Today, the Japanese Yen is considered the third (after USD and EUR) world currency:

- the yen’s share in world gold and foreign currency reserves is about 6%;

- assets with the participation of the Yen occupy more than 30% of the world stock market;

- USD/JPY accounts for almost 16% of the Forex trading turnover and the Yen crosses-pairs give 5-6%.

The Japanese economy is the third in the world after the US and China, which makes this currency one of the most liquid and attractive for trading (and speculating!). However, traders, especially beginners, rarely trade on Japanese assets, since most of the standard technical trading strategies give a negative result to JPY.

The Yen is just that asset, on which without a qualitative fundamental analysis, even one unsuccessful warrant can destroy any deposit. We look forward to earn on the JPY, so let’s begin.

Features of fundamental analysis

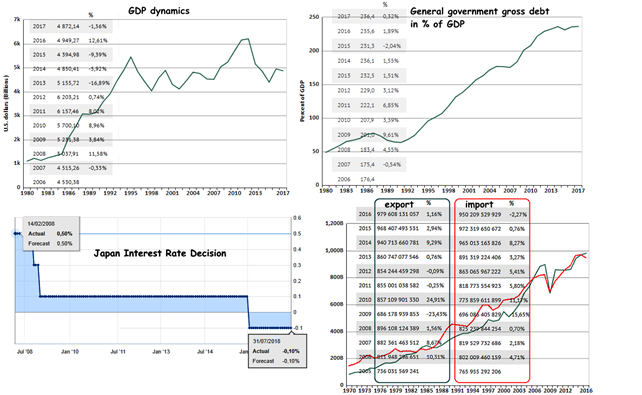

Japan pursues a strict monetary policy, although only its controlling functions are declared. Corporate interests force the government to conduct an aggressive, sometimes illogical policy, and constantly interfere with the dynamics of the stock and currency markets.

In fact, the activity of the regulator remains non-public, information is issued «dosed» and only post-factum. The impact of monetary actions on the JPY is a priority, but it is very difficult to predict it.

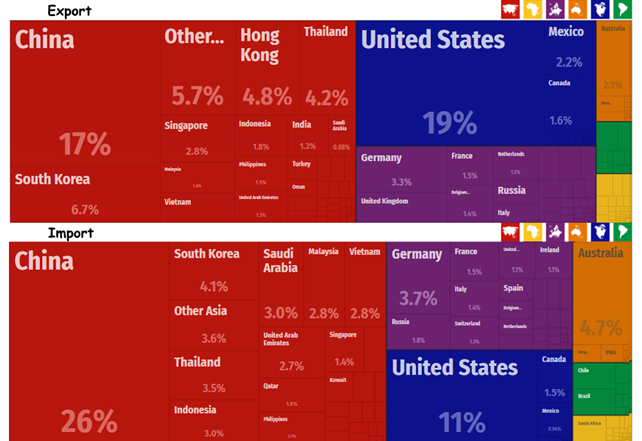

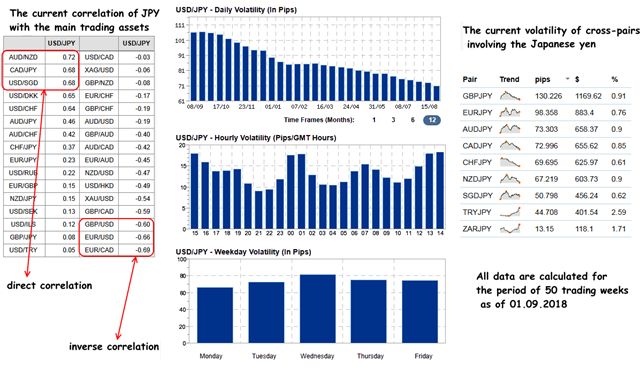

Trade in the Yen is closely linked to the Asian stock market, US treasury securities and interest rates. In addition, the country’s economy nervously reacts to the price of oil (especially WTI) and petroleum products.

Japanese exports are targeted at all basic markets. The main production capacities of Japanese corporations are concentrated in the Asian region, therefore problems (economic, political, or other force majeure) connected with trade partners or the region as a whole, immediately affect the Yen rate.

Japan is heavily dependent on maritime transport communications, so the hurricane season and storm season also affect trading assets involving JPY.

Let’s look at each of the factors in detail.

Financial institutions affecting the JPY exchange rate

The main powers belong to the Ministry of Finance of Japan, its impact on the Yen is significantly stronger than of similar institutions, for example, in the US − on the USD or the UK − on GBP. The speeches of the officials are not always indicated in the economic calendar, although, most often, they mean strong verbal interventions.

The Central Bank of Japan (BOJ, sometimes «Nichigin» is used) belongs to the state only by 55%, the remaining 45% are divided between the owners of the bank’s shares (these shares are freely traded on the exchange). Nominally, since 1998 BOJ is independent of the government and works in the open market only to monitor liquidity, but this «financial» freedom is only declarative.

The main monetary instrument BOJ − the short-term interbank rate (Overnight Call Rate). The low rate (in the range [-0.1%, 0.1%]) provokes deals carry trade, the volume of which exerts additional «pressure» on the low-yielding Yen.

Officially it is considered that the last currency intervention of BOJ was conducted in 2011 (after the earthquake). But even elementary technical analysis shows that hidden interventions are carried out regularly to correct current «price failures» − usually to lower the rate, in order to reduce the cost of Japanese goods in relation to competitors.

So the risk of «getting» on the unexpected infusion of Yen liquidity into the market is still relevant. During the intervention, the volatility for USD/JPY ranges from 150 to 300 points.

The Yen is also influenced by the policy of the Economic and Fiscal Policy Agency, in particular, in the areas of employment, international trade and currency regulation, and the Ministry of Economy, Trade and Industry, whose actions are aimed at protecting products of Japanese corporations at the international level. Both these organizations are interested in reducing the yen’s rate to the main currencies (USD, EUR, GBP).

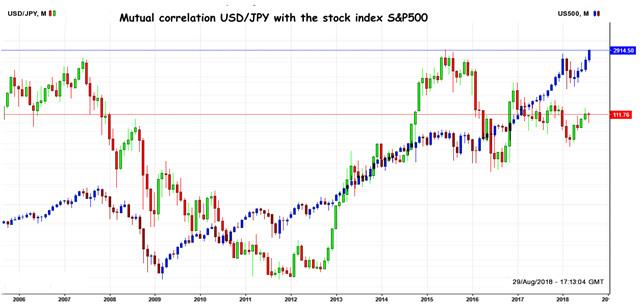

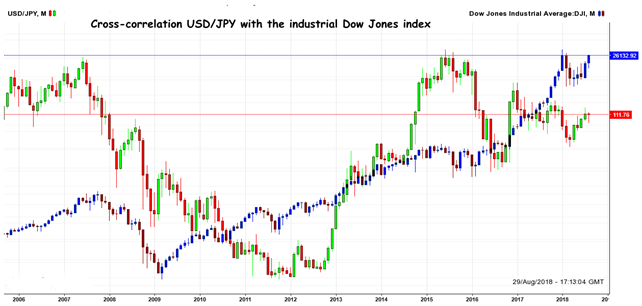

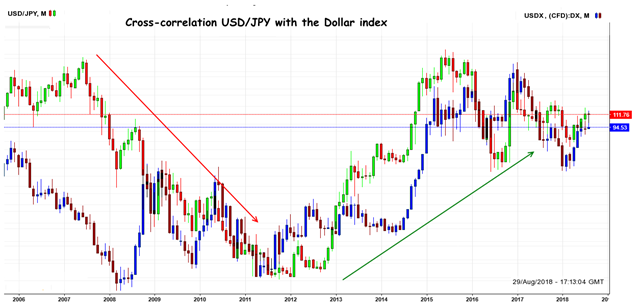

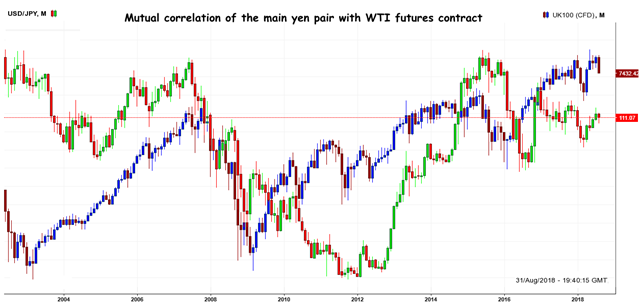

The impact of the stock market

Speculation with a cheap Yen began about 20 years ago, when BOJ began to pursue an ultra-soft policy. If investments in the currency are unprofitable or give a small income (because of low inflation and interest rates), investors «pour» money into securities. As soon as the situation changes, investment flows are adjusted, which ensures the flow of money between adjacent markets.

The Asian market is heterogeneous: approximately 45% of the trading volume is provided by shares of commercial participants, 15-20% falls on state securities. 95% of the turnover of Japanese securities, as well as options and futures contracts passes through the Tokyo Stock Exchange. The Yen needs to track Asian indices (TOPIX, Hang Seng, KOSPI, Nikkei 225, SET50, Composite).

The connection of the pair USD/JPY with the Nikkei225 is clearly visible on the periods from H4 and higher: if the Nikkei 225 chart starts a noticeable down trend, and the USDJPY pair does not fall yet, then this is a possible signal for selling a currency pair on the market. We remind: the currency market works round the clock, and the index Nikkei 225 − only during the Asian stock exchanges.

Treasury, the US stock market and the USD/JPY rate have an inverse correlation. During the growth of the stock market, the price of bonds is reduced, and the yield on them is increased. In this case, the Yen is sold, as investors want to trade risky assets − shares. However, the stock market is not supported by the government, therefore during a market panic, investors will change the security of treasury obligations to significant risk.

Between bonds, shares, USD and Japanese government securities (JGB) there is the same connection. If the value of Japanese bonds falls, then the rate of USD/JPY decreases.

The current difference between the yield of 10-year Japanese JGBs and 10-year Treasury bonds is the leading indicator of the USD/JPY rate. This correlation can change rapidly (usually 1-2 days to several weeks) and can cause large losses, so short-term transactions in this situation need to be fixed.

The assessment of the currency and stock markets correlation by the Yen is mandatory for medium-term positions, but it should be taken into account in the usual technical analysis as an additional indicator of the global trend.

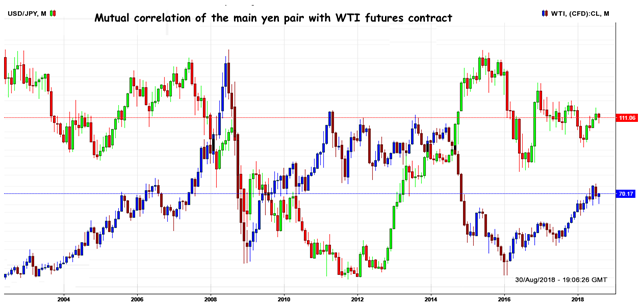

Yen and Oil

This raw material in Japan is almost non-existent, so the economy is rigidly tied to regular external supplies of «black gold». The problem is especially acute after stopping several nuclear power plants, as a result of which the country is forced to significantly increase purchases of petroleum products.

At the moment, the correlation with WTI is unstable, as the market for raw materials is too politicized, but the connection «expensive oil − cheap Yen» as a whole remains.

For those who use this fundamental factor in real transactions, we recommend choosing either a cross-linked pair without oil (EUR/JPY) or pairs that have a strong positive correlation with commodity prices (for example, CAD/JPY).

A confident trading signal to the input with such a correlation is rare, but a sharp turn in the price of WTI is a reliable signal for closing a position or fixing profit on any asset with JPY.

Carry Trade Strategy

According to the Yen, the positive trade in carry trade is considered a negative factor for the Japanese economy − this is a net outflow of money from the country. At the moment, the main players are pursuing a policy of lowering rates (only USD is playing against the market), so the differential for profitable carry trade transactions is decreasing.

Today it is difficult to find assets with a stable difference in interest rates and acceptable commissions, except that deals with US securities. This requires confident skills of inter-market analysis and newcomers is strongly discouraged.

Features of technical analysis

All assets with JPY are recommended to trade on medium-term methods, candle patterns on timeframes below D1 work poorly. However, in the presence of sufficient experience, scalping on M5-M15 is quite possible.

Sometimes there is an opinion that the Yen does not lend itself to technical analysis. We believe that it simply reacts to signals slower than the main pairs − the Yen always needs some time to «think».

USD/JPY is considered as a leading asset for AUD/USD, AUD/JPY, NZD/USD and NZD/JPY; in a strong trend, it moves without kickbacks, with small flat pauses.

This pair is quite volatile almost the entire trading day. In the medium term, the USD/JPY pair behaves strictly according to technical analysis and is perfectly predicted using standard indicators (for example, any variant of the Ishimoku technique see Using Indicators), unless a fundamental force majeure independent of it occurs.

Lovers of trading in the price channel can be disappointed: as a rule, the Yen consolidates in a very narrow range. Therefore, it is necessary to «catch» the moment of breakdown of borders.

Due to the fact that investors view JPY as a defensive asset, especially in case of panic in the stock markets, the demand for this can sharply increase, and then USD/JPY, EUR/JPY and GBP/JPY begin to contradict the fundamental laws. Therefore, the moment to exit the open positions should be confirmed by several indicators.

Trading on the news

The Yen is always prone to panic, so all the political Flash Crash and the strongest statistics it performs faster and more reliably than any other currency. If the market as a whole falls − sell Yen first.

The Yen is rising with unfavorable news from the US, China, Australia and the EU; painfully reacts to any changes in duties and customs regulations, because it is the leading currency in Asian commodity contracts. At the moment, it nervously tracks all the steps of the RMB’s monetary policy. Japanese news (except for critical, for example, interest rates) usually have a longer-term effect.

Information sources

- Japan, Atlasmedia, Japan: World factbook CIA, Web Japan, Japan BBC − reference books about Japan

- Prime Minister of Japan and His Cabinet

- Cabinet Office Japan

- Statistics Bureau

- Japan Securities Dealers Association (JSDA)

- Securities and Exchange Surveillance Commission (SESC)

Several practical remarks

Since 2012, Japan has been carrying out the QQE program (Quantitative and Qualitative Monetary Easing): BOJ buys Japanese Government Bonds with a maturity of 10-20 years on monthly basis, as well as other assets such as ETFs, Japanese real estate investment funds and corporate bonds. The goal is to increase the liquidity of the monetary system.

In September 2016, the Ministry of Finance of Japan decided to increase the issue of 30-year and 40-year sovereign bonds of the country by ¥2 trillion. ($17 billion), while the short-term bonds production with a maturity of 2 years and 5 years is curtailed.

At the moment it is already clear that the QE program has not reached its goals. Nevertheless, from the point of view of the impact on the foreign exchange market, any adjustment to the QE conditions will be perceived by the market as tightening of monetary policy, which can cause a sharp Yen rise and hit corporate profits and the stock market.

The result?

It is profitable to trade a Yen, if you always remember about its eastern character. Yen trading assets are suitable for both trend and intraday trading, and with good fundamental training on the Japanese currency, even beginners can earn a steady income.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this feature was arranged in Forex Tester with the historical data that comes along with the program.

To check this (or any other) feature’s performance you can download Forex Tester for free.

In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska