Most traders start looking for ways of creating a trading algorithm when they realize that intuition and emotions keep ruining their results. They overtrade, change strategies too often, and repeat the same mistakes — hoping that “this time” will be different. A well-built algorithmic system removes this chaos. It brings discipline, consistency, and measurable logic.

In this guide, we’ll show how to create an algorithm for trading step by step. You’ll understand how algorithms work, how to structure your own trading rules, and how to test them effectively.

Bonus: at the end, you’ll learn how to verify your ideas using a modern algo backtesting platform — Forex Tester Online, which lets you automatically test and refine your strategy on years of historical market data without risking real money.

What is a Trading Algorithm?

A trading algorithm is a structured set of rules effectively a computer program that dictates when to enter, exit or adjust trades across financial markets like forex, stocks, commodities and cryptocurrencies. Instead of relying on gut feeling, it uses clearly defined criteria drawn from historical price data and real-time market conditions. In practice, the algorithm will scan for specific patterns (for example, trend reversals or support/resistance touches), and when all conditions align, it executes a trade automatically or signals one for manual approval.

By building a successful trading algorithm, you can see what really works in different financial markets. The process of making algorithms for trading transforms your random setups into repeatable, verifiable strategies.

This approach (also called algorithmic trading) offers human traders the ability to remove emotional bias and act with consistency: once the trading algorithm is built and calibrated, it makes decisions based strictly on the logic you defined.

Key points that make a trading algorithm worthwhile:

- It formalises your trading method into a repeatable format, reducing ad-hoc decisions.

- It works with large volumes of market data and identifies setups that might escape human attention.

- It enables you to build, test and optimise your algorithm(s) across different markets and time-frames, increasing the chances of finding what works (or what doesn’t).

In short: it allows you to test how the algorithm would have behaved in varying conditions before using it live.

Need some examples? Keep reading.

Trading Strategies You Could Use With Trading Algorithms

A trading algorithm can follow almost any market logic you define — from simple rule-based systems to complex multi-indicator models. Here are several practical strategies that traders often automate:

Built around moving averages or momentum indicators, this strategy automatically opens trades in the direction of a confirmed trend. For example, when the 50-EMA crosses above the 200-EMA, the computer program can trigger a buy signal and exit when the opposite crossover occurs.

This method assumes that prices tend to return to their average over time. The algorithm identifies overbought or oversold conditions using RSI or Bollinger Bands and places trades expecting price reversion to the mean. Works well for stocks and commodities with stable ranges.

The bot monitors consolidation zones and automatically enters trades when price breaks a defined support or resistance level. It’s popular in forex and cryptocurrency markets where volatility spikes can be exploited.

4. Arbitrage Strategy

By analyzing multiple financial markets or exchanges at once, the trading algorithm detects price discrepancies and executes paired trades to capture risk-free profit. This type of algorithmic trading requires fast data feeds and minimal latency.

5. News-Driven or Sentiment Strategy

Using APIs or natural-language inputs, the trading bot reacts to real-time headlines or social sentiment, automatically opening or closing trades based on the perceived market impact.

Each of these strategies can be developed, tested, and optimized on historical market data using an algo backtesting platform such as Forex Tester Online, letting you refine your parameters before deploying the algorithm live.

How to Make a Trading Algorithm

Pick one strategy from above (e.g., Trend-Following). We’ll frame it for algorithmic trading and adapt the workflow to an algo backtesting platform — Forex Tester Online.

Step 1: Find or create a strategy

Write a one-page spec: goal, market regime, indicators, timeframes, and position logic. Keep it machine-readable so a computer program (or a human) can execute it the same way every time. You’re building a trading algorithm that can act automatically on signals, not vibes.

Step 2: Select a market

Start with one liquid venue: forex (EURUSD), then expand to stocks, commodities, or cryptocurrencies. Different financial markets respond to trends and volatility differently; scope first, then scale.

Step 3: Set entry/exit rules

Define precise triggers (e.g., 50-EMA > 200-EMA and RSI>55). Define exits (ATR stop, opposite crossover, time stop). No gray areas. If you can’t code it, you can’t create an algorithm for trading it.

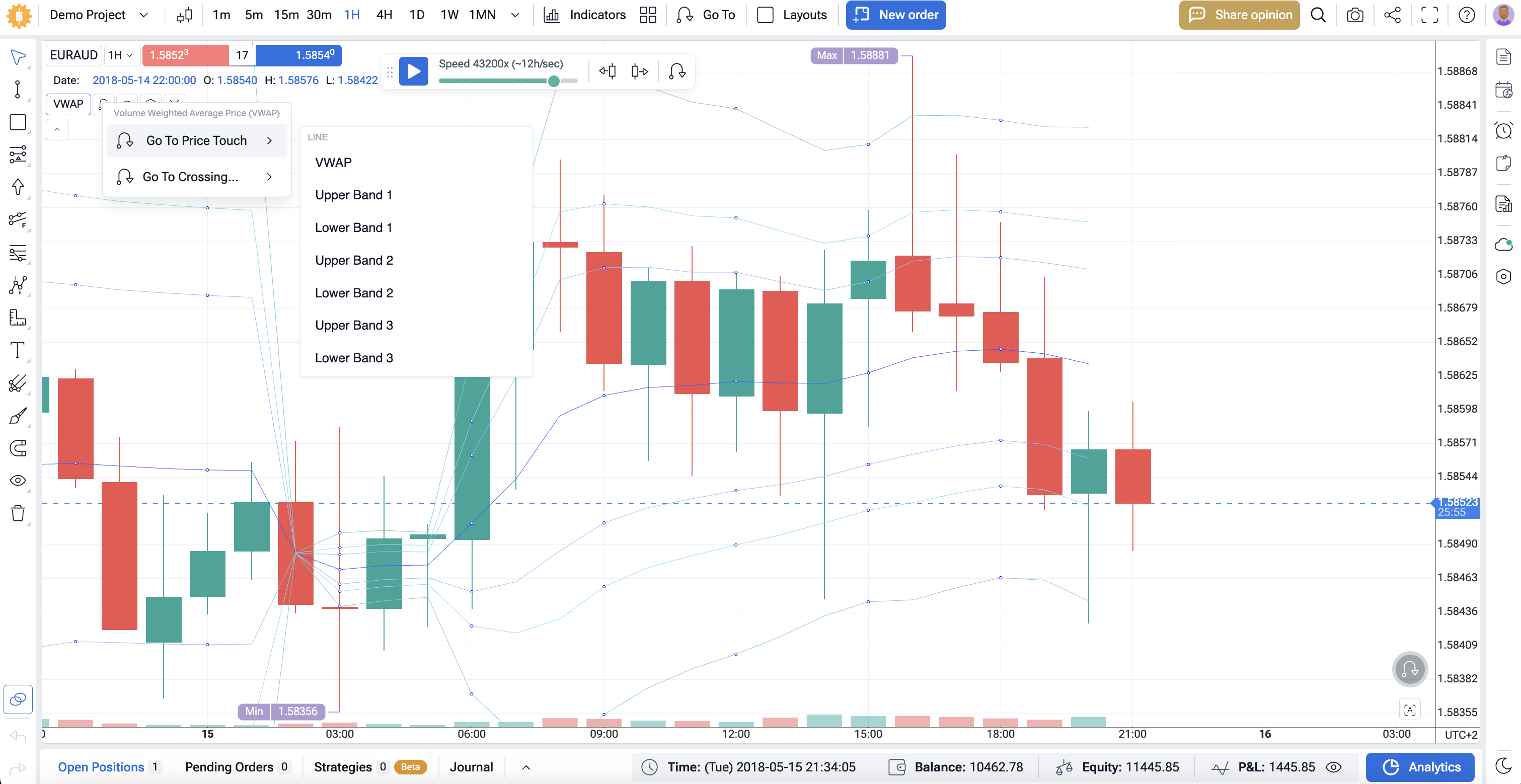

Step 4: Backtest your algorithm (with Forex Tester Online)

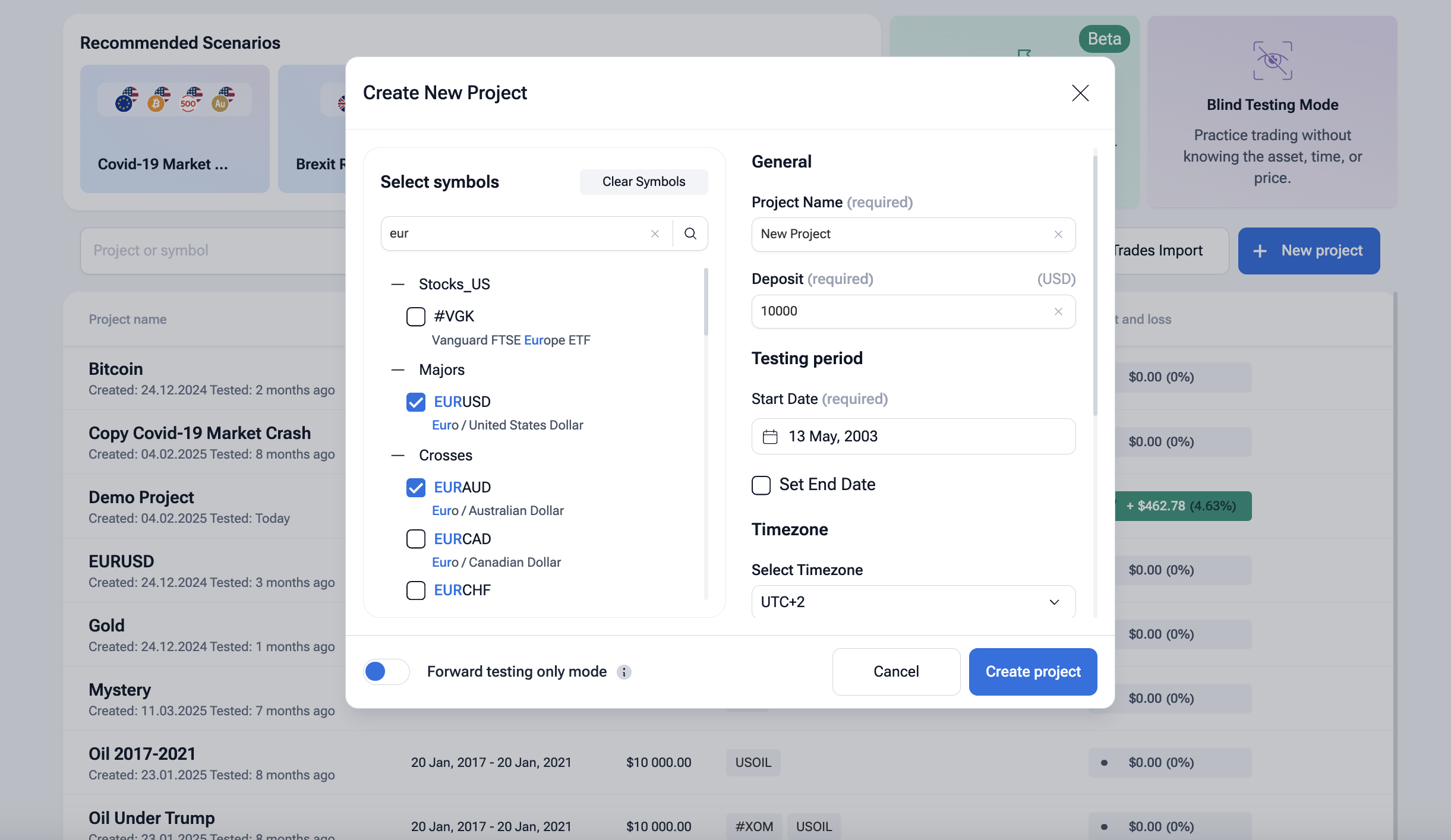

Open Forex Tester Online.

-

Create a project with years of historical price data; pick symbol, dates, and session rules.

-

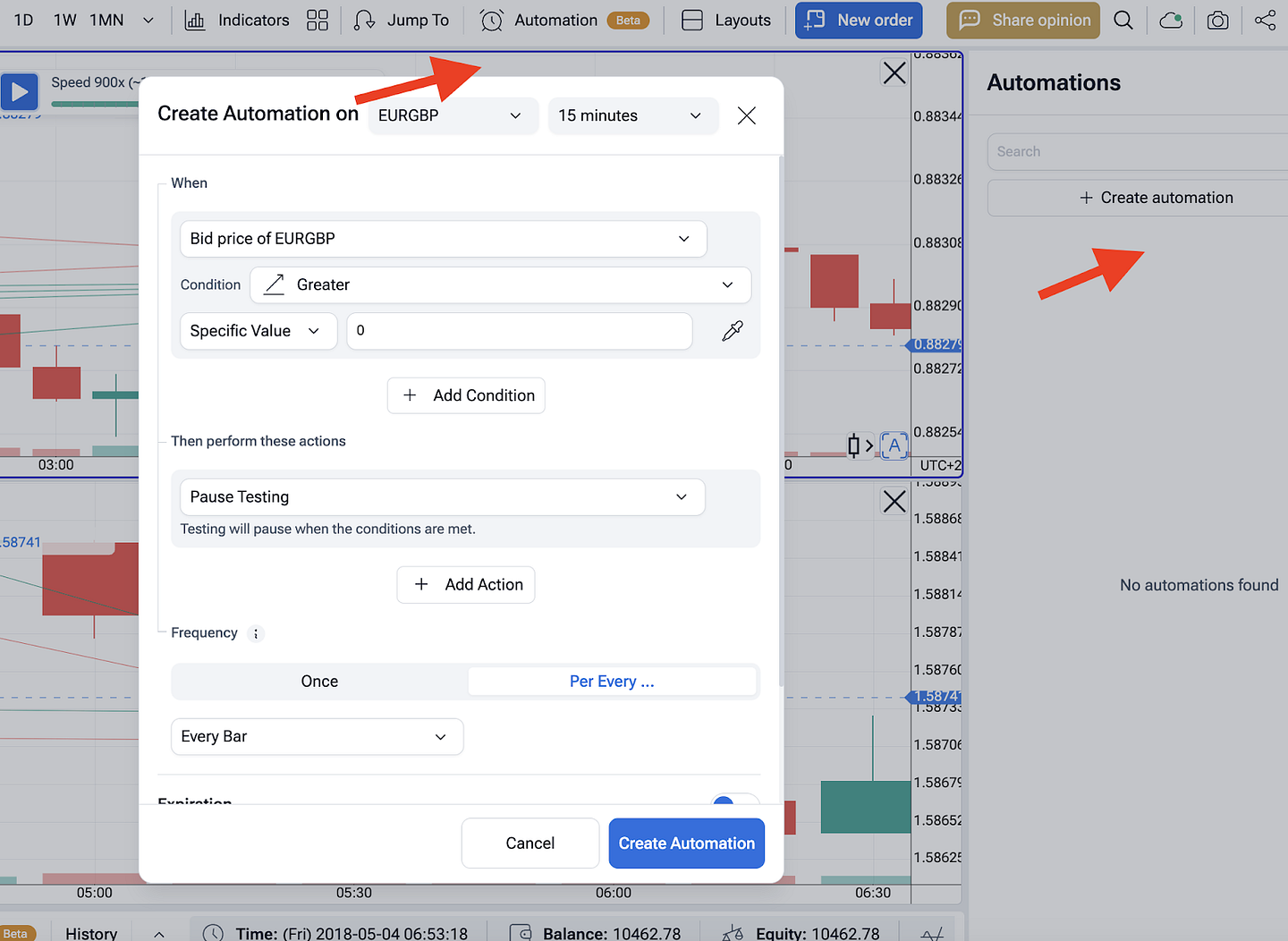

Add indicators and your rule template; map entries/exits to concrete conditions.

-

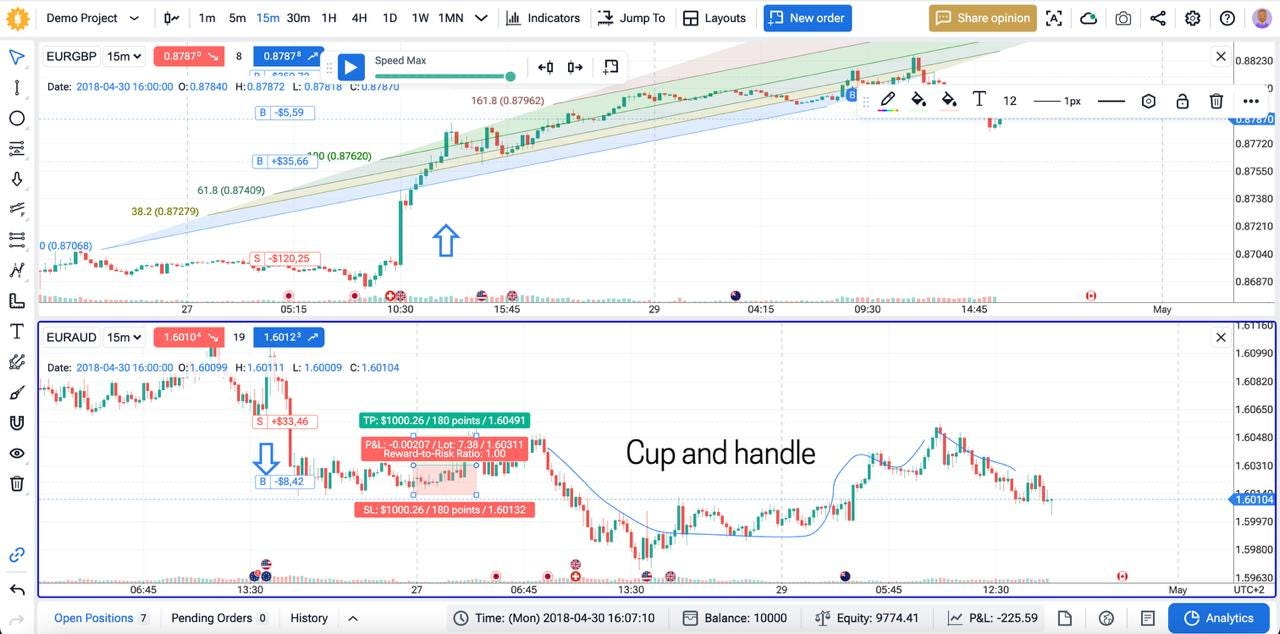

Hit Play to replay markets; the tool simulates fills and logs PnL, drawdown, MAE/MFE, and equity.

-

Use Blind/Mystery modes to avoid look-ahead bias.

This is where algorithmic trading becomes measurable on historical market data before you ever risk capital.

You will find a detailed guide in the next part.

Step 5: Optimize (if needed)

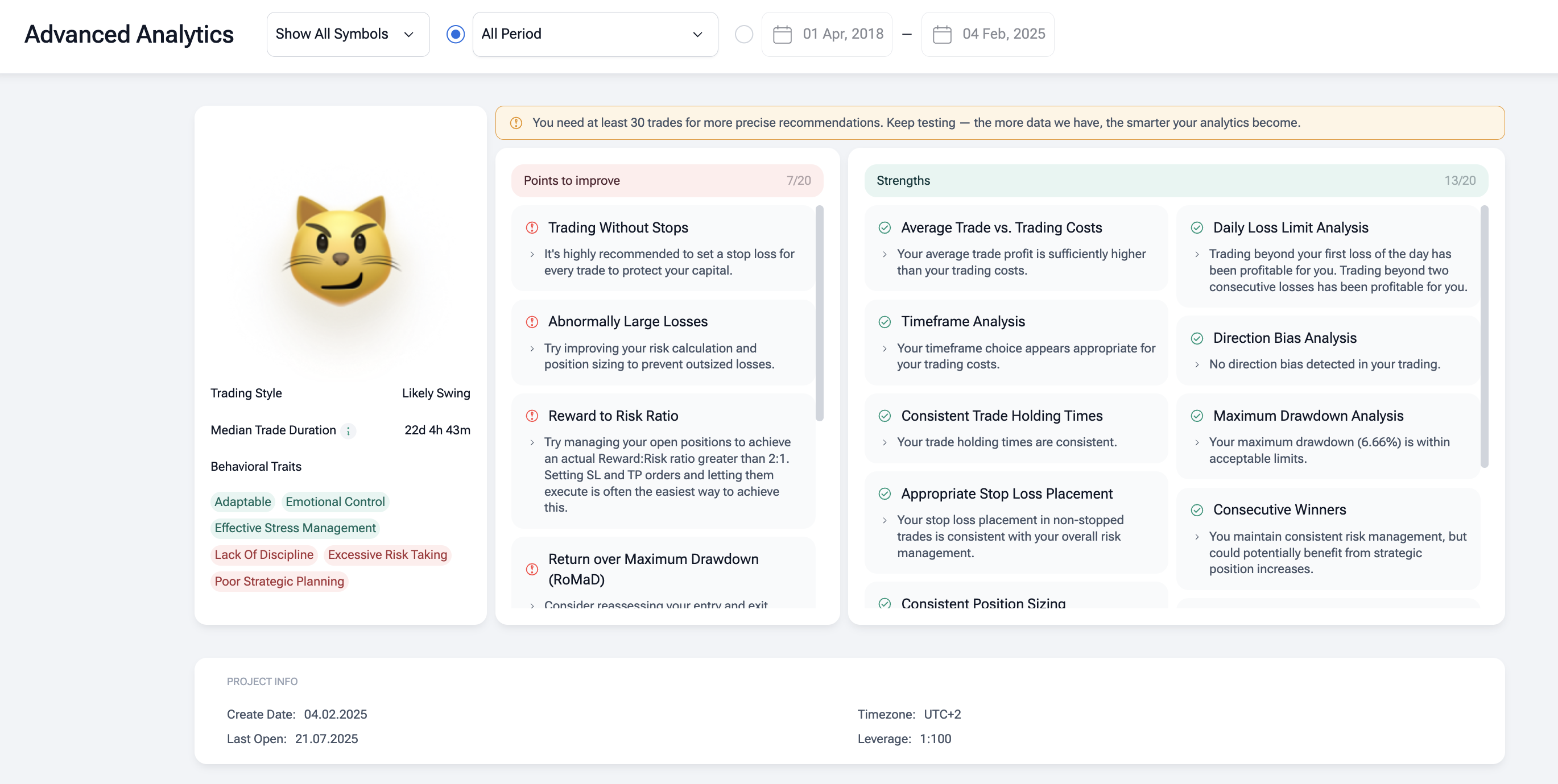

Tune parameters (EMA lengths, ATR multipliers, session filters). Use walk-forward or out-of-sample splits. Track stability, not just peak PnL. The goal is a robust trading algorithm, not curve-fit art.

Step 6: Run the algorithm

Start small or run it as a trading bot that automates signal execution. Monitor slippage, spreads, and regime shifts. Keep a changelog. Algorithmic trading is a process: develop, test, optimize, deploy, repeat.

Do I need a trading algorithm?

When a person knows clearly what and under which circumstances (s)he should do, dramatic changes occur:

- It saves a lot of time to make a decision. In fact, the decision will be made almost instantly, as soon as all the necessary conditions of the external environment compose one image.

- It saves a colossal amount of energy.

- It saves a lot of mental energy. It makes no sense to reinvent the wheel, when a competent algorithm has been already sketched.

We think every trader eventually faces the same problem — too many emotional decisions and too few repeatable rules. That’s where a trading algorithm changes everything. Instead of guessing, you act based on structure, not impulse.

Trading drains mental energy when every click feels uncertain. A clear algorithmic trading plan removes that chaos. You stop overthinking and start executing — consistently, even in volatile markets.

A defined algorithm gives you measurable results. You can look back and understand why a trade failed instead of blaming emotions or market noise. Every loss becomes a testable variable, not a mystery.

Imperfect Rules Still Beat Random Choices

A bad algorithm is still better than no algorithm. Even if it’s not yet profitable, it shows what works and what doesn’t — and that’s the foundation for improvement. Once you test it on historical market data with a good algo backtesting platform, you can optimize and evolve it step by step.

Conclusion

Now when you know the most important moments to consider while creating the trading algorithm, when you know the critical importance of having the algorithm itself, you can create your own trading systems and test them on the historical data with Forex Tester Online. Pay attention that it is necessary to make tests on a large sample of data (at least a few years) in order to obtain adequate and reliable results.

Forex Tester Online

Backtest Your Trading Algorithm Now!

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska