Keeping a good trading journal is one of the easiest ways to improve your performance. It helps you track what works, what doesn’t, and how to avoid repeating costly mistakes. It is such a simple habit that neglecting it would be a crime.

So, we tested several trading journal tools and picked the top five. These are simple to use, offer useful stats, and work well for active traders. Some are better for manual trading, others for automated imports — but all of them can help you trade smarter.

Let’s take a closer look.

But first…

What Is a Trading Journal?

It is a tool traders use to record, review, and analyze their trades. It typically includes details like entry and exit points, trade size, strategy used, market conditions, and the outcome. Many journals also track emotions and thought processes behind each trade. The goal is to identify patterns, refine strategies, and improve decision-making over time. Whether kept manually or through software, a journal helps traders stay disciplined and learn from both wins and losses.

Best Trading Journals for 2025

1. Forex Tester Online: Trading Journal + Backtesting

Forex Tester Online is more than just a backtesting tool — it also works as a detailed trade journal. While you test your strategies manually, you can track trades, write notes, and analyze results right inside the platform.

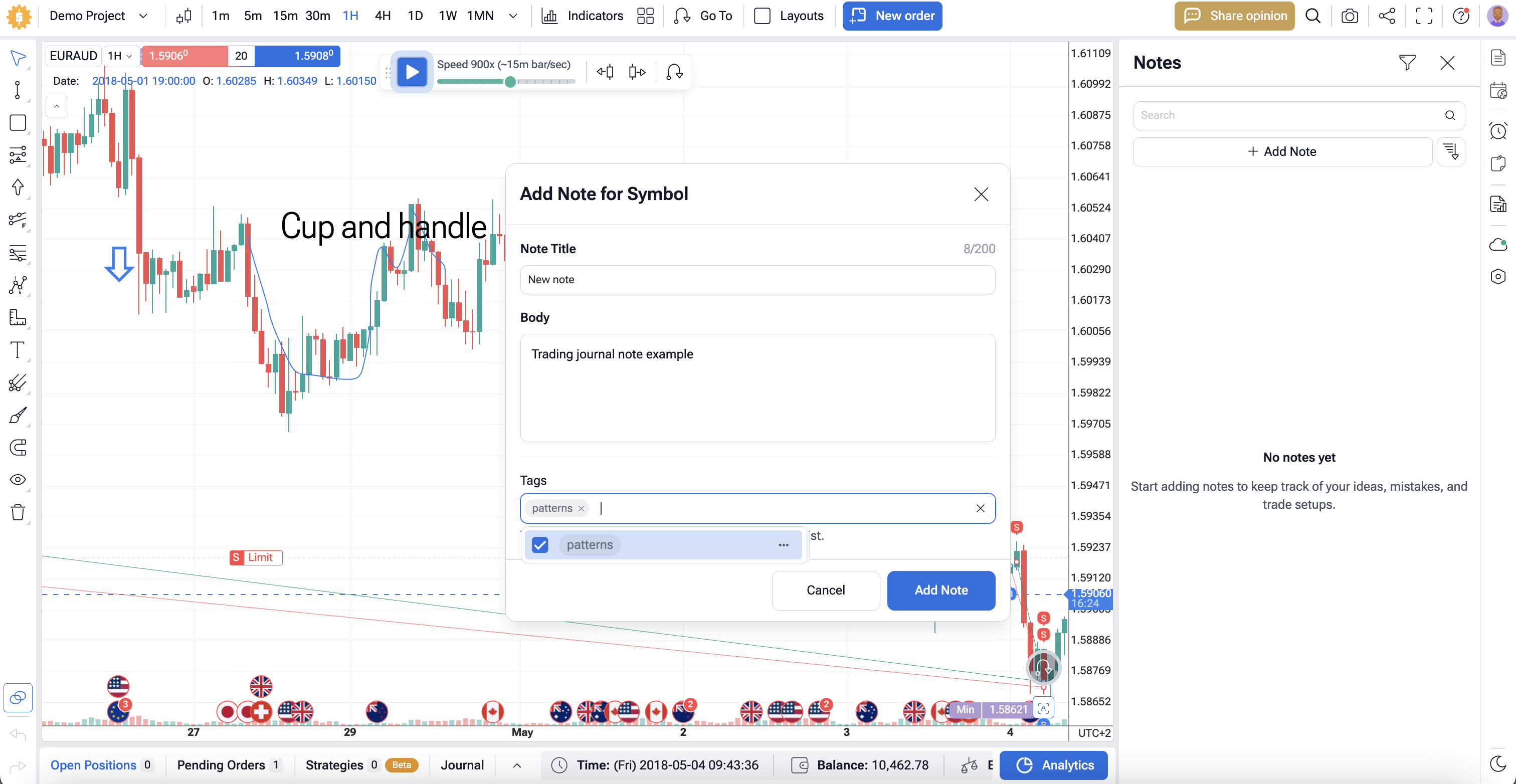

Every trade you place is saved with full stats: entry, exit, lot size, stop loss, profit/loss, and more. You can add personal notes to each trade to explain your logic, emotions, or market conditions. This helps you review your decisions later and spot patterns in your behavior.

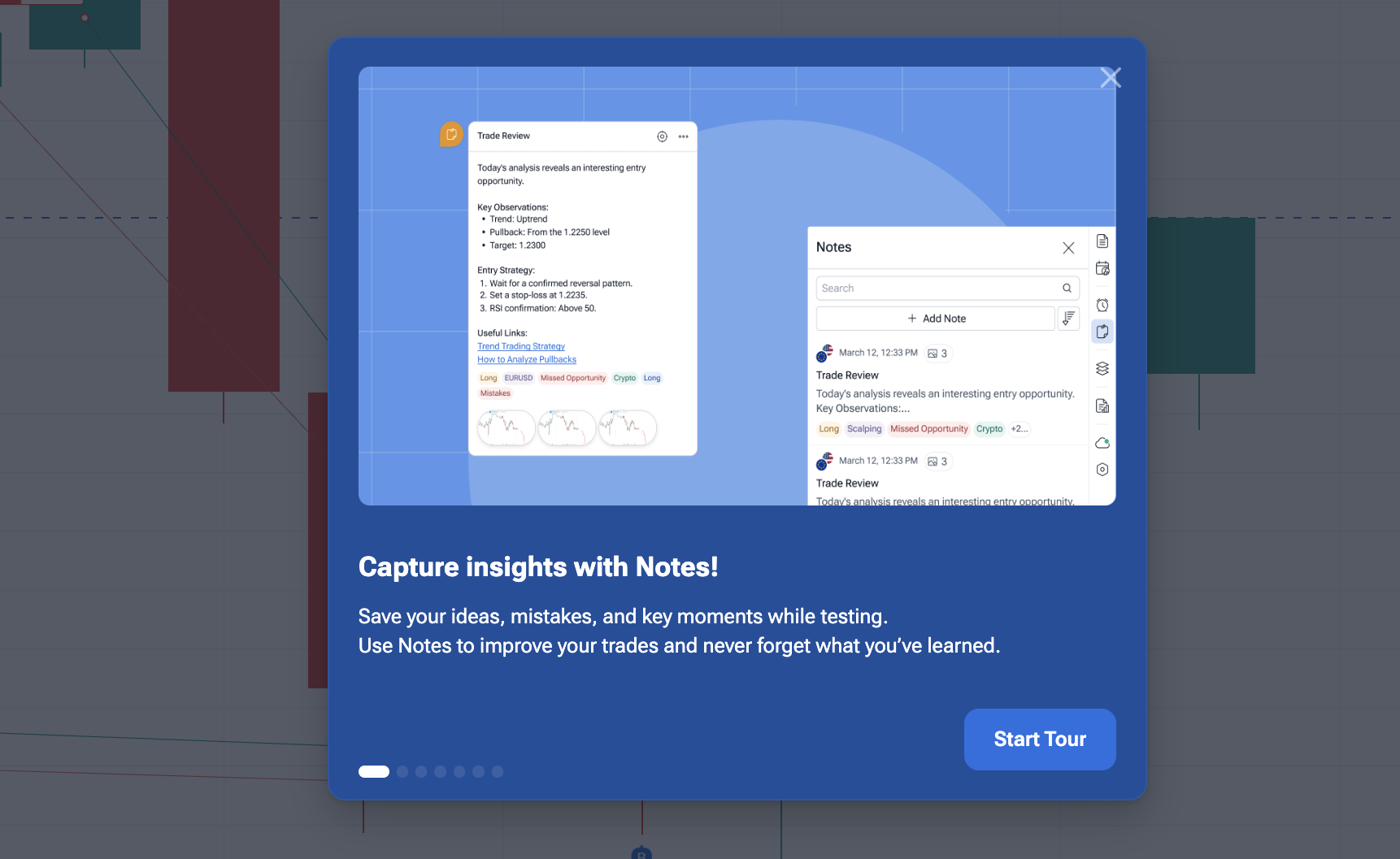

You can leave notes directly during backtesting. They will all be stored in one section.

You can also sort notes by tags and find them on the timeline. Use the “Jump to” feature to navigate the historical data graph and quickly find the event you need.

The platform also gives you detailed analytics — win rate, drawdown, risk-to-reward ratio, and more. You don’t need a separate journal tool. Everything is tracked automatically while you test your strategies using 20+ years of historical tick-by-tick data.

In short, Forex Tester Online gives you both a powerful backtesting environment and a built-in trading journal. It’s a great all-in-one solution for manual traders who want to improve by reviewing real test data and trade decisions together.

2. Edgewonk: Powerful Trading Journal With Deep Insights

Edgewonk is one of the most popular digital trading journals, designed for traders who want to analyze their trades in detail. It supports all major markets — Forex, stocks, crypto, options, and futures. You can import your trades from most brokers in just a few clicks.

What makes Edgewonk stand out is how deeply it analyzes your trading behavior. It tracks not just your results, but how you trade — when you cut profits short, hold losing trades too long, or break your own rules. You’ll see patterns in your trades that aren’t obvious at first glance.

You can fully customize your journal with your own tags, filters, and metrics. Add screenshots, write detailed notes, and sort trades by strategy, time frame, or setup. Edgewonk’s charts and stats show what’s working and what’s holding you back.

Edgewonk also includes features to track emotions, evaluate discipline, and review your mindset on each trade. This makes it a helpful tool for traders who want to grow through consistent review.

It’s a great alternative for traders who already have a separate backtesting tool and want to keep a structured, data-driven journal. But if you’re looking for one platform that combines manual backtesting and journaling together, something like Forex Tester Online might be more efficient.

3. TraderSync: Modern Trading Journal with Market Replay

TraderSync is a journal for trading that helps you track your trades and spot patterns in your trading behavior. It works with more than 900 brokers and supports stocks, forex, crypto, options, and futures. You can import your trades automatically or enter them manually.

The main benefit of TraderSync is its clean interface and clear feedback. The platform turns your trade history into simple reports and charts. You can quickly see which setups are working and which mistakes cost you money. This can help you adjust your strategy over time.

One of the standout features is the built-in market replay tool. It lets you go back and simulate trading scenarios using historical data. You can test your decisions and see how you performed in real market conditions. This is useful for day traders who want to improve their timing and setups.

TraderSync also includes tools to compare strategies and simulate how changes might affect your results. You can tag trades, write notes, and access everything from your phone with their mobile app.

On the downside, some users feel that the platform can be too focused on stock traders, and some of the more advanced features are only available in paid plans. The market replay is also limited compared to dedicated backtesting platforms.

4. Trademetria: All-in-One Trading Journal with Smart Metrics and Risk Tools

Trademetria is a trading journal and analytics platform built for traders who want more than just basic trade logging. It supports a wide range of markets — stocks, forex, crypto, futures, CFDs, and options — and connects with 400+ brokers for quick import.

The platform tracks over 30 key trading metrics. You can break down your trades by strategy, market condition, instrument, or even time of day. It helps you find what works and where your risk habits may be costing you money.

One strong feature is the AI-powered journal assistant. It can generate entries for you and provide suggestions based on your trade history. There’s also a simulator that lets you test past trades to find patterns and missed opportunities.

Charts in Trademetria show entry and exit points directly on daily or intraday charts. This visual feedback helps you understand what setups work best for you.

Risk management is also covered. You can set stop-loss and target levels, track R-multiples, and use exit analysis tools to review how well you manage your trades. These features are useful, especially for day traders who want to stay on top of position sizing and risk per trade.

Customization is another plus. You can tailor dashboards, journal templates, and data filters to your style. There’s even a gamified “trading challenge” feature to track discipline and progress toward goals.

On the downside, some users may find the interface a bit busy at first, and the sheer number of features can be overwhelming. Also, while there’s a free plan, serious traders will need to upgrade to access most of the analytics and features.

5. Excel/Google Sheets Templates: Free, Flexible, but Manual

If you’re just starting out or prefer to keep things simple, Excel and Google Sheets can be used as free basic trading journals. Many traders still rely on spreadsheets to track trades, calculate metrics, and review performance over time.

You can find free or paid templates online with built-in formulas to calculate key metrics like win rate, average return, profit factor, or drawdown. These templates are usually customizable, so you can adjust columns to match your trading style or strategy.

The biggest benefit is for sure full control. You decide exactly what data to track, how it’s displayed, and which metrics matter. If you’re good with spreadsheets, you can build your own custom system tailored to your needs.

But there are downsides. You have to enter trades manually unless you set up a broker export and paste the data in. It’s also easy to make mistakes — one wrong formula can throw off your results. There’s no charting, visual analytics, or automated pattern recognition unless you build it yourself.

So, Excel or Google Sheets work well for traders who want a free, no-frills solution. They’re flexible and private, but they require more effort to manage and aren’t ideal for large volumes of trades or in-depth analysis.

Let’s take some steps on how to keep your Trading Journal!

Record details of every trade:

- Date of the deal

- Type of the deal (order)

- The idea of your deal (why did you open this order)

- How did you close your order

- Result of the deal

- Transaction analysis

Conclusion

Choosing the right trading journal depends on your style, goals, and how much automation you want.

If you’re looking for a no-code backtesting and journaling tool in one, Forex Tester Online is a solid choice. It lets you test strategies using historical data and add notes and analytics, all in one platform.

Edgewonk, TraderSync, and Trademetria are great for traders who want in-depth performance reviews, pattern detection, and custom reporting. Just be ready to pay for those extra features.

And if you prefer full control and simplicity, free Excel or Google Sheets might be enough — especially if you trade less frequently and don’t mind manual input.

In the end, the best trading journal is the one you’ll actually use consistently.

FAQ

Why do traders use a trade journal?

Traders use a journal to track their decisions, performance, and habits. It helps them see what works, what doesn’t, and why. Over time, this helps improve consistency and avoid repeating mistakes.

Is Google Sheets or Excel a good trading journal?

Yes, for some traders. Excel or Google Sheets is free, flexible, and fully customizable. But you have to enter data manually and build your own reports. It works best if you’re comfortable with spreadsheets and don’t need automation.

Can I use Notes on my iPhone as a trading journal?

Technically yes, but it’s not ideal. Notes apps can help jot down quick thoughts, but they lack structure, analytics, and tracking features. You’ll likely outgrow it if you trade regularly or want to improve based on data.

Is a trading journal automatic?

Some trading journals are partly or fully automatic. Tools like Forex Tester Online, TraderSync, Edgewonk, and Trademetria can import trades from brokers and generate reports. Others, like Excel or Google Sheets, require full manual input.

Forex Tester Online: Trading Journal + Backtesting

Forex Tester Online: Trading Journal + Backtesting

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska