Blueshift (by QuantInsti – the one that is for trading) is a truly powerful tool, but it’s not for everyone. Many traders, especially beginners, find it too complex or too technical. So, we’ve reviewed and tested the best alternatives to Blueshift that offer more user-friendly interfaces, faster setup, and solid tools for strategy testing and market simulation. Let’s see if there’s a Blueshift replacement that might suit you better.

Blueshift by QuantInsti Overview

Blueshift by QuantInsti is a cloud-based platform built for backtesting and running algorithmic trading strategies. It supports Python, provides access to historical market data, and lets users test and deploy quant strategies using broker integration. It’s aimed at users with coding knowledge, especially those familiar with quantitative analysis and strategy development.

As said before, while Blueshift offers solid tools, many traders find it too technical. You need to write Python code for almost everything, including basic setups. For those who want a simpler, visual way to backtest and simulate trading strategies — especially in Forex or crypto — Blueshift can feel overwhelming. That’s where the following options come in.

1. Forex Tester Online (FTO) – Best Replacement Option

Forex Tester Online is a strong Blueshift alternative for those who prefer hands-on trading simulation over coding. Unlike Blueshift, FTO does not require any programming skills. You can build and test trading strategies manually using a clear, simple interface — perfect for discretionary or semi-automated traders.

With tick-by-tick historical data going back over 21 years, you can test your strategy in realistic market conditions. The platform offers full control over the testing environment, including floating spreads, commissions, slippage, and more. You can fast-forward or pause tests and easily adjust trades during playback — just like a real trading day.

FTO runs in your browser, so it works on any operating system. It supports multiple assets like Forex, stocks, crypto, commodities, futures, and more. It’s also ideal for traders outside the U.S., since you don’t need a broker connection to use it.

Try Forex Tester Online now:

2. Tickeron

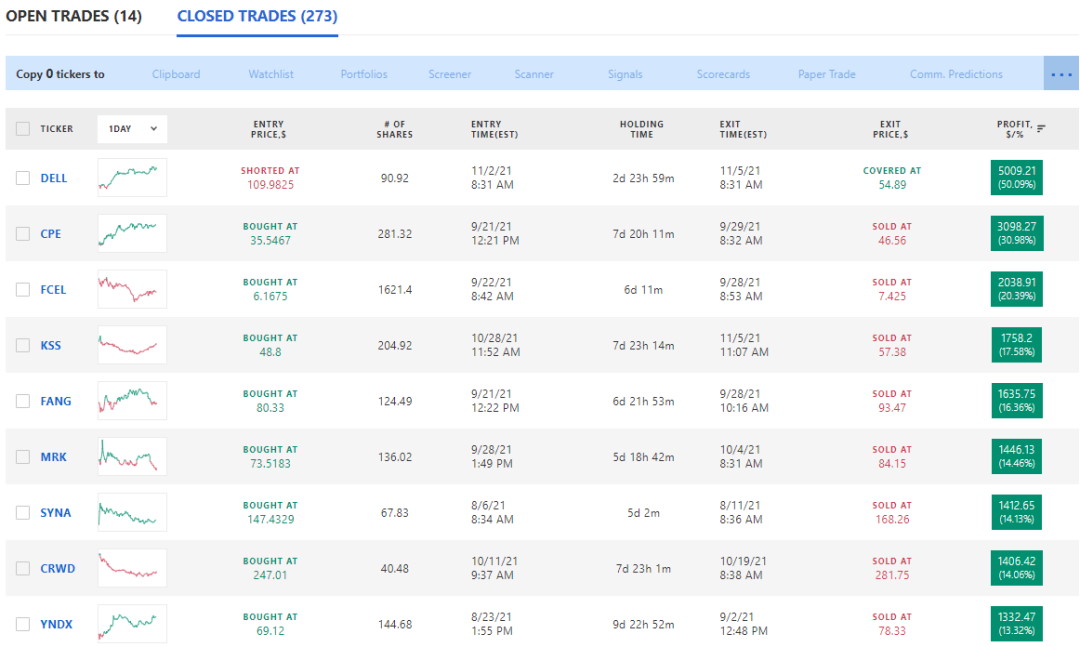

Tickeron is another popular alternative to Blueshift by QuantInsti, especially for traders interested in AI-powered signals and strategy building without coding. It’s a browser-based platform that helps users test and follow trading strategies across stocks, ETFs, crypto, and Forex.

The platform offers tools to build, test, and run trading strategies using visual interfaces. You can analyze historical data and see how AI-generated signals would have performed in different market conditions. It also includes paper trading features to simulate strategies in real-time without risking real money.

Unlike Blueshift, you don’t need to write Python code to use Tickeron. It’s designed for traders who want quant-like analysis without the technical barrier. However, some features — like in-depth testing tools or exporting results — are locked behind paid plans.

Why consider Tickeron?

If you’re looking for an algo trading platform with AI tools and easy setup, and you don’t want to code, Tickeron is a solid choice to replace Blueshift.

3. QuantConnect

QuantConnect is one of the most well-known alternatives to Blueshift for quantitative strategy development. It’s built for advanced users who are comfortable coding in C# or Python. Like Blueshift, it runs in the cloud and supports backtesting, live trading, and data analysis.

QuantConnect gives access to a massive library of historical market data for multiple asset classes — equities, forex, crypto, futures, and options. You can run backtests at scale and use real broker connections to deploy strategies.

However, the platform has a steep learning curve. Just like Blueshift, it’s built for developers and quant researchers — not beginners or casual traders. If you’re looking to build serious algo trading systems with full customization, QuantConnect is a strong replacement. If you want something easier to use, it might not be the right fit.

Also read: Backtesting Algo Trading Strategies in 2025

4. Backtrader

Backtrader is a free, open-source Python library for strategy backtesting. It’s often recommended as a flexible alternative to Blueshift by QuantInsti for those who want to build their own backtesting environment.

Backtrader allows you to code strategies, test them on historical data, and even connect to brokers for live trading. It supports candlestick charts, indicators, order simulation, and portfolio-level testing. But everything is done through Python — there’s no graphical user interface, no plug-and-play options, and no official support.

Traders choose Backtrader if they want full control and don’t mind managing their own data and environment. It’s a good option if you’re tech-savvy and looking to replace Blueshift with something similar but more customizable and free to use. For non-coders, it’s not ideal.

Conclusion

If you’re looking for a simple, user-friendly tool to backtest trading strategies without writing code, Forex Tester Online is the best alternative to Blueshift. It lets you manually test strategies with tick-by-tick historical data, simulate trades in real-time, and fine-tune your trading without the complexity of a coding environment.

For those who want AI-powered tools with minimal coding, Tickeron offers a visual experience and smart trading signals.

If you’re an advanced trader or developer looking for full control and large datasets, QuantConnect is a solid choice.

And if you want to build your own backtesting system from scratch using Python, Backtrader gives you the flexibility — but also demands more technical skill.

As you can see, these 4 alternatives are completely different, so we are sure you will find something for you. Choose the tool that fits your experience and workflow.

FAQ

What is Blueshift trading?

Blueshift trading refers to using the Blueshift platform by QuantInsti for designing, testing, and deploying algorithmic trading strategies. It allows users to code in Python and use historical market data for quantitative analysis and live algo trading across stocks, futures, crypto, and more.

Is Blueshift subscription free?

Yes, Blueshift backtesting and simulation tools are free to use. You can sign up, write your own code, and run strategy tests without paying. However, some features like broker integration or premium data may have usage limits or future pricing changes.

How much does the Blueshift QuantInsti cost?

Currently, Blueshift is free to access for strategy development and backtesting. But since it’s a cloud-based platform with growing features, some users expect future pricing tiers or limitations for heavy usage. Always check QuantInsti’s site for the latest updates.

What is the key purpose of Blueshift?

The main purpose of Blueshift is to let users test algorithmic trading strategies in a professional Python environment using historical data. It helps with strategy development, backtesting, and deployment.

Try our best BlueShift Alternative (zero coding)

Try our best BlueShift Alternative (zero coding)

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어