lacks any features to transition strategies directly into live trading. It’s strictly for backtesting and practice, but if that’s all you need, Soft4FX does the job well.

5. TradingSim

TradingSim is a powerful market simulator primarily aimed at day traders looking to sharpen their skills in the US stock market. It offers a clean, user-friendly interface and lets you simulate trades using historical data, making it a solid choice for those who want to practice without risking real money. With TradingSim, you can replay past trading sessions, experiment with different strategies, and refine your approach.

However, there are some drawbacks. One major limitation is that it only provides three years of historical data, which might not be enough for traders looking to backtest strategies over a longer time period. Additionally, TradingSim focuses mainly on stocks and ETFs, so if you’re interested in Forex demo trading or other markets like commodities or cryptocurrencies, you’ll need to look elsewhere.

Another downside is the pricing model — there’s no lifetime access option.

TradingSim operates on a subscription basis, with plans starting at $33 per month. While this might be fine for short-term use, it can get expensive over time. That said, it’s a solid tool for stock day traders, especially those who are looking for a demo trading website to build and test their skills.

Other Demo Trading Apps Worth Mentioning

Bonus! While we’ve highlighted the top platforms, there are a few other demo trading apps that are also worth considering.

1. Forex Tester (Desktop Version). Forex Tester is another solid choice for Forex traders. It’s a desktop app with accurate tick data, allowing you to simulate real-time market conditions. It offers deep customization, making it a good tool for those serious about backtesting Forex strategies. This is our older product that was used by tens of thousands of our users before we launched Forex Tester Online. Forex Tester is still supported and loved by lots of traders.

2. eToro. eToro offers a demo account with access to multiple markets like Forex, stocks, and crypto. It also has a social trading feature, letting you follow and copy trades from other users. It’s not as focused on in-depth simulation, but it’s a great option if you want to practice and learn from others.

3. Webull. Webull provides a simple, user-friendly demo account for stocks, options, and ETFs. It’s a good starting point for beginners who want to practice trading. However, it’s less suited for advanced strategy testing since it lacks backtesting features.

Usage Cases for Demo Trading Simulators

Demo trading simulators offer several practical uses beyond just basic practice. Here are the key ways traders can benefit from these tools:

Strategy Backtesting

One of the primary uses of a demo trading simulator is testing trading strategies on past market data. Whether you’re working with complex algorithms or simple moving average crossovers, you can see how your strategy would perform in various market conditions without risking any capital. Demo trading apps like Forex Tester Online or TradingView allow you to tweak strategies and replay market movements, making it ideal for fine-tuning your approach.

Learning and Practicing

For beginners, a demo trading app is the perfect place to learn the basics of trading. You can experiment with buying and selling different assets, setting stop losses, and understanding market dynamics. With fake trading websites, you get hands-on experience without any financial consequences. It’s a safe space to make mistakes and learn from them.

Mastering Skills

Even experienced traders can use demo trading simulators to sharpen their skills. The ability to slow down or replay specific market conditions lets traders improve their timing and decision-making.

Growing Confidence

Demo trading simulators are also great for boosting your confidence before switching to live trading. Once you’ve tested and refined your strategy in a simulated environment, you can approach real markets with more assurance. This practice builds trust in your system, knowing it works under various conditions. A good online demo trading platform can act as a confidence builder for traders before putting real money on the line.

Conclusion

The best demo trading simulator depends on what you need. Forex Tester Online is ideal for precise, detailed Forex practice. Soft4FX, FX Replay, and TradingSim are also decent alternatives. TradingView is also a good platform for traders, but unfortunately, not as advanced for demo trading specifically.

FAQ

What common mistakes should I avoid while using a demo trading simulator?

When using a demo trading simulator, it’s important to avoid these common mistakes:

- Treating It Like a Game. Remember that a demo account is still a learning tool. Don’t adopt a reckless mindset just because there’s no real money at stake.

- Neglecting Risk Management. Failing to implement risk management strategies can lead to poor habits that carry over into live trading. Always set stop-loss and take-profit levels.

- Overtrading. It’s easy to get carried away with trading frequently in a demo account. Focus on quality over quantity and develop a solid trading plan.

- Ignoring Emotions. Since there’s no financial risk, it’s easy to overlook how emotions affect trading decisions. Pay attention to your reactions to wins and losses.

- Rushing into Live Trading. Just because you perform well in a demo account doesn’t mean you’re ready for live trading. Take the time to refine your strategies.

- Using the Same Strategies Everywhere. A strategy that works in a demo may not work in real markets. Be prepared to adapt to changing market conditions.

- Not Keeping a Trading Journal. Failing to document your trades can hinder your learning process. Keep track of what works and what doesn’t.

- Neglecting to Learn from Mistakes. Avoiding reflection on losses or mistakes can prevent growth. Analyze what went wrong and how to improve.

- Skipping Education. Relying solely on the demo simulator without seeking additional education or resources can limit your understanding of trading concepts.

By being mindful of these mistakes, you can make the most of your demo trading experience and better prepare yourself for live trading.

What types of assets can I trade on a free demo simulator?

On a free demo trading simulator, you can typically trade a variety of asset types, including:

- Forex (currency pairs). You can practice trading major, minor, and exotic currency pairs.

- Stocks. Many simulators (including Forex Tester Online) allow you to trade shares of individual companies.

- Commodities. This includes trading assets like gold, silver, oil, and agricultural products.

- Indices. You may have the option to trade index funds or ETFs that track major stock indices like the S&P 500 or NASDAQ.

- Cryptocurrencies. Our platform offers the ability to backtest two most popular cryptocurrencies: Bitcoin and Ethereum.

- Options. Depending on the simulator, you might be able to practice trading options on various underlying assets.

- Futures. Forex Tester Online includes futures contracts for commodities, indices, or currencies.

Can I practice advanced trading strategies on a demo simulator?

Yes, you can practice advanced trading strategies on a demo simulator. Most demo trading platforms provide features that support complex strategies, allowing you to:

- Test Different Order Types. You can experiment with limit orders, stop-loss orders, and other advanced order types to see how they impact your strategy.

- Utilize Technical Analysis Tools. Many simulators come equipped with charts, indicators, and other analytical tools that help you implement and refine advanced strategies.

- Simulate Different Market Conditions. You can practice trading under various market scenarios to understand how your strategies perform in different environments.

- Backtest Strategies. Some platforms allow you to backtest your strategies using historical data, helping you gauge their effectiveness before applying them in live trading.

- Implement Risk Management. You can practice setting stop-loss and take-profit levels to effectively manage risk while executing your strategies.

Using a demo simulator is a great way to build confidence and improve your skills before moving on to real trading. Just remember to take the experience seriously. The habits you develop will influence your performance in live markets.

How realistic is the trading experience in a demo simulator compared to actual trading?

The trading experience in a demo simulator can be quite realistic, but there are some key differences compared to actual trading:

Similarities:

- Market conditions. Many demo simulators use real-time market data, so you can experience price movements and volatility similar to live trading.

- Order types. You can place various types of orders (market, limit, stop-loss) in both environments, allowing you to practice executing trades.

- Trading tools. Most simulators offer similar technical analysis tools and charts that you would use in live trading.

- Risk management practices. You can practice setting stop-loss and take-profit levels, helping you learn how to manage risk effectively.

Differences:

- Emotional factors. Even though Forex Tester Online creates the most realistic trading conditions, in a demo account, there’s no real money at stake. So you may not experience the same emotional pressure and stress that come with live trading.

- Slippage and execution. Live trading can involve slippage (when orders are filled at a different price than expected) and other execution issues that may not be as prominent in a simulator.

- Market depth. A demo may not fully replicate the depth of market orders and liquidity available in live trading, which can affect how your orders are filled.

- Real-world variables. Factors such as news events, market sentiment, and economic indicators can impact live trading but may not be reflected in a demo environment. You can remember past events in backtesting, but you can’t predict the future on live account.

- Time constraints. In live trading, markets can move quickly, and decisions often need to be made rapidly, whereas a demo allows for a more measured pace.

Forex Tester Online

Versatile demo trading simulator for backtesting and refining strategies

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska