In the process of formation, Brilliant looks like a common but rather volatile flat. Diamond should have reasonable buffer time. This is not a pattern for short-term speculations, but at least a mid-term figure.

It is a proper Rhombus (in which a growth period is roughly equal to a decline period) that is considered the most reliable option.

On the periods of H4 and higher, the pattern steadily works for a reversal. The figure is hard to identify at all on low timeframes, but if it appears after all, the trend is most likely to continue. The signal is considered working only within the confirmation by trading volumes. So let’s begin.

Technical parameters of the pattern

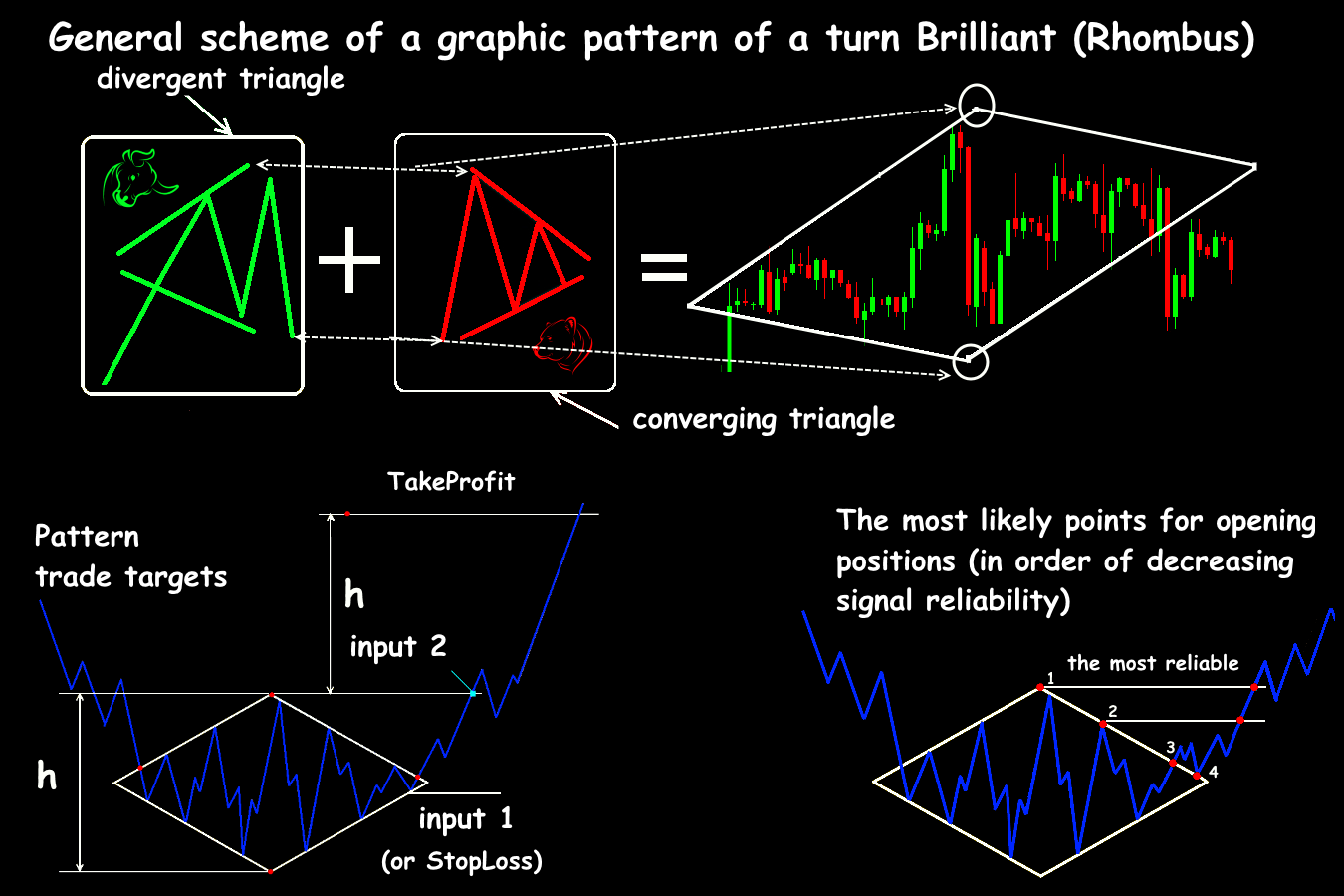

Constructively, the Brilliant pattern is a closed graphical figure of a converging and diverging triangles with shared peaks, borders of which are considered the lines of support/resistance of different directions. Small fluctuations at the borders zone don’t disrupt the common figure.

Theoretically, the diverging part must contain no less than three waves for all options, while compression in the second part can happen with two waves.

A correct correlation of waves is rare in the real market but the common principle — compression faster than diversion — must be fulfilled. The model necessarily has the consolidation zone (about in the middle) with the waves of rollbacks directed toward it.

The exit of the price from the Rhombus model is worked out by standard rules of triangle: with a breakout of the lower border, we sell; the higher border, we buy.

Brilliant as a reversal to the bottom is formed on an uptrend in the upper range, and as a reversal to the top, in the lower range.

It’s interesting that on the bullish trend, the time for the model to be formed is usually less than for an analogical figure on the bottom of the market. Usual market logic works — players always sell assets way more willingly than buy.

The more waves are in the pattern zone, the stronger movement there will be on the border breakout. Let’s look at it in detail.

Standard version of the Rhombus pattern

Theoretically, after the trend reversal, the price must go the distance equal to the height of the model (max-min) postponed from the breakout point.

Potential points for opening positions:

- on the border breakout (higher — buy, lower — sell), more reliable entry — after candle closing behind the line;

- above/below the extremums of the model;

- above/below the last key point;

- after the retest of the crossed border.

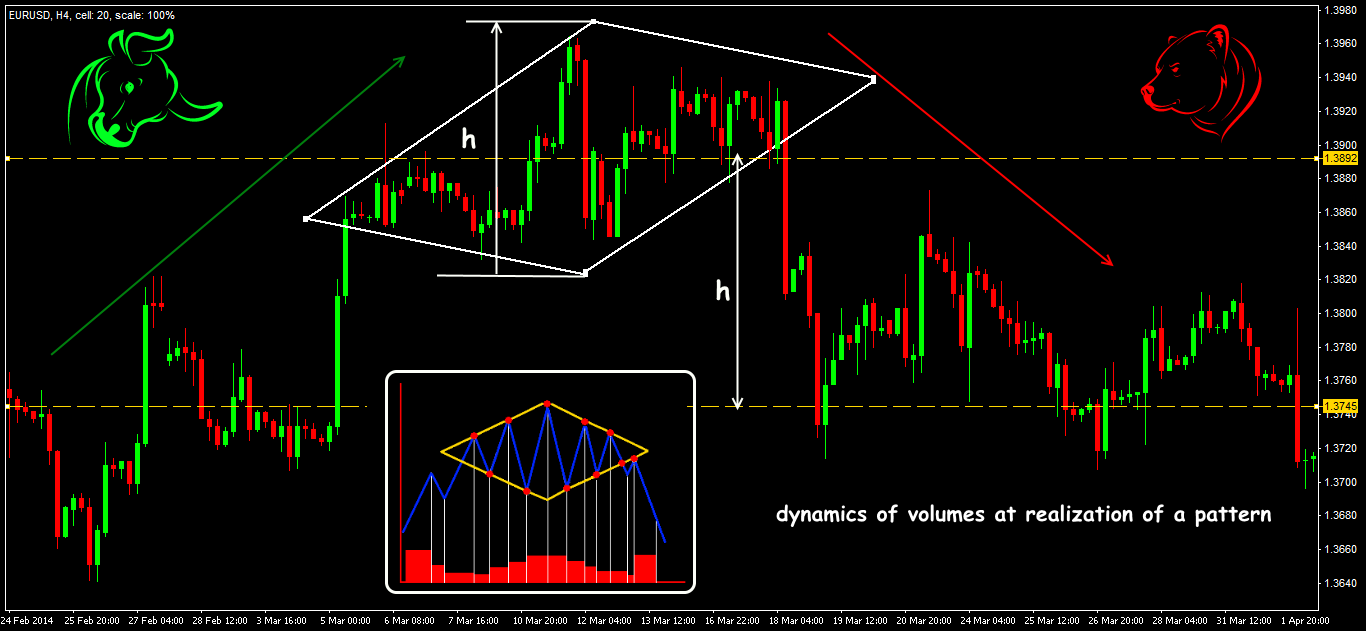

Diamond: model of a turn of the ascending trend

Stop Loss is usually situated either at the level of the last extremum of the pattern (short stop) or under the common extremum of the model (conservative Stop Loss).

We strongly recommend to move the order into a breakeven as earlier as possible and necessarily fix the profit partially.

The movement above the maximum goal point happens extremely rarely. The minimum period for analysis and search of the entry point is H1, the period for the deal accompaniment is no lower than H4.

Dynamics of volumes in the Brilliant pattern

We remind: defining the direction of the main volume vector was always an average trader’s problem. What it means is that you should follow the general mass of market contracts to trade at least at breakeven.

Diamond: model of a turn of the descending trend

Brilliant is a long-term, constructively difficult unstable model, and the analysis of the trading volumes dynamics is necessary to identify it.

It is optimal to use real exchange volumes, but tick volumes can be analyzed as well (see Using Indicators). Regardless of the reversal direction, the volume acts in the same way:

- Stage 1: enhancement — on the first 2-3 waves, the volume must be a bit larger of the average value and gradually decrease in the process of approaching the central extremum.

- Stage 2: in the zone of converging (ideally, symmetrical) triangle, the volume growth with weak volatility is suggested, as the active trading is undergoing in both directions.

- In the moment of breakout, the volume sharply increases as both buyers and sellers hurry to jump into the market trying to intercept the moment of the border breakout from each other.

Several practical remarks

Any deviations from the classical shape and dynamic of volumes, if not cancel the Rhombus pattern, then at least decrease the effectiveness of its trading signals.

The size of Brilliant can be large enough, but the trading inside of a ready model is considered risky and not recommended for beginners.

Of course, if Brilliant was formed, for example, on the D1 timeframe or higher, then you may trade on small timeframes using ordinary methods, but controlling the global model.

All Rhombus models are considered unstable constructions and break on speculative volatility. On H4, Brilliant gives a strong signal, but rarely reaches estimated goals within being processed, and its reversal signal is too weak on the minor periods.

E.g., the Head-and-Shoulders pattern looks much alike Brilliant, giving a reversal signal as well, but way later, which leads to a too early entry into the deal.

What is the result? Due to the support of precisely directed volumes, Brilliant appears much more often with futures and stocks, than in Forex.

In real market conditions, models have non-standard shapes with shifted borders. Fulfilling all the conditions must be strict because a trader constantly has a desire to “continue drawing” the model visually — with no real confirmation.

We remind: open a position only on a fully formed model. Correct in-time identification of the Brilliant model allows to earn well enough in the medium term.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

To check this (or any other) graphical analysis you can try Forex Tester Online.

In addition, you will receive 23 years of free historical data.

Backtest this pattern on Forex Tester Online

Backtest this pattern on Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska