The Traders Dynamic Index (TDI), created by Dan Malone, offers comprehensive market analysis by assessing trend direction, strength, and volatility. Initially used for scalping on short timeframes, it proves effective across various timeframes and assets. The TDI combines RSI, Bollinger Bands, and a moving average to filter sideways markets and identify high-probability trades. This hybrid approach simplifies complex analysis, providing traders with actionable insights for improved trading decisions.

In the following sections, we’ll delve into the TDI’s components, settings, and practical trading strategies to help you maximize its potential.

What are the tasks covered by the Traders Dynamic Index indicator?

The purpose of this indicator is quite difficult to implement: you need to successfully catch a strong volatility, remove speculative throws, but still stay in the current trend.

So, the first task of the TDI indicator is to qualitatively filter the sections of the flat, the second − to distinguish between the price movement entry points, suitable for short-term and medium-term transactions.

That’s why the base for the indicator signals was the classic tools of RSI (for estimating the strength of the trend), Bollinger Bands (for estimating the amplitude of the oscillations) and Moving Average (removes speculative throws). A comprehensive analysis of the situation highlights the entry points with a high probability of success. There are no special secrets in the calculation mechanism, this indicator is a successful software solution that combines several indicators in one circuit and simplifies visual perception.

Understanding the TDI Formula and Components

RSI (Relative Strength Index): The Foundation

The indicator is based on a method of the calculation of RSI − all lines of the indicator are calculated on the information of the main oscillator. It forms the overall graphic picture, because the main task is to assess the rate of the change in the price.

Default settings:

- Price type for calculation − Close price (as the most reliable);

- the optimal period (in bars) is 13 (the recommended value is between 8 and 25);

- Smoothing method − simple average.

Bollinger Bands: Measuring Volatility

The next step: the range of volatility is determined by the Bollinger Bands indicator, the initial data for which is the current RSI values: this allows you to «diagnose» trend areas and flat periods. The parameters are normal, it is not recommended to change them. The middle line is highlighted in a separate color and is considered to be the base (balance) trend line.

The choice of parameters obeys the usual logic:

less parameter − higher sensitivity − more false signals − used for scalping on small timeframes; increasing the parameters makes the lines more stable, and trade signals − more reliable.

Ready to test TDI trading strategy?

To check this (or any other) strategy’s performance you can try Forex Tester Online (FTO).

Check how to use FTO simulator in our step-by-step guide.

TDI Settings: Optimizing Parameters for Your Trading Style

The indicator TDI is included in a standard set of the popular trade platforms, but its different options can be downloaded freely on the internet.

Traditionally for the oscillator, the indicator is located in an additional window under a price chart with the balance sheet level of 50 and additional levels above/below (author’s values − 32 and 68 are by default selected). Versions of the indicator with an audio signal at the appearance of the critical points are the most popular.

The green line is a flattened RSI with a small period (base); red is also RSI, but with a longer period (signal): the RSI indicator itself in the traditional form is not used.

Experiments with a price type for calculation do not lead to improvement of the quality of signals. Also it is not recommended to change the parameter StdDev (default = 1.6185) − the coefficient for the root-mean-square deviation for BollingerBands.

At first glance, it is rather difficult to understand this scheme of lines.

But let’s look at it in detail.

How to Read TDI Signals: A Step-by-Step Guide

At once we warn: to use critical points of the indicator as signals for an input − is risky enough. Its lines are used only for analysis, but the trading solution must be taken with the help of additional tools.

The result of the using of the indicator is an estimate:

Identifying Trend Direction

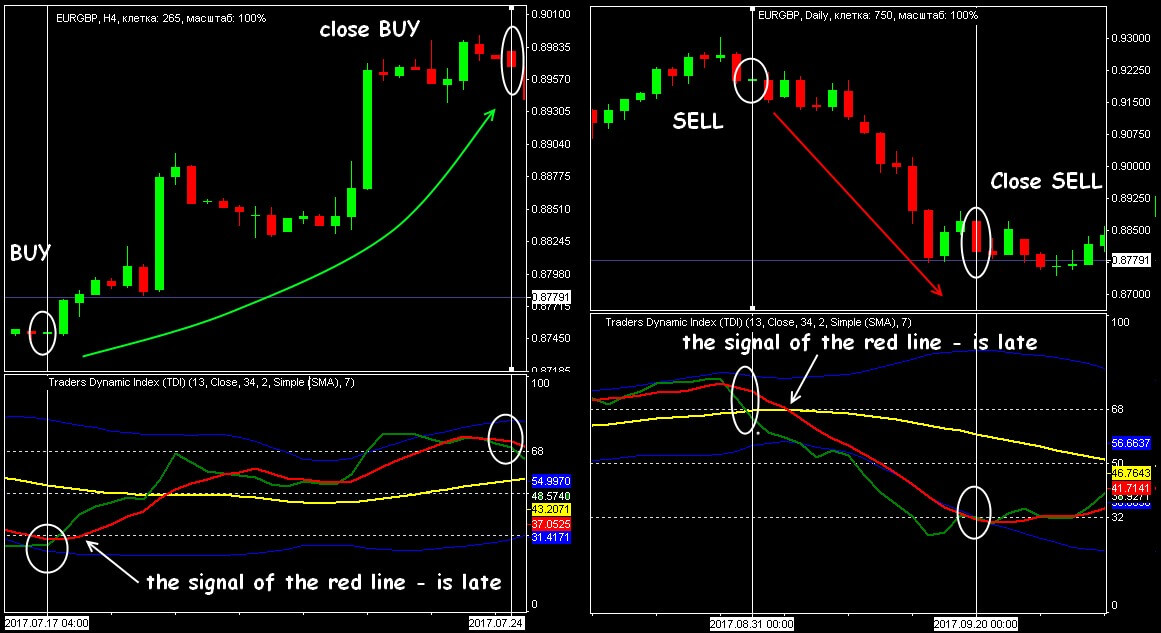

The short-term trend is determined by the relative arrangement of the green line with respect to the red line:

- the trend is considered ascending, while the green line moves above the red line;

- if the green line is below the red line, the market goes down.

The yellow line indicates a long-term trend and most of the trading time moves in the range between the levels of 32-68 − with the exception of speculative moments. This line will define key turns for change of a trend.

The global trend is defined similarly: by the arrangement of the yellow and red lines. While the main trend line is pointing down and the red line is below the yellow one − the trend is confidently bearish; for a growing market you need a mirror image − the yellow line looks up and the red line moves above it.

If the yellow line moves below the level of 32, then the market has reached a local minimum, so a breakdown from bottom to top with a high probability means a turn toward the «bulls».

The main line above level 68 − on the market a local top is formed, breakdown of the level from top to bottom suggests preparing for a turn towards «bears».

Measuring Trend Strength and Volatility

We perform the analysis of the relative location of the blue channel BollingerBands and RSI lines:

- If the channel borders diverge and the green line forms a strong direction (up or down), then there is active volatility on the market (the probability of strong directional movements or continuation of the current trend is very high);

- The greater the angle of the green line, the stronger the players in this direction;

- If the channel lines converge, and the RSI line shows short («nervous») movements − the market is already in the flat, or is preparing for this state;

- The closer the green line to the balance area (level 50), the less the market is active.

We remind you that the narrow BollingerBands channel and weak dynamics of RSI lines are always formed before strong speculation (news, opening/closing of trading sessions, etc.). In such periods, TDI signals cannot be trusted.

Traders Dynamic Index: direction and volatility

Spotting Overbought/Oversold Zones

The key element is considered to be the behavior of the green line:

- crossing level 68 from the top down (turn in the overbought zone) − a signal for sale;

- crossing level 32 from the bottom up (a turn in the oversold zone) is a signal to buy.

Conclusion: Mastering the Traders Dynamic Index

Despite the external complexity of the lines, the indicator signals assume a classical interpretation and do not cause problems even for novice traders.

The TDI indicator is recommended to use on assets with stable volatility − major currency pairs and base crosses. Working period: is not less than H1-H4, confidence in signals on timeframes less than H1 is low.

The Traders Dynamic Index indicator is quite effective as an independent tool for trend analysis, and is also used in conjunction with other indicators and filters to create more reliable trading systems.

After all the sides of the indicator were revealed, it is right the time for you to try either it will become your tool #1 for trading.

FAQ

Is TDI a good indicator?

The Traders Dynamic Index (TDI) is considered a versatile and effective indicator for analyzing market trends, momentum, and volatility. It combines RSI, Bollinger Bands, and moving averages to provide a comprehensive view of market conditions. While it may not function as a standalone trading system, TDI excels as a tool for identifying entry and exit points, spotting divergences, and managing risk. Its adaptability across timeframes and assets makes it valuable for many traders.

What is the difference between RSI and TDI?

The Relative Strength Index (RSI) is a standalone momentum oscillator that measures the speed and change of price movements, identifying overbought and oversold conditions. It oscillates between 0 and 100, with key levels at 70 (overbought) and 30 (oversold). The Traders Dynamic Index (TDI), on the other hand, integrates RSI with Bollinger Bands and moving averages to provide a more comprehensive view of market dynamics, including trend strength, direction, and volatility.

What are the lines of the TDI indicator?

The Traders Dynamic Index (TDI) consists of five key lines:

- RSI Line (Green): Represents short-term market momentum and price direction.

- Signal Line (Red): A moving average of the RSI, used to identify potential trend reversals.

- Market Base Line (Yellow): Indicates the overall market trend and acts as a long-term filter.

- Volatility Bands (Blue): Bollinger Bands that measure market volatility and define overbought/oversold zones.

These lines work together to provide a comprehensive view of market conditions.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska