Backtesting Options Strategies involves simulating trades with historical data. Traders aim to figure out entry signals, exit strategies, and potential profit or loss. The process doesn’t promise real-life results. Still, it’s better than trading blind. A careful options backtesting plan can reveal issues in a strategy early.

What is Options Backtesting and How Does it Work?

Options backtesting is a process that helps traders see how an options strategy might have worked in the past. It’s a critical step before risking real money. Many traders skip this step and rely on guesswork. That’s risky. With a solid plan for backtesting options, you can gather insights into how trades might behave under different market conditions.

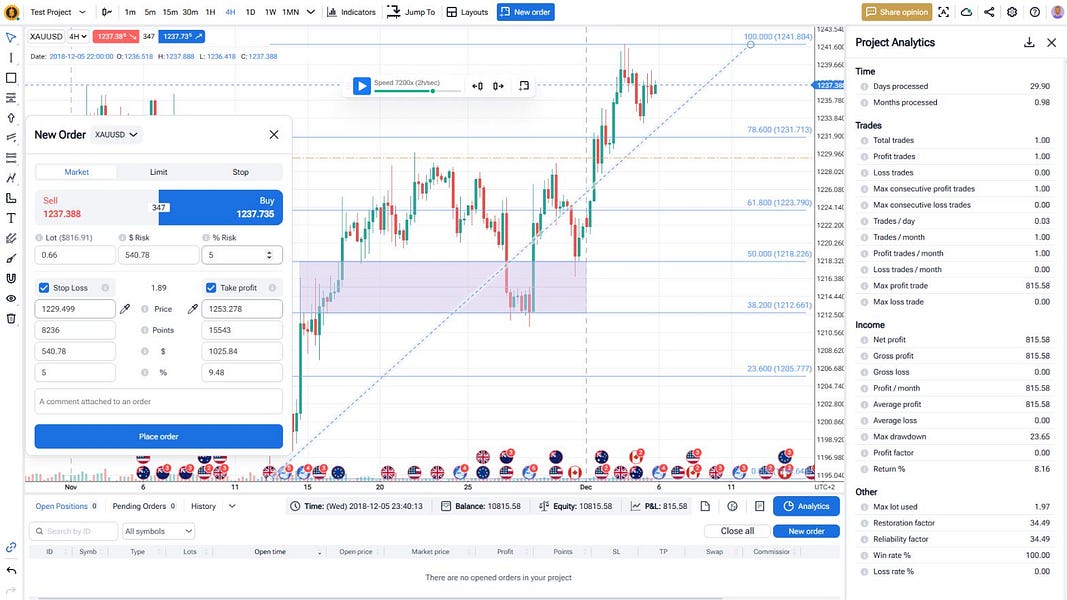

To backtest options, you need a basic framework. You need a defined plan, historical data, and a clear idea of how to measure success. There are tools that can help, like Forex Tester Online. Though it’s mostly for currency pairs, many traders value it for basic testing and practice.

Below, we’ll discuss how to backtest options strategies step by step. We’ll cover defining your strategy, picking a time frame, and gathering historical data. Then we’ll dive into executing the backtest and analyzing the results. This gives you a good picture of what to expect when backtesting options. The goal is to be informed and prepared for live trading.

How to Backtest Options Strategies

We write a lot about backtesting. In our blog, you can find articles about backtesting stocks, crypto, Forex, and futures. But options are very different. So, this is how it works.

1. Define Your Strategy

Start with a clear plan. Know which options you want to trade — calls, puts, or spreads. Are you looking for quick wins or longer-term plays? Write this down. If you don’t define your game plan, options backtesting turns into random guesswork. Backtesting platform is just a tool that helps you to test your strategies. You need to figure out strategies by yourself (or choose one of our 40 Trading Strategies).

Then, clarify your signals. These signals can be based on chart patterns, volatility setups, or fundamental catalysts. Some traders use indicators. Others focus on price action. Pick what suits your style. Backtesting options will make more sense if you know exactly why you enter or exit a trade.

2. Choose a Time Frame

Pick a period you care about. If you’re a day trader, you might backtest options using short data samples, like intraday charts. Swing traders often look at days or weeks. Long-term traders might consider months or years.

Don’t get stuck on a tiny window. One month of data might miss big market swings. If you only test a bull market, you won’t see how your strategy holds up in a downturn. Test various market phases if possible. This gives a broader view of how your trades might fare.

3. Gather Historical Data

Collect reliable historical prices for the underlying asset and the specific option contracts. Look at open-high-low-close info, volume, implied volatility, and any other factor you consider when placing real trades.

Forex Tester Online supports 23+ years of high-quality historical tick data. It comes with a basic subscription starting at just $19.99/month.

4. Execute the Backtest

The main task is to replicate each trade. Start from your first signal. Check the date and time. Then pick the correct option contract based on your strategy. Record the entry price, account for volatility, and see how the trade might have moved over time.

Adjust for position size and margin requirements. If your strategy suggests scaling in, handle that. Keep a log of each trade. Mark down the exit signal, whether it’s a stop-loss or a profit target. This daily or weekly routine helps you spot patterns. The final tally shows the hypothetical gains or losses.

Some traders use a spreadsheet to handle this. Others prefer specialized software. If you want a straightforward tool for testing and learning, Forex Tester Online is a good and reliable tool to use.

5. Analyze the Results

Once you have the raw outcomes, you can see if your strategy makes sense. Look at net profit, win-loss ratio, maximum drawdown, and average trade duration. Identify any outliers. Did one huge gain skew the results? Did a few losing trades wipe out weeks of progress?

Pay attention to volatility spikes. Options pricing can swing fast. A strategy might look good during quiet times but fail in a wild market. This is why a thorough backtest options review is so helpful. You might spot issues before your money is on the line. If the numbers look good, you have a baseline for forward testing in a simulated or live environment with small position sizes.

Best Practices for Backtesting Options Strategies

The more responsibly you approach backtesting, the more accurate results you will get.

Use Sufficient Data

More data makes your backtest options work more reliably. Cover different market phases — bull, bear, and sideways. You’ll spot whether your strategy tanks in high volatility or thrives in choppy conditions. Large sample sizes provide fewer surprises later. A broad data range strengthens options backtesting results. You want to see how your trades behave over time, not just in a single market trend.

Incorporate Transaction Costs

Commissions and fees pile up. Slippage also matters in live trading. When backtesting options, add these expenses to every trade. A strategy that looks great on paper can be a dud once costs are included. This step keeps your results realistic. If you ignore fees, your Backtesting Options Strategies might mislead you. Traders often discover their margin for profit shrinks once costs are factored in.

Factor in Real-World Constraints

Some traders load up on positions without considering margin requirements. In reality, margin can limit how many positions you open. Also, liquidity can be an issue. Thinly traded options can lead to poor fills. This is why you test with real-world constraints in mind. Backtesting options is more valuable when you mimic your exact trading conditions. If you only have so much capital, reflect that in your plan. If your data includes large spreads, factor that in.

Avoid the Hindsight Bias

Hindsight bias is the trap of looking back and pretending you would have made all the right calls. When you backtest options, be strict with your entry and exit signals. Don’t change your strategy mid-test. And don’t cherry-pick trades you want to see. This skews the results. Keep it consistent from start to finish. Genuine options backtesting is honest. It shows you the real story. If the results aren’t pretty, that’s still good info. Better to find out during testing than after losing money.

These best practices help you get the most from Backtesting Options Strategies. Stick to them, and your tests become more trustworthy. Expand your data, track costs, reflect real-world factors, and stay objective. Then, if your final numbers look solid, you can move on to live trading with greater confidence.

Popular Tools for Backtesting Options Strategies

- Forex Tester Online

- Forex Tester Desktop (Try for Free)

- OptionNet Explorer

- Backtrader (Python Library)

- QuantConnect

- Tastytrade

- TradeStation

What’s the best option for options traders?

ThinkorSwim Paper Trading is a great choice for stock and options traders who want live market data, advanced charting, and real-time practice without risking real money.

Forex Tester Online

Simulate trades with historical data and backtest options strategies via FTO

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska