Tick data transforms the process of refining backtesting accuracy much like the difference between learning to drive with an outdated video game versus a professional driving simulator that replicates real-world driving conditions.

Just as a high-fidelity simulator provides the nuances of actual driving — from the feel of the road to the response of the car — tick data offers a detailed replication of market conditions, capturing the intricacies of price action. This precision empowers traders to apply their backtesting insights to future scenarios with a level of confidence akin to stepping into a real car after training on a state-of-the-art simulator.

What is Tick Data?

Tick data is the most granular level of historical data in financial markets, capturing every transaction’s details. Each tick represents a unique trade, detailing the asset’s price, the precise time of execution, and volume if applicable. In the decentralized Forex and CFDs market, where assets are traded across a myriad of exchanges, compiling this data into a coherent whole is both challenging and crucial.

The Quality of Tick Data

Achieving high-quality tick data for Forex backtesting is more nuanced than merely gathering aggregated data. The aggregation process can introduce irregularities such as bid/ask bounces, gaps in data, and various anomalies.

High-quality tick data necessitates rigorous scrutiny and cleansing to provide a reliable foundation for backtesting. It’s about filtering out the noise and keeping the signals that accurately represent market movements. This refinement process is critical to transform raw, aggregated tick data into a premium quality dataset that faithfully mirrors the intricate movements of the Forex market, providing traders with a dependable foundation for precise strategy testing.

The Role of Tick Data in Backtesting

The real value of tick data unfolds in the realm of backtesting, where it serves as a cornerstone for strategy development and refinement:

Granularity for Manual Traders

Manual traders, particularly those who rely on price action, need the detailed landscape that tick data provides. It offers a micro-level view of market dynamics, allowing to test strategies against the nuanced fluctuations of the Forex market and practice with the same precision.

Precision for Scalpers

For scalpers, who navigate the market on razor-thin margins and brief moments, using 1-minute data for backtesting is like trying to examine Mars with old binoculars. Trading on shorter timeframes requires the ability to make quick decisions, and tick data provides this by offering a view comparable to scrutinizing Mars through the Perseverance rover’s camera.

It’s capturing opportunities and threats that lower-resolution data simply cannot reveal. For scalpers, the depth and clarity provided by high-quality tick data aren’t just helpful; they’re essential for backtesting results to be of any practical use.

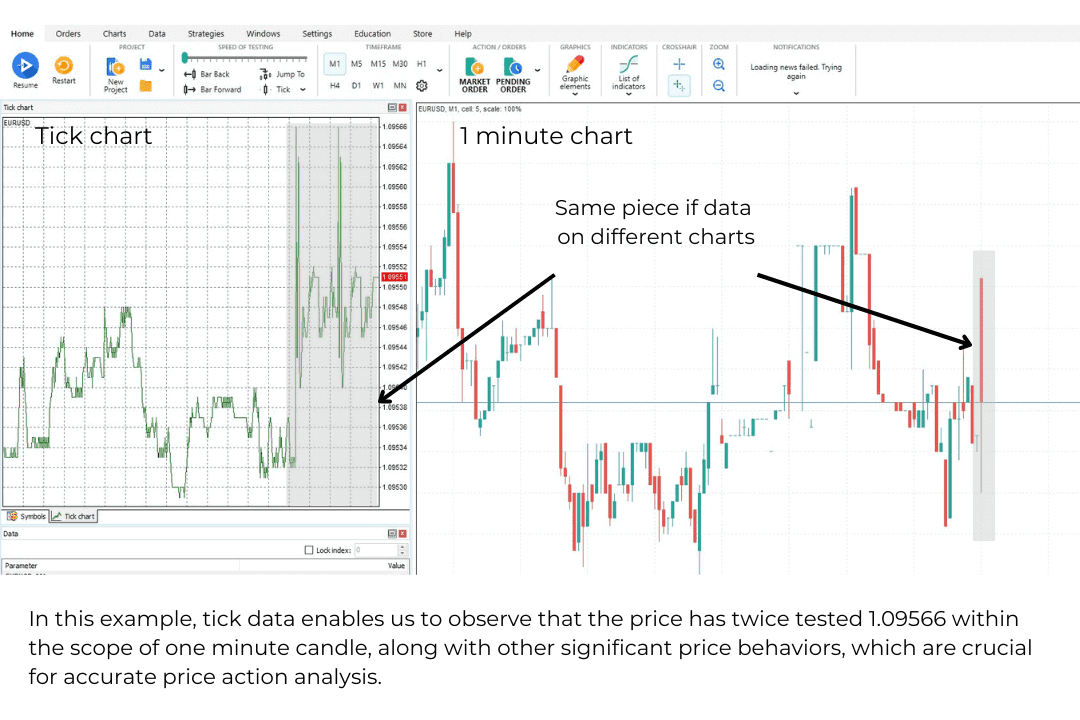

Insights about Multiple Executions Within a Candle

One-minute candle data may be found adequate for backtesting, particularly for strategies developed for longer timeframes. However, the asset’s price during periods of volatility, like financial news releases, can vary significantly within each minute.

The nuances of intra-candle price movements might affect some strategies results seriously, especially if those involve using limit or stop limit orders, news trading, multiple executions within a short period of time. In such cases, understanding the detailed price action within a single minute becomes essential and that is something that only tick data can reveal.

Elevating Backtesting with High-Quality Tick Data

The pursuit of precision in backtesting is a journey rather than a destination. High-quality tick data stands at the core of this journey, offering a level of detail and accuracy that transforms strategy testing from a basic assessment into a deep dive into the market’s true dynamics. The difference it makes is profound, akin to enhancing one’s vision from a broad, blurry view to a sharp, focused clarity that captures every nuance of market movement.

Forex Tester’s offer of a premium quality data subscription brings this necessary depth to backtesting efforts. Our service goes beyond tick data to include features essential for a realistic trading simulation. These include 23 years of historical data for comprehensive strategy testing across various market conditions, 5-digits precision for nuanced price movements, and floating spreads to mirror real market conditions accurately.

In essence, our goal is to equip traders with tools that reflect the market’s complexity as closely as possible. The right data does not just inform strategies. It transforms them, allowing traders to navigate the Forex market with confidence. By leveraging high-quality tick data, traders can refine their approaches with an accuracy that prepares them for the realities of live trading.

How Forex tick data can change your Forex vision for best

Forex Tester allows you to import an unlimited number of currency pairs and years of history data in almost any possible text format (ASCII *.csv, *.txt).

We strongly recommend importing 1-minute data for accurate testing (it is possible to import higher timeframes but testing results may not be as good).

Note: To increase the quality of testing, we recommend using specific M1 or even tick data, as it will give you almost 100% quality of testing. You can download data from our Data Service.

What are the advantages of our paid data services?

In addition to basic historical data that is included in the Forex Tester license price, we also Super Data package.

Compared to the free historical data, Super Data provides you with:

1. A much bigger number of symbols for backtesting – as many as 860 different symbols, including currency pairs, stocks, indexes, commodities, futures, cryptocurrencies and metals. It is 50 times more than our free data package includes!

2. A wider range of options when using our Historical News service:

- historical news for 9 main currency pairs (free data package provides users with historical news for the USD currency only)

- ability to see more types of news: all the events of low, medium and high importance

3. More precise backtesting results: it is extremely important for trading strategies that depend even on small price fluctuations

4. Daily updates: you can even backtest the yesterday’s data

5. 5-digits historical data

On top of all these benefits, our Super data package provides you with the tick-by-tick data with floating spread. By purchasing this package, you receive the most detailed price rates as they are on the real market. It is the best decision for scalping and short-term strategies.

How to download our free historical data?

Price: Bid

Time: GMT (no Daylight Saving Time)

Quality: one of the best free sources

Here you can download free history data for the most common currency pairs (source: Basic (Forexite free data)):

Order tick-by-tick data for the smallest price possible!

When you have decided to purchase Forex historical data from our web source, you will probably notice that it is more profitable to subscribe for several months of data at a time. Forex data as any other product is cheaper if you buy many items at once.

Therefore, our tick data package, as well as 1-min data, has three different purchase types: you can get 1 month or 12 months of the well-picked and organized historical Forex data, or get the unlimited access to our minute or tick-by-tick data (by purchasing a lifetime license). In case if you take Forex seriously and you are sure that you will be on the currency market for your entire life, you should consider purchasing 12 months of historical market data or the lifetime data package.

Those who have selected 12 months will save about 40% of the price depending on the subscription type to the Forex data feed (in comparison with the 1-month subscription). When purchasing the lifetime subscription, you pay just once, and in comparison with the 1-month subscription, your money will be compensated less than in 1 year. As you see, it is better to purchase the whole package of the market data feed: it is more profitable and more convenient.

Our Forex history data includes data for:

- 7 majors

- 29 cross pairs

- 22 commodities

- 20 metals

- 95 exotic pairs

- 111 indexes

- 2 futures

- 6 cryptocurrencies

- and 568 stocks

We give our users an opportunity to have an alternative to Forex historical data. Download this valuable information and back test your trading system on the completely different markets, adapt your strategy and get stable profits using on any financial instrument.

Forex tick data is the best investment one can make into his or her growth as a trader. We spent much of time recording historical tick data. It was never so easy to get Forex data! Download it and start using one of the most accurate and reliable services on the Internet.

*the subscription allows you to download Forex historical data from the very first date in the database till the day your subscription expires. Watch a tutorial on how to use data service here.

If you do not have Forex Tester, you can download data in the CSV format. Free CSV data is are available here.

In addition to historical data, the Forex Tester users have access to our Historical News service. It is useful for traders as it helps them to predict the market moves and plan their trading strategies accordingly.

Forex Tester Online + Tick Data

Forex Tester Online + Tick Data

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska