A Fair Value Gap (FVG) is a slice of price action where bids and offers never meet, leaving a visible price imbalance on the chart. Smart money treats these gaps as magnets; retail traders can too. Learn why it signals hidden liquidity, how they differ from other gaps, and the step‑by‑step rules to trade them across forex, crypto, and stocks. This guide covers: spotting bullish vs bearish, building a Fair Value Gap trading strategy, setting stop loss and take profit, backtesting, and weaving FVGs into algorithmic systems. Ready? Let’s go.

What Is a Fair Value Gap?

A Fair Value Gap (FVG) is a three‑candle price gap that shows a sharp imbalance between buyers and sellers. Candle 1 sets a high (or low), Candle 2 jumps away, and Candle 3 fails to overlap Candle 1. The empty space between Candle 1 and Candle 3 marks unused liquidity – price moved so fast the market could not trade there. Traders call this a price imbalance or inefficiency.

This is how it looks like (the big green candle):

Fair Value Gap (source: Forex Tester Online)

FVGs differ from classic opening gaps that appear after weekends. They form during live sessions, inside fresh momentum. Think of them as micro liquidity voids inside normal candles rather than big overnight holes.

Compared with supply and demand zones or order blocks, an FVG is thinner and more precise. Supply zones cover broad ranges; an FVG nails a tight price strip where smart money may reload. When price revisits that strip, it often reacts, giving sharp trading signals.

How to Identify Fair Value Gaps

Follow this simple checklist on any candlestick chart.

- Spot a wide impulse candle. Look for a long body that breaks recent support or resistance with strong momentum.

- Mark Candle 1 high–low. Note the wick extremes of the candle just before the impulse.

- Check Candle 3 overlap. After the impulse candle, watch the next candle. If its wick fails to touch Candle 1’s wick, the space between the two wicks is the Fair Value Gap.

- Measure the gap. Record the top and bottom price levels. This strip is the price imbalance zone.

- Wait for price retracement. An FVG is valid only when price later returns and taps the zone.

Bullish vs Bearish FVGs

| Type | Visual cue | Trading bias |

|---|---|---|

| Bullish FVG | Impulse candle up; gap sits below current price | Look for long trades when price retraces into the gap |

| Bearish FVG | Impulse candle down; gap sits above current price | Look for short trades when price retraces into the gap |

Timeframes

- Intraday (5 m–15 m): fast fills, good for scalping.

- Swing (1 h–4 h): higher probability, wider stop loss.

- Daily: best for trend continuation setups, gaps can hold for weeks.

Tools and Indicators

- Manual box tool: draw rectangles around Candle 1‑Candle 3 wicks.

- Forex Tester Online: trading simulator to pre-test new strategies.

- Automated FVG scanners: TradingView Pine scripts, MT4/5 indicators, or custom Python code. These highlight gaps in real time.

- Volume overlays: confirm that impulse candle shows above‑average volume – proof of institutional buying or selling.

Once you can spot bullish and bearish FVGs on any timeframe, you are ready to build Fair Value Gap trading strategies.

Trading Strategies Using FVGs

Fair Value Gap trading works in three ways: ride the trend, catch a reversal, or scalp the fast fill. Each setup uses the same price imbalance but different entry and exit rules.

Please note: We don’t recommend using any of these strategies before backtesting it. Use Forex Tester Online to make sure your strategy works before risking real money.

Entry and Exit Rules

- Trend continuation

- Identify the major trend with a 50‑period moving average.

- Then wait for a bullish FVG to form in the trend direction.

- Enter long when price retraces halfway into the gap; place stop loss below the gap low.

- Set “take profit” at the next swing high or 1.5× gap size. chart

- Reversal

- Spot a bearish FVG at the end of an uptrend near key resistance.

- Short when price taps the upper third of the gap and momentum shifts down on RSI.

- Stop loss a few pips above the gap; target the last demand zone. chart

- Scalping

- Use 1‑minute charts.

- Trade quick fills; exit once the gap closes.

- Keep tight stops outside the gap and small position size for risk management.

Combining FVGs with Other Tools

This will make your strategy more complete.

Fair Value Gap and Order Block

Draw the order block that caused the impulse. Confluence of the block and the gap gives stronger trading signals and clearer support and resistance levels.

Fair Value Gap vs Imbalance

The imbalance covers the whole wide candle body; the FVG is the wick strip. Trade the wick zone for precise entry, use the imbalance area as the wider stop‑loss buffer.

Liquidity Void vs Fair Value Gap

Liquidity voids are larger ranges with no trades; FVGs are micro. Treat the void as trend context and the FVG as the exact entry point.

Fair Value Gap vs Inverse Fair Value Gap

An inverse FVG breaks back through a filled gap. Fade this move only if market structure shows a clear shift; otherwise ride the new momentum.

Advanced Tactics

- Multi‑timeframe analysis: find daily FVGs, execute on 15‑minute charts.

- Liquidity zones: align the gap with prior swing highs/lows where stop‑loss clusters sit.

- Smart money concepts: watch institutional buying or selling volume inside the gap to confirm strength.

Blend these tactics into one Fair Value Gap Trading Strategy and always test the plan before risking capital.

Risk Management and Trade Planning

Good Fair Value Gap trading starts with clear risk management. Place a stop loss just outside the gap boundary – below a bullish FVG, above a bearish FVG. Aim for at least a 2:1 reward‑to‑risk ratio; set take profit at the next support and resistance level or a full gap fill. Size each position so one loss costs no more than 1% of account equity. Move stops to breakeven after price covers half the gap. Use partial exits in volatile sessions to lock gains and cut exposure if price retracement stalls.

Common Mistakes and How to Avoid Them

- Overreliance on FVGs. Gaps work best with broader market structure – trend, liquidity zones, and supply and demand zones.

- Chasing every price gap. Wait for confluence: bullish FVG plus rising momentum or an order block.

- Ignoring risk rules. No trade without a stop loss and pre‑defined take profit.

- Trading low‑volatility charts. Thin volume breeds false signals; pick pairs or coins with active institutional buying or institutional selling flow.

FVGs in Algorithmic and Automated Trading

Relying on untested gaps is risky. This is why you need backtesting software. Trading simulators show if a Fair Value Gap trading strategy really works across markets and timeframes.

Backtest Fair Value Gaps in Forex Tester Online

Algorithmic trading lets code find gaps faster than the eye. Forex Tester Online helps you to test your strategies, gain skills and confidence.

Why use FTO?

✅ 20 + years of tick‑level historical market data on forex, crypto, stocks

✅ One‑click FVG indicator

✅ Tick‑by‑tick playback for true price imbalance fills

✅ Tools for partial exits, stop loss and take profit tests

✅ Mystery Mode to hide symbol and timeframe, killing bias

✅ Custom scenarios

✅ Built‑in stats: win rate, drawdown, equity curve, slippage

✅ All you need for proper test

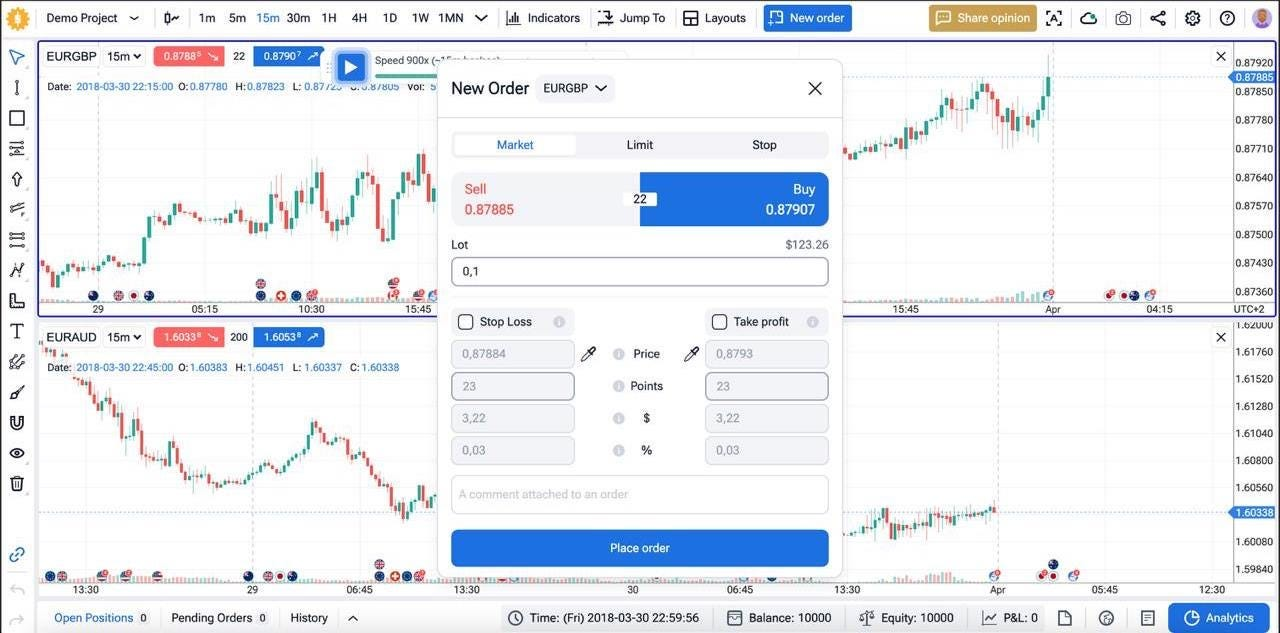

Mini‑Guide: Backtesting an FVG Strategy via FTO

Follow these steps.

Step 1 – Get access

Head to the FTO site, hit Get Started, pick a plan, open your account, and log in. This will take 3-5 minutes.

Step 2 – Create a project

Click + New Project. Name it “FVG Test,” choose EURUSD or BTCUSD, load 20 years of data, set a virtual balance, and press Play.

Step 3 – Perform demo trades without risking real money to gain skills and confidence for the strategy.

Use as many charts, indicators, time frames, and custom instructions as you need.

Hit Start. Watch trades trigger when price taps the gap. Use Jump To for fast replay.

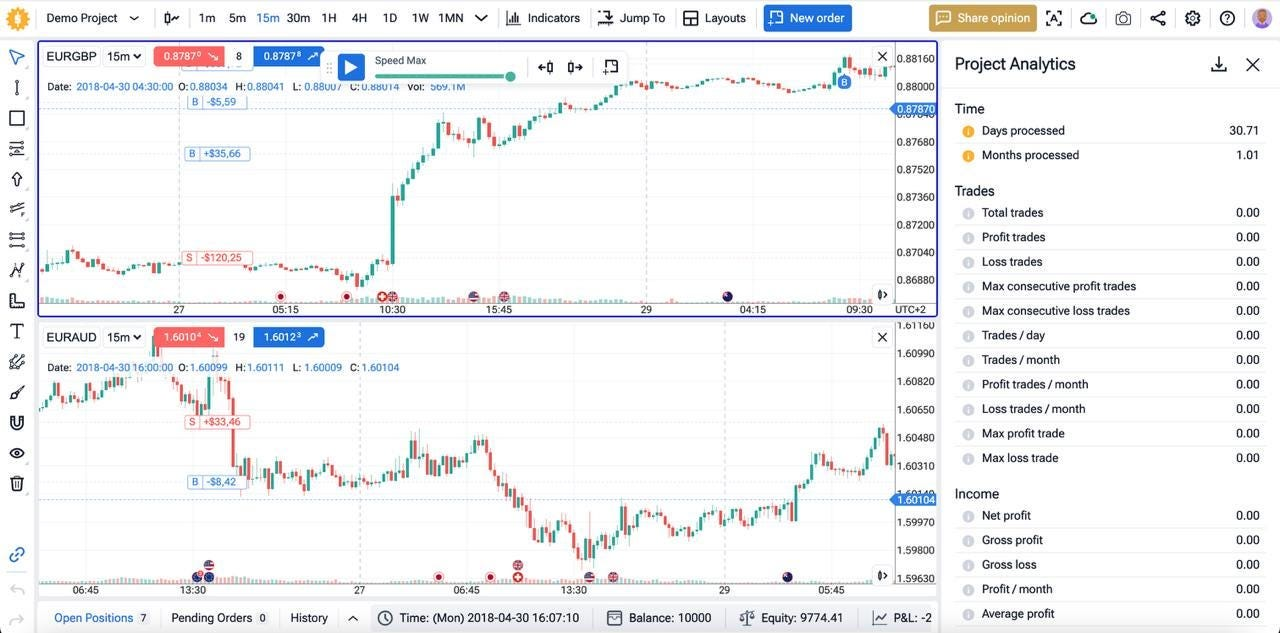

Step 4 – Review analytics

Click Analytics. Check win rate, average fill time, drawdown, and equity curve. Export the log to CSV for deeper study of each Fair Value Gap fill.

Step 5 – Iterate and optimize

Adjust gap size, entry depth, and risk/reward. Run walk‑forward tests until results stay solid out‑of‑sample.

Ready to turn price imbalance into real numbers? Try Forex Tester Online and prove your FVG setup before risking cash.

Available Platforms and Code Snippets

- TradingView Pine: simple FVG script marks bullish and bearish gaps.

- MT4/MT5: custom indicators draw rectangles around three‑candle imbalances.

- Python: Pandas loop to detect non‑overlapping wicks, output CSV for Forex Tester Online.

Pros and Cons of Fair Value Gap Trading

| Pros | Cons |

|---|---|

| Precise entry and exit | Not every gap fills |

| Works on any timeframe | False signals in low volatility |

| Blends with manual or algorithmic trading | Requires chart time to master |

| Clear stop‑loss placement | Gaps inside choppy ranges give noise |

Conclusion

Fair Value Gaps reveal hidden liquidity and offer tight trading signals. Combine the gap with trend, order blocks, and solid risk rules, then test the idea on real history before going live. FVGs are powerful, but only when folded into a full trading plan and backed by numbers.

Disclaimer

Trading involves risk. This article is for education only and is not financial advice. Past results do not guarantee future returns. Always backtest and paper‑trade before using real money.

FAQ

What markets and assets are best for FVG trading?

Major forex pairs, liquid crypto like BTC and ETH, and large‑cap stocks where volume shows clear gaps.

How do FVGs differ from classic price gaps?

Classic gaps form between sessions; FVGs emerge inside a three‑candle burst during live trading.

Are FVGs suitable for beginners?

Yes, if beginners pair them with strict risk management and start on demo accounts.

How often do FVGs get filled?

On intraday charts many gaps fill within hours; daily gaps may take days or remain open in strong trends.

Can FVGs be used with other strategies?

They pair well with trend continuation, momentum, and smart money concepts like order blocks.

Forex Tester Online

Practice FVG strategies without risking real money

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska