Enter intraday backtesting—a crucial technique that allows traders to evaluate their strategies against historical price movements within a single trading day.

This method not only provides insights into potential performance but also helps traders refine their approaches based on real market conditions.

In this article, we’ll explore the ins and outs of intraday backtesting, discussing its significance in the forex landscape, the tools and techniques you can use, and how to interpret your results for maximum effectiveness.

What is Intraday trading?

Intraday trading is short-term trading that happens within a business day. It is exactly Intraday trading that many beginner traders go in for. Don’t hurry with preferring short-term or mid-term trading though. Start with discovering what is what.

Choosing your trading method is like choosing a way on the road. Make a hasty decision and you’ll go in the wrong direction. Ask the locals first.

There’s something similar with trading. If a trader chooses an unsuitable trading style, they may waste money and time in vain. Beginners like Intraday a lot on small timeframes, temporary periods, M1 — one minute, or M5 — five minutes. On such timeframes changes happen very quickly, the price goes up and down, which attracts with seemingly easy earnings. But don’t hurry with conclusions. Analyze all pros and cons of Intraday trading first, and think how it suits your mentality, daily routine, lifestyle, and only after that delve deeper into learning this or that trading kind.

Pros and cons of Intraday trading

Intraday trading is usually conducted on the following timeframes:

- M1-M5 — these timeframes may be used for scalping when hundreds of deals happen within a day.

- M15-M30 — these timeframes are suitable for more calm trading, maybe 1-3 deals a day.

- H1-H4 — these timeframes may give signals for market entry not every day, but movements may be stronger.

Which pros does Intraday trading have?

- Highly profitable trading. In the case of successful Intraday trading with having enough experience, you can get a big profit, making money on growth and decline of instruments within a day. Many financial assets have high intra-day volatility and thereby may yield big income.

- Strong Intraday movements. Price “flies” up and down many times during a day. Such movements may open numerous spots for entry and potential profit.

- Quick experience. Having many deals each day, a trader quickly boosts their skills. With such an amount of deals, trading strategies may be checked for effectiveness pretty quickly.

- Lower risks concerning renewal over night and weekend. Broadening of spread may happen at night, caused by the decrease of liquidity. Strong barely predictable movements may emerge. And during weekends, political or force majeure events may happen, which may lead to price gaps on Monday, with the market opening. All this brings extra risks for an account with open positions. With Intraday, all deals are closed within a day and there are no such risks.

- Small deposit. The main benefit which attracts new traders is the opportunity to start trading with a small deposit. With Intraday trading, Stop Losses are small, so the initial deposit may be not big as well.

Which cons does Intraday trading have?

- Hard to trade, the market moves too rapidly. Strong and rapid movements within a day are hard to analyze and predict. The market picture may change multiple times a day. That’s why one has to put much effort to trade effectively.

- Trading consumes 6-8 hours a day. Intraday trading implies a professional approach to trading which is hard to combine with another job or business. That’s why a trader must fully devote to trading for a few months before expecting the result.

- Requires big experience. To trade in a profit with Intraday, you need to have high experience due to market difficulty and multidirectional movements. This may be tough for a beginner.

- Hard both mentally and emotionally. As you need to make many deals, experience losses, make decisions quickly, watch at the screen 6-8 hours a day, this may be hard from the psychological point of view.

- A portfolio is barely possible. A portfolio of multiple trading systems and instruments will trade more steadily. But with Intraday trading, a portfolio is very hard to set, as a trader can trade no more than 1-2 trading systems within a day.

Intraday trading has many ups and many downs. How to check if short-term trading suits you fine?

What is intraday backtesting?

Intraday backtesting is the process of testing a trading strategy using historical price data within a single trading day. It focuses on short-term trades such as scalping or day trading, where positions are opened and closed within the same day.

Intraday backtesting helps traders understand how their strategy performs during specific market hours, in different volatility conditions, and across multiple trades per day. It’s essential for fine-tuning entries, exits, and risk management for short-term strategies.

Hoo test Intraday strategies?

Intraday testing will help you to feel your trading strategy. You will be able to check how effective it is. Testing daytime trading strategies will save you money, which you won’t lose for loss-making trading. The input of time and effort may be a highly lucrative investment.

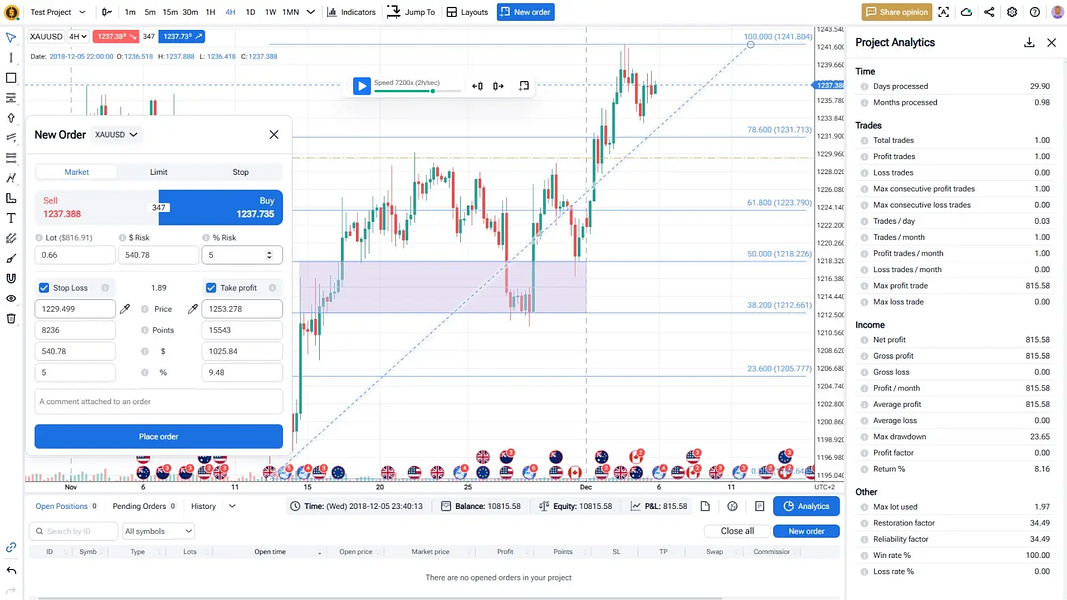

1. Backtesting Intraday strategies on Forex Tester Online

Key benefits of using Forex Tester Online for intraday strategies:

-

Access to high-quality minute-by-minute data

-

Simulated real-time trading environment

-

Instant feedback on trade outcomes

-

Visual charts and indicators

-

Strategy refinement through practice

- To start backtesting, visit this page

- Select assets from the available symbols.

- Choose the desired historical data range for your backtest.

- Set up the testing environment by defining market conditions, spreads, and commissions.

- Use the platform’s charting tools and indicators to create and test your trading strategy.

- Analyze the results using Forex Tester Online’s intraday backtesting platform analytics to refine your approach.

Detailed Guide: How to Use Forex Tester Online

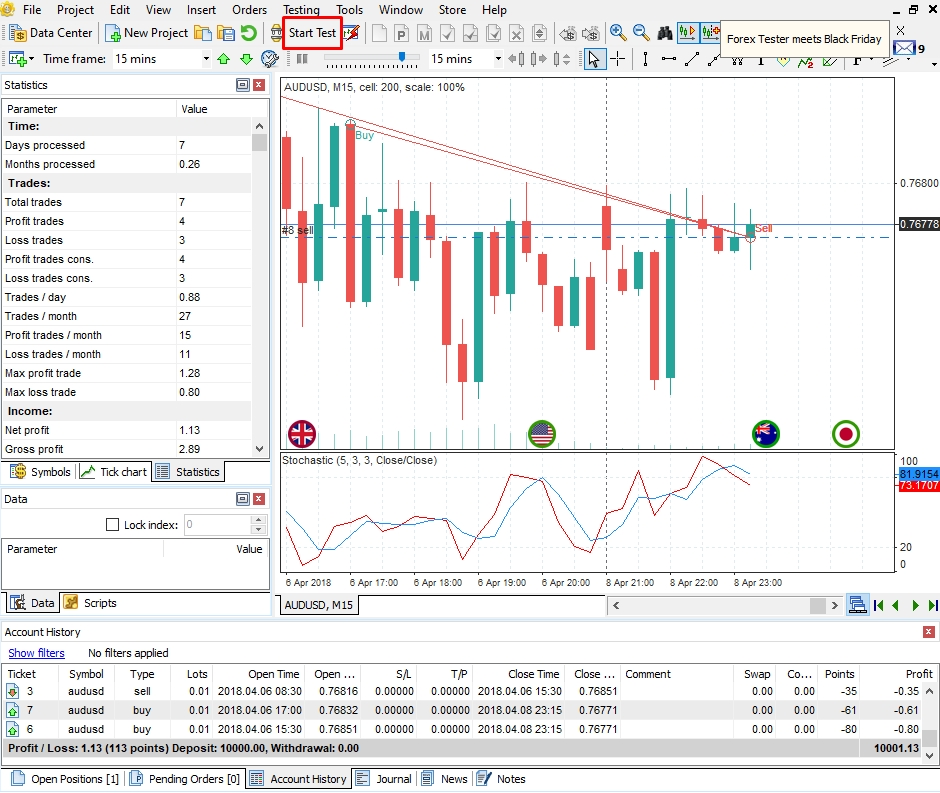

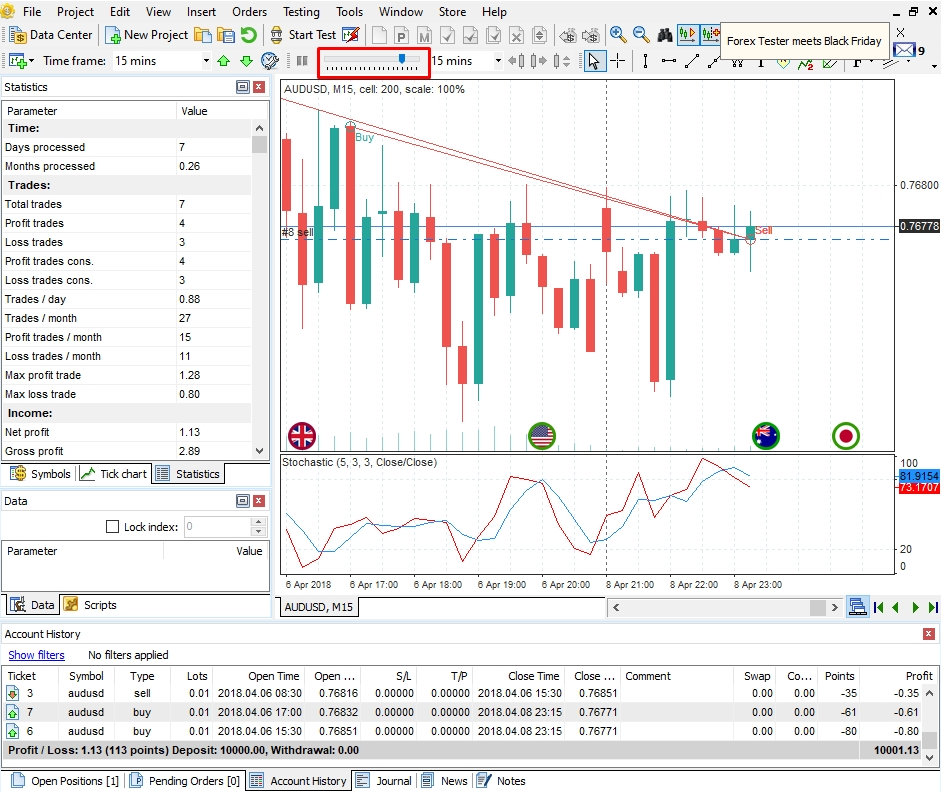

2. Backtesting Intraday strategies on Forex Tester Desktop

Test your trading system on Intraday movements in Forex Tester.

To start testing in Forex Tester, it’s enough to press the “Start Test” button:

If you need to speed up or slow down the price movement, use the slider:

In this way, speeding up the movement in the process of gaining experience, you are able to test a few months within a few hours.

What your Intraday strategy test should be:

- Objective test. An objective test is possible only with a trading strategy written in form of an algorithm. You can’t trade in one way here, and in another way there. Only this is when you may trust the test.

- Long test. A few months long test may be not enough. As the market is constantly changing, it’s important to test the trading system on a long time range with different market phases. Test with one-year length may show the objective picture of how effective your trading system is.

- Many deals in the test. The common principle is the more deals, the better. This is when the statistics of a trading system will be well checked. 100 deals are the minimum number you need for the initial estimation of the trading system.

Conclusions

Intraday strategies are profitable and interesting for trading. But this is what you shouldn’t forget:

- Trading Intraday strategies may be uneasy for a new trader. That’s why in the initial stage, it’s better to focus on mid-term trading on daytime charts. Such trading doesn’t require much time and it may be combined with another job or business.

- Intraday strategies must be tested due to sharp and strong movements which may happen during a day. Without experience, gained with testing on a real short-term market, it may be pretty hard.

- Only a qualitative test performed on the algorithm of the trading strategy on a long time range and with a big number of deals will show if your strategy works or not.

FAQ

What kind of data is needed for intraday backtesting?

You need high-resolution historical data such as 1-minute or tick-level data to backtest intraday strategies accurately. This allows you to simulate real-time trading scenarios and analyze performance in detail.

Can you use spreadsheets for intraday backtesting?

Yes, but it’s time-consuming. Spreadsheets can help organize trade data and calculate metrics, but they lack real-time simulation and visual chart analysis, which are critical for intraday strategy development.

Do you need coding skills to backtest intraday strategies in Forex Tester Online?

No coding is required for manual backtesting. You can visually analyze charts, use built-in indicators, and manually place trades. It’s user-friendly for traders of all experience levels.

How often should you backtest an intraday strategy?

Regularly. Ideally, you should backtest every time you tweak your strategy or market conditions change. Continuous testing helps ensure your system remains effective in various environments.

Which is the best alternative for serious backtesting?

Forex Tester Online is the best option for traders who need a dedicated backtesting platform with precise historical market simulations, advanced analytics, and full control over their strategy testing.

Try our Intraday Backtesting Software

Try our Intraday Backtesting Software

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어