We see algorithmic trading reshaping markets. It runs code at machine speed, applies strict rules, and strips out emotional bias. Automated algorithms now execute most volume, delivering disciplined order flow, lower costs, and round-the-clock access no human desk can match. Let’s start learning algorithmic strategies!

What Are Algorithmic Trading Strategies?

Algorithmic trading, algo trading, and automated trading are synonyms: code sends orders instead of human clicks.

A trading algorithm is a script that embeds clear rules – if-then statements on price, time, volume, or indicators. Once loaded on a server, it scans live data, fires signals, and executes in milliseconds with no hesitation.

We can tune each script for pure profit, tighter risk, or flawless execution – all repeatable, 24/5 (or 24/7 if we talk about crypto), and immune to fear or fatigue.

Popular Algorithmic Trading Strategies

Millions of lines of market code funnel into a short list of repeatable patterns. We focus on the five pillars traders deploy daily. Master these foundations and you can combine, stack, and refine scripts for any asset class.

By the way, we already have an article about 40 manual trading strategies. Check it out.

Meanwhile, we continue talking about algo (automatic) trading strategies. Let’s start!

Trend Following

Trend following captures the market’s big moves. We code simple, repeatable rules, hold positions while price runs, and exit fast when trend momentum fades. The logic is timeless, the execution is fully automated.

Below is the exact workflow we follow to turn a dual-moving-average idea into a live trading algorithm.

-

- Define entry rules

- Go long when the 20-period EMA closes above the 50-period EMA and the Average True Range (ATR) is rising for three bars.

- Go short on the opposite cross with the same ATR filter.

- Define exit rules

- Close the trade if price closes back below the slow EMA (for longs) or above it (for shorts).

- Add a volatility-based stop-loss at 2×ATR and a take-profit at 3×ATR.

- Code the script

- Use a script editor (depending on your trading tool and its programming language) or export the logic in MQL/Python. Simple strategies can be automated via ChatGPT. But basic programming skills would still be very helpful.

- Keep functions modular: data feed, signals, risk, execution.

- Backtest in Forex Tester Online

- Run the simulation over the full data set (tick-by-tick data for 70+ assets and 21+ is pre-downloaded on FTO).

- Simulate your Trend Following strategy on historical data.

- Record win rate, payoff ratio, max drawdown, and Sharpe.

- Export trade log to CSV for deeper analysis.

- Define entry rules

- Optimize parameters

-

- Test EMA lengths from 10/30 to 30/100 and ATR multipliers from 1.5 to 3.0.

- Use walk-forward testing: divide data into five equal blocks, optimize on one block, test on the next.

- Validate out-of-sample

- Hold back the most recent two years.

- Run the final settings only on unseen data.

- Confirm the equity curve rises without new lows.

- Go live

- Deploy the code on a VPS close to your broker’s servers.

- Start with half risk (e.g., 0.5 % equity per trade).

- Track every fill and latency metric; adjust only after 50 trades.

Arbitrage

Arbitrage grabs risk-light profit from price gaps between related markets. We buy the cheaper leg, sell the dearer one, then flatten as the spread snaps shut.

Below is the workflow we use to turn a cross-venue spread idea into a live algorithm.

- Identify spread conditions

- Compute the real-time price difference.

- Flag an opportunity once the gap exceeds 0.15 % after fees.

- Define entry rules

- Buy the cheap leg and sell the rich leg the instant the flag triggers.

- Skip the trade if order-book depth is under twice your intended size.

- Define exit rules

- Close both legs when the spread contracts to 0.02 % or five minutes elapse.

- Force-close if either leg remains unfilled after 50 ms.

- Code the script

- Route each leg on separate non-blocking sockets and tag them with a single ID.

- Log every quote, fill, and reject for later audit.

- Backtest in Forex Tester Online

- Replay to capture micro-latency slippage using precise historical data.

- Record net edge, fill ratio, average hold time, and drawdown.

- Export the trade log for deeper checks.

*Check the detailed backtesting guide below

- Optimize parameters

- Sweep entry gaps from 0.10 % to 0.25 % and exit gaps from 0.01 % to 0.05 %.

- Select the combo that maximizes hourly P&L while keeping drawdown below 1 %.

- Validate out-of-sample

- Reserve the newest quarter of data.

- Run final thresholds only on this slice and accept them only if the equity curve keeps rising.

- Go live

- Co-locate a VPS in the same data center as both exchanges.

- Start with micro size until you log 1 000 matched fills.

- Review latency and rejects daily; tweak timeouts only when needed.

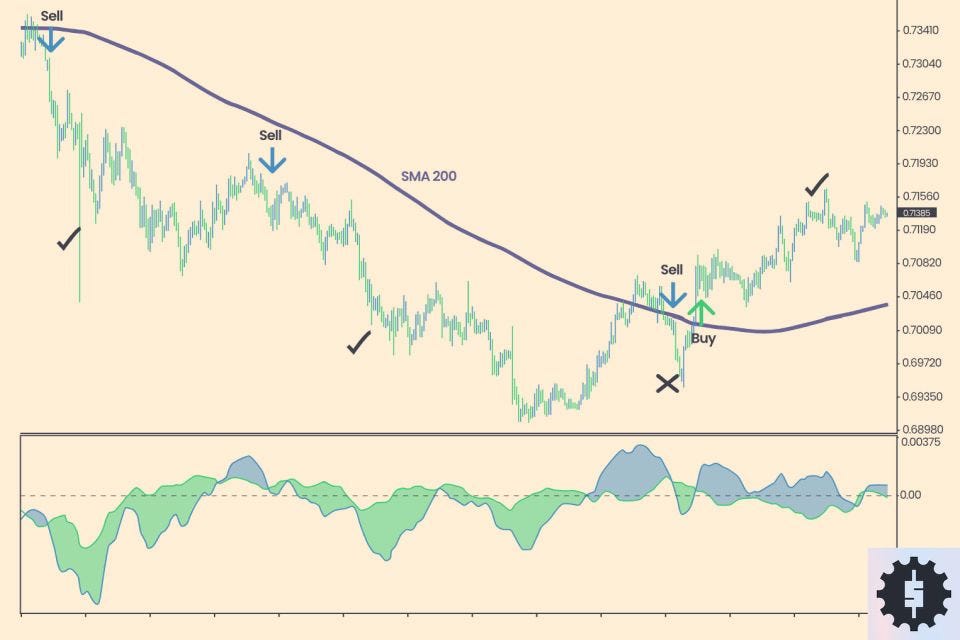

Mean Reversion

Mean reversion assumes price swings too far from fair value, then snaps back. We fade extremes, exit on the snap, and keep exposure brief.

Below is the workflow we use to turn a z-score deviation idea into a live algorithm.

- Collect clean data

- Load ten years of 30-minute bars into FTO.

- Remove any gaps, duplicate stamps, or suspicious spikes.

- Build the fair-value model

- Anchor on a 50-period VWAP.

- Calculate the z-score of price versus that anchor each bar.

- Define entry rules

- Go long when z-score ≤ -2 and RSI < 30.

- Go short when z-score ≥ 2 and RSI > 70.

- Define exit rules

- Close when z-score moves back to 0 or after 12 bars – whichever comes first.

- Add a stop-loss at 3×ATR and a trailing take-profit at 1.5×ATR.

- Code the script

- Keep modules separate: data, signals, risk, orders.

- Write in Python or MQL; simple logic can be scaffolded with ChatGPT.

- Backtest in Forex Tester Online

- Replay the full data set (check the guide below to learn how).

- Record hit rate, expectancy, max drawdown, Sharpe.

- Export trade log for deeper checks.

- Optimize parameters

- Sweep VWAP lengths 30–100 bars; z-score triggers 1.5–2.5.

- Use rolling walk-forward windows (20 % blocks).

- Validate out-of-sample

- Hold back the newest two years.

- Accept the setup only if equity keeps climbing without fresh lows.

- Go live

- Deploy on a VPS near your broker.

- Start at 0.3 % equity risk per trade; scale after 100 trades.

Index Fund Rebalancing

Index fund rebalancing capitalizes on predictable flow from passive funds. When an index provider changes weights, billions shift on the close. We enter early, exit into the surge, and keep overnight risk low.

- Estimate share deltas

- For each constituent, compute target shares minus current float.

- Rank names by expected buy or sell pressure.

- Define entry rules

- Go long stocks with top-quartile net buys at 14:30 ET.

- Go short those with top-quartile net sells at the same time.

- Skip tickers with median daily volume below $20 M to preserve market liquidity.

- Define exit rules

- Close all legs during the closing auction (15:59:50 ET) via market-on-close orders.

- Force-close at 16:05 if any order rejects.

- Code the script

- Use Python with REST trading APIs; batch orders by ticker side.

- Tag each order set with a rebalance ID for audit and regulatory compliance.

- Backtest in Forex Tester Online

- Replay each session; track slip, fill ratio, and P&L (check the guide in the next part of this article).

- Export logs for risk analysis.

- Optimize filters

- Vary entry lead time from 30 to 90 minutes.

- Test liquidity cutoffs from $10 M to $30 M average daily volume.

- Validate out-of-sample

- Hold back the most recent three rebalance events.

- Accept only if net alpha stays positive and drawdown stays under 2 %.

- Go live

- Co-locate on an HFT-grade VPS near the primary exchange.

- Start with 25 % of calculated size; scale after four clean cycles.

Market Timing

Market timing scripts fire only when probability spikes. We combine volatility breakouts, intraday momentum, and news filters to catch fast moves and sit flat the rest of the day.

- Build composite trigger

- Compute a 14-period ATR and yesterday’s high–low range.

- Create a “quiet window” flag: no red-level news scheduled ±30 minutes.

- Define entry rules

- Go long when price breaks yesterday’s high by 0.1 %, ATR is rising three bars, and the quiet window is true.

- Go short when price breaks yesterday’s low under the same conditions.

- Define exit rules

- Trail stop at 1×ATR; hard stop at 2×ATR.

- Close at New York session end or if ATR contracts for five bars.

- Code the script

- Split functions: data feed, signals, risk, trade execution.

- Use REST or FIX APIs for sub-second execution speed.

- Backtest in Forex Tester Online

- Replay the full data set.

- Record win rate, expectancy, max drawdown, and Sharpe ratio.

- Export the trade log for deeper quantitative trading checks.

- Optimize parameters

- Sweep ATR periods 10–20 and breakout filters 0.05–0.2 %.

- Test quiet-window lengths 15–45 minutes. Use walk-forward blocks.

- Validate out-of-sample

- Hold back the newest year.

- Accept only if equity climbs without new lows.

- Go live

- Deploy on a low-latency VPS close to the broker.

- Start at 0.25 % equity risk per trade; scale after 50 fills.

Example Of An Algorithmic Trading Strategy Backtest Via Forex Tester Online

Forex Tester Online helps you to test your manual and algo trading strategies. It includes:

- 20+ years of tick historical data

- Mystery Mode

- Custom indicators

- Scenarios

- Detailed analytics

- Automation tools

- And much more

We can move from concept to hard numbers in minutes. Follow this path.

Get access

- Visit the Forex Tester Online site.

- Compare plans, pairs, and market data depth.

- Click Get Started, pick a subscription, open an account, and complete payment.

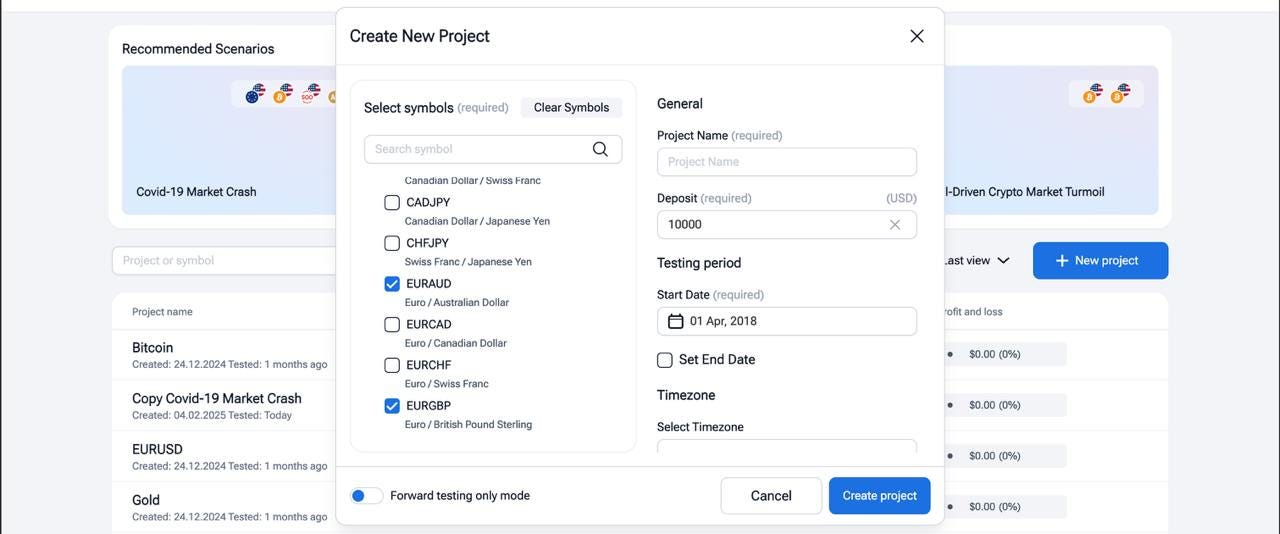

Create a project

- On the dashboard, press + New Project.

- Select symbols, name the project, set the virtual deposit, choose test dates, pick your time zone.

- Hit Play to load the workspace.

- Quick start: choose a preset scenario if you want a ready-made market window.

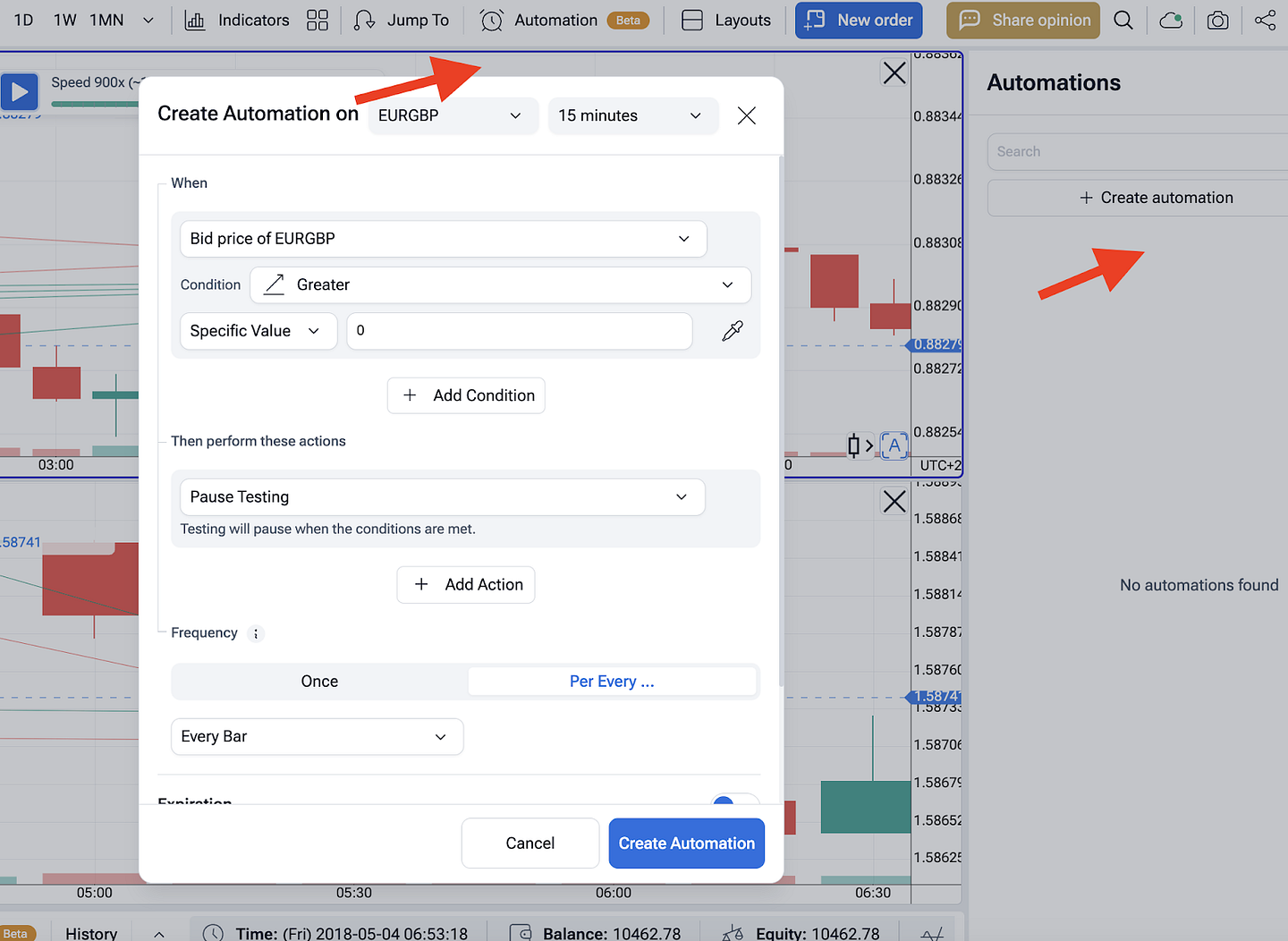

Load or write your algorithm

- Open the “Automation” tab.

- Insert your strategy rules there.

- Click “Create Automation”

Set test options

- Check the box for Floating Spreads to match live spreads.

- Toggle News Marks if your code filters macro events.

- Pick execution speed – tick-by-tick for high-frequency trading (HFT) or bar-by-bar for slower systems.

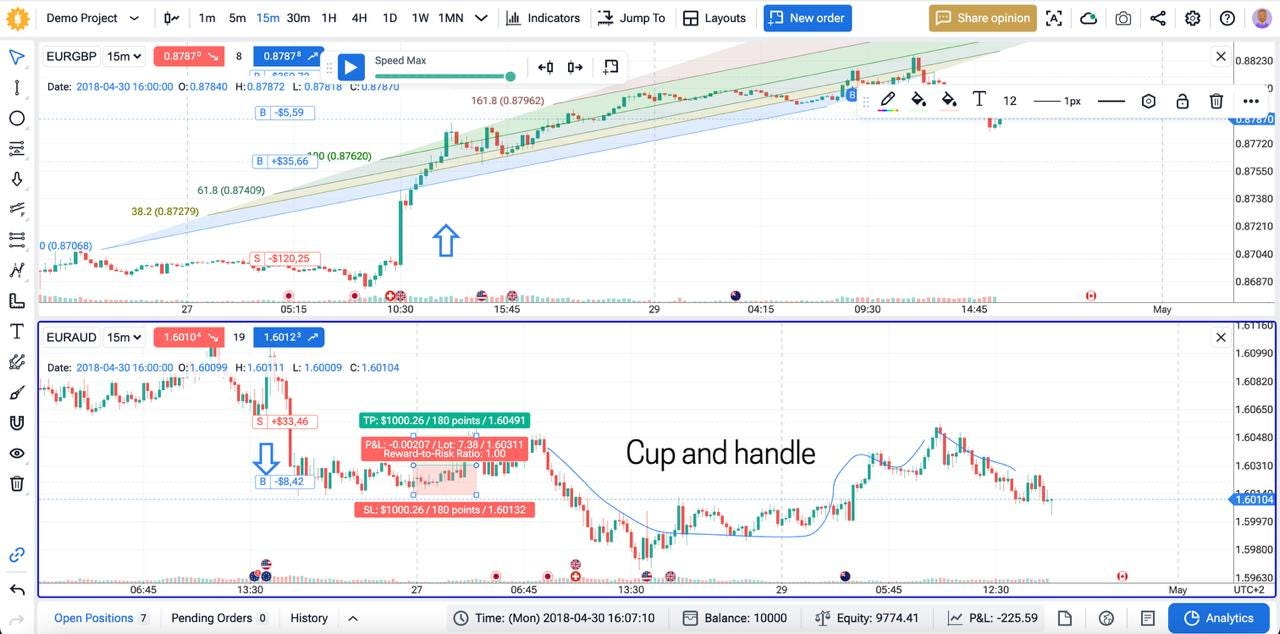

Run the backtest

- Press Start. The platform feeds historical market data into your algorithm.

- Watch trades appear on the chart in real time or jump forward with Jump To for faster sweeps.

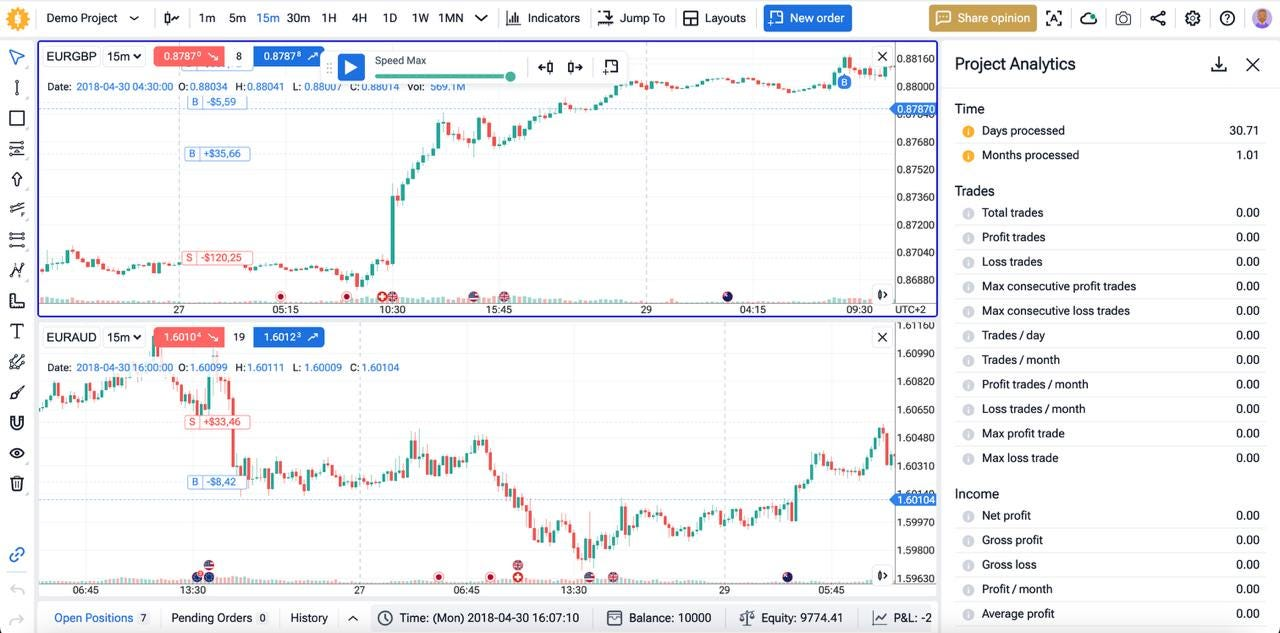

Review analytics

- Click Analytics in the lower pane.

- Inspect win rate, payoff ratio, drawdown, Sharpe, and latency logs.

- Export the trade list to CSV for deeper risk management work.

Iterate and optimize

- Adjust parameters in the script editor.

- Re-run on the same data, then on out-of-sample dates.

- Keep every version; compare curves and pick the most stable.

Move toward live trading

Switch to the real-time demo feed. Verify order timing and slippage for at least 50 trades. Only after clean demo stats should the script go to a live VPS.

Try Forex Tester Online and see if your algorithmic trading idea survives real market history before you risk a cent.

Algorithmic Trading: What Do You Need To Start

You need five things: clean market data, a coding workspace, a backtesting engine, strict risk rules, and a fast API link to your broker. Forex Tester Online supplies the data, testing, and analytics; you add the code and discipline. Log every tick for compliance, then shift the script to a low-latency VPS before live trading.

How to Get Started

Master one coding language, grasp market microstructure, and secure reliable data. Write clear rules, code the algorithmic trading strategy, backtest tick-by-tick, optimize on walk-forward blocks, then validate on unseen data. Paper-trade through a real-time demo to expose slippage and bugs. If the stats still hold, push the script to a VPS via your broker’s API and review every fifty fills for tweaks.

Disclaimer

Trading involves risk. The indicators in this article are for educational purposes only and are not financial advice. Past performance does not guarantee future results. Always test strategies before using real money.

Conclusion

Algorithmic trading rewards discipline and data. We build clear rules, test them on deep history, and launch only what survives. Fast execution speed and solid market liquidity turn code into filled orders. Backtesting inside Forex Tester Online shows strengths and gaps before cash is on the line. Start small, track every tick, and let trading discipline guard capital while the algorithm works.

FAQ

Which strategy is best for algo trading?

No single winner. Choice hinges on market volatility, liquidity, and portfolio management goals. Trend following loves momentum trading; mean reversion suits calm ranges; statistical arbitrage needs top execution speed. We rely on trading automation and trading strategy customization to fit each edge.

Is algorithmic trading actually profitable?

Yes when edge beats fees, latency, and slippage. Profits stem from strict quantitative trading rules, clean market data, and tight order execution systems. Co-location trims microseconds; solid cybersecurity risks controls keep the flow safe.

Can I trade algorithmic strategies without programming code?

Yes. Visual trading software turns ideas into black-box trading blocks and hides trading APIs. Code still adds power for machine learning tweaks and deeper logic.

Is algo trading legal?

Yes, it’s legal worldwide under FINRA and SEC oversight. We log every action, throttle order bursts, and watch for flash crashes to stay within regulatory compliance.

Forex Tester Online

Improve your algorithmic trading strategies using our backtesting tool

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska