FX Replay is a fairly good backtesting service. However, nothing is perfect. And when it comes to professional testing, in addition to known benefits, it has certain disadvantages. In this article we will try to honestly compare it with FX Replay alternatives, highlight the advantages and find the cons.

Let’s find the best backtesting solution for active traders in 2026!

*Pay attention to the first alternative. It is as advanced, but still much more affordable.

Why Look for a FX Replay Alternative?

So, before moving on to alternatives, let’s talk about FX Replay itself. Let’s start with compliments.

This service is very convenient, has a good design, and a simple interface. You can easily find all indicators, all statistics, and all orders. The service also works entirely online through a browser. It generally has good UX.

Then why look for alternatives? Well, FX Replay has two serious drawbacks that turn off many users.

FX Replay has become too slow

Its operation does not depend on the trader’s equipment or the quality of the Internet connection. Many users on Trustpilot are complaining about this problem in FX Replay reviews. By tracking the history of reviews, you can see that FX Replay did not cause discomfort until a certain point. But in 2025 it became very difficult to work with it. It takes too long to wait for a response from the server.

FX Replay functionality limits professional traders

As experience grows and new tools and strategies are tried, it becomes clear that FX Replay no longer meets all the needs of an advanced trader. The lack of automatic strategies, or the ability to add custom auto trading algorithms, insufficient statistics and data for in-depth analysis become significant disadvantages. And one more important drawback is limited data: some pairs have less than 10 years and sometimes even less than 3 years of available range to test on.

That is, FX Replay is good for beginner traders, but not advanced enough for top traders.

Reliability Issues

Many users report that FX Replay doesn’t reliably save chart templates, layouts, and drawing tools. These elements frequently reset when switching between projects or even when reloading the same project, causing frustration and wasted time.

This may sound like not a big deal, but at the same time this can annoy and ruin the general experience for some users, while it’s very important to keep backtesting sessions emotionally stable, reliable, and efficient.

Therefore, many users eventually start looking for FX Replay alternatives. Let’s look at a few popular options.

Best FX Replay Alternatives

In this article, we will review 7 other most popular backtesting solutions on the market.

1. Forex Tester Online

The new Forex Tester Online service is based on the Forex Tester tool, which is already used by tens of thousands of Forex traders around the world. If you have already tried Forex Tester, you will definitely like FTO. And most importantly, even FTO’s basic plan has most features of FX Replay’s Pro version.

It retains the advanced tools for backtesting and analytics, but has a more modern design and the ability to work directly through the browser on any device: Windows, MacOS, Linux, Android or iOS. Today, this is perhaps the best FX Replay alternative. FTO is just as convenient, but much more practical and faster.

An important advantage of FTO is its reliable persistence of chart templates, layouts, and drawing tools between sessions. Unlike FX Replay, where these elements often reset unexpectedly, FTO maintains your setups consistently, saving you time and reducing frustration.

Additionally, FTO’s comprehensive navigation system saves up to 50% of analysis time by instantly navigating to specific price points, orders, news events, drawing tools, and even price intersections with applied indicators’ elements through its “jump-to” functionality.

Forex Tester Online (FTO) vs FX Replay

Let’s compare some features of FX Replay and Forex Tester Online

| Feature | FX Replay | Forex Tester Online |

|---|---|---|

| Assets types | Currencies, Crypto, Indexes, Futures, Energy, Agriculture | Currencies, Crypto, Indexes, Futures, Metals, Exotic |

| Data precision | Minute bars only | Tick-by-tick data for precise backtesting |

| Years of data | Up to 21 years (depending on the pair) | Up to 21 years (depending on the pair) |

| Launched in | 2022 | 2024 |

| Refund options | No | Within 30 days |

| UI design | Generic charting solution | Purpose-built interface optimized for backtesting |

| Different types of orders | Yes | Yes |

| Mid-test modifications | Cannot add symbols during testing | Add symbols during active testing without restart |

| Deposit/Withdrawal | Limited during testing | Can add/withdraw funds during active testing |

| Terminal | Yes | Yes |

| Order history | Yes | Yes |

| Speed management | Yes | Yes |

| Indicators management | Yes | Yes |

| Custom indicators | No | Yes |

| Jump to / Go forward | No | Yes |

| Custom Automations | No | Yes |

| Exit Optimizer | No | Yes |

| Blind Testing mode | No | Yes |

| Prop Challenge | No | Yes |

| Support | No in-app support | Live in-app chat with support specialists |

| Price | $180/year (Intermediate) / $350/year (Pro) | $159/year (Starter) / $239/year (Pro) |

Load Your Favorite Indicators in a Flash

Got your own custom indicators? Uploading them into Forex Tester Online is fast and hassle-free. Just drag, drop, and test your strategy with the tools you trust most.

Bonus Powers You Won’t Find Elsewhere

Forex Tester Online now comes with an upgraded time machine! You can Jump to Historical Moments like big market shocks or events that moved prices like crazy. Or simply fast-forward to the Next Trading Session — Asian, European, New York — or even to the exclusive Silver Bullet Session. Need precision? Jump to a Custom Date, Next News Event, or just hit the Next Day Open. Your replay, your rules.

And if that’s not enough… how about jumping forward till the price hits exactly the level you want? Whether it’s a specific price, a psychological round number, a line you’ve drawn on the chart, a session high, or the high of the previous daily candle — go there in one click. You can even fast-forward until your pending order gets triggered or your current trade is closed.

These ultra-flexible controls are built to save you time and supercharge your strategy testing. No other backtesting tool gives you this much control. Once you try it — you’ll never go back.

Prop Challenge Simulation: Perfect Your Funded Trading Skills

FTO’s Prop Challenge mode transforms how traders prepare for proprietary firm evaluations. Instead of risking challenge fees on unproven approaches, you can create realistic simulation environments that match the exact requirements of today’s popular prop firms.

Set up your custom challenge with:

- Precise profit targets (5%, 8%, 10% or custom goals)

- Maximum daily and total drawdown limits

- Required minimum trading days

- Starting account balance options

- Time window restrictions

The platform provides real-time feedback on your performance metrics, showing exactly how you’re tracking against challenge parameters. This instant visibility helps you identify strategy weaknesses before they would cost you in a real evaluation.

Think of it as your personal prop firm simulator – a risk-free environment to refine your approach and build confidence before committing actual capital to official challenges. For traders serious about securing funded accounts, this feature alone can save thousands in repeated evaluation fees.

Custom Automations to Speed Up Your Testing

Imagine setting your own rules and letting the software do the grunt work. With the Automation feature, you’ll be able to create smart, custom automations for every symbol or timeframe. Want the tester to pause when price hits a key level? Or place a trade when certain conditions align? Just define your comparison logic, set the action, choose how often it should trigger, and when it should expire. It’s like having a personal assistant for your backtesting.

Test Your Skills with the Mystery Scenario

Think you can trade without bias? Activate the Mystery Scenario to blind-trade a random asset with shifted prices. You won’t know what pair or timeframe you’re trading — perfect for sharpening pure price action skills and eliminating emotional baggage.

Prop Challenge Mode with Pro-Level Analytics

Step into the shoes of a funded trader with our Prop Challenge mode. Set your trading goals, follow strict rules, and get detailed performance analytics that reveal your edge — or expose your weaknesses. It’s the ultimate way to prepare for real prop firm evaluations.

Forex Tester Online is actively evolving with new features being added regularly.

Among the recent developments are:

- Prop Challenges Simulations

- Backtesting Automations

- Advanced Analytics

- Heiken Ashi charts

- Volume Indicators

The development roadmap includes:

- Automatic testing (EAs)

- Education materials

- More indicators

- MORE Advanced analytics

FTO has many advanced features for professional traders. It is already a great alternative with even more advanced tools to come. The lifetime pricing model offers exceptional value, as you pay once and receive all upcoming features at no additional cost, even as the product develops and the price potentially increases.

Basically, Forex Tester Online is the best FX Replay alternative, because it is as advanced (even in the Starter plan), and still it is more affordable. FX Replay Pro costs $350/yearly, while FTO costs as low as $239/year (or $399 for lifetime access).

Overall score: 9/10.

Now, let’s look at a few other FX Replay alternatives.

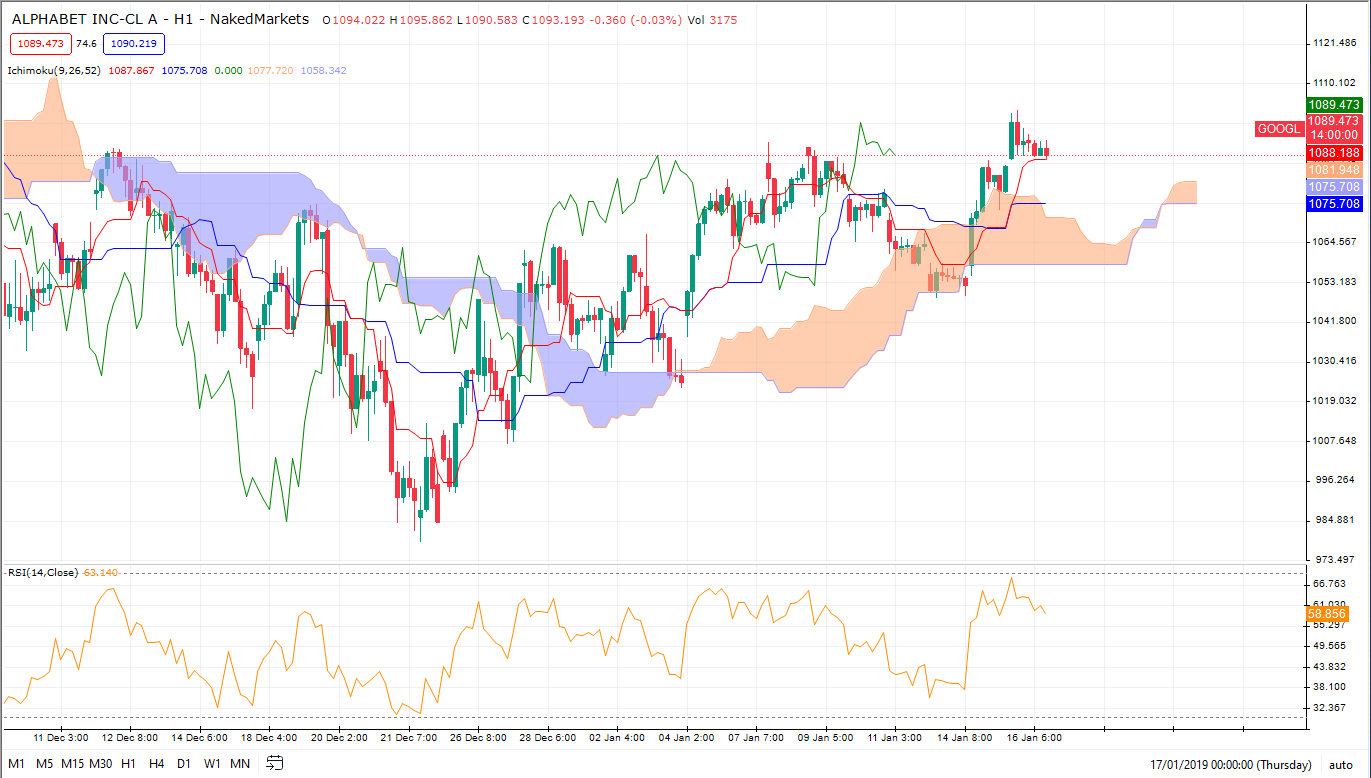

2. NakedMarkets

NakedMarkets is a Forex trading simulator that targets both novice and experienced traders, aiming to offer a realistic and detailed environment for strategy testing using historical Forex data.

Advantages

- Realistic simulation. NakedMarkets uses high-quality, tick-by-tick data, which is crucial for accurately simulating the Forex market. This allows traders to see how their strategies would have performed in real historical conditions.

- Customization. Users can customize various aspects of their trading strategy including entry, exit, and money management rules. This level of customization is important for traders who want to refine specific elements of their trading approach.

- User interface. The platform is designed to be intuitive and user-friendly, catering both to beginners who need ease of use and to active traders who require in-depth analytical tools.

- Backtesting speed. NakedMarkets is known for its fast backtesting capabilities, which means traders can run multiple tests over large sets of data without significant delays.

- Risk management tools. Incorporating robust risk management tools helps traders understand potential losses and adjust their strategies to mitigate these risks effectively.

Disadvantages

- Cost. Compared to some other simulators that might offer free versions with limited capabilities, NakedMarkets requires a purchase, which might be a barrier for those just starting out or looking to experiment without financial commitment. The software itself might only cost between $100 and $500. But professional quality historical data can cost you $30+ per month.

- Complexity for beginners. While it is user-friendly, the depth and range of features might overwhelm beginners who are not yet familiar with Forex trading complexities.

Overall score: 7/10.

3. Soft4FX

Soft4FX specializes in developing software for Forex traders. Their simulator is an add-on that functions as an Expert Advisor (EA) for the popular trading platform MetaTrader 4 (MT4).

Advantages

- Ease of use. By operating within MT4, users who are already familiar with this platform will find it easy to start using the simulator without the need to learn new software.

- Reasonable price. Soft4FX Forex Simulator costs $109 for lifetime access, which is relatively affordable.

- Versatility. It allows for day trading practice as well as longer-term trading simulation, giving it versatility for different trading styles.

Disadvantages

- MT4 dependency. The main limitation is its dependency on MT4. Users of other trading platforms like MT5 or various web-based platforms cannot use this simulator without switching to or also running MT4.

- Limited to Forex. Like many simulators focused on Forex, it does not support backtesting strategies on other asset classes such as stocks or cryptocurrencies.

- No live trading features. The simulator is strictly for backtesting and practice; it doesn’t offer features to transition strategies directly into live trading, which can be a drawback for those looking to seamlessly move from testing to real trading.

- Outdated design. This program is long overdue for updating.

Overall score: 5/10.

4. Tradewell.app

Tradewell.app appears to be a trading platform that focuses on providing access to various financial markets including cryptocurrencies, stocks, and, of course, Forex.

Advantages

- Versatility in trading options. By covering various markets, tradewell.app offers traders the flexibility to engage in multiple types of trading activities all on one platform.

- Educational resources. Just like Forex Tester, Tradewell.app typically includes educational materials and resources, which can be particularly beneficial for new traders.

- Good free version. The free version has a large number of limitations in functionality, but is not limited in time, and is quite usable.

Disadvantages

- Newer platform. As a relatively new or less known entity in the trading space, it might lack the established trust and reputation that come with longer-standing platforms.

- Limited customizability. Depending on the depth of features offered, advanced traders might find the platform’s capabilities somewhat limited compared to specialized or more sophisticated trading platforms.

- Limited functionality. This platform is quite limited in comparison to both FX Replay and Forex Tester Online.

- No life-time access and expensive subscription. Its subscription costs from $30/month (Plus) to $60/month (Professional). So full paid access costs $720 per year, making Tradewell the most expensive tool in the list.

Overall score: 5/10.

5. TradingSim

TradingSim is a comprehensive market simulator designed primarily for those looking to practice and improve their day trading skills without financial risk. The platform provides an opportunity to simulate trading on various US stock markets using historical data.

Advantages

- Ease of use. The platform is designed to be user-friendly.

- Decent functionality. This platform offers a fairly wide range of backtesting features to choose from.

- Educational resources. TradingSim includes a variety of educational blogs, tutorials, and lessons aimed at enhancing users’ trading knowledge and skills.

Disadvantages

- Limited data. The access to just 3 years of historical data is a significant disadvantage, as it doesn’t allow test strategies on other time ranges.

- Limited asset classes. The focus is primarily on stocks and ETFs. Traders interested in other markets like Forex, commodities, or cryptocurrencies will not find these available on TradingSim.

- No lifetime plan. Access to TradingSim is subscription-based. This is bad for those who think long-term. The access costs from $33/month for Pro to $37/month for Premium.

Overall score: 7/10.

6. TradingView

Just to make this list full, let’s also consider TradingView. This is one of the most popular trading apps in the world with over 50 million traders using it. It is not designed for backtesting specifically, but yes, you can use TradingView for testing your Forex strategies.

TradingView is a popular platform among traders for its charting capabilities, technical analysis tools, and collaborative features. It also provides a powerful scripting language called Pine Script, which traders use to create custom indicators.

We recommend you to have a TradingView account as a part of your trading arsenal. But still, it doesn’t offer the same level of trading functionality as FX Replay, FTO, Forex Tester or any similar backtesting platform.

Overall score: 7/10.

7. TradeZella

TradeZella is a trading journal and analytics platform designed to help traders improve by tracking and analyzing their trades. While it’s not a traditional backtesting tool like FX Replay, it offers features that make it a useful alternative, especially for those who focus on journaling and performance analysis.

Its users can evaluate their trading approach, grow from their errors, and improve their overall performance with the use of data, insights, and comments.

Advantages

- Automated trade journaling. TradeZella syncs with various trading accounts, including MetaTrader 4 and 5. This saves you time by automatically recording your trades, so you don’t have to enter data manually.

- Detailed analytics. The platform provides analytics to help you understand your trading performance. You can see your win rates, average profits and losses, risk-reward ratios, and performance by day or instrument. Visual tools like equity curves and P&L calendars make it easier to spot strengths and weaknesses.

- Strategy tracking. You can create a playbook to document your trading strategies, including entry and exit rules. This helps you stay organized and measure how well each strategy performs over time.

- Visual trade recaps. TradeZella integrates with TradingView to show your trade entries and exits on charts. This makes it easy to review your trades and see how the market moved.

- Psychological journaling. The platform lets you record your thoughts and feelings about each trade. This helps you identify patterns in your behavior that might affect your trading decisions.

Disadvantages

- No backtesting features. TradeZella doesn’t offer traditional backtesting or replay functions like FX Replay. If you need to test strategies on historical data, this might be a limitation.

- Subscription cost. TradeZella uses a subscription model. While it offers many features, the ongoing cost might be a concern for some traders.

- Learning curve. There may be a learning curve to use all of TradeZella’s features effectively.

- Data depends on brokers. The platform relies on data from your trading accounts. If your broker’s data is limited, it could affect your analysis.

Overall score: 7/10.

TradeZella is a good tool for traders who want to improve through journaling and analysis. It may not replace FX Replay for backtesting needs, but it offers valuable features for tracking and enhancing your trading performance.

Free alternatives to FX Replay

These 2 platforms have their benefits and drawbacks, but after careful consideration, here is which one I would use if I was going to go the free route.

MetaTrader 4 or 5

MT4 has more custom indicators and EAs available, but MT5 is a newer platform and can be used to trade more markets. MetaTrader and FX Replay are very different in every possible way. But still, both can be used for backtesting. You may try MT4/5 in these situations:

- If you need a free platform with robust functionality.

- If you trade multiple asset classes.

- If you rely on automated trading systems (EAs).

- If you value a strong community and third-party tools.

- If you prefer mobile accessibility.

While FXReplay excels at manual backtesting with user-friendly features, MetaTrader 4 and 5 are still superior for general trading, backtesting, and customization needs. Both are good in their own way and are worth trying.

Traders Gym in ThinkTrader

For most traders, Traders Gym on ThinkTrader offers a more practical, cost-effective and reliable solution for both testing strategies and executing real-time market trading.

- Free to Use: No subscription fees.

- Seamless Integration: Fully integrated with ThinkTrader for live and simulated trading.

- Greater Market Access: Supports multiple asset classes.

- Real-Time Simulation: Testing precise and dynamic strategies.

- Intuitive Design: Easy to use for both beginners and advanced traders.

- Reliability: Fewer interruptions due to connection problems.

Traders Gym is free, so it would be unfair to compare it with FX Replay that costs up to $350 a year. But in general, FX Replay (as well as Forex Tester Online) provide more advanced backtesting features, so if you are serious about it, considering paid tools is 100% worth it.

Сonclusion

FX Replay is one of the best online backtesting tools available today. However, it has its drawbacks, such as lags, limited data volume, lack of automatic trading; it is also missing a number of other advanced features.

The considered alternatives, such as TradingSim, Tradewell.app, Soft4FX and NakedMarkets, are sometimes ahead of FX Replay in terms of functionality, but also have their drawbacks (lack of online testing, outdated functionality, limited number of assets, incompatibility with new versions of Meta Trader, and so on).

Forex Tester Online is a rapidly developing platform that’s already ahead of FX Replay in several important features. More advanced capabilities are being added regularly to further enhance the trading experience.

- Superior Performance: FTO operates with greater speed and reliability compared to FX Replay

- Professional-Grade Data: Tick-by-tick precision versus minute-bar limitations

- Realistic Trading Environment: Features like mid-test deposits/withdrawals and proper margin call handling

- Trader-Centric Design: Purpose-built UI with persistent templates and layouts

- Long-Term Value: Lifetime purchase option versus ongoing subscription costs

More useful advanced features will be added in the near future, including the features available in Forex Tester. So far this is the most interesting FX Replay alternative that definitely deserves your attention.

For serious traders seeking a professional backtesting solution, Forex Tester Online delivers the best combination of performance, precision, and value. While other alternatives offer some advantages, FTO’s foundation in the proven Forex Tester ecosystem combined with modern browser-based accessibility makes it the clear choice for traders in 2026.

Right now, you can try Forex Tester Online and share your feedback to help enhance the platform even further.

FAQ

What is similar to FX Replay?

You can also consider: NinjaTrader, cTrader, Forexthrive.com and TraderEdge.

Can I test automated trading strategies on FX Replay?

No, FX Replay does not support automated trading strategies or the ability to add custom auto trading algorithms. This is mentioned as one of its significant drawbacks for professional traders.

If you’re looking to test automated strategies, you would need to consider alternatives like Forex Tester Online, which has automated testing (EAs) on its development roadmap, or platforms like MetaTrader 4/5 that already support this functionality.

Does FX Replay offer any advantages over MetaTrader for backtesting?

FX Replay’s main advantages over MetaTrader include browser-based accessibility (no installation needed) and a more intuitive interface designed specifically for manual backtesting.

However, MetaTrader provides better customization options, stronger support for automated trading systems, and access to more markets. FX Replay suits simplicity-focused users, while MetaTrader remains better for advanced needs.

How far back can you go on FX Replay?

The time range depends on the currency pair. Some only let you test over a period of 3-5 years (for example, ETH-USD). Some other let you go further, up to 21+ years (for example, USD-EUR).

Forex Tester Online

Best FX Replay alternative and affordable advanced backtesting tool

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska