If you trade on Mac or want a lighter platform, Sierra Chart might not fit your needs. Many traders on Reddit mention Sierra Chart’s problems on macOS, slow learning curve, and complex setup. We tested and reviewed the best Sierra Chart alternatives — tools that work across different devices, are easier to use, and still offer strong charting, market replay, and backtesting features. This list includes modern cross-platform options, perfect for strategy testing on any system.

What is the Sierra Chart?

Sierra Chart is a technical trading platform designed for detailed charting, backtesting, and real-time trading. It offers over 300 technical studies, custom scripting with C++, and strong support for Forex, futures, commodities, and crypto analysis.

Despite its power, Sierra Chart has downsides: outdated design, a steep learning curve, no mobile or web version, and dependence on external historical data sources. Users looking for a simpler setup, easier backtesting with Sierra Chart, or macOS compatibility often look for an alternative.

Below are the 7 best Sierra Chart alternatives we recommend after testing and reviewing different platforms.

List of Alternatives to Sierra Chart

Finding a good Sierra Chart alternative depends on what you need most: easier setup, cross-platform access, or faster backtesting. Some traders want a replacement that feels similar to Sierra Chart. Others just need a tool that makes testing strategies simpler.

Here’s our first and strongest pick.

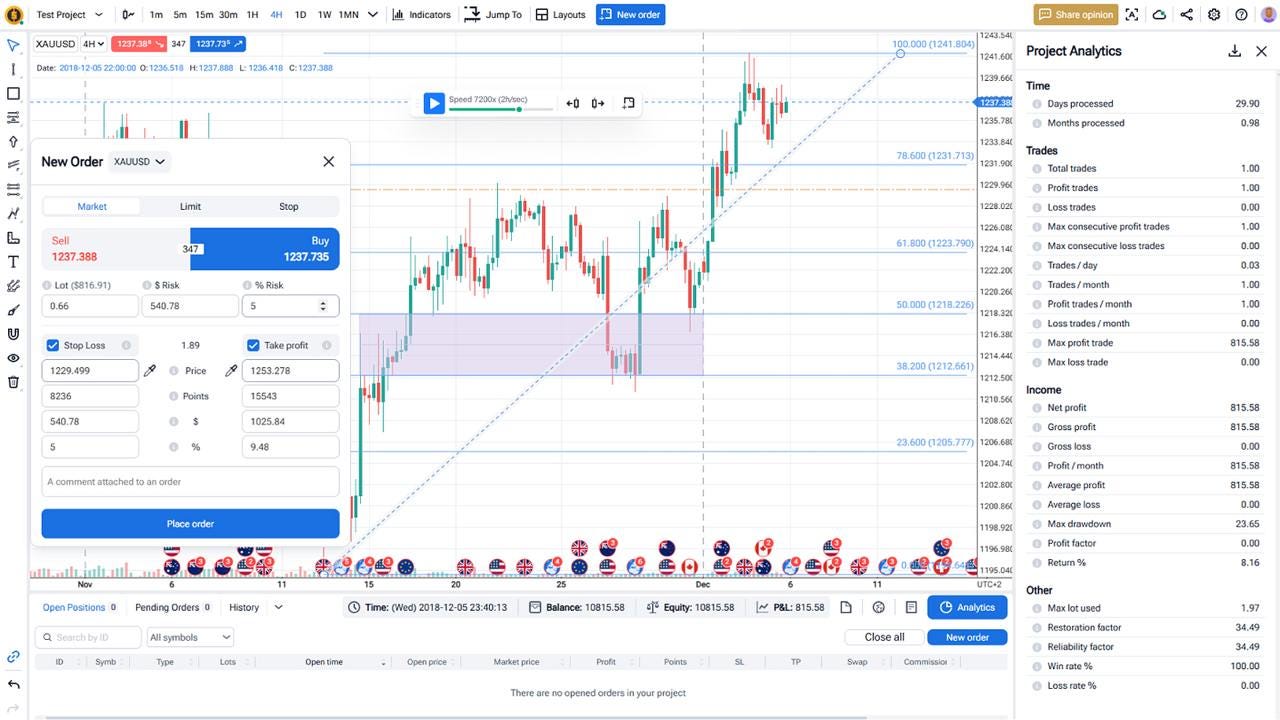

1. Sierra Chart vs Forex Tester Online (FTO)

Forex Tester Online is a browser-based platform focused on strategy testing with real historical data. Unlike Sierra Chart, it doesn’t require installation and works smoothly on any device — Windows, Mac, Linux, iOS, and Android.

| Feature | Sierra Chart | Forex Tester Online (FTO) |

|---|---|---|

| Platform Type | Desktop only (Windows) | 100% browser-based |

| Backtesting | Manual and automated, complex setup | Manual and semi-automated, easy setup |

| Market Replay | Available but setup-intensive | Built-in, very easy to use |

| Historical Data | External sources required | Included (Forex, stocks, crypto, commodities, futures) |

| Ease of Use | Steep learning curve | Beginner-friendly |

| Operating Systems | Windows only | Windows, macOS, Linux, iOS, Android |

| Charting | Advanced, customizable with coding | Flexible, simple charts for testing |

| Programming Skills Needed | Recommended for custom studies (C++) | Not needed |

| Asset Classes | Stocks, Forex, futures, crypto, commodities | Forex, stocks, crypto, ETFs, commodities, indices |

Why traders prefer Forex Tester Online as a Sierra Chart alternative:

- Runs on any device, no installation

- Easier to start backtesting without complex setup

- Tick-by-tick historical data included

- Simple and fast market replay for practice

Try Forex Tester Online now and practice your ETF, Forex, futures, or crypto strategies without wasting time setting up complicated software.

2. Sierra Chart vs TradingView

TradingView is a web-based charting and analysis platform known for its clean interface and ease of use. It offers strong charting, community features, and basic strategy testing tools. Unlike Sierra Chart, TradingView works directly from a browser and runs on Windows, macOS, Linux, Android, and iOS.

Sierra Chart offers more depth in technical analysis and customization, but it requires programming skills for full control. TradingView is better for traders who want a simpler setup, ready-to-use chart layouts, and easy access without downloads.

Users often choose TradingView as a Sierra Chart alternative because of its quick access, social trading features, and flexibility across all devices. However, serious backtesting is limited unless you use paid plans and create custom Pine Script strategies.

If you want smooth charting and lightweight backtesting without needing coding knowledge, TradingView is a strong alternative to Sierra Chart.

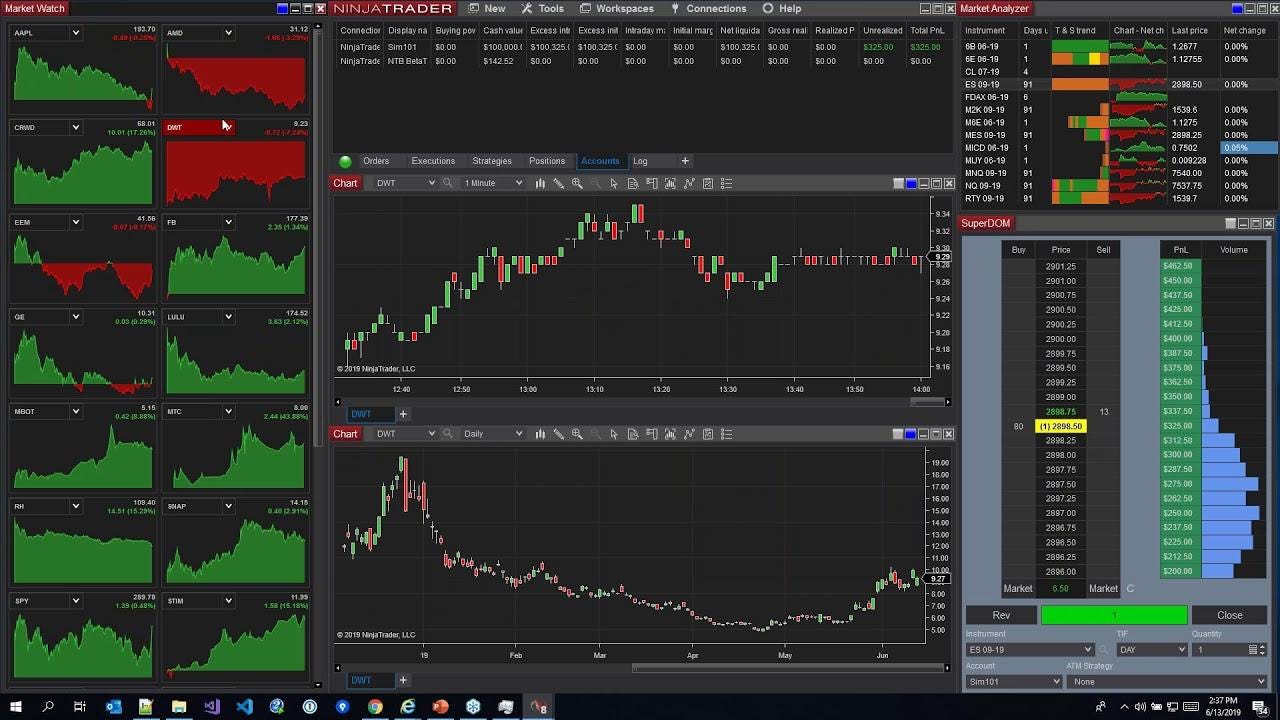

3. Sierra Chart vs NinjaTrader

NinjaTrader is a powerful desktop trading platform, mostly used for futures and Forex trading. It offers detailed charting, market replay, and strong automated strategy testing tools. Like Sierra Chart, NinjaTrader requires installation and works mainly on Windows.

Sierra Chart focuses more on deep technical analysis and extreme customization, while NinjaTrader provides better tools for strategy automation and trade simulation out of the box.

Traders pick NinjaTrader as a Sierra Chart alternative when they want more focus on strategy automation, faster market replay, and better brokerage integration for futures markets. However, NinjaTrader also has a steep learning curve and some features are locked behind a paid license.

If you want a replacement that is still complex but a bit more modern for backtesting and market replay, NinjaTrader can be a good option similar to Sierra Chart.

4. Sierra Chart vs Quantower

Quantower is a modern trading platform designed for active traders. It supports stocks, futures, Forex, crypto, and commodities with solid charting, order management, and strategy testing tools. Unlike Sierra Chart, Quantower offers a more user-friendly interface and runs on Windows, with plans for macOS support.

Sierra Chart is better for those who want extreme customization and are comfortable adjusting every technical detail. Quantower, on the other hand, is chosen as a Sierra Chart alternative by traders who want easier setup, cleaner design, and native support for multiple brokers without heavy configuration.

Quantower also supports algo trading and offers a built-in market replay tool, making it a strong replacement if you want modern design and fast testing features without coding.

5. Atas vs Sierra Chart

Atas is a trading platform focused on order flow, volume analysis, and depth of market tools. It’s popular among futures traders who want to study detailed market movements. Compared to Sierra Chart, Atas is much more specialized — it doesn’t offer the same level of classic technical analysis but is very strong for volume trading strategies.

Sierra Chart is broader, supporting full charting, analysis, and backtesting, but it requires more technical setup. Traders choose Atas as an alternative to Sierra Chart when they need faster access to footprint charts, volume profiles, and order flow without spending hours on configuration.

If your focus is on volume analysis and you trade futures or commodities, Atas can be a solid and easier-to-use alternative to Sierra Chart.

Also read: How to Read a Forex Chart: Guide

6. MotiveWave vs Sierra Chart

MotiveWave is a full-featured trading and charting platform known for its advanced technical analysis tools, especially Elliott Wave, Gann, and Fibonacci studies. It supports stocks, futures, Forex, and crypto trading. MotiveWave works on both Windows and macOS, which makes it a strong Sierra Chart alternative for Mac users.

While Sierra Chart offers deep customization and scripting, MotiveWave is more user-friendly and visually polished. It also includes built-in backtesting, market replay, and strategy building without needing programming skills.

Traders pick MotiveWave when they want powerful analysis and testing tools similar to Sierra Chart but with a cleaner setup, multi-device support, and easier learning curve.

7. Bookmap vs Sierra Chart

Bookmap is a unique trading platform focused entirely on order book visualization, liquidity tracking, and heatmap-style charts. It’s especially popular among futures and crypto traders who rely on real-time order flow data.

Compared to Sierra Chart, Bookmap doesn’t aim to be a full charting and analysis platform. It doesn’t offer traditional backtesting or complex strategy testing like Sierra Chart. However, if you want a tool that gives you a real-time view of market depth and liquidity movements, Bookmap is a specialized alternative.

Traders use Bookmap to replace some Sierra Chart features when they need a better view of the market’s microstructure, not for classic technical charting or broad asset testing.

Conclusion

Sierra Chart is a strong trading system for deep charting and technical analysis. It’s packed with features for futures, Forex, crypto, and commodities trading. But not every trader needs that much complexity, and many look for a Sierra Chart alternative that is easier to use, works on more devices, or is faster for backtesting.

If you want the best Sierra Chart replacement for backtesting strategies, we recommend Forex Tester Online. It’s simple to set up, works on any system (Windows, Mac, Linux, mobile), and offers easy access to market replay and tick-by-tick historical data without complicated installations. It’s the best option for testing strategies quickly and practicing trades safely.

Other Sierra Chart alternatives we reviewed also have their strengths:

- TradingView is great for simple, fast charting and casual strategy testing across all devices.

- NinjaTrader offers advanced automation and strong market replay, especially for futures traders.

- Quantower is a good balance between modern design and powerful multi-asset trading tools.

- Atas is perfect for futures traders who focus on volume, order flow, and footprint charts.

- MotiveWave shines in technical analysis, supporting Elliott Wave and Gann studies with easy backtesting.

- Bookmap is the top choice for real-time liquidity tracking and order book visualization, not full charting.

Each tool has different strengths depending on what you trade and how you trade. But for clear, accurate, and simple backtesting without technical headaches, Forex Tester Online is the smartest pick in 2026.

FAQ

How much does Sierra Chart cost per month?

Sierra Chart pricing starts at around $26 per month for the base package. More advanced packages with additional features, like market depth tools or special historical data services, can cost up to $56 per month. Some add-ons and data feeds may cost extra.

How long is the Sierra Charts free trial?

Sierra Chart offers a 15-day free trial. During this period, you get full access to all charting, backtesting, market replay, and analysis features without restrictions. After the trial, a paid subscription is required.

Is Sierra Chart a brokerage?

No, Sierra Chart is not a brokerage. It is a trading platform designed for advanced charting, strategy testing, and live trading through third-party brokers. To place live trades, you must connect Sierra Chart to a compatible brokerage account.

Does Sierra Chart have tick charts?

Yes, Sierra Chart supports tick charts. You can display charts based on individual trades instead of time, allowing very detailed analysis. Tick data is important for accurate market replay, backtesting, and testing strategies at a micro level.

What is the best Sierra Chart alternative for backtesting?

Forex Tester Online is one of the best Sierra Chart alternatives for backtesting strategies. It offers built-in historical data, market replay, and simple tools for testing Forex, futures, crypto, commodities, and stocks without complicated setup. It also runs in any browser, making it a great cross-platform choice for traders who want easy and fast testing.

Forex Tester Online

The best Sierra Chart alternative for backtesting and optimizing trading strategies

ไทย

ไทย

Tiếng Việt

Tiếng Việt

Polski

Polski

Türkçe

Türkçe

Nederlands

Nederlands

Română

Română

한국어

한국어

Svenska

Svenska