Did you know that in the last century, the stock market has nearly always predicted the winner of the U.S. presidential election? When the market performs well in the months leading up to the election, the incumbent party tends to win. Conversely, a poor-performing market often signals a change in leadership. This fascinating correlation underscores how deeply politics and market movements are intertwined.

As the upcoming U.S. Presidential Election approaches, and tensions escalate between Democrats and Republicans, we, as traders, must adopt the perspective of market professionals. It’s not primarily about which party wins, but rather how various assets will respond to political battles, either appreciating or depreciating in value. That’s where the opportunity for financial gain lies.

Leveraging Presidential Elections for Financial Advantage

Candidates’ promises can significantly impact economic expectations, affecting everything from monetary policies and the job market to international trade.

Let’s delve into how we can strategically capitalize on presidential elections. Using Forex Tester and its precise market data as our guide, we’ll draw lessons from past elections to help us navigate future opportunities effectively. As Donald Trump and Kamala Harris prepare for the 2024 political battle, a careful analysis of the previous 2020 contest could provide valuable insights — valuable in the most literal sense.

Selecting Assets for Analysis

In our exploration using Forex Tester, we must prioritize assets that are historically volatile and significantly impacted by election outcomes. This focus will allow us to narrow our analysis to the most promising hypotheses for our backtesting efforts.

By applying theoretical knowledge and rational analysis, we aim to pinpoint the assets most sensitive to election outcomes. Our objective is to identify those assets that have historically shown substantial responsiveness to shifts in the political landscape.

This strategic approach leads us to concentrate on specific assets — USD/JPY, Bitcoin, and the S&P 500 (SPX500) — each chosen for their unique reactions to political events:

1. USD/JPY (US Dollar / Japanese Yen)

This currency pair often acts as a barometer for investor sentiment towards the U.S. The Japanese Yen is considered a safe-haven currency. It attracts flows during times of uncertainty, such as a presidential election. Analyzing USD/JPY allows us to gauge shifts in risk aversion among investors.

2. Bitcoin

As an alternative investment, Bitcoin’s appeal increases during periods of uncertainty, including U.S. elections. It often reacts sharply to changes in investor sentiment about economic stability and regulatory outlooks, making it a critical asset to watch.

3. The S&P 500 (SPX500)

The S&P 500 is a primary indicator of U.S. economic health and investor sentiment. As a broader index than the Dow Jones, it provides a more comprehensive view of the U.S. stock market. Movements in this index around election times can reflect broader economic expectations and corporate sentiment towards changing administrations.

Now let’s dive into the first pivotal moment of the 2020 elections.

Round 1: Debates. September 29, 2020

Setting the Scene.

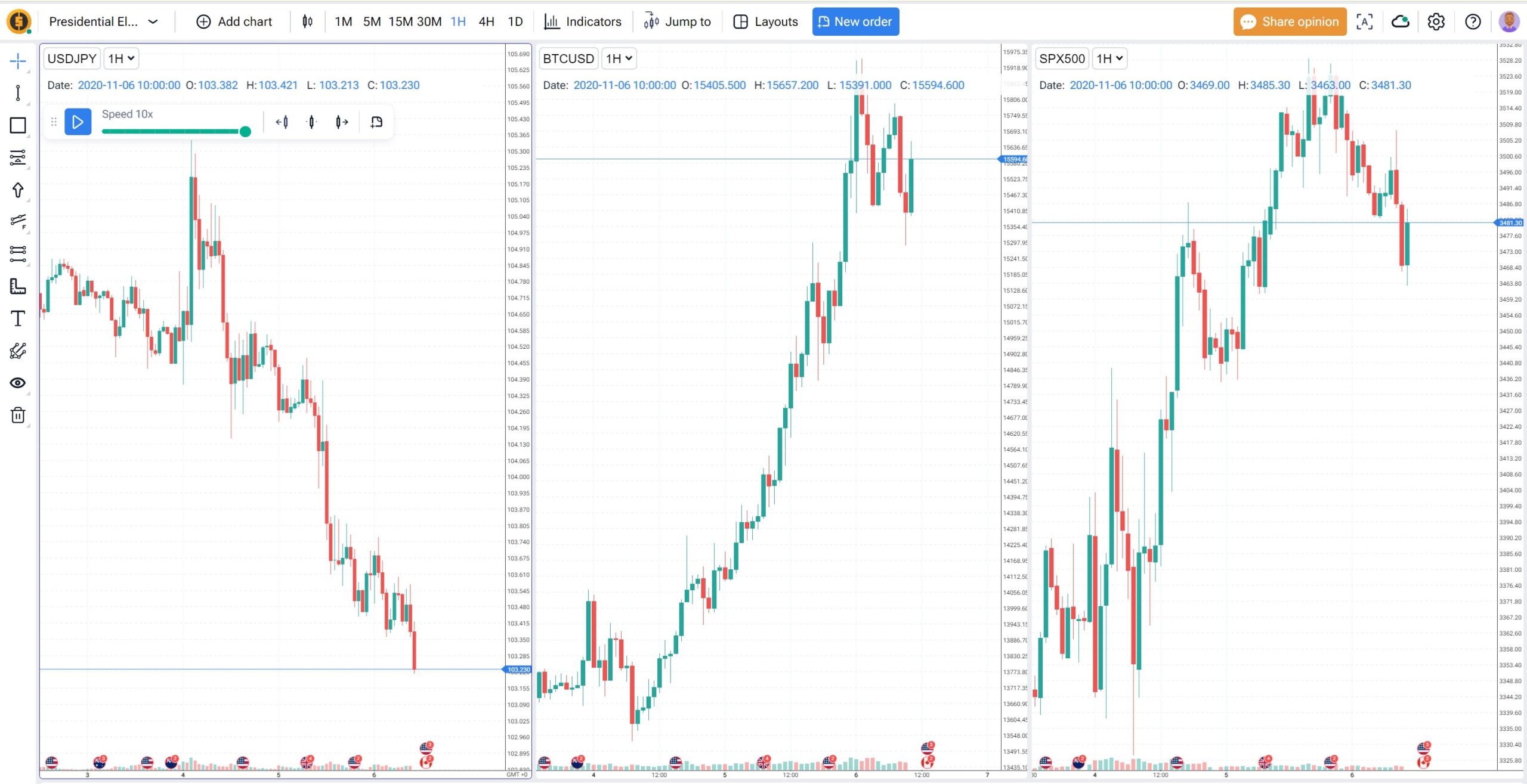

On September 29, 2020, the stage was set for the initial presidential debate, a critical showdown that would potentially sway public opinion and market movements. Here we are with the Forex Tester presets loaded, displaying USD/JPY (Japanese Yen), BTC/USD (Bitcoin) and SPX500 (The S&P 500) charts. The time is fixed at 10 PM EST (2 AM UTC), just as the debates are drawing to a close.

Prior to the debates, investor sentiment was taut with anticipation of high volatility. The market trends were leaning towards a Democratic win, with many investors aligning their strategies under the assumption that Joe Biden might lead. This anticipation was reflected in the pricing of various assets, including equities and currencies, embedding a scenario where the votes were nearly evenly split between the two candidates.

Quick heads-up: Investors’ expectations of news are typically reflected in current prices. If the news does not alter market sentiment, there is usually no significant change in price.

Post-Debate Strategic Asset Management

As the debates unfolded, they confirmed many initial assumptions without drastically shifting the market sentiment. The outcome did little to resolve the prevailing uncertainties but subtly tilted the odds slightly in favor of Biden. What became evident was that despite the high stakes and heated exchanges, the debates essentially maintained the status quo, reinforcing the existing market positions with no dramatic revelations to pivot the trends significantly.

Given this backdrop of sustained uncertainty with a slight edge to Biden, how should we approach these assets? Historically, in times of uncertainty, investors gravitate towards safe-haven assets. The Japanese Yen (USD/JPY), often viewed as a refuge during turmoil, may continue to attract attention. However, the minimal impact of the debates suggests a cautious approach:

- USD/JPY: Keep a close watch on this pair. If market uncertainty persists, the Yen could strengthen against the Dollar as investors seek stability.

- SPX500: The equity markets might experience slight volatility but given the debate’s outcomes aligning with previous expectations, significant dips or rallies may be limited. Investors might remain in a ‘wait-and-see’ mode until more definitive signals emerge.

- BTC/USD: Bitcoin could see varied reactions. On one hand, if investors are feeling cautious but optimistic about a potential Democratic win, they might perceive Bitcoin as a hedge against inflation and uncertainty. On the other hand, stability in market expectations post-debate might temper any dramatic increases.

Forex Tester is your way to test different hypotheses. Would you like to open a trade on some or even all of the three suggested assets based on the given information? Go ahead!

Please note:

Forex Tester offers a risk-free environment to test and refine your trading hypotheses and strategies. Yet, it’s also crucial to incorporate the assessment of implied risks into your simulation process for more valuable insights.

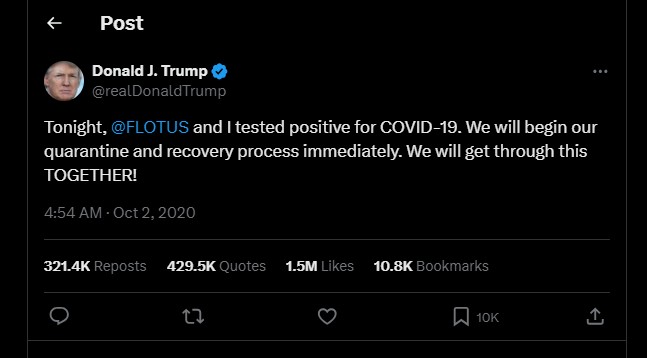

Round 2.Trump Testing Positive for COVID-19. October 2, 2020

Setting the Scene

In the midst of the heated U.S. Presidential Election campaign, an unexpected development rocked the political and financial worlds: President Donald Trump announced he had tested positive for COVID-19. This news came shortly after the first presidential debate and just before the second scheduled debate, introducing a new layer of uncertainty.

Understanding Market Reactions to Uncertainty

When sudden news like a presidential candidate’s illness emerges, markets typically react with increased volatility. Here’s what often happens:

- Seeking Safe Havens. Investors tend to flock to assets considered safer during times of uncertainty, such as gold or the Japanese Yen. This is a typical reflex in the face of unexpected political news that could destabilize the government or its policies.

- Impact on Policies. As a Republican, Trump’s policies have traditionally favored deregulation and tax cuts, which are generally viewed positively by the market. His sudden illness could lead investors to speculate about potential policy shifts or instability.

- Speculative Movements. In such situations, markets might also see speculative moves as traders try to predict the political outcomes and their impacts on various sectors and the overall economy.

| Important Note: Speculative moves in the market are often associated with false price breakouts. These false breakouts occur when the price of an asset moves beyond a defined support or resistance level but then quickly reverses direction, failing to sustain the breakout. |

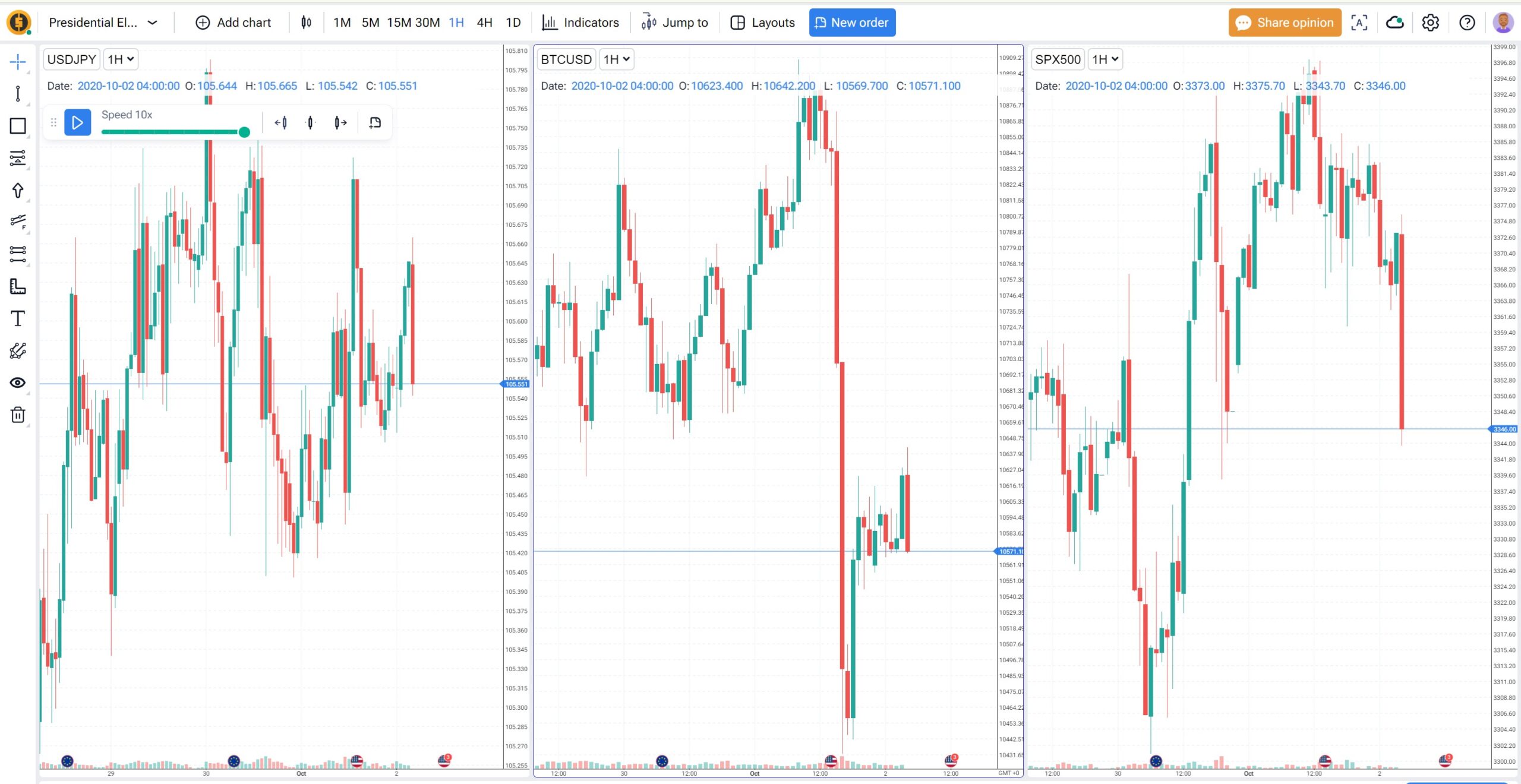

Preset for Analysis: October 2, 5 AM UTC

We’ve set up a Forex Tester preset for this date to help analyze how such a significant event might influence key financial assets. This setup will allow traders to examine:

- USD/JPY: This pair may show a strengthening of the Yen if investors seek safety amidst the uncertainty.

- SPX500: Likely to experience volatility reflecting concerns over economic policies and leadership stability.

- BTC/USD: Bitcoin could gain as an alternative investment if confidence in traditional financial systems and currencies wavers.

As you navigate through the Forex Tester simulations, you’re welcome to stick with the previous preset and continue managing your open trades. Feel free to exit, trail, or adjust your stop-loss and take-profit orders as needed. Alternatively, if you’re looking for a fresh perspective, dive into the new preset that’s specifically tailored to the moment when Trump announced his COVID-19 diagnosis via tweet. This setup offers a unique opportunity to analyze market reactions to unexpected political news and refine your trading strategies accordingly.

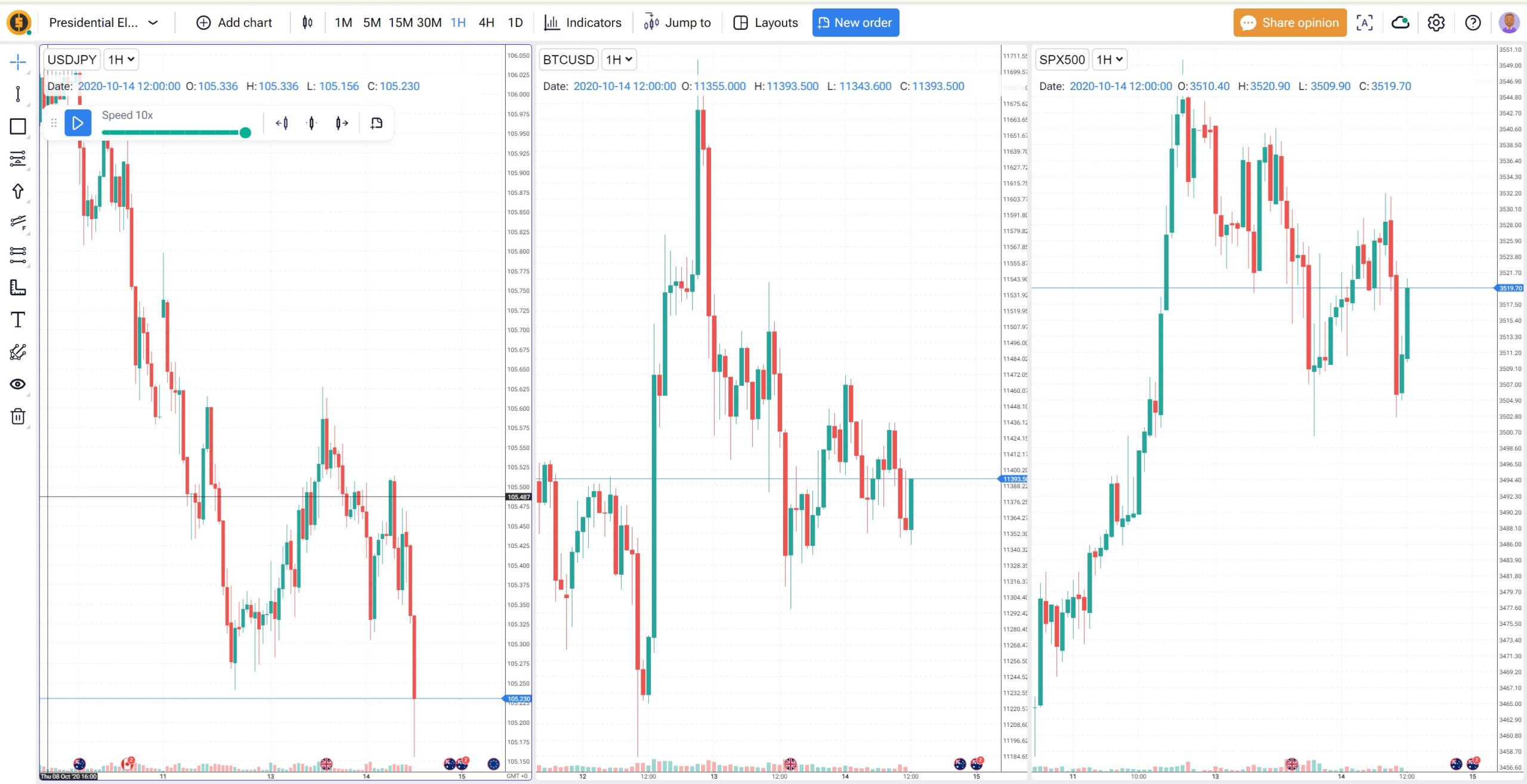

Round 3: The Hunter Biden Laptop Scandal. October 14, 2020

Setting the Scene

On October 14 early morning, a sensational story broke as the New York Post published articles alleging controversial business dealings and potential misconduct by Joe Biden’s son, Hunter Biden, based on emails found on a laptop purportedly belonging to Hunter. This revelation came at a crucial juncture in the election campaign, injecting fresh drama and stirring speculation across financial markets about its potential impact on the election’s outcome.

This development was a twist worthy of a political thriller, reminiscent of historical election scandals that have shaken voter confidence and swayed market sentiments. The emergence of the scandal was strategically timed, as it provided the Republicans with ammunition to potentially level the playing field or even tilt it in their favor.

| Fun Fact: Scandals are so common in the lead-up to U.S. Presidential elections that there’s a specific term for them — the “October Surprise.” This refers to unexpected events in the final stretch of a campaign that have the potential to sway public opinion. |

Drawing parallels to the 2016 election, where WikiLeaks revelations and the FBI’s announcement of revisiting Hillary Clinton’s email investigation played pivotal roles, markets might have anticipated similar disruptions. Such events historically lead to significant shifts in investor behavior and market dynamics.

Preset for Analysis

We’ve dialed the Forex Tester to the morning the story hit the headlines: 9 AM EST (1 PM UTC).

This preset allows traders to observe the initial reactions across various assets. Feel free to continue working with the previous project or jump to this new chapter of Elections 2020. What to pay attention to when deciding upon market action?

Dynamic Position Management. Traders should be ready to adjust their positions rapidly as new information emerges and market sentiment shifts.

Risk Assessment. It’s crucial to reassess risk parameters, considering the increased volatility and potential for sudden market moves.

With the playing field potentially leveled or even tilted in favor of the Republicans, how should traders position themselves?

- USD/JPY: This pair may reflect a shift towards safer assets, potentially strengthening the Yen. Monitoring for continued strength in the Yen as a safe haven could be prudent.

- SPX500: The equity market could show immediate reactivity, potentially dropping as uncertainty rises. It’s important to keep a close eye on this asset, watching for signs of recovery or further drops as the market digests the implications of the scandal.

- BTC/USD: Considering Bitcoin as a hedge against potential currency devaluation and political risk may be wise. Bitcoin might experience an uptick as investors look towards alternative investments amidst political upheaval.

By engaging with the Forex Tester project specifically tailored for exploring the Biden Laptop Controversy, you can closely observe how different assets initially responded and develop strategies for handling similar events in the future. This hands-on experience will not only deepen your understanding of market dynamics in the wake of political scandals but also enhance your ability to manage your trading positions effectively under real-time market conditions.

Seize this opportunity to refine your trading strategies: experiment with various entry and exit points, adjust your risk management parameters, and closely analyze how markets react to rapid shifts in sentiment. The insights you gain from this exercise will be invaluable in building resilience and adaptability in your trading practices, equipping you to navigate future uncertainties with greater confidence and precision.

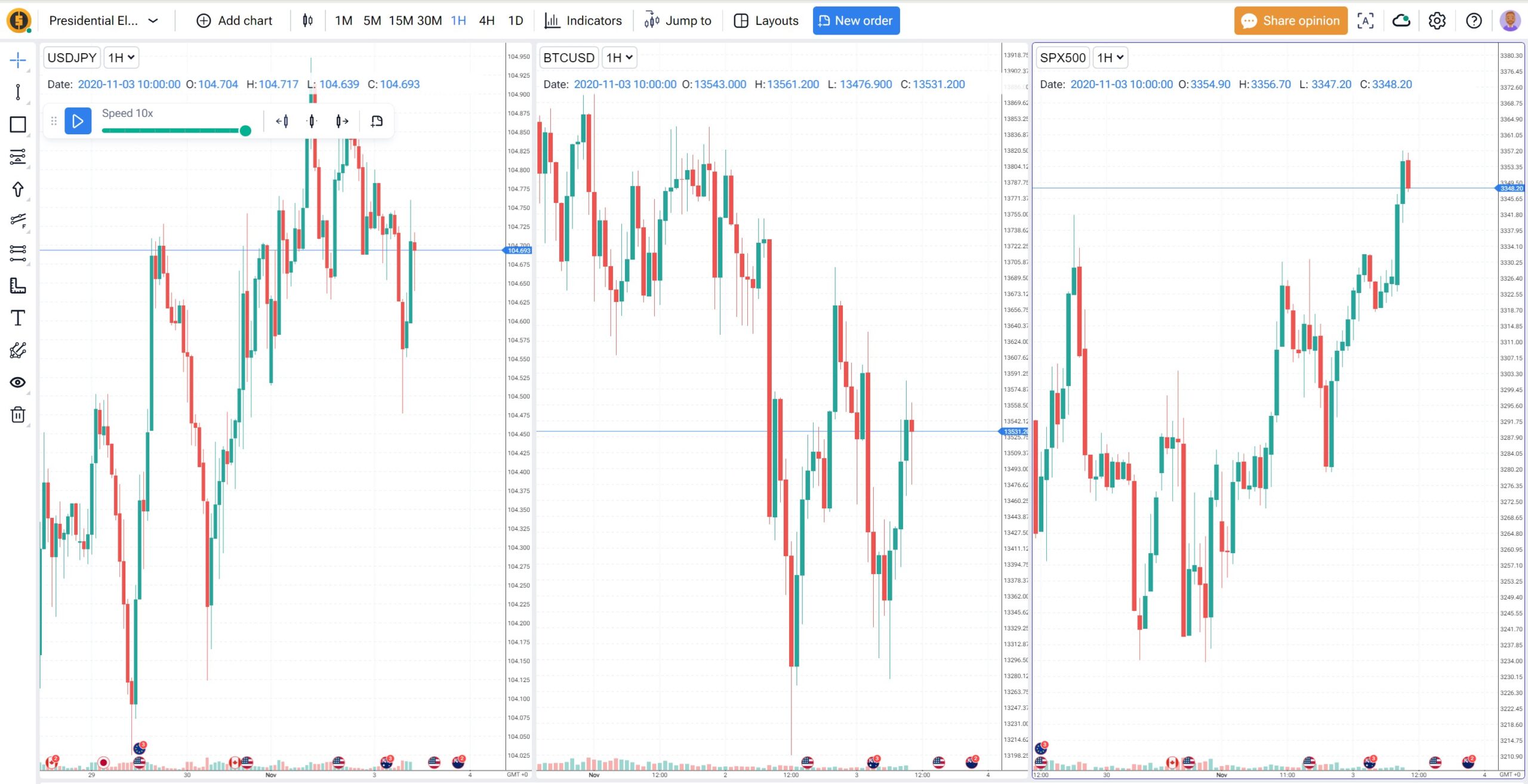

Round 4: Election Day and Result Delays – November 3, 2020

Setting the Scene

November 3, 2020, arrived with a palpable tension as Americans cast their votes amid a global pandemic. Given the substantial increase in mail-in ballots, it was anticipated that election results might be delayed, setting the stage for a period of prolonged uncertainty that would test both political and market resilience.

Timeline of Vote Counting and Shifts

Let’s have a closer look at the progression of vote counting and its implications for market participants, focusing on the perception of a potential divided government and its impacts.

November 3, 2020 – Election Day

Early Results: Initial counts showed strong leads for President Donald Trump in several key states. The uncertain nature of the results, with a significant number of mail-in ballots yet to be counted, set the stage for potential shifts.

November 4, 2020

- Morning: Key battleground states like Pennsylvania, Wisconsin, Michigan, and Georgia were still in play, with substantial votes left to count.

- Afternoon: Shifts began to appear as mail-in ballots, which skewed heavily Democratic, were counted, narrowing the margins in crucial states.

November 5, 2020

- Day Progress: Biden’s numbers strengthened in Wisconsin and Michigan, suggesting a possible shift in the electoral college balance.

November 6, 2020

- Major Shift: Biden took the lead in Pennsylvania. If sustained, this lead could deliver the presidency to Biden, indicating a likely scenario of a divided government, with Democrats controlling the White House and Republicans likely retaining significant power in Congress.

Preset for Analysis

Generally, a divided government is seen as maintaining the status quo, which can lead to a more predictable economic environment in the short term. If investors believe that drastic fiscal changes are unlikely, there can be less volatility in the USD. However, if the gridlock is seen as a barrier to necessary fiscal responses, particularly during economic downturns, confidence in the USD might weaken. And here we are in the midst of COVID pandemia.

Historical Fact:

U.S. presidential elections have often led to short-term market fluctuations as investors react to potential policy changes. For instance, the 2000 election between George W. Bush and Al Gore saw significant market unrest due to the Florida recount saga, which led the decision all the way to the U.S. Supreme Court. The prolonged uncertainty during this period caused the S&P 500 to drop by about 5% between the election and the court decision in mid-December.

Let’s set Forex Tester to the morning of November 3, at 7 AM EST (11 AM UTC), focusing on USD/JPY, the SP 500 index (SPX500), and Bitcoin (BTC/USD) again. This setup provides a base to analyze how the unfolding results might influence market dynamics.

USD/JPY: In the short term, the expectation of ongoing, albeit slow, policy responses might keep the USD relatively stable. However, as the pandemic wears on and if fiscal gridlock prevents adequate responses, concerns might grow about the U.S. economy’s resilience, leading to potential weakness in the USD against the JPY.

SPX500: Monitor this index closely for signs of volatility as it adjusts to shifts in business and economic policy expectations. The S&P 500 index often reflects changes in risk premia, where investors demand higher returns for taking on increased uncertainty and potential instability. As the political and economic environments evolve, especially with potential delays or changes in fiscal policies and broader economic recovery measures, the index may exhibit significant fluctuations. This reflects the market’s ongoing reassessment of the risk and the necessary premium investors require to hold equities in a dynamically changing landscape.

BTC/USD: Bitcoin may see an increase in interest as an alternative investment, especially if traditional financial systems appear unstable or if the political landscape promotes uncertainty.

This extended period of vote counting offers a unique opportunity. By exploring various strategic responses and observing asset behavior during this crucial period, traders can gain valuable insights into managing positions in real-time scenarios. Don’t hesitate to allow Forex Tester, this financial time machine, to help you experiment with and refine your strategies. Use it to simulate different market conditions, test your responses to hypothetical scenarios, and enhance your trading acumen in a controlled, risk-free environment.

Round 5. Biden Declared President-Elect. November 7, 2020

Setting the Scene

On November 7, 2020, following an intense period of vote counting that captured the nation’s attention, Joe Biden was declared President-elect of the United States. This declaration came after days of uncertainty as the world awaited the results from key battleground states. The announcement not only signified a forthcoming change in administration but also marked a crucial moment for financial markets, which had been eagerly anticipating the resolution of electoral uncertainty.

Important Observation:

Historically, the confirmation of a new president tends to lead to significant market reactions as uncertainties clear and investors begin to align their strategies with the anticipated policies of the incoming administration. For instance, markets generally reacted with volatility in the immediate aftermath of the 2008 election during the global financial crisis but found direction as policy outlines became clear.

In 2020, with Biden’s victory, markets were keenly focused on his proposed policies, which included substantial investments in infrastructure, renewable energy, and healthcare, alongside potential increases in corporate taxes and regulatory changes. These policies could have varied impacts across different sectors of the economy.

Preset for Analysis

Set the Forex Tester to the morning of November 7, at 7 AM EST (11 AM UTC), to examine the reactions of USD/JPY, the S&P 500 (SPX500), and Bitcoin (BTC/USD) immediately following the election results announcement.

- USD/JPY: This currency pair might experience initial fluctuations as markets adjust to the prospect of a Biden presidency, which could influence U.S. foreign and trade policy predictability.

- SPX500: This index is likely to react to policy initiatives affecting domestic industries. Expect volatility as markets weigh the benefits of potential infrastructure spending against concerns over increased regulation and taxation.

- BTC/USD: Bitcoin’s reaction in this context is challenging to predict due to its nature as a decentralized asset often viewed as a hedge against inflation and currency devaluation. With Biden’s potential regulatory changes and economic policies, Bitcoin could see varied investor interest. However, it remains a complex asset to analyze purely in the context of a U.S. presidential election due to its global influences and speculative nature.

Some long-term planning can be considered after election results are finalized. It’s time to look beyond immediate market reactions to understand how long-term economic policies under Biden might shape market fundamentals.

Utilize Forex Tester to simulate various trading scenarios that might unfold under the Biden administration. This tool can help you explore and refine strategies in a controlled environment, preparing you to manage real-market conditions with greater confidence.

What are some tips for trading during the US elections?

Trading during the US elections can be both thrilling and challenging because of the volatility and market responses related to this significant event. To assist you in the 2024 US presidential election, here are 6 tips:

- Stay Informed. Follow the latest news to stay updated on developments that could affect the market. You may even spend more time reading the news than trading, and that’s completely fine.

- Trade in Real Time. React quickly to market movements by trading US indices around the clock. Our users also benefit from extended hours on key US shares.

- Set Alerts for Key Events. Don’t miss important market moves by setting up alerts for significant events through our platform. You can choose to receive notifications via email, SMS, or push notifications.

- Focus on Impacted Markets. Pay attention to key markets that are likely to be affected by election results, such as US indices and specific sectors. We will tell more about these markets later in FAQ.

- Manage Your Risk. Use stop-loss orders and hedging strategies to protect your investments. While volatility can create new opportunities, it also increases risk, so utilize our risk management tools to mitigate potential losses. If you have some election-releated trading strategy in mind, and you want to test them before risking real money, you can backtest them on Forex Tester Online.

Key Markets to Watch

Certain markets are likely to be more affected by the US presidential election results, including:

- US Indices: S&P 500, Dow Jones, and NASDAQ

- Forex Pairs: USD/EUR, USD/JPY, and other major currency pairs

- Commodities: Gold, oil, and agricultural products

- Sectors: Energy, healthcare, technology, and financial services

The Bottom Line: Harnessing Election Cycles for Strategic Trading

As we conclude our guide on profiting from the US Presidential Elections, it’s clear that the intersection of politics and market dynamics offers unique opportunities for the astute trader. While we’ve explored several strategies to navigate through election-related volatility and capitalize on the outcomes, the learning doesn’t stop here.

One intriguing area to investigate further involves the historical performance of US indices in the days leading up to the elections 😉

Market trends suggest there might be a pattern worth exploring, possibly linked to adjustments in risk premia as traders and investors position themselves ahead of potential changes. Delving into this area could reveal valuable strategies for those looking to enhance their market engagement during these critical periods.

However, it’s essential to remember that while historical data can provide insights and help form probabilities, they do not guarantee future results. Each election cycle is unique, and the strategies that worked in the past may not always yield the same outcomes. Therefore, the key is not just to react to market changes but to anticipate them, giving you a strategic edge in your trading endeavors.

Happy trading, and may your investments cleverly align with the insightful patterns history may suggest!

FAQ

What are the main risks associated with trading during the US presidential election?

Trading during the US presidential election involves risks like heightened market volatility and swift price changes. This is bad for long-term holders, but at the same time a great opportunity window for traders.

To reduce risks, diversify your portfolio, implement stop-loss orders, and explore hedging strategies. It’s also essential to stay updated on political developments and market responses for effective risk management. Well, you know it yourself.

Which Sectors Will Be Affected by the Election?

Different sectors may experience varying impacts based on whether a Republican or Democratic candidate wins the upcoming US presidential election.

Sectors Likely to Benefit from a Democratic Presidency:

- Clean energy

- Infrastructure

- Financials and semiconductors

Sectors Likely to Benefit from a Republican Presidency:

- European defense

- US real estate

- US small caps

- Crypto

How Are Different Asset Classes Impacted by the US Election?

Asset classes can be influenced by news leading up to and the outcomes of the US election. Here are some key considerations for trading different asset classes during this period:

- Forex. US elections affect forex markets, with potential shifts in trade policies impacting currency strengths across various regions.

- Commodities. Election outcomes (and sometimes even polls) might reshape commodity markets, with trade policies and geopolitical changes potentially affecting global supply and demand dynamics.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska