Summarize at:

ICT Trading stands among several established approaches that help traders decode the eternal battlefield of supply and demand in financial markets, where participants continuously seek to understand the footprints of major players.

This comprehensive guide explores the core principles of ICT Trading, its practical application, and methods for strategy validation. From foundational concepts and market structure analysis to backtesting approaches, we’ll examine how traders can effectively validate and optimize ICT trading strategies.

What is ICT Trading?

In the landscape of trading methodologies, ICT represents a distinctive approach to understanding market structure and institutional order flow. While traditional price action traders focus on candlestick patterns and chart formations, and Smart Money Concepts practitioners emphasize liquidity manipulation, ICT Trading synthesizes many of these elements into a comprehensive framework for market analysis.

The methodology places particular emphasis on understanding how larger market participants operate. ICT Trader attempts to reverse-engineer institutional trading strategies by analyzing how major market players accumulate positions, manipulate liquidity, and execute large orders. This understanding comes through detailed analysis of market structure, time frames, and price action within specific contexts.

What distinguishes ICT Trading isn’t its individual concepts – many of which professional traders have utilized for years under different names – but its structured approach to market analysis.

What Are the Biggest Challenges for Beginners When Using ICT Trading?

The greatest challenge for Inner Circle Trader lies not in understanding the concepts, but in validating trading decisions and developing reliable strategies.

The core challenge of ICT Trading lies in its contextual and multi-dimensional nature. Unlike traditional indicators that can be easily programmed, ICT patterns require careful consideration of both market context and multiple timeframes.

Measuring strategy effectiveness in ICT Trading goes beyond traditional metrics like win rate or risk-reward ratio. The quality of entries and exits depends heavily on pattern quality and market context rather than fixed rules. This contextual dependence makes it particularly difficult for beginners to objectively assess and improve their trading performance.

Developing proficiency in ICT Trading requires extensive study of pattern formation, execution, and failure scenarios. This learning process cannot be rushed or automated, as understanding pattern quality and market context comes only through careful observation. The challenge lies in finding an efficient way to accelerate this learning while maintaining necessary attention to detail.

How To Utilize ICT Concepts In Forex Tester Online

Understanding ICT concepts is one thing, but developing the skill to identify and trade them in real-time requires systematic practice. You can check how Forex Tester Online’s tick-data-based replay helps master these concepts through practical exercises, from basic pattern recognition to complex strategy testing.

FTO’s tick-data replay with multi-timeframe synchronization, news integration, and especially the feature of fast forwarding the chart till price touches the object – it all provides the ideal environment for this progression. You can observe how patterns develop simultaneously across different timeframes, pause to analyze key moments, and perfect your skills at each stage before moving to more complex applications.

Key ICT Concepts

Before diving into strategy testing and validation, let’s examine the essential concepts that form the foundation of ICT Trading, along with how they’re typically understood and applied.

1. ICT Trading: Swing Points

These are price points where significant market structure shifts occur, marked by higher highs and lower lows (or vice versa). Inner Circle Trader typically identifies these by observing a series of candles where price reverses direction after making an extreme. Higher timeframe swing points are generally considered to carry more weight in the ICT framework.

When backtesting ICT strategies in Forex Tester Online, the fractal indicator can be a valuable tool for identifying these swing points. This indicator works by marking points where a high or low is flanked by at least two lower highs or higher lows on each side. While the indicator automatically marks every technical swing point on the chart, traders should note that it will identify both major and minor swings. In choppy market conditions, this can result in numerous signals, requiring traders to filter them based on their specific strategy requirements.

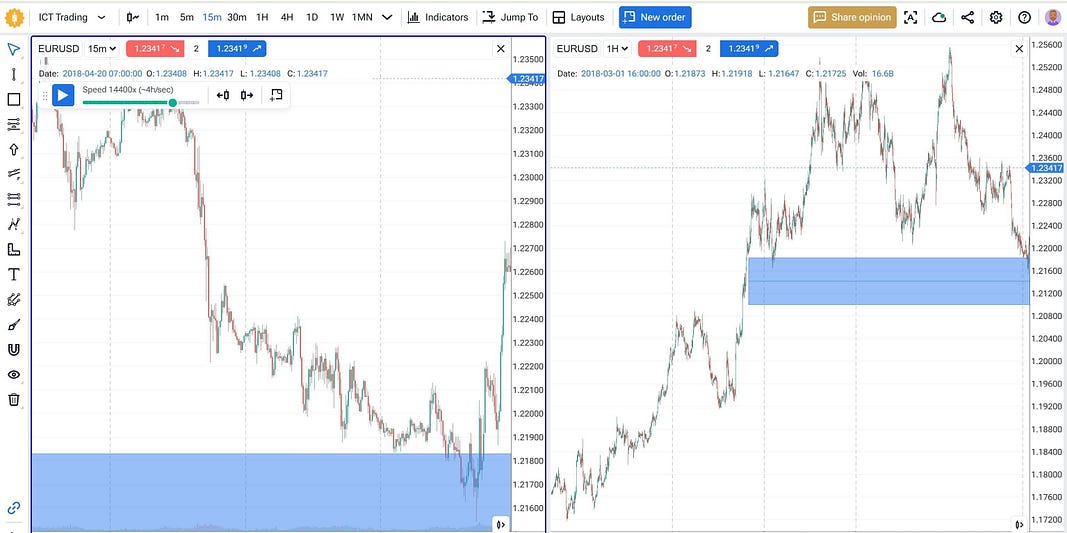

As shown in the image below, FTO’s multi-timeframe synchronization capability allows traders to identify significant fractal points on a higher timeframe (M15, left) and see how those same levels influence price action on lower timeframes (M1, right).

The horizontal blue lines mark key swing levels identified by fractals on the 15-minute chart, which are then automatically displayed on the 1-minute chart. This powerful feature helps traders see how significant swing points from higher timeframes create support and resistance zones on lower timeframes — essential for executing precise ICT trading entries and exits.

2. ICT Trading: Liquidity Zones

In ICT methodology, these zones are believed to form above swing highs and below swing lows, where stop-loss orders tend to cluster. According to ICT theory, institutional traders often push price into these areas to fill large positions.

Inner Circle traders following this approach watch for sharp price movements that sweep just beyond these levels before reversing – a pattern that’s commonly interpreted as institutional traders triggering retail stop losses to accumulate positions. It’s generally observed that the most notable liquidity zones form during low-volume periods or at the edges of trading sessions.

Forex Tester Online makes backtesting liquidity zones significantly more efficient with its ‘Go forward till price touches object’ feature. After identifying a potential liquidity zone with horizontal lines or rays, traders can right-click on these objects and select this option to instantly jump to when price interacts with that level.

This eliminates hours of manual chart scrolling, allowing traders to:

- Study dozens of liquidity sweeps in a single session

- Compare successful vs. failed sweeps across different market conditions

- Analyze post-sweep price behavior to develop precise entry criteria

- Test various stop-loss placements around potential liquidity zones

By practicing on historical data using this accelerated method, traders can quickly develop the pattern recognition skills needed to identify high-probability liquidity sweeps in live markets.

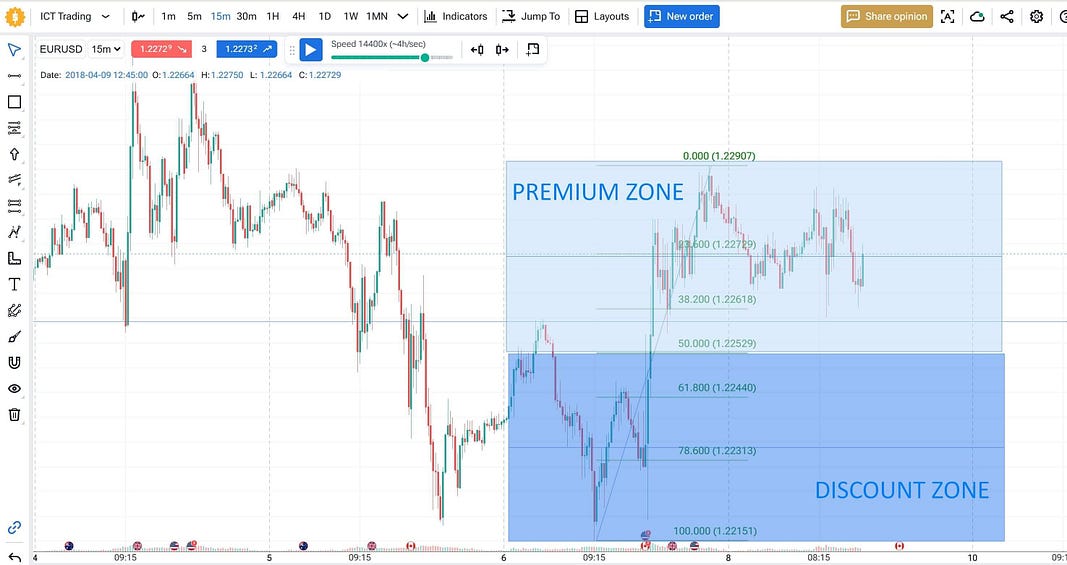

3. ICT Trading: Discount & Premium Zones

Within the ICT framework, discount zones are understood as areas where price trades significantly below the fair value, often observed following sharp selloffs or during pre-market hours. Premium zones represent the opposite scenario.

These zones are considered particularly significant by ICT practitioners when they align with institutional support/resistance levels or major swing points. Inner Circle trader may monitor price acceptance/rejection in these zones as potential confirmation signals.

4. ICT Trading: Optimal Trade Entries

In ICT trading theory, these setups are identified when multiple concepts converge at a single price level. For instance, practitioners often look for situations where a discount zone aligns with a liquidity zone near a significant swing point.

According to many ICT traders, the most favorable entries tend to appear during the London/New York session overlap or at the start of major trading sessions.

Forex Tester Online offers exceptional tools for focusing on these optimal entry timeframes. Using the “Jump To” menu feature, traders can instantly navigate to the “Silver Bullet” time window (10-11 AM New York time) — considered by many ICT traders as one of the most powerful trading periods. This time-saving feature allows traders to efficiently analyze dozens of these high-value time periods across different days and market conditions.

Additionally, FTO’s customizable trading session indicator allows traders to highlight any specific time windows on their charts with custom colors. ICT practitioners can set up personalized session markers for critical periods such as London/New York overlap, Asian range development, or other market-specific timeframes where optimal entries tend to cluster.

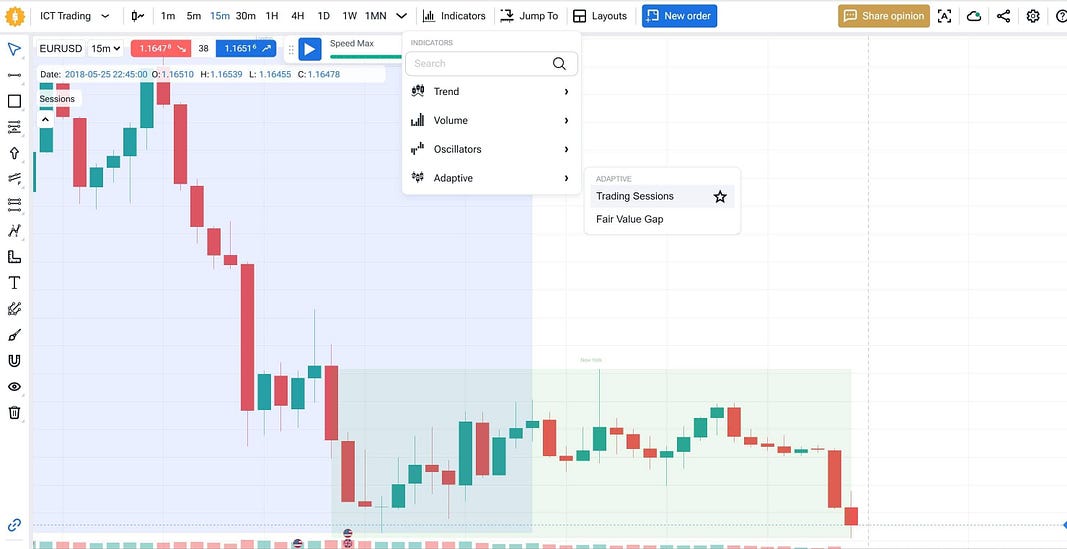

5. ICT Trading: Fair Value Gap (Bullish & Bearish) and Inversion

Within ICT methodology, fair value gaps are recognized as empty spaces on the chart where price has moved sharply without leaving any candle wicks. The theory suggests that the most reliable gaps occur during high-volume periods or significant news events. ICT traders often observe price behavior around these gaps, with particular interest in scenarios where price fills the gap and then reverses (inversion).

Forex Tester Online streamlines the identification of Fair Value Gaps with its built-in FVG indicator. This specialized tool automatically detects and marks both bullish and bearish Fair Value Gaps on your charts, eliminating the tedious process of manually scanning for these formations. By having FVGs clearly highlighted, traders can focus their attention on analyzing the quality and context of each gap rather than spending time on identification.

6. ICT Trading: Volume Imbalance & Gaps

According to ICT principles, volume imbalances are identified as sharp price movements with significantly higher volume than surrounding periods. Practitioners of this methodology often look for candles that are notably larger than previous ones, especially when breaking through key levels. These imbalances are typically thought to create gaps that might serve as future support/resistance levels.

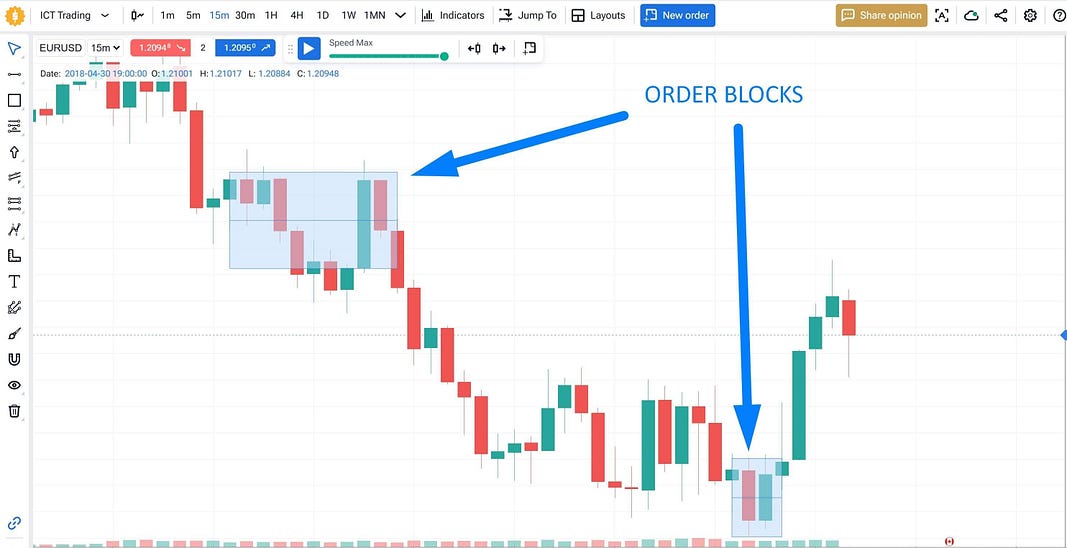

7. ICT Trading: Order Block (Low & High Probability)

In ICT theory, order blocks are understood to form where institutional traders place significant orders. The methodology suggests that high-probability blocks typically show a strong reversal with high volume, followed by a sharp move away from the level. Many ICT traders look for blocks that form at key market structure points or round numbers, with particular attention to the last candle before the move (the order block candle).

8. ICT Trading: Daily Bias

ICT methodology suggests determining daily bias through analysis of the previous day’s high/low and the Asian session range. Practitioners often observe price acceptance above or below these levels during London/New York sessions. According to this approach, strong bias is often recognized when price maintains direction after retesting these levels.

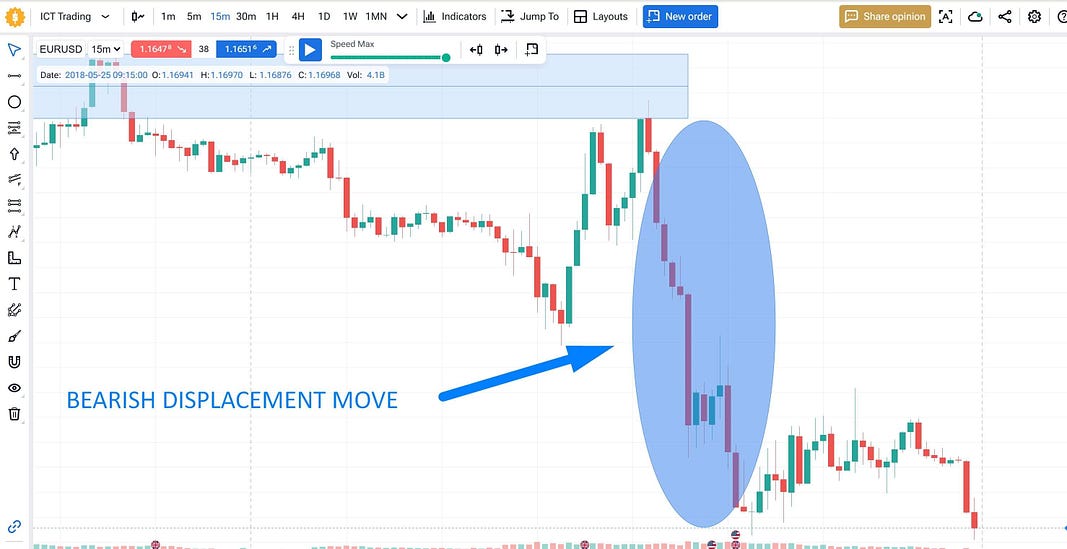

9. ICT Trading: Displacement

Within ICT trading theory, price displacement is understood as institutional pushing of the market away from significant levels to build positions. The methodology suggests watching for sharp moves away from major support/resistance, followed by a gradual return to these levels.

Many ICT traders believe the most significant displacement trades occur when price returns to the original level but displays different market structure characteristics.

These concepts are generally viewed as forming an interconnected framework for market analysis, with practitioners finding their greatest potential when used in combination. For example, many ICT traders look for scenarios where an order block forms in a discount zone, combined with a fair value gap and aligned with the daily bias.

What are the methods of ICT trading?

ICT methodology centers around two primary methods of analysis: Market Structure Analysis and Order Flow Analysis. The combination of these methods, practiced systematically in a realistic backtesting environment, helps traders develop the skills needed to identify and act on institutional trading activity across different market conditions.

Market Structure Analysis

Market structure analysis provides the broader context for trading decisions, typically starting on higher timeframes where institutional activity is most visible.

The methodology focuses on identifying structural changes through breaks of structure (BOS), changes of character (CHoCH), and market structure shifts. Using FTO’s tick-by-tick replay, traders can study how these transitions unfold naturally across timeframes, understanding how higher timeframe movements influence lower timeframe price action.

Order Flow Analysis

Order flow analysis reveals institutional activity in real-time by identifying patterns of position accumulation, distribution, and liquidity engineering. Through FTO’s replay capabilities, traders can practice recognizing these patterns at various speeds, while using volume analysis as a confirmation tool.

Pros and Cons of ICT Trading

ICT Trading, like any methodology, comes with its distinct advantages and limitations. Understanding these can help traders set realistic expectations and develop appropriate strategies.

Advantages

- Provides a structured framework for understanding institutional activity in the markets

- Focuses on higher probability trades aligned with major market moves

- Works across multiple timeframes and instruments

- Reduces reliance on lagging technical indicators

Limitations

- Steep learning curve and complex terminology

- Requires significant time investment for pattern recognition mastery

- Can be subjective in pattern interpretation

- Challenging to automate due to contextual nature of setups

- Demands constant attention to multiple timeframes

Most of these limitations can be addressed through proper practice and systematic backtesting using advanced platforms like FTO, which enables traders to accelerate their learning process through realistic market replay and multi-timeframe analysis.

Backtesting ICT on Forex Tester Online: Mini Guide

Mastering ICT trading requires practice, not just theory. Here’s how to test your ICT setups step by step using Forex Tester Online:

1) Register and access the tool

Visit the Forex Tester Online website, create an account, and activate your subscription.

2) Launch a new backtest project

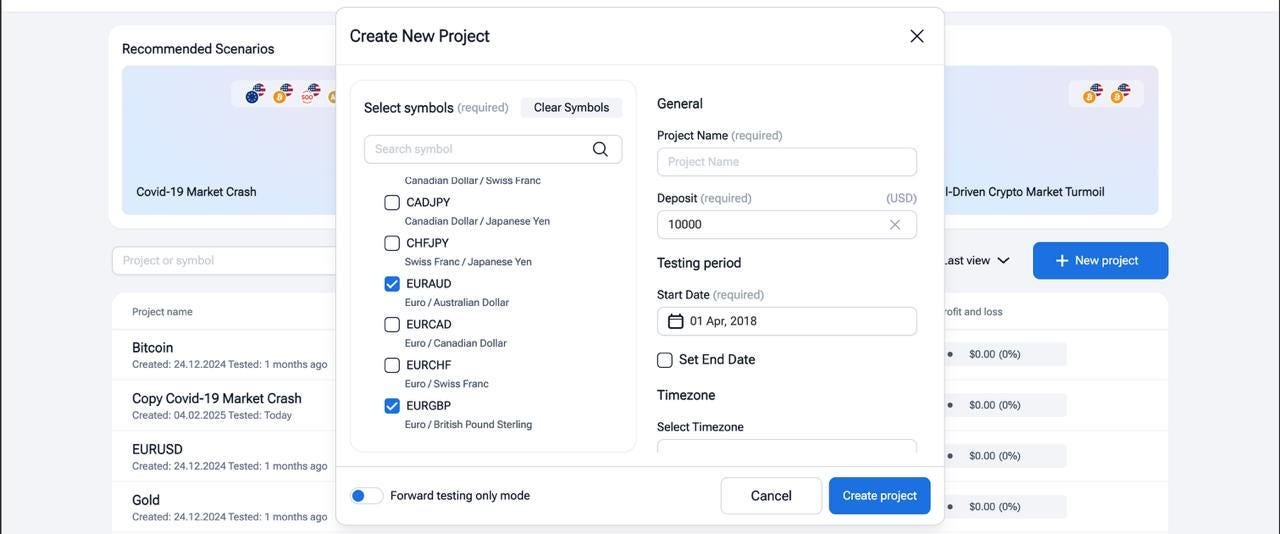

Click “+ New Project.”

Pick a symbol (e.g., EURUSD), name your project (e.g., “ICT Liquidity Sweep”), set the date range (e.g., last 3 months), and choose your time zone. Hit “Create Project”.

3) Enable key features

-

Turn on multi-timeframe view (e.g., M15 + M1).

-

Activate tick-by-tick replay for realistic simulation.

-

Use Floating Spread and News marks to reflect real-world market behavior.

4) Draw your ICT levels

-

Use horizontal lines to mark swing highs/lows, liquidity zones, and fair value gaps.

-

Use the “Go forward till price touches object” function to quickly jump to key moments like liquidity sweeps.

5) Simulate entries manually

Watch price action near your marked levels.

Look for ICT confirmations like displacement, optimal trade entry, or fair value gap reactions.

Place virtual trades with the Buy/Sell buttons.

6) Use “Jump To” for Silver Bullet timing

Quickly skip to 10–11 AM New York time — the preferred ICT window — using the Jump To feature. Analyze entry opportunities during this high-probability session.

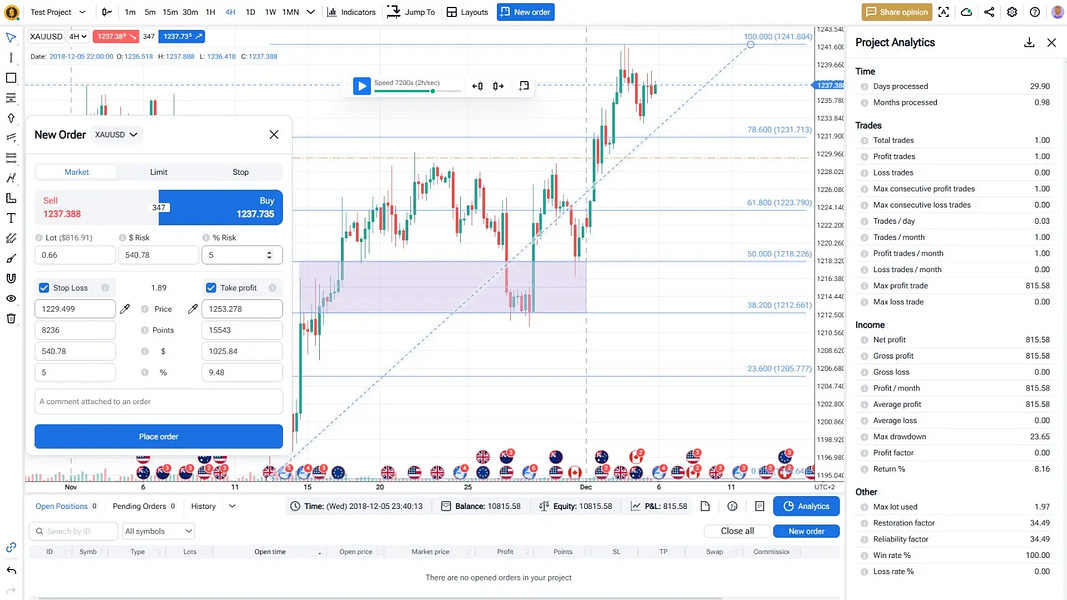

7) Analyze results

Go to Analytics to check win rate, drawdown, and trade stats.

Export your report or take screenshots to track your learning curve.

8) Repeat and refine

Run multiple tests with different setups:

-

Liquidity sweep + order block

-

Discount zone + fair value gap

-

Daily bias + optimal trade entry

Over time, this process helps you sharpen your edge and gain confidence in real conditions — without risking real capital.

Test ICT setups the right way

Conclusion

ICT Trading provides traders with practical tools for identifying institutional activity in the markets, from order blocks and fair value gaps to liquidity sweeps and market structure shifts. Through systematic practice using tick-by-tick historical data in platforms like Forex Tester Online, traders can learn to spot these patterns as they develop across multiple timeframes. This multi-timeframe analysis helps identify high-probability setups where institutional order flow aligns with market structure.

Understanding these concepts allows traders to anticipate potential price movements before they occur, position themselves ahead of major market shifts, and manage risk more effectively by identifying key institutional levels.

While mastering ICT Trading requires dedication, the ability to read and react to institutional activity gives traders a significant edge in today’s markets. With proper practice and validation tools, traders can develop these skills in a risk-free environment before applying them to live trading.

FAQ

What Is ICT Trading In Forex?

ICT Trading is a methodology focused on identifying and trading alongside institutional order flow in the forex market. It emphasizes market structure analysis, order blocks, and liquidity patterns that large financial institutions typically create.

What Is ICT Strategy?

ICT Strategy refers to any trading approach that incorporates ICT concepts. Strategies can range from simple setups based on a single concept like order blocks to complex methodologies combining multiple ICT elements with other technical analysis tools. Traders often develop their own unique approaches by adapting ICT concepts to their trading style.

How does the ICT strategy work?

There isn’t a single defined ICT strategy – traders develop various approaches using ICT concepts. Some focus on market structure analysis, others on order flow or specific patterns like fair value gaps. These concepts can be used independently or combined with other technical analysis tools. Many traders adapt and modify their strategies based on extensive backtesting results.

What is the difference between ICT and SMC trading?

Both ICT Trading and Smart Money Concepts share common ground in their focus on institutional activity and market structure. While they may use different terminology and specific concepts, both approaches aim to help traders understand and align with institutional order flow. Many traders incorporate elements from both methodologies in their trading.

Is ICT Trading Profitable?

Profitability in ICT Trading varies significantly as traders develop different strategies based on the core concepts. Since many of these strategies are traded manually, results often depend on individual interpretation and decision-making.

Whether a particular strategy can be profitable and how to improve its performance can be systematically assessed through comprehensive backtesting.

Platforms like Forex Tester Online allow traders to validate their interpretations of ICT concepts, refine their entry and exit points, and optimize their risk management across different market conditions before risking real capital.

Where Did ICT Trading Methodologies Come From?

ICT Trading methodology was developed through observation of institutional trading patterns in financial markets. While various traders have contributed to the concepts over time, the methodology has evolved to provide a systematic approach to understanding and trading alongside institutional order flow.

Forex Tester Online

Validate and optimize ICT trading strategies using our backtesting tool

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska