We have tested a line of the well-known indicators and now it is time to try the Parabolic SAR indicator.

As it is better to use the combination of the indicators for signals confirmation, we compliment the Parabolic SAR with the Moving Averages.

And let’s see how they have worked together.

A Couple of Words About Indicators

Parabolic SAR shows the potential reversals, SAR itself stands for “Stop and Reverse” and it basically explains the whole meaning of the indicator:

The dots above the candles provide the signal about the downtrend or the SELL signal, while the dots under the candles indicate the uptrend or the BUY signals.

Therefore, the change of the dots position indicates the potential reversal may happen.

One more important thing about the Parabolic SAR: except showing the potential reversals, it works excellent as marks for the trailing stop. That is another reason why traders single out this indicator into the top of the favorite ones.

As well as indicators depicted before, the Parabolic SAR is also the trend-following indicator, so we cannot wait to learn how it is going perform through the different markets.

Why Parabolic SAR is accompanied by the Moving averages for this strategy?

Moving Averages are there to determine the entry point the moment they cross.

We hope that combination of these two indicators will give us accurate trend reversal set ups.

Technical Information

Indicators:

- Parabolic SAR (with default settings);

- 40 SMA;

- 20 SMA.

Timeframe: any (but we use 1h while backtesting).

Currency pair: any.

Stop Loss/Take Profit: check for the closest support/resistance levels and place ST over/below them (about 30-50 pips away).

Exit the trade when the MA cross again or the dot of the Parabolic SAR will provide the reverse signal. Or you can place the Take Profit over/under the closest Support and Resistance level (what we are going to do while backtesting this strategy).

Long trade entry rules:

- Parabolic SAR dots must be below the price.

- 40 SMA will cross the 20 SMA and goes below it.

- Enter the Buy trade at the next candle after these two conditions met.

Please, not, that first two conditions can occur not necessary at the same time, but to enter the trade we should wait for the both of them to happen.

Short trade entry rules:

- The Parabolic SAR must change to be above the candle

- 2The 20 MA and 40 Moving Averages cross and 20 MA goes below the 40 MA

- Enter the Sell trade the next candle after all 2 conditions are met

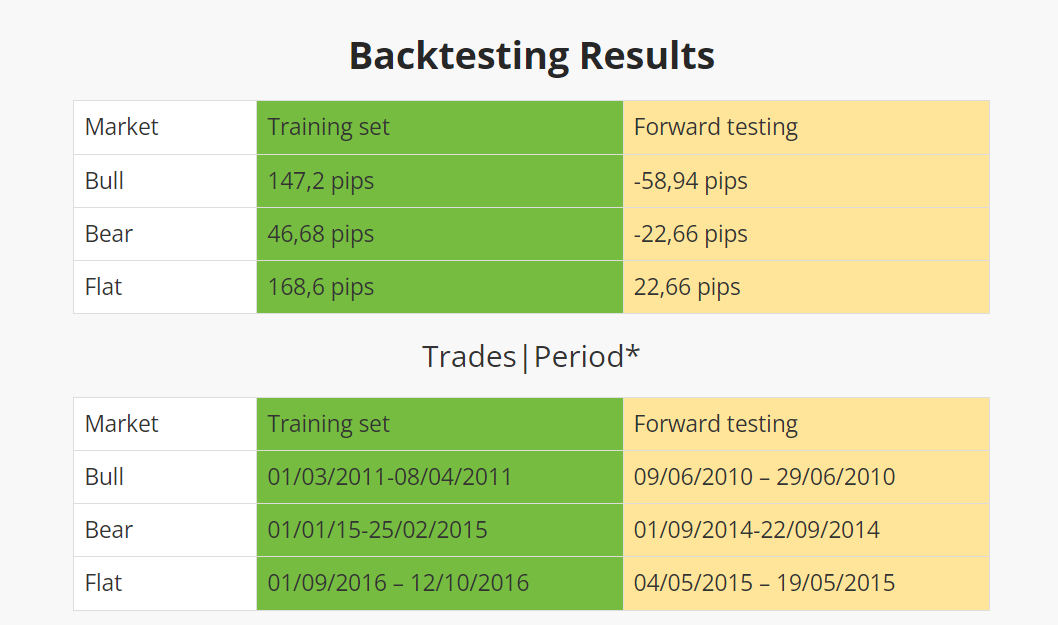

*How long it took us to enter the 50 trades for the Training Set and 20 trades for the Forward Testing.

A Reminder: in order to save your valuable time and efforts, we have introduced the system of backtesting when you perform only 50 trades through 3 different types of market (Bullish, Bearish and Flat markets) and then again 20 trades through the given types of market, but during other periods. Then with simple math calculations, we can make conclusions about effectiveness or irrelevance of the chosen strategy.

The full version of the theory of our backtesting experiments and how did we came up with the idea of such backtesting you can read here.

Conclusion

Probably, something is wrong with the chosen settings or the risk management: while showing the optimistic results during the Training Set, the forward testing showed the negative results unfortunately.

While backtesting during the Training Set (Flat market) we were surprised with the results: could it be possible to find the best strategy to trade while market is consolidating?

Surprisingly, this strategy showed positive results only during the Flat markets.

One more thing about this strategy during the Flat markets worth mentioning:

It was hard to find the entry points with these indicators – once one of them show it is time to enter the trade, another one shows the reversal signs.

But, again – no surprise for trading during the flat markets.

However, we cannot ignore one positive moment:

Check the ratio between the trades and the period – during the most of the backtesting sessions, it took about the month or so to perform the needed quantity of the trades.

That should mean that the entry points of the trades were picked carefully and didn’t filter out the potential trades.

Parabolic SAR itself is an amazing indicator; and you should definitely try different combination of it with other indicators.

It doesn’t mean the strategy itself is not profitable, the aim of our experiment wasn’t to give the ready advices you should blindly believe in. But to show that even the slight details of the any trading strategy should be carefully backtested before being used during the live trading.

Further Adjustments for Better Results

There are dozens of the ways to trade the indicator alone or with the combinations with other ones.

We show only one way to trade, however, nothing should stop the curious minds to try different settings and check how it can influence the final results.

What particularly can be a matter of the additional change and backtesting?

- Stop loss and take profit – one of the ways to utilize the Parabolic SAR is to use the dots as the marks to place the trailing stop.

Besides, you can try different ratio of the TP and SL, or close the trades manually when the Parabolic SAR’s dots show the signal of the reversal.

- Timeframe and the currency pair – try this strategy for scalping or the daytrading;

- You can try Parabolic SAR indicator with combination with MACD or Stochastic or other indicators.

Try what combo can work the best for you.

As you can see, adjust, test and then change accordingly – is the only possible way to find the options suitable for YOU.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this strategy was arranged in Forex Tester Online with the historical data that comes along with the program.

To check this (or any other) strategy’s performance you can try Forex Tester Online. In addition, you will receive 23 years of free historical data.

What do you think about the strategy as whole and Parabolic SAR as an indicator particularly? Have you tried to trade with this indicator? What are other combinations to try it with?

Develop Moving Averages Trading Strategy

Develop Moving Averages Trading Strategy

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska