Gold in any form – physical, paper, jewelry, and even virtual – has historically been considered a financial (and political!) safe-haven asset, the protection against inflation, and a guarantee of stability. Even a minimal hint of any problems is enough for investors to leave any other assets en masse, and invest in gold deals, saving their capital.

Until financiers have come up with a more stable monetary system than tied to gold, and sovereign currencies based on blockchain have not yet conquered the world, we should also join a team of successful speculators, so let’s get started.

Gold Trading: Currency history and basic parameters

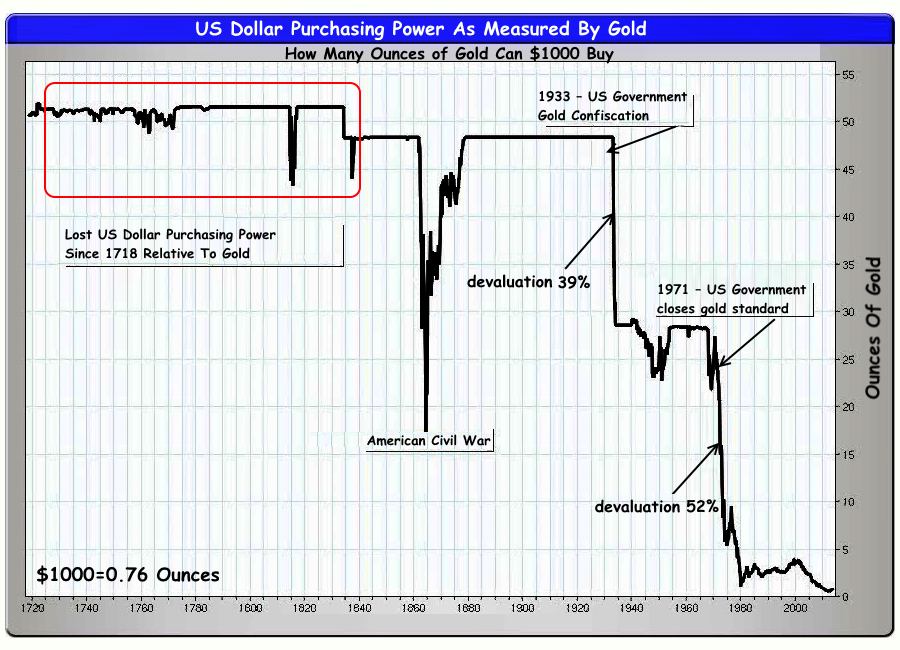

Let’s omit the ancient history of the precious metal. Before the abolition of the gold standard in 1971, the real value of any money was determined not by the face value written on banknotes, but by the weight of gold, which could be obtained in return for the “paper pulp”.

At that time, Europe was suffocating under the mass of cash dollars that it received as loans for post-war reconstruction under the “Marshall Plan”. The European business was ready to repay the United States those loans for any price as well as return trustless American money, demanding a real precious metal instead.

The consequences of the Jamaican G7 leaders meeting, at which it was decided to evaluate all currencies through the US dollar, are visible on the illustration below. Since 1978, the US Federal Reserve has sharply reduced the level of guarantee coverage of its currency with gold and continued to fill the world with an “empty” mass of dollars.

Gold and the dollar: then and now

The central banks of leading countries continue to accumulate strategic gold reserves to support and stabilize the economy.

Transactions for the manipulation of gold are usually made on the OTC market and actively influence the market rate. During periods of any financial risk, gold reserves are traded on international exchanges to increase the supply of foreign currency in the country, usually USD and EUR.

Fundamental analysis or why the volume does not go into the price

Gold assets are never traded without a preliminary assessment of the fundamental situation.

External factors that are monitored mandatory:

- dollar exchange rate – the higher it is, the cheaper the gold;

- energy prices – the more expensive, the more gold grows;

- crises, wars (including trade wars), political, economic and natural disasters;

- the macroeconomic situation in the main regions: USA, Europe, China, Japan;

- stock market dynamics.

For the market, gold is, first of all, a currency, not a commodity; therefore, the physical volume of production does not affect its speculative price.

Modern industry consumes gold in insignificant amounts. For the past 20 years, bull market fans have been actively speculating on the technological problems of the “gold” production growth. Still, in reality, the annual production volume is so small compared to the already accumulated reserves that the market does not notice it.

How To Do Backtest XAUSD

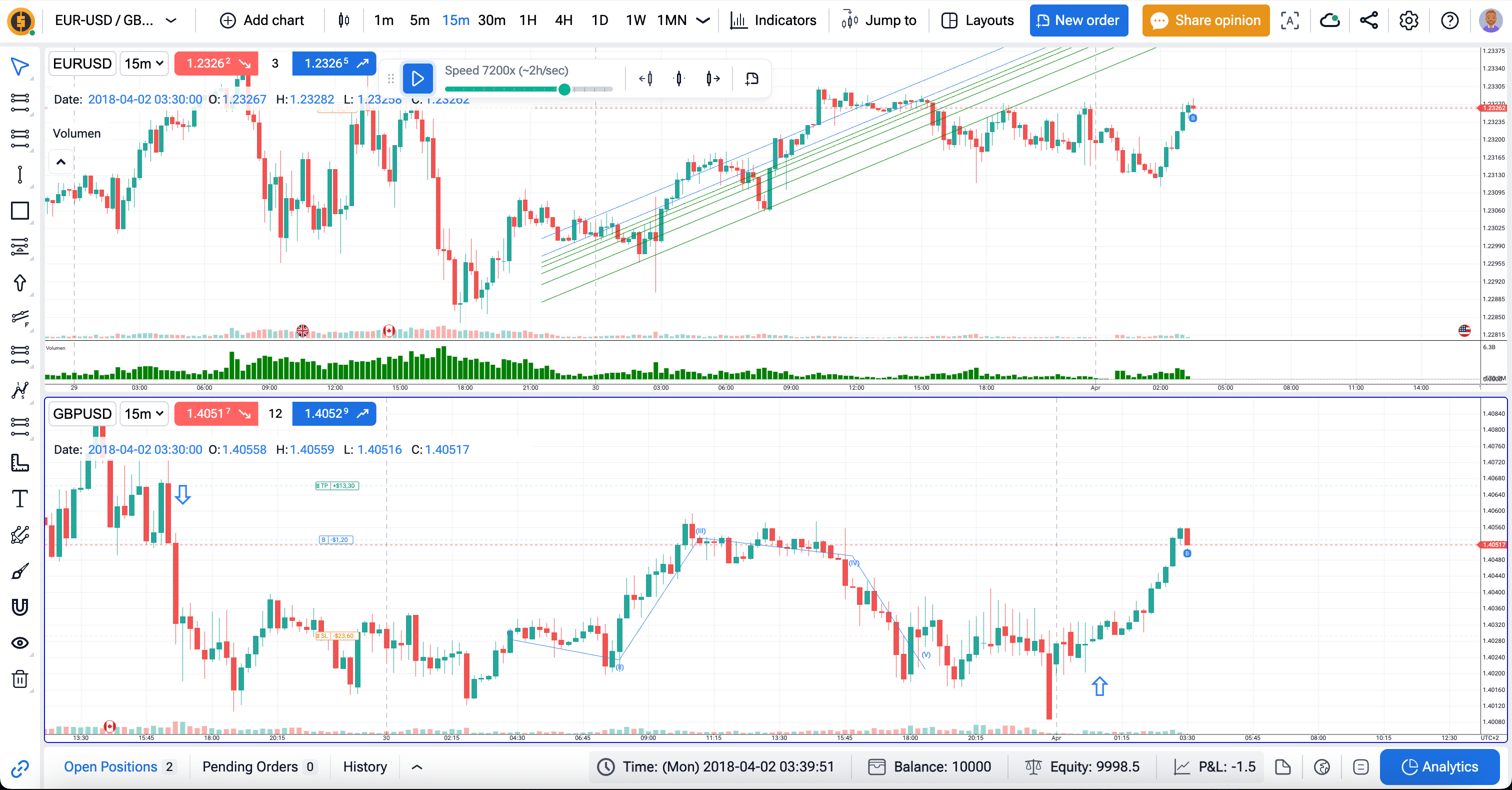

Backtesting XAUUSD (Gold against the US Dollar) involves analyzing historical price data to test a trading strategy’s effectiveness before applying it in real-time markets. Here’s a step-by-step guide to backtest XAUUSD:

1. Define the Strategy

- Specify your rules: Define entry, exit, stop-loss, take-profit, and position-sizing rules.

- Decide the time frame: Day trading, swing trading, or position trading.

2. Gather Historical Data

Obtain XAUUSD historical price data, including:

- Open, High, Low, Close prices.

- Volume (if applicable).

- Time frames (e.g., 1-minute, 15-minute, 1-hour, daily).

Sources include ForexTester or financial APIs like Yahoo Finance or Alpha Vantage.

3. Choose a Backtesting Platform

Use tools such as:

- Forex Tester Online

- TradingView

- MetaTrader (MT4/MT5)

- Other platforms

4. Prepare the Data

- Clean the dataset by removing anomalies or errors.

- Adjust for market events like splits or holidays (if necessary).

- Organize the data into a format compatible with your platform.

5. Execute the Backtest

- Run the strategy using the backtesting tool.

- Adjust parameters to evaluate different scenarios (optimization).

6. Analyze the Results

Metrics to evaluate:

- Profitability: Net profit, profit factor.

- Risk Metrics: Maximum drawdown, Sharpe ratio, Sortino ratio.

- Trade Stats: Win/loss ratio, average trade duration.

Visualize results with equity curves, trade distributions, and heat maps.

7. Refine the Strategy

- Optimize parameters based on the backtesting results.

- Adjust for overfitting by using out-of-sample data for validation.

8. Simulate Live Testing

Once the backtest shows consistent profitability, run the strategy on a demo account or paper trading to simulate live market conditions.

9. Implement the Strategy

Transition to live trading with proper risk management and monitoring.

The good thing about Gold is that historically it always goes up on the long run. Corporations fail, countries go bankrupt, currencies are subject to inflation, but gold is always in demand. Especially during the economic unstability.

What is the best gold trading simulator?

Practicing gold (XAUUSD) trading in a simulated environment is an excellent way to develop and refine your strategies without risking real capital.

Forex Tester Online is our top choice for a gold trading simulator. It offers a realistic trading environment where you can practice without risking actual money. Here’s why you consider it the best option available.

- Forex Tester Online provides high-quality, real-time market data. You can trade using live prices, just as you would on a real platform. This is the most advanced trading simulator not only for gold, but for traders in general.

- Users have access to up to 20 years of historical data for many instruments.

- Forex Tester Online is web-based, so there’s no need to download or install any software. You can access it from any device with an internet connection — be it a computer (Mac & Windows), tablet, or smartphone.

- Forex Tester Online includes features like tick data and floating spreads.

- You can set stop-loss and take-profit levels, manage open positions, and simulate different order types.

Forex Tester Online supports Gold (XAU), along with Silver, Oil, and other commodities – and also Forex, Indicies, Crypto, Stocks, ETF, and more.

Backtest Gold for Free

Backtest Gold for Free

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska