Article on RVI appeared in the S&C magazine in January 2002, and the credibility was provided by the author John Ehlers − the best expert in the use of cycles in technical analysis.

An Indicator of the «confidence» about the trend continuing has long proved to be effective.

So let’s begin and we will find out why a trader needs to know about an average «balance» or assessment of «cheerfulness» of the market.

Logic and purpose

«Optimism» or «cheerfulness» of the current direction is estimated by the estimation of the price after closing of the period of calculation.

The idea is simple:

The classical trend assumes that in growth periods each subsequent closing price of the period has to be higher than previous, during the periods of the bear market, respectively, a closing price has to be (consistently!) lower. A main task of the indicator − to show and evaluate the dominating tendency, and also to reveal the periods of the «hidden» or «unreliable» trend.

See Compliments to the RVI indicator.

This is especially important in assessing the dynamics of the correlating assets, in addition, the Relative Vigor Index confidently shows all the situations of divergences.

Calculation procedure

The basic principle of calculation of RVI is similar to normal Stochastic, however, the index of «cheerfulness» compares Рrice Close with Price Open, but not with the minimum price for the period. The base line of the indicator shows the actual price change, normalized to the maximum range for the period:

RVI = (PriceClose − PriceOpen)/(PriceHigh − PriceLow)

This baseline, except for it, adds a signal line − a symmetrically weighted smoothed average of RVI values with a period of 4.

Parameters and control

The Relative Vigor Index indicator has only one parameter − the number of bars for calculation and standard settings of the colour scheme. Visually the indicator has an appearance, usual for the oscillator: a reference and signal line in an additional window under a price chart.

Red-green or red-blue colour couple is traditionally offered. Critical overbought/oversold zones are not used (see more).

Standard version of the RVI indicator

The default parameter is 10, which guarantees reliable indicator signals for periods of no more than D1.

The increase in the settlement period allows you to monitor the medium-term trend, small values (up to 10) − are strictly not recommended.

Experiments with settings should be made carefully. Reduction of number of bars for calculation will provide you with the mass of «false» signals, sharp increase − causes the chronic delay even on the big periods.

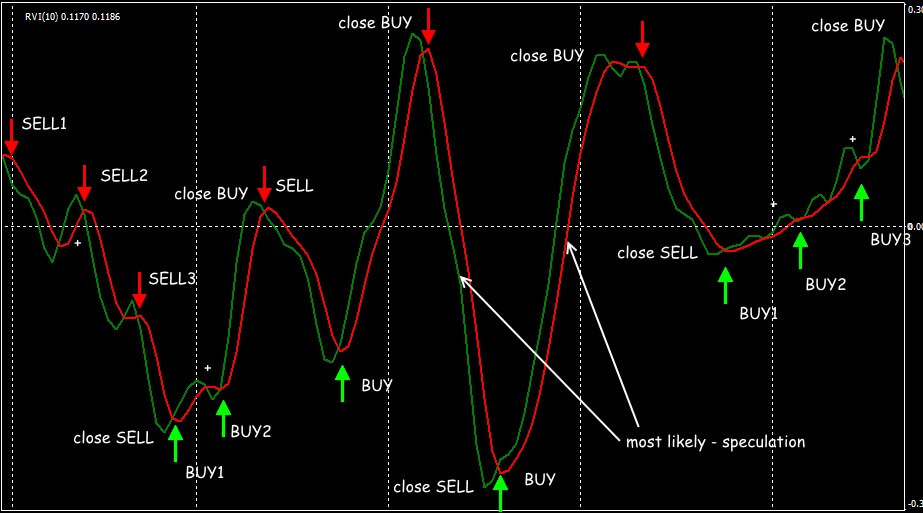

Intersections of lines give the signals, typical for the oscillator.

Let’s look at it in detail.

Trade signals of the indicator

The author of Relative Vigor Index believes that the fast line analyzes the pace and equilibrium of the market for periods of less than one hour, the long one − from H1 to W1.

The basic direction is determined by the main (green or blue) line indicator: while it is above the red line − the trend is up, the long trades are in priority, while it moves below the red – the trend is down − you should only sell (see more).

Does this sound familiar?

However, we draw your attention to the fact that potential situations for the trades arise only after the fact of lines crossing.

When the indicator is flat − the mutual movement of lines in horizontal direction − does not count as a trading signal.

Trading signals of the Relative Vigor Index indicator

The result?

There are several types of trading situations, the strongest of which are direct signals.

- For a long position:

We open the transaction after the fast RVI line crosses the red (slow) line from below up − buyers prevail at the market. Stop Loss is placed below the last local min.

Scheme of the Relative Vigor Index Indicator Signal

- For a short position:

We open the transaction after the fast RVI line crosses the slow line from top to down − sellers prevail at the market. Stop Loss − above the last local max.

Indirect trading signals arise after the analysis of behavior of the indicator of rather central (zero) line: growth is higher than zero level − in the market strong ascending trend; steady falling – descending trend. Analysis of the indicator with various parameters allows you to clarify and confirm the entry point to the market, as well as monitor open transactions.

The Relative Vigor Index indicator with different parameters

- Divergence

Traditionally, the market signal of a reversal is considered to be the divergence of the dynamics of the RVI oscillator with the direction of price movement. The leading effect is strong enough, and the indicator shows even the smallest variants.

RVI’s trading schemes: divergence and breakdown of the flat

Application in trade strategy

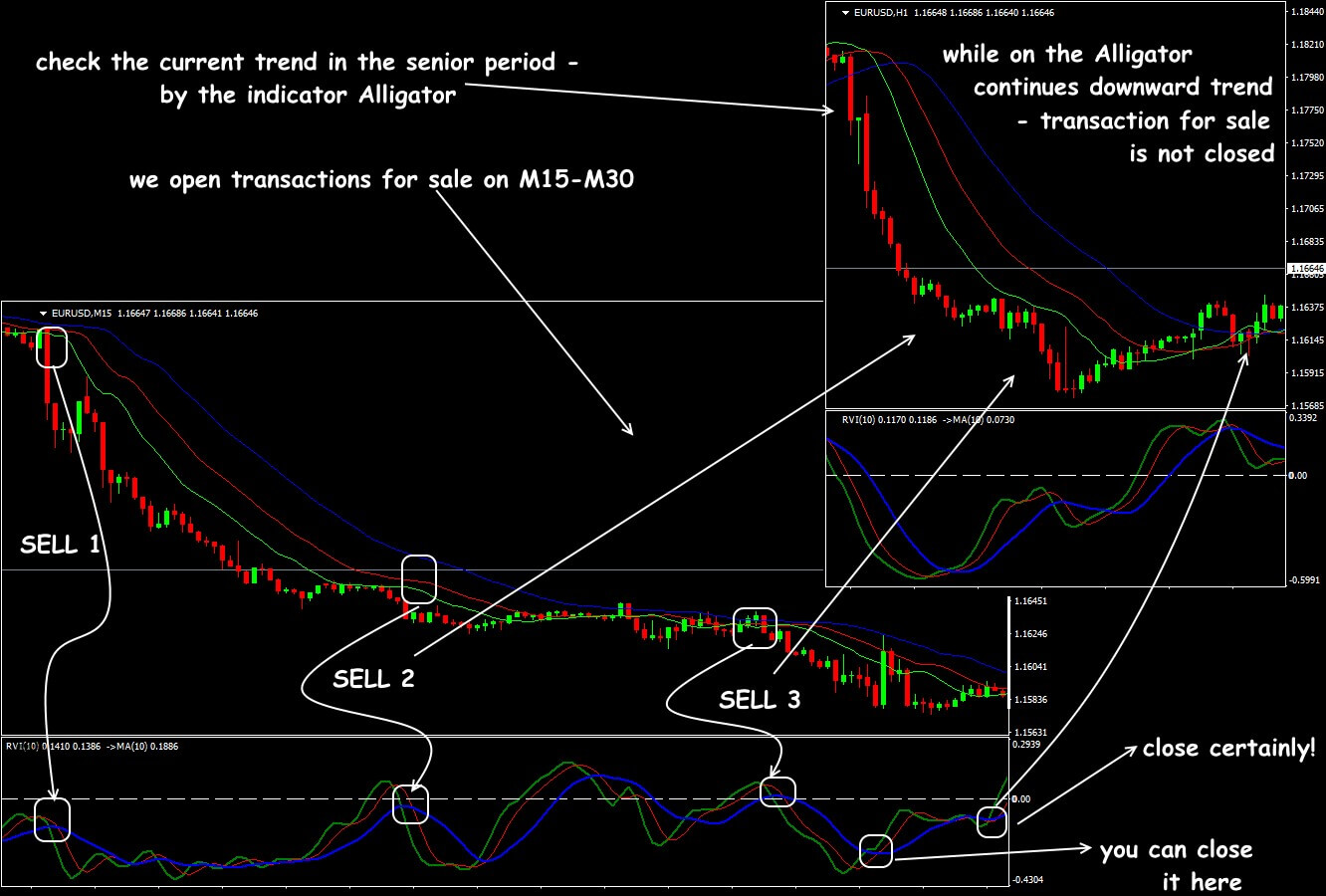

Purposes of this indicator − show the strongest trend, but as with any oscillator, RVI work much more efficiently complimented by the additional indicators.

What this means is:

Stable results are given by strategies using classical trend instruments, where RVI acts as the main oscillator.

Scheme of trading signals RVI+Alligator

We know that moving averages always reduce delay, for this reason, RVI (100) is successfully applied in popular strategy «A new method of Sidus».

Trade channel EMA complete with Relative Vigor Index

The RVI indicator is constantly looking for a point, or rather, an equilibrium line, and therefore its signals allow you to trade even during periods of a flat, of course, if the price range is wide enough.

However, as you know, there are no ideal trading instruments.

Several practical remarks

First of all, let’s remind: on the RVI indicator, there are no standard levels of overbought/oversold, so any attempts to treat the dynamics of RVI according to the usual scheme of Stochastic or RSI are incorrect.

Signals of divergence are strong, but on RVI they appear long before a real turn. Therefore, you should not hurry to close transactions, as long as there are no signals from additional indicators yet.

Using the RVI together with other oscillators or indicators of volume is ineffective, but confirmation of its signals by the trend indicators − is obligatory.

Try It Yourself

After all the sides of the indicator were revealed, it is right the time for you to try either it will become your tool #1 for trading.

In order to try the indicator performance alone or in the combination with other ones, you can use Forex Tester with the historical data that comes along with the program.

Simply get Forex Tester Online. In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Share your personal experience of effective use of the indicator Relative Vigor Index. Was this article useful to you? It is important for us to know your opinion.

Try Forex Tester Online

Try Forex Tester Online

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska