One more element of the well-known Theory of Trade Chaos analyzes how attractive the asset is to financial market participants. Except for dynamics of the price, the MFI indicator, in addition, considers market volume that, according to Bill M.Williams, allows you to see how fast money «enters and leaves the market».

Of course, you cannot see the real amount of the money in open positions on Forex, but even the available data on the number of transactions (tick volume) allows MFI to give stable results.

So let’s begin.

Logic and purpose

Indicator Money Flow Index links the concept of price with the amount of money that forms it. The main goal of the MFI indicator is to find market points where price movements do not correspond to open volumes and to «catch» the decline in activity of market players before the price turns.

Players who trade in the direction of the «old» trend have been long in the market and are preparing to capture their result (at least in part). At the same time, those who tried to trade against the trend, suffer losses, close their positions. Both sides do not hurry to open new transactions. The result − the volume of the active money on a trade asset sharply decreases.

MFI compares volume «negative» (withdrawal of means from an asset) and «positive» (inflow of means to an asset) cash flows, therefore for the engineering analysis it makes sense only the direction of the indicator, but not its absolute value. It is important to evaluate the price fluctuation. The indicator was created to analyze real stock volumes, but Forex traders hope that tick volumes repeat their dynamics. It is assumed, that the more money flows, the more the price should move more actively, but in practice, unfortunately, everything is much more complicated.

Even in the stock and commodity markets, which are tightly regulated, it is not easy to determine the direction of the capital flow (you can see here).

Calculation procedure

The basis of the calculation is the favorite Bill M.Williams’ typical price of an asset in the period. It is believed, that a typical price better characterizes what happens to a trading asset than the market closing price (see here).

Calculation of the indicator MFI consists of several stages. First, we calculate the Typical price: the average value of the High, Low and Close prices of the bar:

TypicalPrice = ((High+Low+Close)/3)

If a typical price for the current period is higher than the previous one, then there is an inflow of cash into the trading asset on the market. In this case, the price is considered a «positive single cash flow». If the typical price decreases, then investors are eager to withdraw money from this asset. Similarly, this price is called «negative unit cash flow».

The following basic concept: Money Flow (cash flow) is the amount of demand for a trading asset at a typical price. Calculated as the product of a typical price for the volume of transactions for the period.

MoneyFlow = (TypicalPrice)*(Volume)

The sum of «positive single flow» for the period generates a general «Positive Money», «negative single flows» − «Negative Money.

Next stage: we calculate Money Ratio:

MoneyRatio = (PositiveMoneyFlow/NegativeMoneyFlow)

And, finally, we get the final value of the indicator MFI:

MoneyFlowIndex = 100 – (100/(1+Money Ratio))

The absolute value of the indicator is in the range (0; 100).

Calculation of Money Flow Index does not contain an averaging method, so the dynamics of the indicator is synchronized with the price, and in some cases is ahead of the price.

Parameters and control

The MFI indicator is an oscillator line in an additional window, with a traditional balance line and levels of overbought/oversold zones (70/30 or 80/20). The value of the calculation period − 14 bars − is recommended by Williams.

Standard version of the indicator Money Flow Index

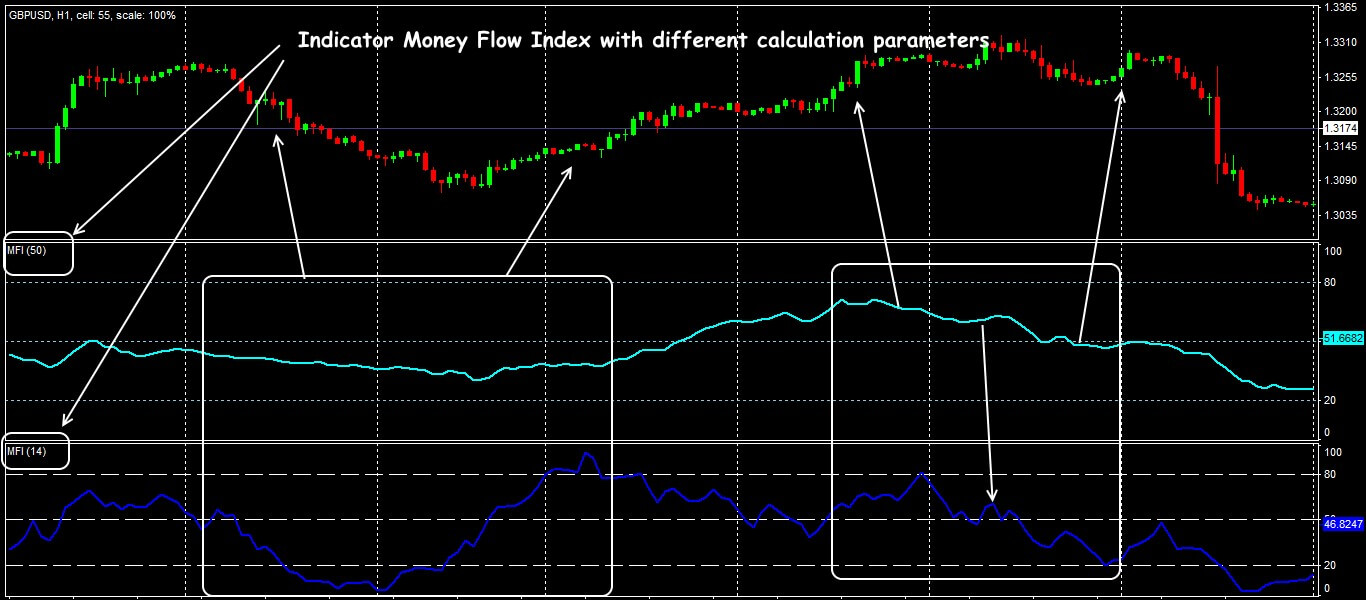

The smaller the calculation period, the more «nervous» will be the Money Flow Index indicator line.

A long and short period in the Money Flow Index

Trading signals of the indicator are similar to the usual oscillator.

Let’s look at it in detail.

Trade signals of the indicator

Usually, there are three groups of the signals of MFI:

Breakdown of critical zone levels

An asset is considered «overbought» if the MFI indicator exceeds the level of 80 (70) and «oversold» − if the indicator falls below the level of 20 (30). The trading signal appears on the reverse breakdown of the boundary of the critical zone.

Trading signals of the MFI indicator

Attention! On a strong and active market (from the point of view of the tick volume), the indicator line can «hang» in critical areas long enough.

- For purchase: it is necessary for the indicator line to reverse from the range (0; 20) and break the boundary from the bottom up.

- For sale: the indicator needs to turn from the range (100; 80) and break the border from top to bottom.

Before changing the trend, the indicator line can turn around without reaching critical zones. In such cases, the direction of the transaction is determined according to the central line (level 50): movement from the bottom up − the purchase, from top to bottom – the sale.

Money Flow Index: reversal signals

The most reliable reversal signals are obtained on the periods from H1 and higher because on smaller timeframes the line will display the usual price noise. Be cautious − active dynamics of trading volumes in periods of news or other speculations distort the behavior of the indicator line.

Divergence with price

Such situations are traditionally considered to be the strongest trading signals, mainly due to their outstripping effect.

Trading schemes for divergence and flat on MFI

In practice, divergence on MFI is extremely rare. As a rule, the indicator gives a warning signal for 3-5 bars before a real turn.

Only the strongest types of divergence are reliably worked: direct for sale, reverse (convergence) for purchase. Open the transaction after the breakdown of the boundaries of the critical areas, Stop Loss is set for a local extremum.

Graphic figures on the indicator line

Graphic patterns on the indicator line always outstrip the formation of similar figures on the price chart for several periods.

Money Flow Index: standard patterns

The result?

Transactions are opened after the breakdown by the lines of the indicator of its own trend line, Stop Loss is beyond the local extremum.

Application in trade strategy

First of all, we should note:

Since Money Flow Index is a typical oscillator, all trading strategies with it require the use of a trend filter. An example of a stable solution on standard indicators will be:

BollingerBand + MFI

BollingerBands operates as a trend indicator and a filter of a Money Flow Index signals: only purchases with the ascending mid-range BB and only sales − with its fall.

Stop Loss can be placed over the local max / min, and to close the transaction − according to standard signals BollingerBands (see).

The scheme of trading signals MoneyFlowIndex+BollingerBands

Scalping inside MFI

Indicators are required: MFI (6) with levels (30/70), SMA (3) on MFI data.

- For BUY: the MFI line crosses the SMA from below to below to the top, under the level of 30;

- For SELL: the MFI line crosses the SMA from the top to below, above level 70;

- Open the deal at the next bar after the signal candle, place Stop Loss to the nearest max/min (no less than 10 points!), it is recommended active trailing with a step of 5-10 points.

Moving Average on the Money Flow Index

Another option, see here.

There is a more complex system for the fans of the technical indicators:

Combined MFI

Indicators are required: SMA (300) and a synthetic tool of three consecutive algorithms: MFI (100) → Standard Deviation (10) → RSI (10). Levels for MFI are standard.

The chart of trading signals of the integrated strategy MFI

Signals for opening transactions appear strictly after touching the critical levels:

- For BUY: SMA (300) looks up; «Synthetic» RSI turned down above level 70.

- For SELL: SMA (300) is directed downwards; «Synthetic» RSI turned up below level 30.

- Stop Loss − at the local max/min level (at least 20 points!), Take Profit − trailing in 10-15 points.

Several practical remarks

The Money Flow Index indicator demonstrates the distribution of forces bulls/bears, and also possible changes of the market situation in the nearest future. You should not forget that it was initially developed for the stock market where there is much more information for forecasting.

Signals of the indicator are not redrawn; it is possible to collect statistics of the signals and to evaluate risk. MFI steadily works at any assets, is steady against market noise, but it is not recommended to make a trade decision only on the basis of its signals.

What this means is:

The turn of its line does not mean the emergence of a strong, and most importantly − stable movement. The indicator only shows the change in trade preferences, and how profitable will be this turn − it is necessary to evaluate by additional tools.

Try It Yourself

After all the sides of the indicator were revealed, it is right the time for you to try either it will become your tool #1 for trading.

In order to try the indicator performance alone or in the combination with other ones, you can use FTO with the historical data that comes along with the program.

Simply start using Forex Tester Online. In addition, you will receive 23 years of free historical data.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska