As we loved Awesome Oscillator in action, we proposed another trading strategy using this indicator, but accompanied with the RSI indicator this time. Let us check how powerful these two can be together and either such combo of the indicators will make our trading decisions more precise.

The combination of these two popular indicators believed to make the strategy applicable almost for any trader – it is simple to understand even for the beginners.

Let us check if it is really true.

A Couple of Words About Indicators

The Relative Strength Index, or RSI, is again among the most popular indicators used by traders. The RSI provides information about the strength of the price movements and its popularity can be explained with the simplicity of this indicator’s interpretation.

The standard setting for the RSI is 14 periods, which means that the RSI evaluates the last 14 candles, however, as mentioned further, this setting along with other ones is a matter of change and adjustments according to your needs.

RSI shows the strength of the trend and the possibility of the trend reversals as well as overbought and oversold periods.

Awesome Oscillator is another great tool adored by traders.

It can be utilized in order to find the best entry point for the trade and as well as a trade filter, so you reduce the false buy or sell signals generated.

Awesome Oscillator is histogram consisting of slopes turning from red to green and vice versa.

As the entry signal, we will take the moment when the histogram’s slopes cross the zero level and change color according to the trade rules. *

The Basic principles are the same as with other histograms – the cross of the zero level up indicated the upcoming trend and the cross of the zero level down – the possible reversal to the downtrend.

* In the section called “Further Adjustments”, you can find our advices how the setting of the strategy can be modified further.

Feel free to try different modifications and compare the results.

Check this part in order to try all the settings and the way they can influence the strategy outcome.

Technical Information

Indicators: RSI (14), Awesome Oscillator (default settings).

Currency pair: Any.

Timeframe: 15 min and above (we use 1h timeframe)

Stop Loss/Take Profit: 15/30*

Buy Entry Rules:

- RSI crosses the 30 level from down to above.

- At the same time, the signal from the RSI should correspond with the green bar of the Awesome Oscillator.

- Wait for the Bullish candle to form and enter the trade.

Sell Entry Rules:

- RSI crosses the 70 level downwards and continues falling.

- At the same time, the signal from the RSI should correspond with the green bar of the Awesome Oscillator.

- Wait for the Bearish candle to form and enter the trade.

*We set the same number for the Stop Loss/Take Profit of every trade for this backtesting experiment (1:2 ratio), but if you want to set it manually, you should follow the next:

- You can set the Stop Loss above the highest swing preceding the candle where all the conditions for the trade set up were met for the Sell trades. For the Buy trades you can place it below the lowest swing preceding the entry candle.

- You can double or triple your Take profit compared to your Stop Loss.

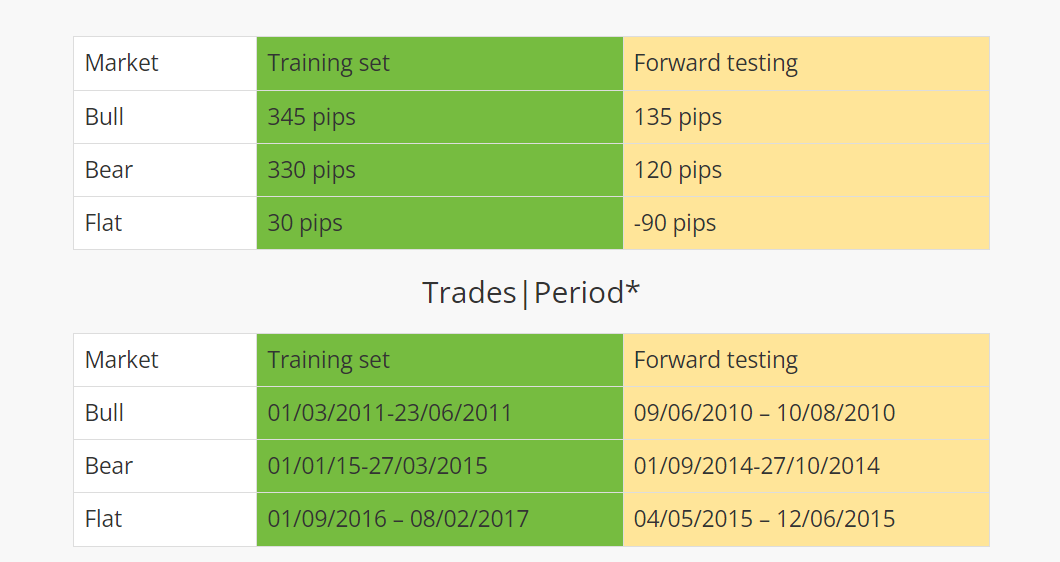

Backtesting Results

*How long it took us to enter the 50 trades for the Training Set and 20 trades for the Forward Testing.

A Reminder: in order to save your valuable time and efforts, we have introduced the system of backtesting when you perform only 50 trades through 3 different types of market (Bullish, Bearish and Flat markets) and then again 20 trades through the given types of market, but during other periods.

Then with simple math calculations, we can make conclusions about effectiveness or irrelevance of the chosen strategy.

The full version of the theory of our backtesting experiments and how did we came up with the idea of such backtesting you can read here.

Conclusions

What can we say? The results has astonished us: probably, the strategy will not make the millionaire, but still with the GIVEN settings, it has shown quite satisfying results.

Through the Bullish and Bearish markets, it has shown the positive results.

Only at the Flat market it has ‘stumbled’ a little – however, it is hard to trade the trend strategies during the flat markets anyways, so the negative result was predictable and expected.

It is crucial to mention: it took a while to enter the described quantity of trades within the given trading entry set ups.

Although the strategy itself brought positive results within the Bull and Bear markets, such humble profits won’t matter a lot for the professional trader who perceives trading more than like a hobby.

Disclaimer: it is necessary to repeat again – we have brought up such experiment not for the sake of searching for the Holy Grail among the strategies, but to show you that with the superpower of backtesting you can achieve much more than without it.

We would love to show you that the Forex trading should be perceived more like a profound analysis than a lucky guess and endless fortune.

And the last important thing.

It would be great if you perceived our backtesting experiment as the sign that you shouldn’t believe blindly anything found on the Internet especially if you bet your real money on it. Try any information, test it, prove it and then use it within the real-time trading.

Further Adjustments

As “there is no limit to perfection”, you can always try to improve any of the received results.

What else you can try to adjust:

- Indicators settings – we use the default settings, however, there are still a lot of options and moreover – there are a lot of strategies based on the custom indicators’ settings;

- Utilization of the indicators in general – as we have mentioned above, you can read the signals of the indicators in numerous ways: for example, there are at least 3 widely used signals provided by the Awesome Oscillator. We have checked how to apply one of them, it is up to you to try other ones;

- Timeframes and currency pairs;

- Stop Loss and Take Profit – we have mentioned this above;

- Use only one of the indicators or try to add the third one (maybe there is another one you trust a lot).

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this strategy was arranged in Forex Tester Online with the historical data that comes along with the program.

To check this (or any other) strategy’s performance you can try Forex Tester Online for free. In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Backtest Your Trading Strategy

Backtest Your Trading Strategy

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska